I grew up in Manhattan, and like many of my fellow island-dwellers, had no need for a car. It was only after leaving New York did I start commuting to work via automobile, and I’m just grateful I had good enough credit for an auto loan. But had my credit been bad, I may have turned to no-credit-check auto loans.

These loans do not depend on your credit score. Naturally, they cost more, but at least they enable you to acquire a set of wheels so you can get to and from work. We’ll dive into some information about these loans and explore how to qualify for no-credit-check auto loans, and address some other common questions on the subject.

Lenders | How to Qualify | FAQs

No-Credit-Check Auto Loans for Bad Credit

These five lending services facilitate offers for car loans with no credit check. All are reputable companies that will work with you to get you an auto loan even when you have bad credit or no credit at all. If your credit history includes collections, bankruptcy or repossessions, these matching services can still make it possible for you to obtain automobile financing.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

It takes but 30 seconds to pre-qualify for a no-credit-check loan from Auto Credit Express. Simply enter your credit score range, monthly income, rent or mortgage payments, credit card and loan payments, and any garnishments.

You’ll immediately receive an estimated approval amount, after which you can apply online for the loan. Bad-credit applicants must have a monthly income of $1,500.

Auto Credit Express is a loan matching service that has been in business since 1999, and its dealer and lender partner network has closed $1 billion in bad credit auto loans. It is a member of the Internet Brands automotive group.

2. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

LendingTree is one of the nation’s largest lending networks. It can net you up to five loan offers from different banks, dealers, and other types of lenders willing to work with people who have poor credit histories.

You can compare your offers with no credit pull, so you’ll know whether you qualify before you bother to apply. It’s completely free to use, and your data and privacy are secured.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

The MyAutoLoan.com matching service can get you up to four loan offers from members of its lender and dealer network. You can apply for a new or used car loan, refinancing, a lease buyout, or financing for a private-party purchase.

Uniquely, the website displays the lowest current auto loan rates and provides an interest rate estimator and payment calculator. You receive approval within minutes and an online loan certificate or check within 24 hours. Horizon Digital Finance owns and operates MyAutoLoan.com.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Car.Loan.com, which is also a member of the Internet Brands automotive group, is a loan matching service specializing in auto loans for consumers with bad credit or no credit, and auto loans for during or after bankruptcy. You will need just three minutes to complete the no-obligation loan request form.

Car.Loan.com matches your loan request to the lenders and dealers on its partner network, who compete to offer you a no-credit-check auto loan. There is no fee for using the Car.Loan.com matching service, and same-day approval is available.

5. RefiJet

- RefiJet helps people lower their monthly auto payment

- Pre-qualifying for a refinance auto loan does not impact your credit score

- Nationwide network of lenders

- Presents you with options from lenders that fit your situation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2016 | 5 minutes | 8.0/10 |

RefiJet is a network of lenders that specializes in helping people find personalized auto refinance loans based on their unique qualifications. There’s no credit check to see which offers you qualify for.

Refinancing is good for people who want to lower their monthly payments, cash out equity in their vehicles, and save on interest fees. You must have a verifiable source of income, a recent history of on-time car payments, and full coverage insurance, among other requirements, to qualify for auto loan refinancing.

How to Qualify for a No-Credit-Check Auto Loan

Normally, you apply for a no-credit-check auto loan when you have no credit history or a low credit score. While qualifying for a loan without a credit check is certainly harder, certain factors will improve your chances.

- Show adequate monthly income: Typically, lenders have minimum requirements for monthly income. It can be any mix of wages, Social Security benefits, alimony or child support, disability payments, state assistance, and so forth. The lender may set a maximum debt-to-income (DTI) ratio (i.e., monthly debt payment divided by gross income). A lower DTI helps improve your creditworthiness and facilitates a loan, even a no-credit-check loan.

- Make a large down payment: The more money you put down, the less you need to borrow. Furthermore, you’ll have more equity invested in your automobile, meaning you have greater motivation to avoid repossession. Lenders take your down payment into consideration when underwriting your loan and assigning you an interest rate.

- Use a co-signer. A co-signer with strong credit will greatly facilitate loan approval. A co-signer is responsible for making the monthly loan repayments if you fail to do so. Keep in mind you will be putting your relationship with your co-signer on the line. Therefore, let the co-signer know as early as possible if you are having trouble making payments.

- Pledge additional collateral. While the car you buy serves as collateral for the loan, you can improve your loan approval chances if you can pledge additional collateral to the lender. Good candidates include your home equity, cash in a savings account or certificate of deposit, stocks, bonds, and other assets. Lenders view secured loans as much safer than loans that are unsecured, making it easier to gain approval and receive a lower interest rate. Bear in mind that you will be putting your assets at risk if you default on your loan payments.

Employing some or all of these strategies should make it easier to obtain your auto loan.

What is the Best Auto Loan Company for Bad Credit?

