BMG Money partners with a roster of employers to provide installment loans to employees and retirees. It has strict eligibility rules but does not check applicants’ credit.

Consumers with bad credit have many options when they need an emergency loan. Researching the loans available to subprime borrowers is essential because interest rates vary drastically from one lender to the next. Selecting the right lender can save you lots of money regardless of your low credit scores.

Best Alternatives to BMG Money Loans

BMG Money lends money to active and retired employees of select employers. It operates in 42 states and the District of Columbia.

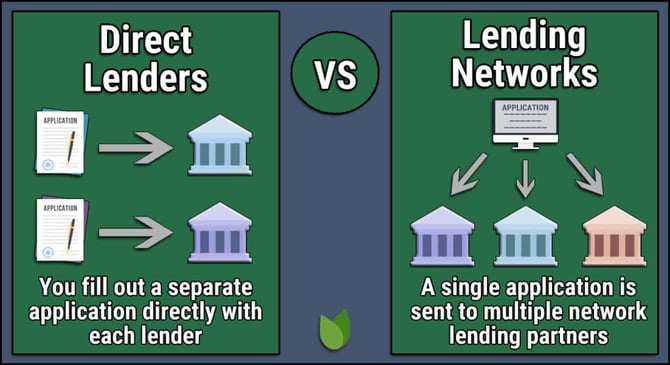

The following are the best loan networks that do not restrict bad credit borrowers based on where they work or which state they live in. They can quickly prequalify your loan request before you submit an application, so you’ll know your approval odds without a hard credit check.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual is the best personal loan network for finding loan offers of up to $5,000. You can apply for personal or payday loans, get multiple offers, and, if approved, receive your money as soon as the next business day. The exact terms of your loan will vary by lender and your state’s lending laws. You can use your loan for any purpose.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group has a maximum loan amount — $35,000 — that exceeds the $10,000 cap on loans from BMG Money. Another difference is that 24/7 Lending Group arranges loans for bad credit borrowers in all 50 states, regardless of employer or job sector. And with 24/7 Lending Group, you repay your lender directly, not through a payroll deduction.

3. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com can find offers for personal installment loans with a loan term ranging from three to 72 months. You can submit one loan request form and receive multiple offers — something BMG Loans can’t do. CashUSA.com does not charge for its prequalification and loan-finding services.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com is a lending network that can find you multiple loan types. You may qualify for short-term loans similar to payday loans or installment loans with a longer repayment term and lower interest rate. You can receive the loan proceeds in your bank or credit union account by the next business day, matching BMG Money’s post-approval funding time.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

BadCreditLoans.com helps borrowers with low credit scores find loans through an extensive network of lenders. You can request up to $10,000, but the loan amount will depend on your credit profile. BadCreditLoans.com specializes in helping people with poor credit, so it may direct you to debt relief, credit repair, or other services if it can’t find you a loan offer.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan.com can find you a small personal loan starting at $250, which is half of BMG Money’s minimum loan amount. This network may be able to get you a quick loan you can use for any reason. CreditLoan.com has been helping consumers find loans for more than 25 years.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

InstallmentLoans.com helps borrowers find loans to pay for unexpected expenses. Its maximum loan amount is $5,000, and the repayment term varies depending on your state and chosen direct lender. It’s a sound option when you need cash quickly.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com operates two separate networks, one for borrowers with a poor credit history and another for those with good credit. You’ll need good credit to get this network’s maximum loan amount, but its services are available to all workers, unlike BMG Money.

BMG Money Reviews Around the Web

BMG Money receives mixed reviews. Several consumers report positive customer experiences, but many fault the company’s treatment of ineligible applicants.

Trustpilot gives BMG Money an “Excellent” rating of 4.7 from more than 3,000 reviews. We have edited the following reviews for clarity and brevity.

“Waited almost 10 days just to learn that you guys don’t work with my company. This is absurd. Why not tell me upfront and not make me wait on hold for hours or talk to a live agent? Just be upfront and maybe hire more help.”

— Robert

“Kiman was very professional and helpful. He immediately started solving my problem of helping me pay off my loan. He logged into my account and walked me through each step, which I really appreciate. Thank you again, Kiman.”

— Shareese

We should point out that BMG Money replies to each review and offers to help when possible.

BMG Money is accredited by the Better Business Bureau and has an A+ rating. Some BBB commentators complained about loan availability and service.

“This company has ruined my life. Being a veteran who suffers from PTSD and trying to get my family settled in a nice home has been draining due to this company. They reported a missed payment even though I called and asked whether I was overdue because I made a lump sum to cover the months. The Supervisor and representatives were so insensitive. I am currently obtaining a lawyer to fight against the lies they have told. They recorded the supervisor saying they did make a mistake, but basically, they can’t fix it. Like what kind of customer service is this?”

— Anonymous

Naturally, the BMG Money website features only positive information about the company, but customer reviews are strangely absent.

What Is BMG Money?

