Even though many people believe credit cards are problematic, consumers continue to use them. In fact, a report from Experian found that the typical American holds four credit cards and carries an average balance of nearly $6,200.

So what exactly is causing people to take on so much debt?

Although a flurry of unexpected expenses can send your bills soaring, poor shopping habits can also add a big bump to your debt load. Luckily, with a few small tweaks, you can improve your shopping behavior and ultimately reduce your credit card balance.

Here’s a look at 9 common shopping mistakes that are keeping you in debt, with tips on how to keep your spending budget in check.

1. Shopping without a Plan or List

Consumers spend an astronomical $5,400 per year on impulse purchases, according to a survey from Slickdeals, a consumer-driven deal sharing platform. This is often a result of consumers not planning out their shopping trip beforehand, and where a list comes in handy.

Spend some time looking through your home and pantry to identify the items you need. Jot them down in the Notes app on your phone or on a piece of paper before you head to the store. Then, commit to sticking to it when you shop!

Create a shopping list and commit to only buying what’s on the list.

On the flip side, if you find you consistently make impulse purchases at a particular retailer (looking at you, Target), your best defense is to avoid these stores altogether. You can always order online and pick your order up at the store’s drive up delivery service, which will help you avoid seeing those endless spending temptations in the store.

2. Letting Emotions Dictate Your Purchases

Are you shopping because it makes you feel better after a tough day of work or as a reward after scoring a big client? Such emotional highs and lows can influence buying decisions, often leading to many unnecessary purchases.

The first step to fix the toll emotional spending has on your finances is to be aware of it and figure out other ways to cope with your feelings instead. Simple things, such as going for a walk after a fight with your partner or calling a friend to share in your excitement about a job promotion, are much healthier ways to deal with your emotions that won’t lead to debt.

3. Giving in to the Fear of Missing Out

Giving in to the fear of missing out may be causing you to keep up with a lifestyle you can’t afford and lead you to buy items that are well beyond your budget. In fact, a study from the PR firm Citizen Relations reported that 60% of millennials make a reactive purchase after experiencing FOMO, also known as the fear of missing out.

A recent study found that 60% of millennials make a purchase after experiencing FOMO (fear of missing out).

Often fueled by what is seen on social media, it’s important to keep things in perspective and remember that you don’t need to live up to what other people are posting. If FOMO is affecting your mood, stop following the brands and influencers on social media who make you feel the need to buy things.

4. Buying Just Because an Item’s on Sale

If you have a hard time passing up a sale, you may be taking on a lot of unnecessary debt. In fact, according to the same Slickdeals survey cited above, 64% of shoppers reported that they make an impulsive purchase if there’s a deal, with 40% admitting they went out and bought something just because they received a coupon in the mail.

While scoring a deal is a good way to save money on essential purchases, you shouldn’t let it lead you to unnecessary spending. Instead, only search for coupons and sales when you’re planning to make a purchase.

Creating a separate email account for retail newsletters can also help you avoid sale temptations that bombard your inbox. Then, search this account for a coupon when you’re about to buy something.

5. Spending More to Save

Retailers use all types of marketing tricks to get consumers to spend more than they planned, something that can have negative consequences on those who are already carrying credit card debt.

Among the common sales traps are deals that promote bigger savings when you spend more, such as buy two, get one free or those buy more, save more sales, like $10 off $50 or $20 off $100.

Retailers use different marketing tactics to get you to spend more, including buy two, get one free promotions.

In this last example, the percent savings is the same, but more people tend to opt for the bigger discounts since it appears to be a better value, increasing their total spending.

Always ask yourself if you would buy the item even if it weren’t on sale or if there weren’t a discount available. If the answer is no, it’s best to walk away and give yourself time to think over the potential purchase.

6. Overlooking Receipt Errors

How closely are you monitoring the register for pricing mistakes when checking out? Whether you’re shopping for groceries or shoes, errors happen.

For instance, a sales associate could enter the wrong barcode number or forget to add a coupon. Or retail systems can be faulty and not reflect the updated sales information, charging you more than the advertised price.

Always double check your receipts to look for potential errors. Overpaying on your purchases can add unnecessary debt to your already growing balance.

7. Buying New Instead of Used

No matter how much you cut back, there will always be items you need to buy, like clothing for your growing kids or perhaps a new phone to replace a broken one. When it comes to these necessities, those who overlook secondhand marketplaces are missing out on significant savings.

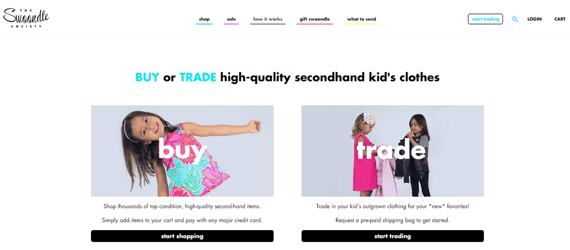

It’s easier than ever to lower your total spending with the plethora of online sites selling secondhand merchandise. For instance, online resellers Poshmark and The Swoondle Society are top resources for gently used women’s and kid’s clothing, while Apple, Newegg, and Best Buy offer refurbished or open-box laptops, tablets, computers, and smartphones for up to 75% off.

Sites like The Swoondle Society sell gently used children’s clothes that can help lower your spending.

Spend time searching for used options to stretch your budget and use the money saved to pay down credit card debt.

8. Focusing on Price Over Quality

When trying to save money, you may be tempted to choose the less costly alternative, but this isn’t always the best bang for your buck if you’re constantly replacing the item. That’s why it’s important to focus on quality items that last longer over cheaply made goods.

Just don’t make a determination on an item’s quality based on a high price tag, something this one study found that many consumers tend to do. Instead, read product reviews, speak with store associates for recommendations, and give the item a full inspection to verify its quality.

Calculating the cost per use or wear can also help you determine the value of an item.

9. Signing Up for New Store Cards

Sales associates try to lure customers into opening store credit cards by offering extra savings on their purchase, but taking advantage of these new card deals can lead to unnecessary spending and extra debt. Not only do store cards carry notoriously high interest rates and have limited reward redemption options, but they often cause shoppers to buy more than they planned.

Retailers will offer you a discount on your purchase when you sign up for their store credit card, but these cards charge notoriously high interest rates, and the rewards offered are usually less than stellar.

Plus, when you carry a wallet full of different cards, managing your debt becomes more complicated, and it’s easy to miss payment dates. Instead, stick with just one or two credit cards to maximize your reward earnings and stay on top of your balance.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.