Auto Credit Express scored the highest among the loan services rated in this article. It and Car.Loan.com are members of the Internet Brands automotive group, which means there should be little difference between them.

It’s important to understand the distinction between a loan matching service and a direct lender. The reviewed loan matching services are not responsible for the loan offers you receive from their lender and dealer partners. That is, these services do not have a say in whether any direct lending partners will offer you a loan, and if they do, what rates and terms will apply.

Rather, the value of a loan matching service is convenience. By completing just one loan request form, you have access to perhaps dozens or hundreds of loan partners on the network. Furthermore, when the partners compete for your business, they are more likely to offer the best rates they can.

When choosing a loan matching service, look for characteristics that indicate honesty and effectiveness, such as:

- Length of time in business: A company that has been operating for many years has withstood the test of time. A shady or ineffective lending service would likely lose out to more reliable competitors. Even the youngest of the services we reviewed, MyAutoLoan.com, has been operating since 2003.

- Volume of business: Look for how much loan money the lending service has facilitated over its lifetime. Both Auto Credit Express and Car.Loan.com report closing $1 billion in auto loan volume.

- Ratings: Check the website for an A+ rating from the Better Business Bureau and/or an excellent rating from Trustpilot.

We evaluate these and other factors in our reviews.

Can I Get a Car Loan with Bad Credit and No Money Down?

It is possible to get a car loan with no money down but coupling that with bad credit complicates the picture. Lenders look for ways to qualify applicants for loans, as that’s how they earn income.

However, they must trade off income potential against the risk of the lender defaulting on the loan, forcing the lender to repossess the car.

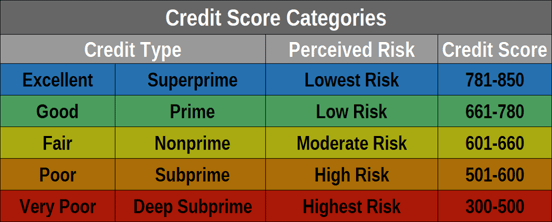

Your credit score represents the risk a lender takes when you borrow money. Having poor credit constitutes the highest risk and often comes with high interest rates.

Nonetheless, we have performed extensive research on the top auto loan providers for bad credit and they all offer no-down-payment loans. If you cannot afford to make a down payment on your loan, you may have to agree to certain conditions, including:

- A higher interest rate, often greater than 20%.

- More frequent payments. Lenders may require weekly or bi-weekly payments tied directly to your pay schedule.

- Automatic payments. The lender may require you to agree to have automatic payments deducted from your checking account. Some may insist that your checking account have overdraft coverage.

- Pay down other debts. You may receive a loan offer conditional on first paying down credit card debt and other loans.

- Co-signer: You can greatly increase your approval chances by recruiting a creditworthy co-signer.

- Buying an older car. Older cars with high mileage cost less, and dealers are more eager to find buyers for them. Even if the car isn’t your first choice, it may be a good strategy to purchase it and make your loan payments on time. By demonstrating responsible behavior, you can raise your credit score and make it easier to buy your next car.

The more of these techniques you can adopt, the easier it should be to receive financing.

Can I Get Auto Financing with No Credit History?

Having no credit history is different from having bad credit. Some folks are either naturally disposed against debt or are too young to have had a chance to develop a credit history. Bad credit is the result of unfortunate actions, such as delinquencies, collections, defaults, and bankruptcies. Contrast this with no credit history, where there is no track record to put lenders on guard.

Nonetheless, if you have no credit history, you may have to take the same kind of remedial steps you would if you had bad credit. This includes making a large down payment, using a co-signer, purchasing an older vehicle, and perhaps pledging extra collateral.

One good strategy for students and others with no credit history is to apply for a secured credit-building credit card. These are credit cards backed by money in a locked account at a bank or credit union. The credit card has a credit line equal to the account balance. In this way, the card issuer has full collateral to protect against delinquent payments.

You build your credit history by using your credit card and always making timely payments, preferably in amounts above the required minimum. You must make sure that the card reports your payments to one or more of the three credit bureaus (TransUnion, Experian, and Equifax) so you can build your credit history.

In a similar vein, you can open a credit-builder account, which are readily available from many credit unions, banks, and online platforms. In this arrangement, you receive a small loan, which is deposited into a locked account or CD. You then repay the loan over time, and after it’s fully repaid, the lender will unlock the account so you can access the funds.

Your payment activity is reported to the credit bureaus and will help you build a credit history that will make it easier to get a car loan.

Find the Right Loan and Get Back on the Road

The five lending services in this review will all go the extra mile to find you a no-credit-check auto loan. If you have bad credit, a no-credit-check loan may be your best alternative for financing a car purchase.

Look upon the loan not only as an opportunity to get back on the road but also as a way to raise your credit score through timely payments. Then, at trade-in time, you may no longer struggle with bad credit, giving you access to easier and cheaper credit.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.