Your credit score or, more accurately credit scores, are used by lenders to assess the risk of doing business with you. If you have good or great scores, you are likely to be approved for a loan. Conversely, if you have poor scores, you are likely to be denied or approved with less advantageous terms.

Two of the more common questions floating around on the web are what does your credit score start at? And, when do you actually start to have a credit score for the first time?

Without a Credit Report, There is No Credit Score

This is going to sound somewhat like the “what came first, the chicken or the egg” conundrum. Credit scores, which are actually called credit bureau-based risk scoring systems, do not and cannot exist without a credit report.

In fact, for the credit bureaus to calculate your credit scores (yes, the credit bureaus are the ones that calculate your scores), they have to marry two things, a credit report and a credit scoring model.

Because the credit bureaus have both your credit report and, through their partnership, access to FICO’s credit scoring models, they are able to perform the scoring process. But without a credit report, a credit scoring model is fairly useless because there is no data to which the model would be applied.

So the answer to the question about when you will get your first credit score is going to be answered, more appropriately, by answering when you will finally have a scorable credit report at Equifax, Experian, and TransUnion.

Once you have scorable credit reports across the three credit bureaus, then you will become a scorable consumer.

When Do My Credit Reports and Credit Scores Start?

Prior to the CARD Act of 2009, consumers were able to establish credit when they turned 18 by applying for some form of credit card. The CARD Act now requires that you have an income or a co-signer with the capacity to make payments, which can force consumers to wait to establish credit for the first time until they have a job, something that may not be possible if you’re a full-time student.

When you first apply for credit, the credit bureau will establish a new, and empty, credit report for you with nothing other than your personal information and the inquiry caused by that first attempted credit application. This is called an inquiry-only credit report. This report is not scorable by FICO’s scoring models.

If your application was approved, the lender would generally report or “furnish” the newly opened account to the credit bureaus, thus beginning the credit report-building process. But even this does not mean you can be scored, not just yet. Your credit report has to still meet certain minimum criteria for it to qualify for a FICO credit score.

For a scoring model to calculate a reliable score, credit score developers will generally put in place minimum criteria that must be met by your credit report before the scoring model will perform the scoring process. This minimum scoring criteria exists to ensure lenders and other users of credit scores that any score they receive is based on a sufficient amount of credit information and is a reliable and predictive credit score.

For FICO’s scoring models, the same minimum scoring criteria have existed for all of their credit bureau scores since the first one was implemented at Equifax in 1989. For your credit report to qualify for a FICO credit bureau score:

- You have to have at least one undisputed tradeline that has been opened for at least 6 months and,

- You have to have at least one undisputed tradeline that has been updated within the last 6 months and,

- You can’t have a deceased indicator on your credit report.

A couple of things may stick out to you, which is my repeated use of the words “tradeline” and “undisputed”, and reference to a deceased indicator. You may also read the above and conclude that you must have at least two tradelines to qualify for a FICO score. It’s actually much simpler than the above suggests.

If, for example, you have an American Express account on your credit reports that was opened five years ago and was also just updated last month, and you do not have anything on your credit reports indicating you are deceased, then you will qualify for a FICO score. You will not qualify for a FICO score if that American Express account has not been updated in the last six months, if it’s actively in dispute, or if your credit report indicates you are deceased.

Of course, this assumes the only account you have on your report is that Amex account. But, you can certainly meet the two six-month requirements across more than one account.

Also, for clarity, “tradeline” is industry jargon for a traditional credit account, like a loan or credit card. A third-party collection account, those reported by collection agencies, is not a tradeline.

Thus, if all you have on your credit reports are collections, you will not qualify for a FICO score. You have to have actual loans or credit cards to qualify for a FICO score.

Whenever your credit reports meet these qualifications, then they will become scorable. If that happens when you are 18, then you will get your first score at 18. If that does not happen until you are 25, then your first score will be at 25.

There is No Set First Credit Score

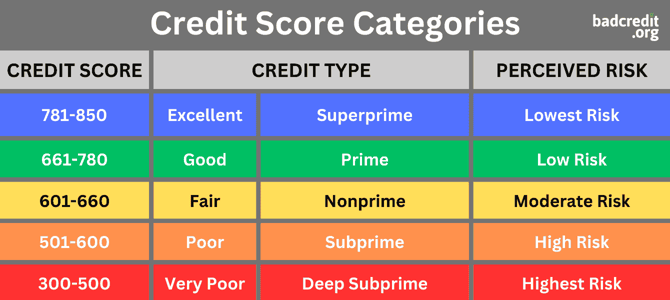

If you’ve ever heard someone suggest they have a “zero credit score” they are mistaken, as there is no such thing. The scoring range or scale of the several dozen FICO score models is either 300 to 850 or 250 to 900. And zero does not fall between either of those two ranges.

What’s likely happening is that someone is interpreting the failure of the above-referenced minimum scoring criteria as meaning they have a score with the numeric value of zero.

To be clear, nobody has a zero credit score, it doesn’t exist because it is a systematic impossibility. Now that we’ve gotten that out of the way, where does your score begin? There is no set first-timer score. As in, your first score is not predetermined, and it can fall anywhere between any of the score ranges, whether that is 300 to 850 or 250 to 900.

Your age is not a factor in your credit score, so it doesn’t matter if you’re 18 or 65. You’re not rewarded for being older, and you’re not penalized for being younger. Your first score will be entirely dependent on the same thing as your 500th or 10,000th score, which is the data on your credit reports.

Now, if your credit reports are younger, then it will be harder to hit the highest scores possible. But, that’s not a product of your age. It is instead a product of the age of your credit reports.

How Can I Find Out My Scores?

Places to get free FICO and VantageScore credit scores abound. In fact, FICO’s Open Access Program has authorized over 200 lenders to give away free FICO scores. There are also methods by which you can get free FICO and VantageScore credit scores even if you don’t have a relationship with any particular financial services company.

The point being, it’s highly unlikely you’ll ever have to pay to find out your credit score ever again. What you will see, regardless of where you end up procuring your credit score or scores, is that none of them are zero.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.