Floridians with bad credit have no shortage of local lenders. But if you want to find the most affordable car loans, take a look at online lenders that operate nationwide.

We have compiled a list of the best online loan sources for bad credit car buyers. Before applying for local financing, you owe it to yourself to check out the offers from the reviewed lenders and lending networks — you may be able to find a bad credit car loan that better fits your monthly budget.

Best Subprime Auto Loans in Florida

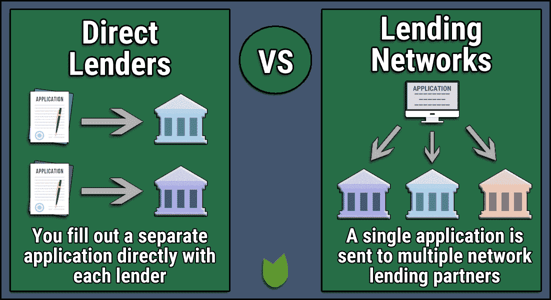

The following list is a mix of direct and network lenders. All operate online and can arrange loans as quickly as the same day. Bad credit won’t prevent you from prequalifying for a loan from these lenders.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% – 29.99% | 1999 | 3 minutes | 9.5/10 |

Auto Credit Express works with a network of car dealers throughout the US to help bad credit car buyers find a loan. Most dealers can arrange bad credit auto financing for you within hours after you prequalify for a loan.

Once the dealer contacts you — which typically happens soon after Auto Credit Express prequalifies your bad credit loan request — you can schedule an appointment to review your financing options. If all goes well, you can drive your newly purchased vehicle off the lot on the same day.

2. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

LendingTree can get you up to five auto loan offers in just a few minutes. This lender-finding service works with a nationwide network of auto dealers highly experienced in bad credit financing.

LendingTree can find a nearby auto dealer to help you select a vehicle and walk you through the financing process. LendingTree’s partners can expedite your loan so you may be able to drive your new car today.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

myAutoloan.com works with a vast network of dealers and private lenders to arrange new and used car loans, leases and lease buyouts, and cash-out refinancing loans.

Once you submit a short loan request form, you may receive up to four loan offers, each with a unique loan term, interest rate, and monthly payment. The direct lenders on the myAutoloan.com network will consider your loan request regardless of your credit history.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Car.Loan.com Auto Loans claims it can prequalify your bad credit loan in three minutes or less, which allows you to begin shopping for your next automobile immediately. Car.Loan.com boasts of having the most extensive online network of auto dealers trained in special finance arrangements for bad credit consumers.

The website indicates that once you submit a loan request, you’ll hear from a local dealer within 24 hours, although many applicants get an email or phone call within minutes. The dealer will walk you through the remaining steps to purchase your vehicle.

- Prequalify in minutes without impacting your credit score

- Refinancing loans save an average of $191 per month

- 125% financing available for cash-out refis

- PenFed Credit Union membership required but can be applied for at the same time as your loan

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 5.19% and up | 1935 | 5 minutes | 8.5/10 |

PenFed Credit Union can help you secure a car loan with lower rates and friendlier terms than other for-profit financers can, which makes it a source of better deals.

You can cash out the equity in your vehicle if you wish to borrow more than the amount you currently owe. Stretching out the payment term or refinancing to a lower interest rate can help reduce your monthly payments.

What Is a Bad Credit Auto Loan?

A bad credit auto loan helps consumers with weak credit finance a vehicle purchase. Qualifying for this type of loan is challenging, but you can succeed if you have enough income to afford the monthly payments. In other words, having poor credit doesn’t mean a lender will deny your loan application, but you will likely pay a higher interest rate.

As with conventional auto loans, bad credit car loans bill borrowers in fixed monthly installments. The loan term generally ranges from two to eight years, depending on the following factors:

- The price of the vehicle after discounts

- Your down payment or trade-in

- The requested loan amount

- The interest rate

- Any fees rolled into the loan

- Your desired monthly payment

A lender uses this information to offer a loan with a fixed repayment term. You’ll know in advance how much you have to pay each month and how long it will take to pay off the loan.

The lender maintains a lien on your vehicle until you repay the loan. You can refinance a partially paid loan to reduce the interest rate, extend the loan term, or cash out your accumulated car equity.

The lender-matching networks we recommended offer online prequalification applications that take only a few minutes to complete, usually without a credit check. If a direct lender decides to work with you, the lending network will give you the link to the lender’s site so you can continue the loan process. The direct lender will likely perform a credit check.

By making the monthly payments on time, your credit score may improve, and eventually, you may be able to refinance the loan at a lower interest rate. Even with a low credit score, you can boost your chances of approval and get a better interest rate by adding a cosigner to the loan or increasing your down payment on the vehicle.

Some bad credit lenders require borrowers to work with a specific car dealership within their lending networks. Others are direct lenders that will give you a loan and then let you decide where to buy a car.

How Do I Apply For a Subprime Auto Loan?

Bad credit auto financing starts with you submitting a loan request. All reviewed lenders allow you to use a computer or mobile device to request an auto loan online. Thanks to modern underwriting systems, you’ll usually receive a loan decision within minutes.

