Even if your credit score is low, you can obtain gas credit cards for bad credit to keep your vehicle’s tank full. Over the last 150 years, gasoline (and its cruder iterations) has gone from a somewhat-useful product to one of vital importance for hundreds of millions of people. The U.S. alone consumed almost 124 billion gallons of gasoline in 2020 — enough to fill over 170,000 Olympic-sized swimming pools.

And, unfortunately, all that gasoline doesn’t come cheap; In 2020, the average price at the pump was $2.24. Considering that the pre-Covid average American drove 39 miles a day, that’s over $1,240 a year just in gas purchases — assuming your car gets the average 25.7 miles per gallon.

For many consumers, one of the best ways to save on that big fuel bill is to use a gas rewards credit card. While most gas station-branded cards are out of reach for bad credit applicants, you can still save money — or, at least, time — at the pump with the right card. In the article below, we explore some of our picks for the best gas cards for bad credit, including unsecured and secured rewards cards and cards tied to specific gas stations.

Unsecured Cards | Secured Cards | Station-Specific Cards | FAQs

Best Unsecured Gas Cards For Bad Credit

After a while of ceaseless searching, the idea of finding a rewards card with bad credit can feel a bit like looking for Nessie in a rowboat. Thankfully, you won’t need to set sail to find a rewards card with flexible credit requirements.

Take a look at some of our favorite picks for bad-credit rewards cards to see what kind of deals are out there:

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

- 1% Cash Back Rewards on payments

- Choose your own credit line - $200 to $2000 – based on your security deposit

- Build your credit score.¹ Reports to all 3 credit bureaus

- No minimum credit score required for approval!

- ¹ Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 19.24% (V) | Yes | 7.5/10 |

- 1% Cash Back Rewards on payments

- Choose your own credit line - $200 to $2000 – based on your security deposit

- Build your credit score.¹ Reports to all 3 credit bureaus

- No minimum credit score required for approval!

- ¹ Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 8 minutes | 15.24% (V) | Yes | 7.5/10 |

6. Discover it® Secured

A rarity in both the subprime and secured credit card worlds, the Discover it® Secured card not only offers unlimited cash back rewards on all purchases, but also provides bonus rewards for restaurant and gas station purchases.

- Earn 2% cash back at restaurants and gas stations

- Earn 1% cash back on all other purchases

- Pay no annual fee

As a secured credit card, the Discover it® Secured card will require an initial deposit to open your account. The minimum deposit for a Discover it® Secured card is $200.

7. Bank of America Cash Rewards Secured

This card offers the highest rate of rewards for gas purchases, a market-leading 3% cash back for a subprime card offer. But it requires an initial security deposit of at least $300 to open an account, which may be unattainable for some.

- Earn 3% back on fuel purchases or any other eligible category of your choice

- Earn 2% back at grocery stores and wholesale clubs, 1% back on everything else

- Pay no annual fee

If you aren’t capable of putting down a large deposit upfront, you can still open a secured credit card as long as you can manage at least the minimum required deposit. That’s because most secured credit cards allow you to add to your deposit at any time, giving you control over the size of your credit limit.

Most Gas Station Credit Cards Require Fair Credit

As with any type of credit card, the better your credit score, the better your chances of qualifying. The vast majority of gas-station branded credit cards will want you to have at least fair credit, which means a FICO credit score above 580, and applicants with scores above 650 will have the best approval odds.

That being said, each credit card issuer has its own particular standards, and few companies actually have hard-and-fast minimum credit score requirements. Instead, specific red flags — or the lack thereof — may be a more important deciding factor. Remember that each new credit application will result in a hard credit inquiry, which can damage your credit, so be wise about how often you apply for a new card.

8. Chevron/Texaco Techron Advantage™ Credit Card

While you can select cards specific to either Chevron or Texaco, the Chevron/Texaco Techron Advantage™ Credit Card is the most versatile because it can be used at any Chevron or Texaco gas station.

- Earn 3¢ per gallon in fuel credits on Regular/Diesel fuel at Chevron or Texaco stations, 5¢ on PLUS, and 7¢ on Supreme/Premium

- Receive exclusive cardholder offers and discounts

- Pay no annual fee

Although most sources recommend borrowers have at least fair to good credit for the best chance at approval, multiple reviewers report being approved with FICO credit scores in the low-600s, with several even reporting scores in the upper-500s at the time of approval.

