You should know some important details before you choose which bad credit repair company to hire. After all, choosing a credit repair service isn’t just about adding a few points to your credit score.

Cleaning up your credit history can not only help propel you to good credit, but it can also improve your overall financial reputation. This can make it easier for lenders to trust you and offer you better — and more affordable — loan offers.

An improved credit history can save you thousands of dollars over the life of just one loan. That money stays in your pocket and can help you build savings, eliminate existing credit card debt, or make a large purchase. The savings alone can offset the cost of a good credit repair company.

Credit Repair Services That Can Fix Your Bad Credit

We’ve vetted each top credit repair service on the market and narrowed our list of favorites down to four. Each agency below has a long history of successfully removing inaccuracies and negative items from credit reports while providing excellent customer service and financial education.

Each company charges a monthly fee, and some offer multiple tiers of service that go beyond just filing disputes with each credit bureau. Depending on which company and tier you choose, you may also receive credit counseling, identity theft protection, credit monitoring, or late payment removal negotiations with your credit card company or another lender.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

Lexington Law is considered by most to be one of the top credit repair agencies on the market. This isn’t solely because of the company’s long history of successfully helping clients clean up their credit reports.

Instead, this company is held in such high regard because of its staff of highly trained paralegals and credit lawyers who work on your behalf to put your credit history in order. When you hire Lexington Law, you aren’t adding a random customer service agent to your team. Instead, you’re adding an entire firm that will fight for your rights.

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

Sky Blue Credit Repair limits how many items it will dispute on your behalf each month. That can extend the time it takes to complete your credit repair process if you have many items to remove.

The company does offer a unique platform where you can pause, cancel, or restart your service at any time. This makes it easier to take a break if you can’t afford the monthly service payment.

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

CreditRepair.com is an online credit repair service that provides clients with a dashboard that offers real-time updates on each credit dispute as well as regular credit score updates from at least one credit bureau.

The company has nearly a decade of experience and has helped to remove millions of negative items from clients’ credit reports in that time.

- Free online evaluation

- One-on-one action plan with a certified FICO professional

- Unlimited disputes of any questionable items on your credit reports

- 24/7 Access to your online client portal

- 90-Day Money-Back Guarantee

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 2009 | $69+ | 7.5/10 |

The The Credit Pros offers three packages at separate price points so you can customize your credit repair service.

The Credit Pros will file all of the necessary dispute paperwork with each credit reporting agency and provide real-time updates on your disputes through your online dashboard.

- Credit Firm has helped consumers improve their credit scores for more than 20 years

- No hidden fees — just $49.99/month

- Credit Firm uses every legal tool and procedure allowable by law to remove as much derogatory information as possible from your credit reports to increase your credit scores

- 97% of our clients refer us to friends and family

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A | 1997 | $49.99 | 8.5/10 |

CreditFirm.net is rated “Great” on Trustpilot, has an A rating with the Better Business Bureau, and several positive customer reviews.

You can enroll in its monthly program to help understand the factors affecting your credit history and work with an experienced credit advisor to repair it. Couples receive a $10-per-month discount when signing up together.

What Is Bad Credit Repair?

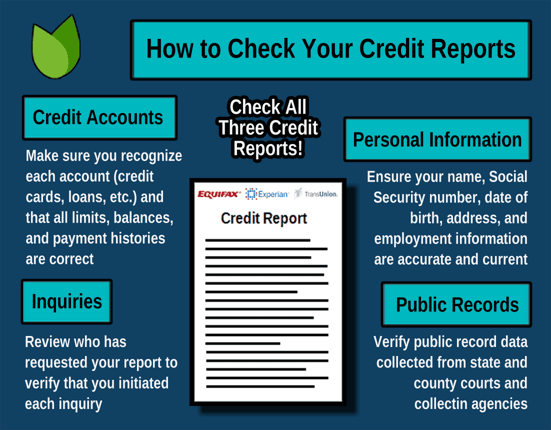

Credit repair is a process in which you or a hired company file disputes with each major credit bureau — Experian, Equifax, and TransUnion — to petition for the removal of inaccurate negative information from your credit report.

These items can range from an inaccurately reported credit card balance to old negative credit accounts that should no longer be reported as active to a creditor. These inaccuracies misrepresent your credit limit, available credit, or late payment status to current or potential lenders.

Having these items on your credit reports can lower your credit rating and make you less attractive to a lender.

Some credit repair agencies may be able to work with your lenders or a creditor to remove accurately reported items in exchange for repayment of a delinquent debt.

Can You Really Fix Bad Credit?

You can correct previous financial mistakes and begin to rebuild credit in several ways, and possibly go from poor credit to good credit in a matter of months.

The first step is to examine your free credit report from annualcreditreport.com — the official government resource mandated by the Fair and Accurate Credit Transactions Act (FACTA) — for any inaccuracies and petition for the removal of those items.

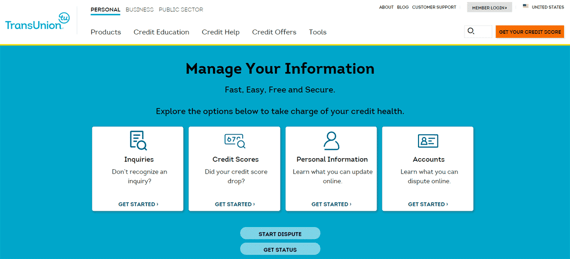

You can file disputes separately with each of the credit bureaus online. You can also submit a goodwill letter to your creditors requesting that they remove a late payment from your credit history.

