If you happen to be searching for loans for people with bad credit and no bank account, you may have a difficult time finding an option that fits those exact criteria. Below, we take a deep dive into this issue so you can know what to expect if you’re searching for loans and do not have a checking account.

Certain facts have the ability to make one feel old simply by being facts. For instance, consider the fact that the popular science fiction movie, Men in Black, was released in the summer of 1997, which makes it a shocking two decades old.

But while it may seem like yesterday, the world is a very different place today than it was when Tommy and Will saved the galaxy for the first time. For instance, we all have touchscreen computers in our pockets, cars are starting to drive themselves, money has been replaced by plastic — and checking accounts now cost a fortune.

Yes, like Pogs, feathered bangs, and paper checks, it often seems that free checking is a thing of the past. Unfortunately, despite the cost, it’s getting harder to avoid the necessity of a bank account in today’s digital world, particularly if you need other financial products.

Installment Loans | Short-Term Loans | Credit Cards

The Majority of Lenders Will Require a Checking Account

Whether we like it or not, between direct deposits and online shopping, the average consumer needs a bank account simply to function in the modern financial world. And while you can obtain prepaid cards and use cash for most purchases, some things in life simply require a checking account — and that includes obtaining a personal loan, regardless of your credit.

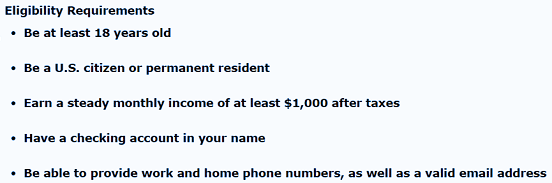

In fact, excepting a few questionable payday lenders, the vast majority of lenders will require you to have a valid checking account as a basic application requirement. For one thing, that’s where the lender will most likely deposit your funds if you’re approved. For another, this gives the lender a little more information about your finances, which it will use as part of its credit risk analysis.

The majority of personal loan lenders will have the same basic requirements, including a steady income and valid checking account.

Of course, the cost of maintaining a checking account seems to keep increasing every year, and the only way to avoid the fees is through elaborate systems of automatic transfers and minimum balances. Or is it?

The solution to the high-priced checking account dilemma may actually be to ditch the traditional checking account altogether — and head online. A number of banks are now offering fee-free online-only checking accounts with all the basic features, including direct deposits, bill paying, and debit cards.

What you won’t get is access to brick-and-mortar branches with in-person tellers or dedicated ATMs. This means any check deposits will need to be done remotely. You may also have limits on the number of transactions you can perform per statement cycle.

Personal Installment Loans for Bad Credit

Named for the installment-based repayment structure, personal installment loans are a good way to finance purchases you need to repay over a longer period of time, as they typically extend from three months up to seven years. Installment loans typically have minimum amounts of $1,000, but you can find personal installment loans of up to $35,000, even with poor credit, so long as you meet other requirements.

What you won’t find are installment loans that don’t require at least a basic checking account to qualify, so know that when you apply. When considering taking on an installment loan, be sure to do your homework; shop around a bit for different rates to get an idea of what’s fair for your income and credit score. Online lending networks, such as our top-rated picks below, can be an easy way to receive multiple quotes all at once.

1. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 60 Months | See representative example |

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

+See More Loans for Bad Credit

While it can be easy to fixate on the size of your monthly payment, it’s important to pay attention to the length of your loan, as well. The longer you take to repay your installment loan, the more it’s going to cost you due to the additional interest payments. The best loan will balance an affordable monthly payment with a cost-effective loan length.

Short-Term Cash Advance Loans for Bad Credit

Often called cash advance loans, short-term personal loans typically have lengths of six months or less. In contrast to installment loans, short-term loans are repaid in a single, lump-sum payment at the end of your loan length that includes both the principal and applicable finance fees.

Where short-term loans are similar to installment loans is in the fact that you’ll have a hard time trying to find a lender willing to skip the checking account requirement. Even if you do find a lender that doesn’t require a bank account, you’ll likely pay higher finance fees or maintenance fees for the privilege. You can use online lending networks, like our expert-rated options below, to find the most affordable lender.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% - 2,290% | Varies | See representative example |

5. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

+See More Loans for Bad Credit

Well before you look for a short-term loan lender, it’s vital that you determine if you’ll be capable of repaying the loan when it comes due. Many borrowers take on a short-term loan, then can’t afford the lump sum needed to repay the loan, initiating a cycle of extensions and additional fees that can cause the debt to multiply exponentially. If you think you’ll need more than a few months to repay your loan, consider an installment loan, instead.

Credit Card Loans for Bad Credit

As casually as we use our credit cards, it’s easy to forget one key detail: credit cards are loans. Every time you make a purchase with your credit card, you are, essentially, borrowing money from the issuing bank, with the understanding that you’ll repay that loan. Along those lines, your credit card might be a viable loan replacement, particularly for short-term loans.

What’s more, most credit card issuers won’t require banking information to qualify, so you could potentially obtain a card without checking account. The cards on our list are from issuers who specialize in poor credit applicants and include both unsecured and secured card options.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 5 minutes | N/A | Yes | 9.5 |

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $400.00 (Subject to available credit)

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 10 minutes | 35.90% Fixed | Yes | 7.5/10 |

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

+See More Credit Cards for Bad Credit

One thing to keep in mind, although you likely won’t need a checking account to apply for a new credit card, you may need a bank account to pay your new card, at least online. Most credit cards are paid via banking transfer from a checking or savings account. Depending on the nature of your card, you may be able to make payments with cash through a branded ATM or bank branch, or through the mail with a money order.

Bad Credit Loans You Can Bank On

Like rose-colored glasses, nostalgia can tint our perception of the past — and the present. Considering the massive changes that have occurred in our world over the last few decades, it’s easy to yearn for simpler times, when phones only made phone calls and banks didn’t charge account fees. At the same time, however, few of us would eagerly part with our fancy, newfangled cellphones for anything — not even free checking.

And much like the cellphone has become a near-necessity in modern society, so, too, has the checking account, regardless of its potential fees. Everything from your paycheck to your loan application will require you to have a viable bank account, so the only real option for most of us is to embrace the change (perhaps by using an online banking app to make your loan payments with your newfangled phone).

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.