Opportunity Financial LLC does business as OppLoans, a provider of online personal loans. It competes with many other online loan providers, such as the networks we include in this review.

While OppLoans can get you a fast loan without a hard credit inquiry, its rates can be much higher than the competition’s.

OppLoans Funds Online Loans For Subprime Credit

OppLoans offers small personal loans from $500 to $4,000 with a repayment term of nine to 18 months. Loan APRs range from 59% to 160%, well above the usual 36% cap on personal loans. State regulations determine your maximum loan term, amount, and rate.

The company makes high-interest direct loans in Alabama, Georgia, Nevada, and Wisconsin. In 30 other states, it services installment loans from funding partners that include Capital Community Bank, FinWise Bank, and First Electronic Bank.

It can also send your application to other private lenders to check whether they can provide a lower interest rate. OppLoans says that few consumers (i.e., less than 2%) take advantage of this feature, a statement we cannot confirm.

The OppLoans website is a valuable educational source regarding credit, debt, saving, and spending.

Best Online Personal Loans Like OppLoans

The following loan services connect borrowers with lenders that specialize in helping consumers with all types of credit, including poor credit. Network lenders charge up to 36% on personal loans, but some can also offer you a payday loan with a potential APR of 400% or more.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

OppLoans requires applicants to earn at least $1,500 per month, but MoneyMutual accepts applicants who earn just $800 per month. The company’s online loan request form takes only a few minutes to complete and can net you a loan offer of up to $5,000, deposited within 24 hours of approval.

Network lenders review your loan request in real-time to decide whether they will make you an offer. If so, you’ll be redirected to the lender’s website to complete the application, review the loan terms, and e-sign the loan agreement if you find the terms acceptable.

2. Avant

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $2,000 to $35,000 | 9.95% – 35.99% | 12 to 60 Months | See representative example |

Avant provides installment loans ranging from $2,000 to $35,000 with repayment terms of 12 to 60 months. These loans are targeted toward individuals with fair to good credit scores, although Avant will consider applicants with lower credit scores as well. Avant’s loans often come with origination fees and APRs that can vary based on factors such as creditworthiness.

While both lenders cater to individuals who may have difficulty obtaining loans from traditional banks, Avant tends to target a broader range of borrowers, including those with fair credit, while OppLoans focuses specifically on serving individuals with poor credit.

3. Upstart

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn’t impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% – 35.99% | 3 or 5 Years | See representative example |

Upstart targets individuals of all credit types, using advanced algorithms to consider factors beyond traditional credit scores for loan approval. Upstart offers unsecured personal loans with competitive interest rates based on creditworthiness and aims to provide quick online decisions, often within minutes.

Upstart and OppLoans both offer alternative lending options, but their loan products and approval processes differ.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group can arrange small to large installment loans, even if you have bad credit. It receives numerous positive reviews from customers who claim the network helped them find a quick installment loan.

Connecting with one or more willing lenders only takes minutes after you prequalify for an online loan. You can easily compare rates and terms to choose the best loan offer for your needs.

5. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com helps consumers find personal loans from $500 to as much as $10,000. Loan proceeds can help pay all sorts of bills, from medical emergencies to fancy vacations.

The company’s website explains how the loan process works for someone with a bad credit score. It also details the simple eligibility requirements and how to fill out a loan application. CashUSA.com requires borrowers to have a reliable monthly income of at least $1,000 after taxes.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com can arrange a bad credit loan as low as $100 and as large as $20,000. It vows the process is safe, secure, fast, and reliable, with no hidden fees.

Filling out its simple loan request form takes only minutes. SmartAdvances can help you connect with a direct lender willing to work with you, even if you have abysmal credit.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

True to its name, BadCreditLoans.com finds loans for consumers with really poor credit. Loan amounts range from $500 to $10,000, with a repayment term of three months to three years.

As with other subprime lender networks, BadCreditLoans.com doesn’t need you to post collateral to get a speedy cash loan. Network lenders require borrowers to have a checking account and steady income.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan.com helps people with subprime credit obtain a personal loan, even consumers with previously discharged bankruptcies. But it won’t accept your application if you have a pending bankruptcy.