Aside from those clerical tasks, you can also pay down large balances or take out a debt consolidation loan to help you pay off your debts. You can attempt to increase your credit card’s credit limit to help lower your credit utilization ratio, and always keep your payment history up to date to improve your credit report and boost your low credit score.

You can also use the free service Experian Boost to help improve your Experian FICO Score.

In the meantime, limit your access to new credit, keep your credit card debt to a minimum, and maximize your credit utilization to repair your bad credit over time.

How Much Does Credit Repair Cost?

Most credit repair agencies charge a monthly fee. This means that you’ll pay more if your services take longer to complete. If you have fewer credit disputes, it won’t require as much time and as many monthly payments.

Some firms may also charge an account setup or first-work fee before they’ll begin work on your case.

Here’s a breakdown of the prices of each of our rated companies above. The monthly cost is accurate as of the date of publishing.

- Lexington Law offers services for $99.95 per month.

- Sky Blue Credit Repair has one flat-rate service that runs $79 per month. You must also pay an account setup fee that equals your monthly service fee.

- CreditRepair.com offers three service tiers ranging between $69.95 and $119.95 per month.

- The Credit Pros offers three service tiers at $69, $119, and $149 per month. You’ll also be required to pay a first work fee of $119 or $149 if you choose the most expensive plan.

While the cost may seem significant with some companies, you should keep in mind that the overall price tag is substantially less than what you’ll pay for your loans and other financial products when you have bad credit.

Higher service tiers include more assistance, such as credit counseling, identity theft protection, and FICO score updates. You may also get credit monitoring and educational modules that help you with building credit the right way.

What Can Credit Repair Remove From My Credit Report?

Credit repair agencies can remove inaccurately reported items from your credit report and negotiate with a lender or creditor to remove some accurate items. Inaccurate items may include:

- Misspelled names, addresses, or other info

- An incorrect credit limit, credit card balance, or available credit

- Old credit accounts that should have aged off your report

- Improperly reported late payments

- Unauthorized credit inquiries

These inaccuracies can result from identity theft or simple clerical errors with the lender. Removing them can give your credit score an immediate boost and push you into good credit territory.

Credit repair cannot remove most accurate items on your credit report — including charge-offs, collections accounts, bankruptcy reports, or other negative items. If a credit repair service promises to remove those items, you may be headed into one of many credit repair scams.

How Long Does Credit Repair Take?

The time it takes to go through the credit repair process will vary based on the amount of work you need to complete.

For example, someone who only has a few inaccuracies to remove can complete the process in two months or less. Someone with many inaccuracies that resulted from a large identity theft case may need several months to fully recover.

When you or a credit repair firm submits a dispute with a credit bureau, the bureau must investigate the claim before making a ruling. This can take between 30 and 45 days. There’s an ensuing investigation for every dispute you file.

So if you file five disputes in one day, you’ll likely have to wait up to 45 days to receive a decision on all five. This means that you’ll need, at a minimum, 45 days to complete your credit repair process.

If you hire a credit repair company that limits how many disputes it will file for you each month, you may have to wait several months to file all of your claims — and wait 45 days after each filing for a result.

Our top-rated firm, Lexington Law, states this on its website:

“Statistically, 70% of Lexington Law clients who saw a credit score increase had an average increase of 40 points in six months.”

Just remember that every case is different, and the time you’ll need to complete the process will depend on how long each credit bureau takes to investigate your claim.

Can I Repair My Own Credit?

You absolutely can repair your own credit. Each credit bureau provides an online portal for filing disputes and following up with any information that the bureau needs during its investigation.

While filing a dispute is an easy process, you’re best served if you have at least a rudimentary knowledge of credit and financial terms.

Filing and following up with many claims can also take a substantial amount of time. This is why many people choose to hire a credit repair firm that can work fast and knows what it takes to successfully petition each credit bureau.

Plus, the best credit repair agencies — such as those listed above — have working relationships with many lenders and creditors which can work to your advantage if you’re appealing for the removal of an accurately reported negative item.

What Is the Fastest Way to Fix My Credit?

The fastest and easiest way to fix your credit is to hire an experienced credit repair company to complete the task for you. These companies have experience in filing disputes and communicating with lenders and each credit reporting agency.

This means your case is handled quickly and accurately. In many cases, you won’t have to do any work or spend any of your time worrying about the dispute process. You’ll receive regular updates from your hired credit repair service, and you will reap the benefits of any success the company has on your behalf.

Another perk that comes from hiring an experienced firm is that the company may have positive working relationships with your lenders and can often fix any errors in reporting with a brief phone call or email. This typically isn’t possible if you attempt to repair your own credit by contacting a customer service hotline.

Does Credit Repair Show Up On My Credit Report?

Hiring a credit repair company will not reflect on your credit report, and your credit history will not receive any negative marks as a result of your working with a credit repair firm.

The company you hire simply files disputes on your behalf for the removal of negative and inaccurate items. If the bureau investigates your claims and rules in your favor, the negative inaccurate items disappear from your credit history. If the bureau rules against you, the items stay.

There’s no indication of your relationship with any credit repair company on your credit history.

Find the Best Bad Credit Repair Services Online

Your Social Security number is more than just a few digits that identify you with the government. This number leads to your financial profile, which can make or break your quality of life.

On occasion, inaccurate information and other negative items can drag down your credit score and make it impossible to get the loan you need. Credit problems can make life difficult and make it nearly impossible to sleep at night.

But with the best bad credit repair services listed above, you can free yourself of any errors listed on your credit history and regain your financial freedom. This can help you rebuild credit and get debt collectors off your back. Before long, your poor credit score will be a thing of the past.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.