Doom spending is the act of spending money without concern. Commonly referred to as retail therapy, it’s spending in pursuit of the dopamine and endorphins that release “feel-good” hormones. Credit cards and BNPL services make it easy to spend without seeing the money deducted from your bank account, but this can leave you with mounting debt that can take a long time to pay off.

We conducted a new personal finance trends survey focused on the difference between men and women when it comes to haphazard spending, budgeting, and their personal feelings about bad credit. The survey revealed insights into doom spending, loud budgeting, and even how bad credit compares to bad breath.

Why Are 22% of Men Doom Spending?

The survey reveals that, when it comes to who is spending more thoughtlessly, 22% of men surveyed were more likely to engage in doom spending compared with only 10% of women. And 60% of women surveyed said they have never engaged in doom spending, compared to 47% of men surveyed who reported never having done so.

“Doom spending is common, but ultimately, it’s a negative habit that will only add to your stress,” says Erica Sandberg, consumer finance expert with BadCredit.org. “The sun always comes up the next day, and when it does, it will shed light on what you did yesterday.”

That said, Sandberg recommends splurging on an affordable luxury when it will help you carry on and enjoy the moment.

“Find something within your budget that feels indulgent. It can be a $3 nail polish or a $15 ticket to the movies, but whatever it is, it should improve your mood. You can’t cure outside troubles, but you can create a happy environment,” Sandberg continued.

Men Are Also More Likely to Loud Budget

On the flip side, loud budgeting refers to being vocal about your budgeting. Based on survey responses, women are less likely to discuss their finances (59%) than men (49%) who report not discussing finances. In fact, men (29%) are more likely to be vocal about their budgeting compared with 19% of women (19%).

“This is about control,” said Sandberg. “When you don’t believe your actions will impact the world at large or your budget, it can cause despondency. That can lead to regrettable money and credit decisions. On the other hand, when you feel in control, confidence grows, and you’ll be more apt to make the economic choices that will make you feel better now and tomorrow.”

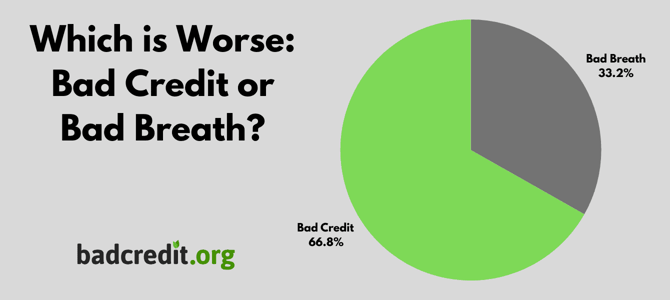

1 in 3 Respondents Believe Bad Breath is Worse Than Bad Credit

The survey also revealed that 1 in 3 Americans (33%) surveyed said they think having bad breath is worse than having bad credit. Of those, there is an almost even split between men (66%) and women (68%).

While that sounds funny, the fact that men are twice as likely to engage in doom spending than women may infer that men may be less in tune with their credit scores than women. A previous study found that 31% of people surveyed don’t know their credit scores.

Survey Methodology

A national online survey of 1,015 U.S. consumers, ages 18 and older, was conducted by Propeller Insights on behalf of BadCredit.org in February 2024. Survey responses were nationally representative of the U.S. population for age, gender, region, and ethnicity. The maximum margin of sampling error was +/- 3 percentage points with a 95% level of confidence.