9. Shell Fuel Rewards Card

The Shell Fuel Rewards Card’s most lucrative benefit is its signup bonus offering a 30¢-per-gallon discount for your first five months after account opening.

- Save 5¢ per gallon at Shell stations

- Add additional cards at no extra cost

- Pay no annual fee

The majority of Shell cardholders will have fair credit or better, but some reviewers report approval with scores below 600.

10. Valero Credit Card

Best for those who drive gas-guzzlers, the Valero Credit Card requires you to purchase at least 50 gallons of gas (with your card) per billing cycle to earn gas rebates. Earn 4¢ per gallon when you purchase 50 to 74.9 gallons a cycle, and 8¢ per gallon if you purchase 75 or more gallons per cycle, to a maximum of 110 gallons.

- Earn up to 8¢ per gallon in gas rebates at Valero stations

- Manage your account and fuel rebates online

- Pay no annual fee

The lowest scores reported for the Valero credit card are between 551 and 600, but the bulk of approved applicants have at least fair credit.

How Does a Gas Credit Card Work?

A gas credit card offers rewards for gas station purchases. Some general-purpose, open-loop credit cards offer bonus rewards for purchases at gas stations and other merchant types. Oil companies also issue gas cards, either as open-loop or closed-loop cards. You can use the open-loop cards like any other credit card, but the closed-loop cards work only at the issuer’s gas stations.

Gas cards make sense if you drive a lot because they usually offer the best credit card rewards on purchases at the pump. Remember that closed-loop cards may only save you money on current or future gas purchases but do not pay you cash back or points. You can’t use your closed-loop card rewards to buy gift cards or airplane tickets.

The cards in this review welcome folks with any type of credit or no credit at all. The closed-loop cards are the easiest to get because they present the least risk of loss from theft. After all, a thief can only run up a bill on gas purchases.

Open-loop gas cards are more selective of applicants because they are riskier for the issuer. Nonetheless, the cards in this review accept new cardmembers despite low credit scores.

Typically, the open-loop variety offers better interest rates than the closed-loop cards, but it would be a stretch to call them bargains. Assuming your card provides a grace period, you need not worry about your APR if you pay your entire balance by the due date, as doing so will avoid interest charges.

Check out the secured gas cards above if you want the lowest fees and APRs.

What Is the Easiest Gas Card to Be Approved For?

A secured card is generally the easiest type of card to get approved for. It may not require a credit check for approval, and most pay rewards redeemable in several ways, including for gift cards or a statement credit.

As with most secured credit cards, approval depends on the issuer’s receipt of your security deposit. This particular card is unique in that it requires no minimum deposit. The deposit is collateral, establishing a matching credit limit while protecting issuers from cardmember defaults.

Closed-loop gas cards are notoriously easy to obtain. Some reviews report that our top recommendation, the Chevron/Texaco Techron Advantage™ Credit Card, has very lenient terms, accepting new cardmembers with credit scores in the high 500s. The card caps the fuel credits you can earn at only $300 per year.

The problem with closed-loop gas rewards credit cards is that they only work at the issuer’s pumps. If you don’t happen to be near a participating gas station when your engine starts stuttering, you’re out of luck.

One solution is to own multiple gas station closed-loop cards, which may be feasible because these cards are easy to get. Alternatively, you can get an open-loop card that works at any pump.

Do Gas Cards Build Credit?

It’s wise to start building credit with a gas card. You can do so with open- and closed-loop cards, as they all report your payments to at least one major credit bureau.

FICO, the dominant credit scoring system for consumers, calculates 35% of your score based on your payment history. A flawless record of paying your bills on time helps when you are building credit. Of course, payment reporting only works in your favor if you make timely payments. Late payments can harm your credit score, and defaults, write-offs, and collections can crush it.

It makes sense to pay the entire balance of your closed-loop gas cards every month because they usually carry high APRs, typically above 25%. Paying your total balance also helps your credit score by reducing your credit utilization ratio (CUR), which is credit used divided by credit your total available.

The FICO scoring system apportions 30% of your credit score to the amounts you owe, as expressed by the CUR. For example, if your credit card has a $300 credit limit and your unpaid balance is $150, your CUR is 50%. Any value above 30% hurts your score, so in this example, you need to keep your balance below $90. The highest credit scores generally have a CUR below 10%.

