In today’s digital world, online shopping is a major part of American consumer culture. It’s hard to top the convenience and accessibility that online shopping offers consumers, but financial responsibility comes with that. Do Americans know how much they spend online in a month, and how heavily do they rely on online shopping?

We surveyed American online consumers to understand their spending habits and see if there were any discrepancies between what they think they spend online in a month versus what they actually spend.

Shoppers Overestimate How Much They Spend Online

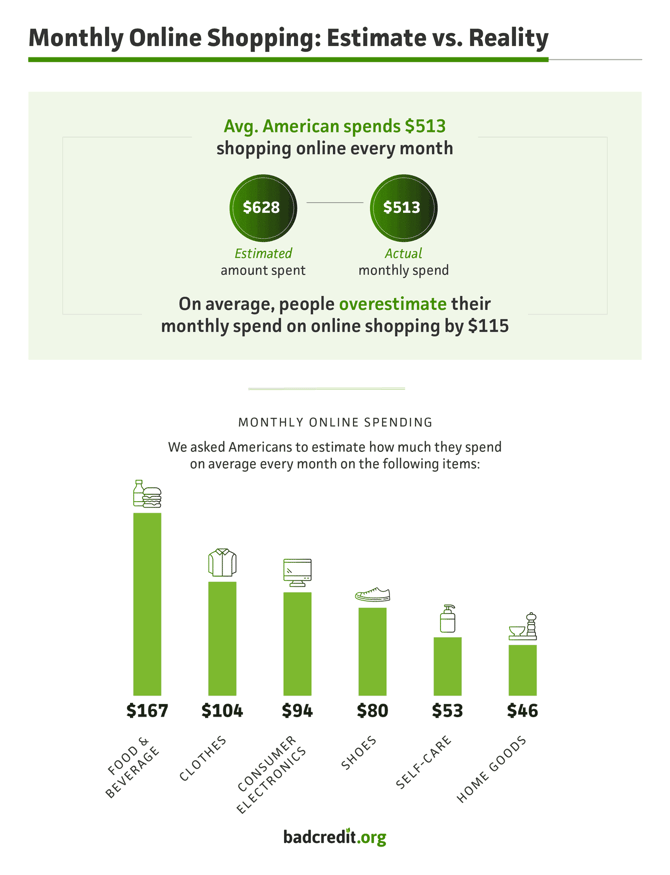

Every month, Americans estimate they’re spending $628 online shopping. But when asked to check their most recent bank statement or online accounts, the actual monthly online shopping spend was $513. This discrepancy highlights the disconnect between perception and reality that many American online shoppers have, as they overestimate their total monthly spending by $115.

When asked to break down their monthly spending by categories, Americans estimate they spend the most at $167 on food or beverage purchases, such as groceries or meal delivery services. Americans also spend $104 a month on clothes, $94 on consumer electronics, $80 on shoes, $53 on self-care and beauty, and $46 on home goods.