We applaud CreditLoan for providing extensive information on how poor credit affects loan costs and ways you can improve your chances of getting a loan.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com offers some of the largest loans among the lending networks we regularly review. You can use your money for any purpose, from medical emergency loans to home renovation financing, among other things.

PersonalLoans has separate lending networks for people with poor credit scores versus those with good and excellent credit. The company can also provide credit repair, debt relief, credit monitoring, and other services tailored to your credit needs.

How Does OppLoans Work?

You apply to OppLoans online. To be eligible for a loan, you must:

- Be at least 18 years old

- Reside in one of the states where OppLoans services

- Own an active checking or savings account for at least 40 days

- Earn at least $1,500 of gross income monthly

- Receive paychecks through direct deposit

Notice that OppLoans does not have a minimum credit score requirement.

If you qualify, you must submit the following information to apply for a loan:

- Name

- Email address

- Phone number

- Purpose of loan (optional)

- Date of birth

- Social Security number

- Address

- Gross monthly income before taxes

- Your primary source of employment and method of payment

- Bank routing and account numbers

- Age of bank account

- Loan amount requested

- A secure password

OppLoans does not perform a hard credit pull, instead relying on Clarity Services and Experian to verify your information and payment history without impacting your credit score. If OppLoans or one of its lenders approves your application, it will specify the loan term, amount, APR, and monthly payment.

OppLoans synchronizes your billing to match your pay dates. You can request more frequent billing but must provide pay stubs if you want OppLoans to bill you less frequently.

You may get your money on the same day if you receive approval before noon. Otherwise, expect your loan proceeds to arrive in your bank account by the next business day.

OppLoans reports payments to each major credit bureau. Timely payments will help you build credit, but missing a payment will hurt your credit score.

Because OppLoans operates out of Utah, it claims to be exempt from state interest rate caps, such as the 36% limit on loans in California. The company settled a lawsuit in 2021 with the Washington DC attorney general in which it paid out more than $1.5 million in refunds and fines.

OppLoans cautions consumers to borrow from it only as a last resort. Given its high interest rates, we entirely agree.

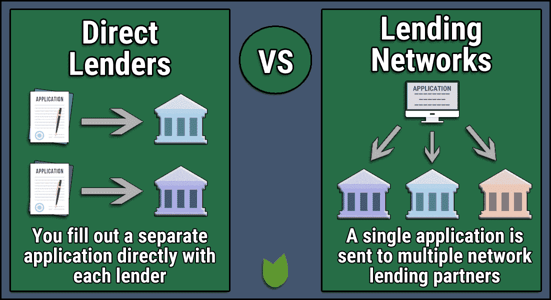

How Do Personal Loan Networks Work?

Personal loan networks match borrowers to direct lenders. You fill out a loan request form to see whether you prequalify for a loan offer.

The alternative matching services reviewed above collect the same type of information as OppLoans, but it passes the loan request along to the direct lenders on its networks. The companies don’t perform a hard credit check nor charge for their service. Once they hand you off to a lender, they cease involvement in your loan.

A matching service either transfers you to a direct loan provider or offers links to multiple lenders. You then finish the application process by supplying any additional information required.

If approved, you can review the loan agreement specifying all the terms and conditions. You can then e-sign the agreement after carefully reading it. Expect the lender to deposit the loan proceeds in your bank account as soon as the next business day.

The lender will withdraw your monthly payments directly from your bank account. In almost all cases, you can prepay the loan without penalty.

What Is Subprime Credit?

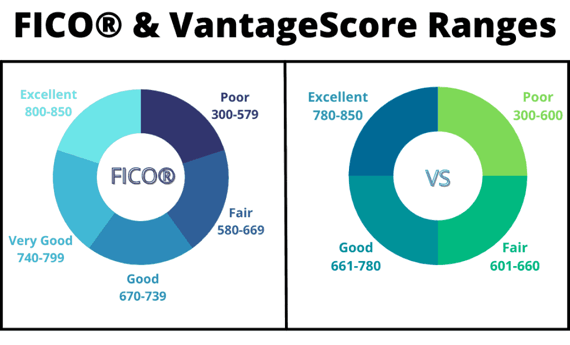

You can borrow money even if you have subprime credit, reflected by a score that FICO and VantageScore (the two leading consumer credit-scoring systems) define as “poor.”

