Your credit reports and credit scores have considerable influence over your financial life — whether you think about them every day or not. Over 200 million Americans have credit reports at each of the three credit reporting agencies. If you’ve never thought about how you compare to the rest of them, you may be shocked to see how you stack up.

What follows are 15 fascinating bad credit statistics. You’ll also learn about common problems that may be holding your own credit scores down, along with some reasons why you should work hard to improve your credit scores if needed.

1. Only 11% of U.S. Consumers Have the Lowest FICO Scores

Credit problems are not uncommon. You certainly didn’t need to read this to figure that out. But severely low credit scores are absolutely not the norm.

Only 11.1% of U.S. consumers have credit scores in the lowest FICO Score ranges according to FICO, the company that designed the FICO credit scoring system. More specifically, 11.1% of U.S. consumers have credit scores that are lower than 550.

On a scale of 300–850, FICO scores that fall under the 580-threshold are considered to be very poor.

Consumers with ultra-low credit scores tend to face many challenges when compared to those whose credit scores are higher. For example, it can be difficult for those with very poor credit scores to qualify for financing, depending on the lender’s approval criteria.

Even when consumers with the lowest credit scores qualify for a loan, credit card, or another type of account, they can expect to pay significantly higher interest rates and receive less attractive borrowing terms. That’s the bad news.

The good news, looking at this from a glass-half-full perspective, is that almost 89% of the population has FICO scores above 550. And while the best rates are generally reserved for consumers who have scores in the 700s, credit is certainly available for consumers who score in the 500s and 600s.

2. Close to 20% of Americans Have a Subprime Credit Score

Experian defines a subprime credit score as a FICO Score ranging between 580 and 669. Eighteen percent of U.S. consumers have a credit score that falls into this category.

Credit scores in this range certainly aren’t as bad as the 11% addressed above (580 and below). That’s the difference between subprime and ultra-high-risk. Yet, even though you may be able to qualify for better deals on financing than those with severe credit issues, subprime scores between 580 and 669 can still cause financial difficulties.

For example, qualifying for certain types of financing, such as premium credit cards, may still be out of reach. And, some lenders don’t even have a product designed for the high-risk borrower.

3. FICO Scores are On the Rise: 43% of Consumers Have Fantastic Credit Scores

You aren’t alone if you have bad credit, but you are in the minority. More than 22% of U.S. consumers have FICO scores higher than 800, and 43% of people have FICO Scores over 750. Those are elite credit scores using any definition of the word.

Consumers who have these excellent credit scores share several common characteristics. If you want to join this group, these are the good habits you will have to practice:

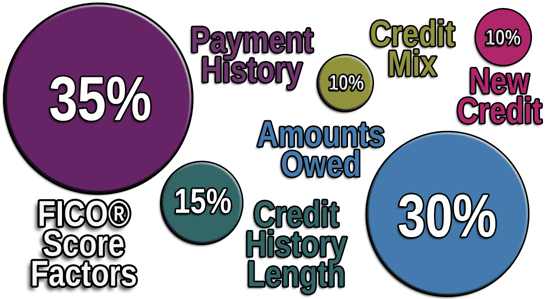

- Pay your bills on time, every time, without exception.

- Keep the balance-to-limit ratio (credit utilization) on your credit cards low.

- Have a good mix of account types on your credit report (e.g., revolving credit cards, installment loans, etc.).

- Don’t apply for new credit too often.

These financial best practices will help you achieve a credit score that ranks among the elite 43% of the population.

4. FICO says 17% of the Population Has Paid an Auto Loan, Credit Card, or Mortgage at Least Three Months Late in the Last Two Years

The purpose of both the FICO and VantageScore credit scores is to predict how likely you are to pay a credit obligation 90 days late or longer anytime during the next 24 months. As such, falling 90 days behind on a credit card, auto loan, mortgage, or any other account on your credit report is a huge problem because you’ve already proven to the credit scoring model that you’re willing to go significantly past due.