3 Out of 5 Respondents Do Most of Their Shopping Online

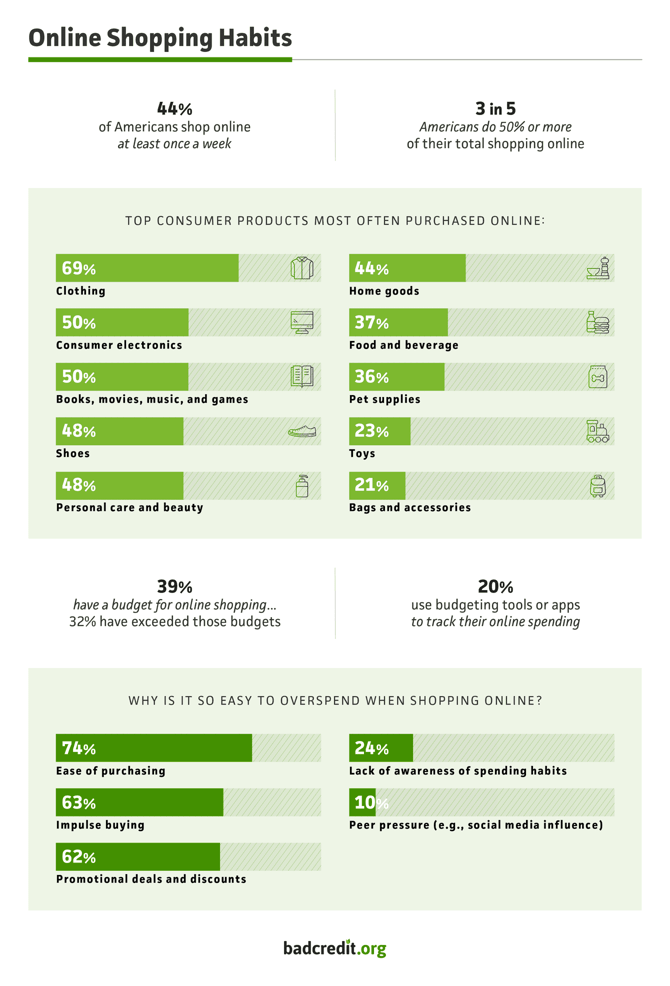

Americans frequently shop online, with more than 2 in 5 survey respondents saying they shop online at least once a week. American consumers also turn to online shopping for almost anything, and 3 in 5 say they do 50% or more of their total shopping solely online. The top products consumers buy online include clothing (69%), consumer electronics (50%), books, movies, music, and games (50%), shoes (48%), and personal care items (48%).

All of this browsing can add up, and 39% of surveyed consumers say they have a budget when shopping online, with 1 in 4 using a budgeting tool or app to track their online spending. But those apps don’t stop them from spending more than their budgets allow, as nearly 2 in 5 have done.

Why is it so easy to exceed budgets or overspend when shopping online? For 3 in 4 surveyed Americans, it’s due to the ease of purchasing. You can browse sites and fill your shopping carts from the comfort of your home. Other reasons it’s easy to overspend include impulse buying (63%), promotional deals and discounts (62%), or just a lack of awareness of what is being spent (24%). Additionally, 1 in 10 say they feel pressured by peers or social media to shop online.

Common Concerns About Online Shopping Habits

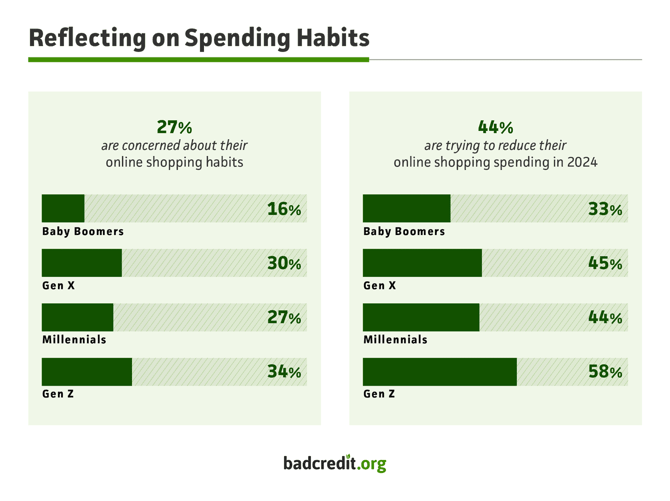

Despite overestimating their monthly online spending, when American consumers in the survey examined their online shopping habits, 27% expressed concern. Broken down by generation, the most concerned in the survey were Gen Zers (ages 18-27), followed by Gen Xers (ages 44-59), millennials (28-43), and then baby boomers (60-78).

Consumers surveyed said they are aware of their online shopping in 2024, with 44% wanting to shop online less. Gen Z respondents, the most concerned about their online shopping habits, lead the generations in trying to reduce online shopping spending in 2024, followed by Gen Xers, millennials, and baby boomers.

Methodology

In April 2024, we surveyed 808 self-reporting Americans who shop online once a month or more to get their feedback on online shopping and spending habits. The age range of respondents was 18 to 78 with an average age of 42 years old. Respondents identified as 50% female, 49% male, and 1% non-binary.

The household income breakdown of respondents was under $20,000 (7%), $20,000-$40,000 (15%), $40,001-$60,000 (17%), $60,001-$80,000 (16%), $80,001-$100,000 (12%), and $100,001 or over (33%).

Fair Use: When using this data and research, please attribute by linking to this study and citing BadCredit.org

For media inquiries, contact media@badcredit.org.