BMG Money is a direct lender. Personal loans of $500 to $10,000 are available for a loan term of six to 36 months. According to the website’s fine print, the company’s loans charge an annual percentage rate (APR) ranging from 16.99%-35.99%. The company also promotes financial wellness programs.

BMG Money works with approximately 90 employers and 100,000 customers. You must work for an employer partner to qualify for a loan. Employer partners include companies in the following sectors:

- The federal government

- Hospitals

- School districts

- Colleges and universities

- Public sectors

In addition, the company lends to military and federal retirees.

If you leave your employer for any reason, BMG Money will work with you to set up a payment plan outside the workplace.

The amount you can borrow varies by state, program, and employer. You apply online and, depending on the particulars, pay a one-time fee after approval ranging from $0 to $59.

What Are BMG Money’s Requirements to Get a Loan?

Employees may be eligible to apply for a BMG Money loan if they:

- Are employed by an employer that partners with BMG Money

- Meet the employment tenure and other employment requirements

- Reside in a state in which BMG Money does business

- Are 18 years or older

- Are not active in the military

- Do not have an open bankruptcy

- Can afford the biweekly or monthly payment

Retirees may qualify if they worked for the US military or the federal government.

The company’s underwriters review applications, which generally takes three business days. Once approved, you may receive your loan proceeds by the next business day.

Most BMG Money loan programs require you to link your bank or credit union information. You cannot pay your bill with a credit card. Other credit criteria may apply, and approval is not guaranteed. Requirements vary depending on the loan program and are subject to change.

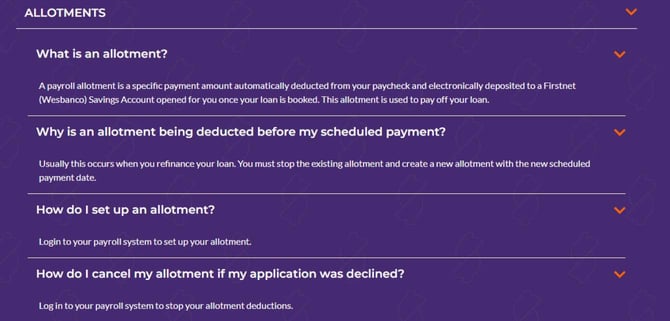

To receive a loan, you must allow your employer to deduct your payroll allotments from your paycheck or split your direct deposits. Payroll allotment loans require a specific weekly, biweekly, or monthly payment amount your employer automatically deducts from your paycheck and electronically deposits to a Firstnet (a division of WesBanco Bank) Savings Account.

BMG Money opens savings accounts once it books allotment loans. The allotment pays off your loan.

The split direct deposit is a payment amount you set up through your payroll system to deduct payments from your paycheck and electronically deposit the money to a Firstnet Savings Account.

BMG Money does not charge you a fee for early repayment of your loan. You may be able to refinance your loan based on consecutive scheduled payroll deductions (or allotments) and income.

Which States Does BMG Money Operate In?

Loans are available to residents of 43 states:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Delaware, Florida, Georgia, Idaho, Illinois, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Missouri, Minnesota, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carlina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Washington, or Wyoming.

Residents of Washington, DC, are also eligible. The list of eligible states may change over time.

Will BMG Money Appear On My Credit Reports?

BMG Money reports your payments to all three major credit bureaus in the middle of the following month. Reporting may impact your credit history. BMG Money does not check credit, so your loan application will not appear on your credit report nor affect your credit score.

How Do I Choose Between BMG Money and These Alternatives?

BMG Money is a feasible choice if you happen to work for an employer partner or are a retired military or federal employee. You must also reside in a state in which BMG Money operates.

The loan-finding networks do not restrict loans based on employer or state. They also accept non-working applicants who receive government benefits.

You may prefer the network lenders for their:

- Lack of employment and state restrictions

- Ability to find multiple quotes

- Fast approval process (often same-day) instead of BMG Money’s three-day underwriting procedure

- Ability to offer multiple types of loans

- Lack of processing fees

- Privacy (they don’t inform your employer about your loan)

- Access to larger loans

The best personal loan offers from the networks and BMG Money have similar APRs and terms.

Is BMG Money Safe to Use?

BMG Money appears to be a reputable company. It scores well with TrustPilot and the Better Business Bureau. It uses multi-factor authentication, firewalls, and other security safeguards.

WesBanco Bank, Inc. has headquarters in Dayton, Ohio. It has BBB accreditation and an A+ rating, though reviews are limited. The BBB has received only one complaint about WesBanko Bank in the last three years.

Consider Your Alternatives to BMG Money Before Applying

BMG Money can get you a loan within one business day of approval, but underwriting takes three days. The reviewed alternatives operate much faster, often providing an instant loan decision and next-day funding, even with a low credit score.

You should select a loan based on its funding speed, interest rate, and repayment terms. That may be a loan from BMG Money — if you meet the loan eligibility requirements and can qualify. But the loan-finding networks are faster, have more accessible qualifications, and provide a greater number of options. Your specific situation will help you choose the best loan for you.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.