How much will a 90-day late payment hurt you? It may damage your score a lot, especially at first.

But as with the scenario above, a 90-day late payment won’t affect everyone’s credit score the same way. And, if you get caught up and avoid going delinquent ever again, the late payment’s impact will wane over time.

Paying a bill three months late will never help your credit score, but the specific number of points your score will change in this situation won’t be the same as the next guy’s experience. In general, the cleaner your credit report, the more a new 90-day late payment will hurt your score because you’re starting out at a higher point with more room to fall. Someone who already has poor credit won’t experience the same impact because they have already forgone so many points.

5. Almost 20% of Consumers Have Been 30 Days (or More) Past Due in the Last 12 Months

Paying your creditors on time is the best way to ensure a solid credit score. Conversely, paying your creditors late is one of the fastest ways to damage your credit scores.

As far as FICO scores are concerned, your payment history affects you more than any other information on your credit reports. Payment history makes up 35% of your FICO Score.

Even the occasional late payment can be a big setback. A new 30-day late payment may trigger a credit score drop of 30 or more points for some consumers, depending on when the late payment occurred and whether the account is still past due.

That being said, it’s important to understand that late payments impact the credit reporting of different people in different ways. In some cases, a recent 30-day late payment isn’t as big of a deal as long as you pay it before you go 60 days past due. For others, paying 30 days late is very problematic.

6. FTC Finds 1 in 5 Consumers Have an Error on at Least One of Their Reports

It’s important to accept responsibility when you do something wrong and your credit score drops as a result. Acknowledging the problem can be uncomfortable, but it puts you in the driver’s seat and should motivate you to correct your credit management practices.

Sometimes, however, bad credit happens due to someone else’s mistakes. If your creditor reports incorrect information to a credit bureau or if a credit bureau accidentally messes up, you might be the one who ends up with the incorrect credit report information.

The Federal Trade Commission released a credit reporting accuracy study several years ago that revealed that 1 in 5 consumers had mistakes on at least one of their credit reports. This is why the dispute provision exists in the Fair Credit Reporting Act. Consumers who believe they have errors in their credit reports can challenge those errors and have them corrected, at no cost.

7. Around 15% of U.S. Consumers Don’t Have a FICO Score

Having bad credit can hurt you when you want to apply for new financing, including a credit card or loan. What you may not realize is that having no credit score can hold you back in many situations as well. After all, lenders may be nervous to loan you money when they have no indicator of how well you’ve managed your credit obligations in the past.

To qualify for a FICO credit score, your credit report has to meet some minimum requirements. Your report needs to contain:

- At least one undisputed account that is older than six months

- At least one undisputed account that has been updated within the last six months

- No notation on your credit report that you’re deceased

According to FICO, around 15% of U.S. consumer credit reports don’t meet these requirements, and, therefore, cannot qualify for a FICO Score. VantageScore, a competing scoring model to FICO, has a more liberal minimum scoring requirement, so more people have a VantageScore credit score than have a FICO credit score.

NOTE: While some so-called personal finance celebrities brag about having a “zero” FICO Score, this is untrue because it is systemically impossible. There is no such thing as a credit score of zero. Scores range from 300 to 850, and that range doesn’t include zero.

8. Someone’s Identity is Stolen Every Few Seconds

Not only can your credit be hurt by mismanagement and credit reporting errors, but fraud and identity theft have the potential to damage your credit scores as well. There’s a new victim of identity theft around every two seconds.

It’s important to take action right away if you suspect that you are a victim of identity theft. You can place fraud alerts on your credit reports or you can opt to freeze your credit reports altogether. If you like, you can even take advantage of both credit protection tools at the same time.

The credit freeze option is much better because it is a proactive approach and prevents creditors from even seeing your credit reports and scores. This way you can prevent a new account from being opened rather than being notified afterward.

