Trucks are some of the most versatile vehicles on the market, but they often come with a high price tag. A compact truck may cost anywhere from $38,000 to $55,000, while full-size pickup trucks can have a price tag of as much as $60,000, depending on the model.

While used trucks can be cheaper, most people will still need to finance their new truck purchases. Finding bad credit truck loans can seem like a challenge if you have a low credit score. Luckily, a few lending networks and loan options cater to those with bad credit, allowing you to still drive home with the truck you’ve been eyeing.

Best Truck Loans You Can Get With Bad Credit

While many banks and credit unions offer truck loans, it is difficult to get approved with a subprime credit score. Some of the best bad credit truck loans can be found in online loan marketplaces that work with a wider network of lenders.

This allows you to prequalify for a loan through multiple lenders and shop around to find the best terms for your needs. When you select a product, the network will forward your information to the lender’s website so you can complete a loan application and receive the funds to purchase your truck.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% – 29.99% | 1999 | 3 minutes | 9.5/10 |

Auto Credit Express partners with several auto loan companies to help you get the financing you need — no matter your credit score. Whether you have bad credit, poor credit, a past bankruptcy, or no credit at all, Auto Credit Express helps you connect with an auto dealer in your area that can offer you a truck loan.

The company includes more than 4,000 lenders in its dealer network and has helped process millions of auto loans. To get started, you’ll need to fill out a short loan request form on the website. Then you’ll match with lenders or auto dealers and review their loan offers. Once you select a loan, Auto Credit Express will send your information to that dealer so you can complete the application process.

To qualify, you typically need to earn at least $1,500 to $2,000 per month from a single income source. You should also have a minimum of three years of employment history and at least six to eight personal references.

- Prequalify in minutes without impacting your credit score

- Refinancing loans save an average of $191 per month

- 125% financing available for cash-out refis

- PenFed Credit Union membership required but can be applied for at the same time as your loan

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 5.19% and up | 1935 | 5 minutes | 8.5/10 |

PenFed Credit Union offers car and truck loans with up to 125% financing. The lender offers competitive rates on loans for new and used cars and trucks along with a simple preapproval process. You can see how much you qualify for in minutes by filling out one online form.

Prequalifying won’t impact your credit score, but if you like the terms and choose to move forward with an application, it will result in a hard credit inquiry. While PenFed Credit Union typically offers lower rates, they still depend on your credit score and the loan terms.

If you choose a longer repayment term, such as 84 months, you will likely get a higher interest rate on your loan, and it will cost more overall. The website also offers a free calculator you can use to estimate your monthly payment based on certain loan terms.

3. RefiJet

- RefiJet helps people lower their monthly auto payment

- Pre-qualifying for a refinance auto loan does not impact your credit score

- Nationwide network of lenders

- Presents you with options from lenders that fit your situation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2016 | 5 minutes | 8.0/10 |

RefiJet can help you refinance your existing truck loan for a lower interest rate. Refinancing is a popular financing option that may also lower your monthly payment.

You start by speaking with a RefiJet auto refinancing expert to discuss your options. Customers can get prequalified quickly without impacting their credit score and see loan options from various lenders.

RefiJet helps you complete any paperwork required by the lender to streamline the process, and most customers save around $150 per month on their payment. When you receive a refinance loan through RefiJet, you may have the option to not make a payment for the first three months, and you can add or remove a cosigner if needed.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Car.Loan.com Auto Loans is another leading option for bad credit truck loans. The platform has been around since 1994 and offers bad credit financing to those with no credit or poor credit history.

Start by filling out an auto finance request form online to match with one of the network’s dealers in your area that can offer you a subprime auto loan. Should you choose to move forward with the dealer, you can head to the lot, choose your car, and finish the financing application.

Car.Loan.com Auto Loans partners with some buy here, pay here (BHPH) dealers that offer in-house financing to make it easier to qualify for a subprime auto loan. While you may have a higher interest rate dealing with a BHPH lot, the financing process may be more streamlined, and you’ll make monthly payments to that dealer each month.

5. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

LendingTree is an online lending marketplace that helps match users with financing options, including auto loans. The platform allows you to compare current loan rates online and even receive your own personalized quotes from different lending partners.

While LendingTree doesn’t cater to borrowers with low credit scores, you may find a bad credit loan due to its vast network of more than 300 lenders.

LendingTree’s website also frequently adds financing partners and updates eligibility requirements, so you’ll know what you need to qualify. If you’re looking for the best auto loan for a truck even with bad credit, LendingTree is free to use and worth a try.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

myAutoloan.com is an online lending marketplace that makes it easy to shop around and compare loan terms from a wide variety of dealers. You can match with up to four lenders when you fill out one online loan request form.

myAutoloan.com helps you finance new or pre-owned vehicles based on your needs. Customers also come to the platform to secure auto refinancing and lease buyouts. While myAutoLoan.com doesn’t mention a bad credit car loan option, it partners with several dealers that cater to borrowers with bad credit.

You must earn at least $2,000 per month or $24,000 per year to qualify, although loan terms may be more favorable when you have a cosigner. You also may not have an open bankruptcy or reside in Hawaii or Alaska. myAutoloan.com includes vehicle requirements for financing, so a used vehicle must not have more than 100,000 miles on it or be older than eight years.

