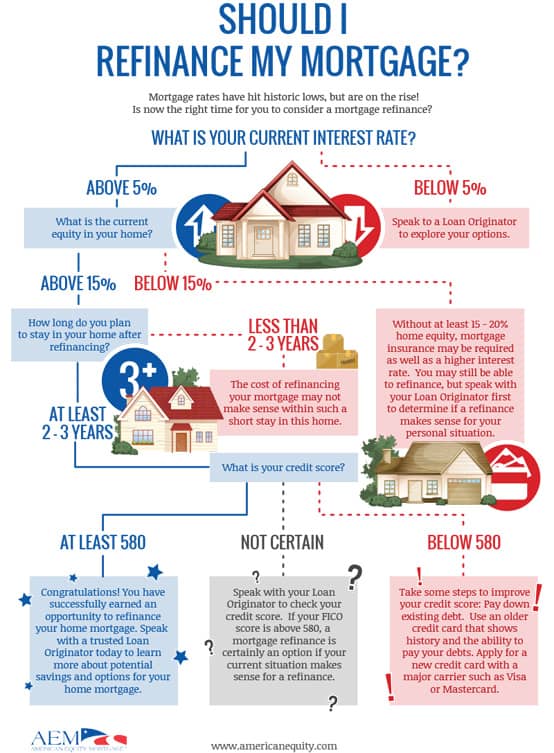

Knowing when to refinance your home is not an exact science. It can depend on a number of variables and circumstances, which we will take a closer look at below.

A big part of the American Dream is home ownership. For most of us, that also means carrying a mortgage. With the average down payment at 11% in 2016, new homeowners face a mountain of debt before they own their homes free and clear. That’s why mortgages extend to 15 or 30 years.

Given the length of time it takes to pay off a mortgage, it’s not surprising that many folks refinance at some point during the original term. Knowing when to do it, however, is something that depends on your mortgage terms and personal financial situation.

Let’s take a look at five ways to know when it’s the right time to refinance your home. We’ll explore considerations like lower interest rates, shorter mortgage terms, how long you plan to stay in your home, the amount of equity in your home, and whether your current payments are a struggle to keep up with.

1. If a Lower Interest Rate is Available

There is no better reason to refinance than to save money, and a lower interest rate will certainly help if it is substantial enough to overcome closing costs. Often, a reduction of 1 percentage point is enough to net you an overall savings. Obviously, you can benefit from a smaller rate reduction if the lender waives some or all of the usual closing costs. Lower rates not only save you money, but can also reduce your monthly payments and build equity quicker.

You can use a mortgage refinance calculator to gauge the effect of a lower interest rate. For example, suppose you owe $100,000 on your 9%, $150,000 30-year mortgage, requiring monthly payments of $804.62 (excluding taxes, HOA fees, insurance, etc.). Refinancing for 30 years at 6% will yield monthly payments of $608.54, assuming that $1,500 in closing fees are included in the amount financed.

That’s a monthly savings of $196.08, or $2,352.96 per year. You recoup the 1.5% closing fee in less than a year.

2. If You Can Shorten the Mortgage Terms

Perhaps you are more interested in paying off your mortgage than in reducing your monthly payments. Refinancing at a lower interest rate gives you the opportunity to achieve this goal. For example, if you reduce your 30-year-mortgage interest rate from 9% to 5.5% but keep your monthly payments just above $800 a month, you can cut the term from 30 years to 15.

LendingTree is our top recommendation for mortgage refinancing. Consult with one or more of our leading lenders to see if you can potentially shorten your mortgage terms and/or receive a better interest rate.

- America's largest mortgage lender

- The entire process is completed online

- Options for new mortgages and refinancing existing mortgages

- Award-winning customer service and cutting-edge digital platforms

- More than 90% of clients would recommend us

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

- Best for cash-out refinance

- Utilize your home equity with America's #1 lender

- eClosing allows customers to close electronically, greatly speeding the process

- A+ rating with the BBB

- Receive cash for home improvements, college tuition, or paying off debt

- 24/7 access to your loan through the Rocket Mortgage app

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

- Get today's mortgage rates from the top mortgage lenders and banks

- Easily compare and choose mortgage lenders with no obligations or fees

- Review current mortgage rates side by side

- Pick mortgage lenders that meet your specific needs

- Compare rates from pre-qualified and approved mortgage lenders — 100% online, 100% free

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1979 | 4 minutes | 8.5/10 |

Paying off the mortgage certainly frees you up to spend the money on other things and/or save it for later years. You also might contemplate taking out a reverse mortgage sometime after the 15th year, and you’ll receive the best terms if you own the home outright.

3. If You Plan to Stay in the Home Long Term

It doesn’t make much sense to refinance a home you plan to soon leave because you are unlikely to recoup the closing costs. However, if you plan to stay put for at least five years, refinancing might be a good idea, assuming interest rates are favorable.

Some folks initially finance their homes with a variable rate mortgage that has a balloon payment in three, five, or seven years. These mortgages are ideal for homeowners who think they might relocate on or before the balloon due date. If you have a variable rate mortgage but decide to stay in your home, you can refinance into a fixed-term loan to lock in your interest rate and dispose of the balloon payment.

Another scenario involves those who initially took a fixed-term, 15-year mortgage thinking they’d like to move when the term was up and receive the full proceeds of the sale. If you decide part way into the term that you will keep the home longer, you may decide to refinance into a 30-year term to lower your monthly payments.

4. If You Have Equity on Your Home

Your home equity is equal to the price you would get for selling the house minus the amount you owe. Mortgages are amortizing, meaning that your monthly payment is split between interest and principal. In the early years, that split heavily favors interest and only slowly tips over to mostly principal. Equity increases with principal payments, but rapid price appreciation can also produce equity, even in the early years.

A cash-out refinance allows you to tap some of the home equity you’ve built. It works like this: You refinance an amount greater than your current mortgage balance, up to the maximum loan-to-value percentage of required equity set by the lender. For example, if you owe $100,000 on a home appraised at $150,000, you can refinance up to $142,500 with a lender that requires a 95% loan-to-value ratio. You can receive $42,500 in cash (less fees), but of course, owe that much more to the lender.

5. If You’re Struggling to Make Payments (But Aren’t Behind)

If you have trouble making your monthly mortgage payments, it behooves you to refinance — even at a higher interest rate — if you can stretch out the payments over a longer period. Sure, you might end up paying more in interest, but that’s a lot better than risking foreclosure, losing your house and destroying your credit score.

If you refinance before you fall behind, you can preserve your credit score and ease the pressure on your budget. The alternative is to sell your house and move to less expensive accommodations.

This might be a good idea, but it also might be extremely inconvenient, and you might be locking in a loss on the home if prices have fallen since you purchased it. Refinancing can give you the breathing room to restore your finances to a healthier condition.

Does it Make Sense for You to Refinance?

Before deciding to refinance your mortgage, factor in the application and origination fees (which can cost up to 6% of the remaining principal), as well as the need for a new appraisal and title search. If refinancing makes sense despite these costs, then, by all means, take advantage of the benefits afforded by replacing your old mortgage with a better one.

Should you choose to refinance, you’ll want to comparison shop mortgage providers to see which one offers the best terms and the lowest fees. If you must pay a fee, consider paying it upfront so that you aren’t charged additional interest.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.