A subprime score can reduce your ability to get a loan or credit card. Traditional financial institutions such as banks usually turn down subprime loan applicants, creating a demand for alternative lenders such as OppLoans and other online lending sources.

A problematic credit history can cause scores to descend into subprime territory. Expect the following consequences if you have bad credit:

- Reduced access to loans and credit cards

- Lower loan amounts

- Higher interest rates

- Higher fees

- Less favorable terms

FICO and VantageScore use multiple factors to calculate credit scores:

As you can see, your payment history and ability to repay loans on time are the most influential factors in your credit scores.

What Are the Requirements to Get an Online Personal Loan?

Generally, you must satisfy the following requirements:

- US citizenship or residence

- Minimum age of 18

- Reliable monthly income

- A bank account in your own name

- An email address

- A phone number

Most online personal loan providers specify a minimum income requirement, which may be as low as $800 monthly. The income source may be a job, alimony, or ongoing government benefits such as Social Security or disability insurance.

Can You Have Two Loans With OppLoans at the Same Time?

According to the OppLoans website, “You are only allowed to have one active loan per customer at any one time. If you pay off your loan in full or become eligible to refinance your loan, you may apply again for another loan.”

But refinancing your loan through OppLoans is still a way to get more money. You can apply to borrow the difference between your existing loan and what you already paid toward the principal. You’re basically reborrowing what you paid off on your original loan, though you may be approved for more, depending on your application.

So, while you can’t have two open loans at one time, you can reapply to borrow what you already paid toward your existing loan, helping you secure more funding.

How Can I Increase My Approval Odds?

Payment history is the most significant factor affecting your approval odds. Late payments, delinquencies, defaults, repossessions, collections, and bankruptcies drag down credit scores by varying degrees and remain on your credit report for up to 10 years. The best way to build credit is to pay your bills on time, every time.

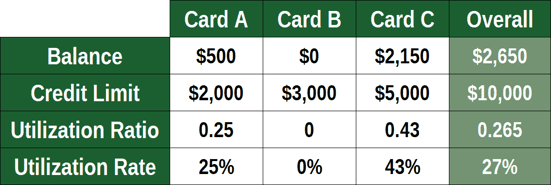

Another important factor is your credit utilization ratio, defined as the amount of credit card credit used in comparison to your total available credit. For example, a credit card with a $1,000 credit limit and a $300 balance has a 30% utilization ratio. The lower your utilization ratio, the better your credit scores.

Credit account age, credit mix, and recent applications also impact credit scores to varying degrees. You benefit by maintaining credit accounts, such as credit cards and auto loans, over extended periods, as FICO associates this with the ability to manage your finances. Using a broad credit mix also demonstrates financial prowess.

Applying for several new credit accounts within a short period can hurt your score because it may indicate financial distress. You can avoid this problem by waiting about six months before applying for another loan or credit card.

Recruiting a cosigner with good credit can solve the problem of impeded bad credit loan approval. Most private lenders welcome cosigners who share the responsibility for repaying a loan. The credit bureaus assign the account to both you and the cosigner.

Therefore, both your credit scores are vulnerable to missed payments, strongly motivating the cosigner to ensure that doesn’t happen.

You can also increase your loan approval odds by posting collateral. Secured loan arrangements are available, although less popular than unsecured loans. Just as with an auto loan or mortgage, failure to repay a secured loan can result in the loss of your property. In effect, collateral shifts default risk from the lender to the borrower.

Check the Competition Before Borrowing From OppLoans

OppLoans is not your best source for personal loans due to its high interest rates. We suggest consumers apply for loans like OppLoans from the reviewed lending networks first since their lenders can offer you far lower APRs.

All these lenders can help you rebuild your credit by reporting your payments to each major credit bureau. It’s up to you to take advantage of this reporting by always paying your bills on time. Otherwise, your credit score may suffer further damage, making it even harder to borrow money.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.