Four of the reviewed companies are online lending networks. You need to submit only one loan request — the loan-finding service sends your request to lenders on the network. The remaining reviewed lender, PenFed, directly originates online loans for credit union members.

The competition among multiple lenders in these networks benefits you. You may receive several loan offers from which to choose.

The loan-finding networks don’t charge you for their services. Instead, they receive a finder’s fee from the lender if the loan goes through.

You begin the financing application process by completing a loan request form on the online lending network. The required information includes your name, income, home address, and insurance. You may also need to provide vehicle information (if available) and a Social Security number.

Lenders perform a soft credit pull when you submit the initial loan request. A soft inquiry has no impact on your credit score. If you successfully prequalify, the loan-finding service will contact lenders in your area. You should expect one or more loan offers soon before too long.

You can submit a formal loan application once you connect with a direct lender. The lender will perform a full credit check that will include a hard inquiry for your credit report.

If nothing unexpected appears on your official credit check, the lender will continue with the paperwork that finalizes your loan. The loan process typically takes no longer than one hour.

You can often go from submitting your loan request to driving your new car on the same day. Many dealers can complete the entire process in just a few hours.

How Do I Get a Car Loan With Insufficient Credit History?

Many lenders will consider your car loan application even if you have a limited credit history. That’s because they are using the financed vehicle for collateral.

With a traditional unsecured loan, the bank has little recourse if you default on your debt. At best, it can sue you in court or sell the debt to a collections agency for pennies on the dollar.

But a secured loan has collateral backing the debt — in this case, your vehicle. If you stop making payments, the lender can repossess the car and sell it to recoup the money from the unpaid loan. Secured loans impose less risk on lenders who are typically more forgiving of your limited credit history when they consider your financing application.

Buy here, pay here dealerships self-finance the vehicles they sell. Many of these dealerships will not require a down payment and will finance the entire purchase price of the car, even if you have limited credit.

Consider the following suggestions to increase your chances for loan approval or better terms:

- Put some of your money at risk: By trading in your old vehicle or depositing a down payment, you demonstrate your confidence in your ability to repay your loan.

- Recruit a cosigner who has good credit: You and the cosigner are equally obligated to repay the auto loan. Lenders are much more willing to approve loans cosigned by individuals with good credit.

- Build your credit: If you have time to plan a future car purchase, you can take steps to establish or build your credit. Consider getting a credit card and using it to make purchases. You’ll build credit by paying your credit card bill on time each month. Another option is to open a credit-builder account at your local credit union or through an online provider.

- Purchase a less expensive vehicle: Many modern cars have excellent long-term reliability. You’ll need to borrow less if you choose a dependable used car with high mileage.

Car dealers are eager to move inventory. Don’t be discouraged if your credit is thin, as many dealers will arrange financing for just about anyone who expresses interest in a vehicle.

In-Person Options for Bad Credit Auto Loans in Florida

There are several advantages to applying for a bad credit auto loan in person. Loans are sometimes more about personal connections than numbers, and there’s no business connection more personal than a conversation.

Here’s a list of bad credit auto loan office locations throughout Florida:

Quick Cash Auto Loans

3680 NW 11th St Suite A

Miami, FL 33125

Automotive Fresh Start Center

6319 Blanding Blvd

Jacksonville, FL 32244

Automotive Financial Services

6025 N Dale Mabry Hwy

Tampa, FL 33614

Credit Cars

4500 W Colonial Dr

Orlando, FL 32808

Coast Auto Store

8123 66th St N

Pinellas Park, FL 33781

DriveTime

2421 W Tennessee St

Tallahassee, FL 32304

Coastal Auto Ranch, Inc.

10720 US-1

Port St. Lucie, FL 34952

Auto Advantage USA

1424 Viscaya Pkwy

Cape Coral, FL 33990

FinBe USA

1475 W Cypress Creek Rd #300

Fort Lauderdale, FL 33309

Hollywood Automax

1450 N State Rd 7 #441

Hollywood, FL 33021

DriveTime

3336 N Main St

Gainesville, FL 32609

Deal Time Cars & Credit

2195 N Pine Ave

Ocala, FL 34475

DriveTime

6400 Pensacola Blvd

Pensacola, FL 32505

Fort Myers Auto Mall

2475 Fowler St

Fort Myers, FL 33901

Goldmark Auto Group

4000 Bee Ridge Rd

Sarasota, FL 34233

B&B Automotive Solutions, Inc.

2611 Palm Bay Rd NE

Palm Bay, FL 32905

Mainland Auto Sales

1942 N Nova Rd

Daytona Beach, FL 32117

DriveTime of West Palm

2707 Okeechobee Blvd

West Palm Beach, FL 33409

Deal Time Cars & Credit

2625 US Hwy 98 N

Lakeland, FL 33805

It’s much easier to ask and answer questions in person versus online. And when you need wheels, you can receive same-day financing and drive away as opposed to having to wait a business day or two for the check to clear in your bank account.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.