7. Carvana

Carvana is an online car dealership that allows customers to shop for vehicles and finance them all in one place. Whether you’re looking for a new vehicle or a pre-owned model, it offers plenty of truck options and other vehicles. Carvana is a nationwide platform — it has several physical lots — and can even deliver the car you purchase to your home.

You can finance your truck directly with Carvana and trade in or sell your current vehicle to put more money down on the loan. Start by finding the make and model you like on Carvana’s website. Then, you can get prequalified by filling out a form online and reviewing the loan terms you qualify for.

This has no impact on your credit score and will show what your interest rate and monthly payment could be based on your loan amount and other personal factors.

What is a Bad Credit Auto Loan?

Bad credit auto loans are similar to regular auto loans with a few small differences. Traditional lenders like banks and credit unions may not approve someone for a loan to purchase a vehicle if their credit score is too low since they see it as risky.

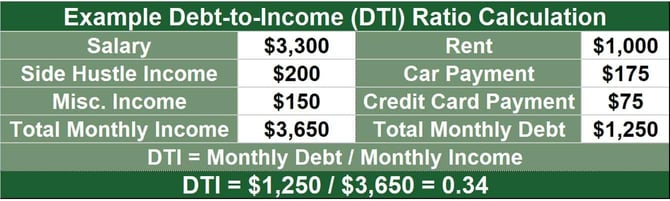

On the other hand, online lenders or loan marketplaces may have more lenient loan requirements and place a higher emphasis on other factors, like income and debt-to-income ratio for the borrower.

A few companies, including Auto Credit Express and MyAutoLoan.com, partner with lending networks that may offer a bad credit loan or approve someone who’s filed for bankruptcy in the past.

These loans are designed to assist individuals with a history of missed payments, bankruptcy, and other credit products to access funds to purchase a car, truck, or other vehicle. Bad credit loans usually have a higher interest rate and require higher down payments.

Can I Get A New Truck With a 500 Credit Score?

If you have a 500 credit score, your best option is to consider a bad credit loan and try to get matched with a lender that can approve your loan request. Trying to get a truck loan with a 500 credit score can be challenging because that is considered a poor credit score.

However, there are some alternatives. You can explore bad credit loan offers from online lenders and auto dealerships that specialize in working with individuals who need bad credit auto loans. You may even want to call a lender’s customer service department to speak with a loan expert to discuss their requirements and your options. This can help you save a lot of time and ensure you actually qualify for the loan before you apply.

What is the Average Interest Rate on a Bad Credit Car Loan?

The average interest rate on bad credit auto loans is around 14.08%. However, rates vary depending on the lender and the applicant’s unique financial situation.

| FICO Score | New Car Loan Avg. Interest Rate | Used Car Loan Avg. Interest Rate |

|---|---|---|

| 781 to 850 | 5.18% | 6.79% |

| 661 to 780 | 6.40% | 8.75% |

| 601 to 660 | 8.86% | 13.28% |

| 501 to 600 | 11.53% | 18.55% |

| 300 to 500 | 14.08% | 21.32% |

To secure a lower interest rate, consider increasing your down payment, working with a cosigner, or getting prequalified to receive quotes from different lenders.

Do Bad Credit Truck Loans Require a Down Payment?

Yes, most bad credit truck loans will require a down payment. A down payment lowers the risk for the lender and can also strengthen your application. Additionally, you’ll have a smaller loan amount when you put money down on a truck.

Sometimes, your down payment can be as small as $500 or you can put down $5,000. It depends on your situation and each lender’s requirements. Have a conversation with lenders early on to determine if they have any down payment requirements.

If you’re looking to finance through a car dealership and have a vehicle you plan to sell, you can also ask about trading your vehicle in. The lender will provide you with an offer, and the sum you decide on can go toward the cost of your new truck.

Can You Build Credit With an Auto Loan?

Yes, borrowers can build credit with an auto loan so long as they commit to making payments on time and don’t borrow more than they can afford. A car loan will go on your credit report and can impact several factors that make up your credit score.

Credit mix. Your credit mix represents the variety of account types that are on your credit report. This only affects about 10% of your credit score, but having different types of accounts, like credit cards, auto loans, and personal loans can improve your credit mix, which could positively impact your credit score.

Amounts owed. The total amount of debt you owe is a factor that impacts 30% of your credit score. If a large portion of your total credit limit is being used on loans and credit card balances, this could negatively impact your credit score. Paying down your auto loan and keeping other debts low could improve your credit over time.

Payment history. Payment history is the biggest factor that impacts 35% of your credit score. It’s important to make payments on time each month to avoid late fees and also negative marks on your credit report.

Some other factors that impact your credit are the total length of your credit history, new accounts, and how many hard inquiries you have. If you want to maintain a good credit score, it’s best to practice healthy financial habits, including paying bills on time.

Improve Your Chances of Getting a Truck Loan With Bad Credit

Getting a truck loan with bad credit is still an option. Several bad credit auto loans exist, but you need to know where to find them and how to qualify. This list of the best bad credit auto loans is a resource that can help you get started and identify loan offers that work for your situation.

When you don’t have good credit, it may be difficult to think of putting in several loan applications that could get denied and rack up hard inquiries. Instead, start by filling out a loan interest form to get prequalified for an auto loan and compare terms from different lenders. Check your credit score to see where you stand and realize that you can still shop around and compare loan terms even without having excellent credit.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.