You can learn more about freezing your credit reports, which is now entirely free, here.

9. Survey Shows 43% of Consumers Haven’t Checked Their Credit Scores in the Last Year

Credit reporting errors and identity theft are common problems. However, you generally won’t know there’s a problem unless you develop a habit of checking your three credit reports from Experian, TransUnion, and Equifax.

It’s smart to check your credit reports and scores frequently. A significant drop in your credit score, after all, can alert you that something is wrong on your credit reports. Your credit information is so important that reviewing your reports and scores once a month is ideal.

Unfortunately, not everyone monitors their credit as they should. According to an annual survey by the Consumer Federation of America and VantageScore Solutions, 43% of consumers haven’t checked their credit scores in the last year.

In normal times you can check your three credit reports once every 12 months at AnnualCreditReport.com. There’s no fee for these annual reports, thanks to the Fair Credit Reporting Act.

In response to the Coronavirus pandemic, you can also claim a free credit report from each of the major credit reporting agencies each week by visiting the same website. You can do this at least through April 2021. That means you can check all three of your credit reports 52 times each year.

10. Children Can Have Bad Credit Too

As a parent, you work hard to keep your child safe and healthy. You teach them how to brush their teeth, eat their veggies, and not to stick their fingers in electrical outlets. But it may not cross your mind that your child’s credit reports need to be protected too.

Normally, children under 18 shouldn’t even have credit reports or scores. For example, your son or daughter may not have a credit report until after they turn 18 and apply for a student credit card or a loan. Or, they may establish credit sooner when you add them to your existing credit card account as an authorized user.

Yet, sadly, there’s another reason a credit bureau may create a credit file for your child. Children can be victims of identity theft.

A study published in 2018 by Javelin Strategy & Research revealed that over 1 million children were victims of identity fraud. When a fraudster applies for credit in a child’s name, it can create what’s called an inquiry only credit report, which is clear of any negative information and can then be used as the basis to apply for fraudulent credit.

Be sure to watch for red flags of child identity theft, like unexpected bills or collection calls in your child’s name. You can also freeze your child’s credit reports with the three credit bureaus if you want an added measure of security.

11. The Average Credit Card Balance is Close to $6,200

The best way to use your credit cards is to use them and then pay them off every month. Doing this can protect your credit scores and your bank accounts. Yet many Americans don’t follow this important rule of thumb.

As of May 2020, the average credit card balance among U.S. consumers was $6,193, according to Experian.

You may allow your credit card balances to creep upward for several reasons. Perhaps you used credit cards to help you through a financial emergency. Maybe you lost your job and needed the cards to help you make ends meet. Or you may simply have a bad habit of overspending and not following a monthly budget for your household finances.

Whatever the reason is for your credit card debt, you should create a plan to start chipping away at those balances as soon as possible. For example, you may want to examine whether consolidating your credit card debt with a personal loan or balance transfer offer sounds like a good fit for your situation.

12. The NFCC Reports 62% of Adults Have Revolved Credit Card Debt in the Last Year

Credit scoring models, such as FICO and VantageScore, place a lot of emphasis on how you manage your credit card accounts. And while credit cards themselves can help you build your credit reports and scores, credit card debt is another story and not very helpful at all.

Failing to pay off your credit card balances each month is a common practice, but it can be an expensive way to use plastic. When the balance-to-limit ratios on your credit cards increase, your scores will likely start to slide.

According to the National Foundation for Credit Counseling, 62% of adults in the United States admit that they have carried credit card debt sometime in the last year. If you’re guilty of this bad habit, you should aim to break it as soon as possible.

The good news is that as you pay down your credit card debt and your utilization rate decreases, your credit score may start to rebound. You’ll also save money because you won’t be paying expensive interest on your credit card debt.

13. At least 25% of Consumers with Low Incomes Don’t Understand How to Improve Bad Credit

Breaking out of the bad credit cycle takes a lot of hard work. It also requires an understanding of how credit scores work, which isn’t taught in school at any level.