You earn rewards for using your gas cards, but you must ensure you use them before they expire. Some closed-loop cards revoke rewards that you haven’t redeemed within six months.

If you are a fan of closed-loop gas cards but not of any particular oil company, you may want to apply for several cards all at once. However, submitting multiple applications for new credit within a short time can lower your credit score.

New credit counts for 10% of your FICO score. A credit bureau tracks hard inquiries, which occur when a potential creditor checks out your credit reports in response to your application for a new account. FICO interprets several hard inquiries as a possible sign of financial distress and lowers your score accordingly.

If you want the flexibility of using multiple gas brands, you’ll probably be better off with open-loop gas cards since they don’t restrict you to a given oil company.

What Is the Best Gas Credit Card to Get?

The Aspire® Cash Back Reward Card ranks highest among the reviewed open-loop gas cards and may be the best credit card to get. It offers cash back rewards for purchases at various merchant types, including gas stations. The card lets you prequalify without damaging your credit score, reports your payments to all three credit bureaus (Experian, Equifax, and TransUnion), and periodically reviews your credit line for possible increases.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

The Chevron/Texaco Techron Advantage™ Card leads our rankings of closed-loop gas cards. It’s a smart card to own since you can use it to earn fuel credits at both Chevron and Texaco gas stations. You also receive exclusive perks and don’t have to pay an annual fee.

Is There a Gas Card That Can Only Be Used For Gas?

If you want a gas-only credit card, choose the closed-loop kind from one or more oil companies. You may find this card type useful if you pay attention to your gasoline costs as a separate item.

For example, you may have an employer-issued gas card because your job requires driving. In this case, the business credit card lets the company track and control employee gas consumption. Self-employed individuals can receive the same benefit from a business credit card.

We think most folks will prefer to own an open-loop card that offers bonus rewards for gas station purchases. This is a smart card type to own. These cards offer rewards on gasoline and other types of eligible purchases while not restricting you to one particular brand of gas.

In addition, open-loop cards let you redeem your rewards in many ways – they don’t limit you to discounts on gasoline purchases. Open-loop cards are more likely to offer benefits not available from their closed-loop cousins.

Are Gas Cards Worth It?

If you drive frequently, take long driving trips, or own a car with poor fuel mileage, gas cards may be worth owning. These cards make it cheaper to drive.

The closed-loop variety encourages you to fill your tank up only at the issuer’s stations, which may be a tad inconvenient. However, since closed-loop cards are likely to offer the most generous rewards, you may be willing to endure the inconvenience.

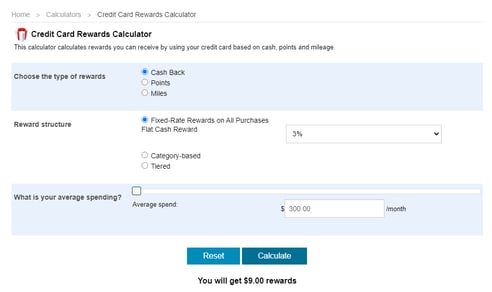

This rewards calculator from CardBenefit.com shows that you’d receive $9 per month in rewards if you spent $300 a month on fuel at 3% cash back. The more you spend on gas, the more value you’ll receive from a gas card.

Closed-loop cards are less likely to charge an annual or setup fee. They are among the easiest gas reward credit cards to obtain, and most do not require a security deposit. However, they may not be the best credit card type, as the cards usually carry low credit limits, have high interest rates well above the prime rate, and their rewards may expire if not used within a relatively short period. They also do not provide cash advance or balance transfer transactions.

Save Time — & Money — Every Time You Fill Up

For well over 100 years, the gas-powered engine has been the cornerstone of American transportation, epitomized by the consumer automobile’s presence in nearly every driveway in the country. And despite predictions that our beloved combustion engines will be usurped by electric vehicles within the next few decades, it’s probably safe to say that trips to the gas station aren’t a piece of the past quite yet.

So, the only thing for most of us to do is try to make the best of those trips, perhaps by finding a quality rewards card to take the edge off the cost of filling up. At the very least, you can save time on every fuel up by simply using your trusty credit card to pay at the pump, potentially shaving a few minutes (and a lot of hassle) off every stop.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.