If you are a homeowner, you may have accumulated equity that you can access. Depending on various factors, you can either borrow against the value of the equity with an installment loan or draw from it on an as-needed basis with a line of credit. Both options can be helpful ways to pay for things you want or need.

For example, you may need to use the money to repair a roof after storm damage, cover your child’s college education, or pay off expensive consumer debt.

So, is a home equity loan or line of credit better for you? Here’s what you need to know.

What is a Home Equity Loan?

A home equity loan that you would get from a financial institution is similar to your primary mortgage. It is a lump sum of money that is secured by your home. The interest rate is usually fixed, and the fees are built into the loan.

You will make regular payments in the same amount every month, and each time you do, you will drive the balance down. Repayment terms typically range from five to 20 years.

Home equity loans are considered a type of second mortgage, which means that if you do not make your payments as agreed and go into default, the lender would only get paid after you satisfy the first mortgage.

For this reason, they are inherently more risky to lenders than first mortgages. Consequently, the interest rate may be considerably higher than the one on your primary mortgage.

Home equity loans can be beneficial if you need a large amount of money for something specific and necessary, and you are certain that you can make the payments as agreed upon for the entire term.

Common reasons people take out home equity loans:

- home repairs

- college tuition

- debt consolidation

- business finding

- student loan deletion

What is a Home Equity Line of Credit (HELOC)?

HELOCs are another way to borrow against the equity in your home, but they offer greater flexibility than loans.

After qualifying for the amount you can borrow, you are free to withdraw as much as you want from that credit line. The interest rate on HELOCs is usually variable, so the rate can begin low and go higher until it reaches a maximum.

As with a credit card, HELOCs are revolving credit products. Unlike a credit card, however, they come with a time-sensitive draw period, which is typically between five and 10 years. Depending on the lender and HELOC, you may only have to send monthly interest-only payments during the draw period.

When it ends, though, and a debt remains, you will have to repay the balance in installments, usually within 10 to 20 years.

Common reasons people use HELOCs:

- emergency expenses

- home renovations and remodels

- medical bills

- to finance expensive events, like weddings and funerals

Home Equity Loan and HELOC Fees

Some lenders will charge an origination fee for a home equity loan, usually not more than 1% of the amount you take out.

Other fees associated with both home equity loans and HELOCs may include:

- Professional appraisal

- Credit check

- Document preparation

- Title search

- Application or origination

- Notary

- Early payoff

Some fees are only associated with HELOCs. For example, the lender may charge you an annual fee or a fee each time you draw from the credit line. Some lenders will charge an inactivity fee if you don’t use the credit line often enough, and many have cancellation fees.

Dealing With Bad Credit

Even though the equity is yours to use, the financial institution you are working with is still lending you the money. Despite being a secured loan or credit line, there is risk involved. For this reason, there are usually credit requirements. The higher your credit score is, the lower the APR you will be offered.

In general, you will need to have a credit score of at least 620 to qualify. A FICO Score in that range is considered fair.

But there are options if your credit score is lower — 300 to 579 — and considered poor. But you will have to do some extra work and the costs will be high if you do qualify.

- Earn more: Lenders also check your income and employment history and compare it to your current debt payments. That’s your debt-to-income (DTI) ratio. If your DTI is low, it can help influence the decision. Typically, you will need a DTI of no more than 43% to 50%.

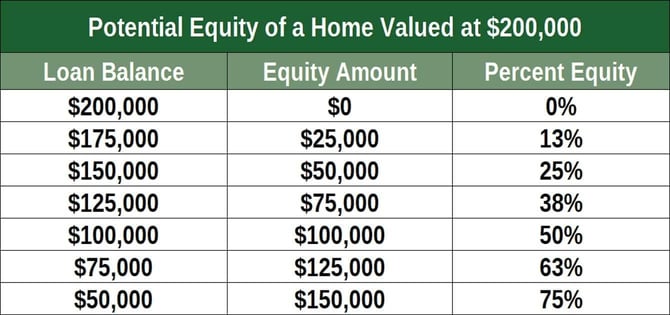

- Increase the equity. You will also need at least 15% to 20% equity in your home, but the more you have, the more appealing you will be as a borrower. That may mean waiting until your regular mortgage payments lower the amount you owe.

- Increase your home’s loan-to-value (LTV) ratio. This figure represents the loan amount compared to the value of your home. Your current loan balance and your new home equity loan balance cannot exceed the lender’s LTV ratio requirements. Many lenders set the LTV limit at 80% to 85%. A low LTV can make you more attractive to a lender, even with a low credit score.

Preparing to Apply for a Home Equity Loan or HELOC

Shopping around for home equity loans and HELOCs is especially important when your credit isn’t great. Not only do you want to qualify, you want to get the lowest rate possible.

First, be prepared with a letter of explanation. You may have had a very good reason for missing payments on credit accounts. If so, prepare a letter with your explanation and supporting documents.

Review several different home equity loans and HELOCs. The terms will be spelled out for you to compare and contrast. But before you apply, make sure the lender has a preapproval tool so you can get a good idea of whether you qualify without it hurting your credit score.

Our Top-Recommended Lender of Equity Loans:

- Best for cash-out refinance

- Utilize your home equity with America’s #1 lender

- eClosing allows customers to close electronically, greatly speeding the process

- A+ rating with the BBB

- Receive cash for home improvements, college tuition, or paying off debt

- 24/7 access to your loan through the Rocket Mortgage app

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

You will need to enter basic details about your home, financial situation, and location, and in seconds, you will know whether you are a good candidate. Once a few come back with potential agreements, you can choose among them.

Look for the loan or HELOC that has the lowest interest rate and fees and is in the amount you want. At that stage, you’re ready to apply for the product you want and hopefully will get.

Take Action if Your Credit Scores are Too Low to Qualify

If your credit scores are so low that you are not eligible for a home equity loan or HELOC now, don’t despair. You can change those numbers with certain actions.

- Bolster your payment history. The most important credit scoring factor is your payment history. For every account that is listed on your credit report, you should have a steady stream of on-time payments. If you don’t, and you can wait at least six months before applying for a home equity loan or HELOC, use that time to send all of your payments by the due dates.

- Pay down revolving debts. The second most important credit scoring factor is the amount of money you owe lenders. One part of this factor is the amount you owe on your credit cards compared to the amount you can spend on your credit cards, known as your credit utilization ratio. The less you owe on your credit cards, the lower your credit utilization ratio. So if you can, pay these accounts down so you have at least 70% of your credit lines unused.

Remember, all lenders just want to reduce their risk when they do business with a borrower. You can prove that you are a responsible borrower by meeting the terms of your credit accounts and using loans and credit lines appropriately.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.