Unfortunately, a recent survey from the Consumer Federation of America and VantageScore Solutions indicates that at least one-quarter of low-income consumers (defined as those who earn less than $25,000 per year) don’t have the knowledge they need to earn higher credit scores.

The 10th annual credit score survey by the Consumer Federation of America and VantageScore Solutions reveals several credit score misunderstandings that may hold some consumers back. According to the survey, low-income borrowers lack credit score knowledge in the following areas.

- Less than half understand that consumers have more than one credit score

- 25% don’t realize that mortgage lenders use credit scores

- Over 30% don’t know that maintaining low credit card balances may boost credit scores

Maybe it’s time to bring credit education into the classroom so that everyone can be armed with the knowledge needed to responsibly manage a credit score.

14. Low Credit Scores Can Cost You Over $100,000 More for a Mortgage

It’s no secret that good credit scores are an essential key to locking in attractive rates and offers when you apply for financing. The same holds true for mortgage loans.

But it may surprise you to learn just how much lower credit scores may cost you. The extra interest fees can easily add up to well over $100,000 on a single mortgage loan.

For example, on a $350,000, 30-year fixed mortgage with a 2.523% APR, you’d pay a total of $149,360 in interest over the life of the loan. You’d need a FICO Score of 760 or higher to potentially qualify for that rate.

But if your FICO Score was lower than 640, your rate may be 4.112% instead. At that rate, your total loan interest climbs to $259,707.

The difference between the overall interest on these two mortgages adds up to $110,347. That’s $110,347 more you would pay to finance the same house over the same length of time, all because of a lower credit score.

This assumes, of course, that you never refinance your loan to take advantage of a lower rate. It also assumes that you’ll pay off a 30-year fixed-rate mortgage over 360 months rather than paying the loan off early or selling your home.

15. The Average Credit Score is On the Rise

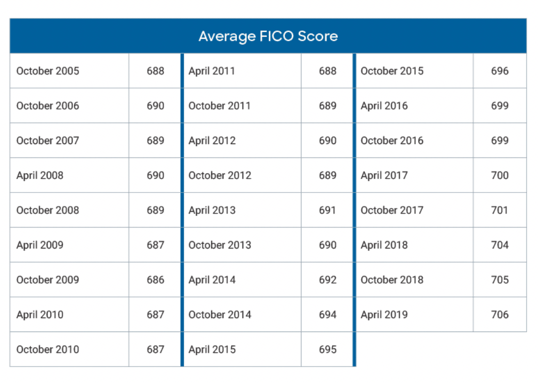

You may be encouraged to learn that, over the last nine years, credit scores in the United States have been trending upward. The most recent figures show that the average FICO Score is 706.

As a result, the average U.S. consumer has a credit score that is generally classified as being good, although ultimately, it’s up to your lenders to determine what is and what isn’t a good credit score.

According to Experian, just 8% of consumers who have good credit scores are likely to fall seriously behind on their credit obligations in the future. So, if you work hard to improve bad credit and bring your credit scores up to the good range, you’re likely to receive much better offers from lenders when you apply for new financing.

What Do These Bad Credit Statistics Mean for You?

Bad credit can hold you back from getting the things you want and need. For example, you may be turned down when you apply for certain types of financing.

A poor credit history can make it tough to lease an apartment, establish new mobile phone service, or in some cases even get hired for a new job. Low credit scores can cost you money in the form of higher interest rates, higher insurance premiums, larger utility deposits, and more.

If you have bad credit, it may be comforting to know you’re not alone. But you don’t have to accept credit problems as a permanent situation. Many people have struggled with bad credit and worked hard to change their situations.

Improving your credit can be a long, difficult journey. But even small steps forward can have a meaningful impact on your financial life. Even if you can raise your credit score from 550 to 600, that’s a very meaningful improvement that you can start to enjoy right away.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.