Finding short-term loans online doesn’t have to be difficult. A little research shows that some are better options than others; some work better for people in one situation over another.

We’ve done the research to find the seven best short-term loans for bad credit. These loans are all available online, so you can apply without having to leave the house. If you need a quick financial boost to keep you on track, read on.

Short-Term Loans You Can Get Online

A few different types of short-term loans are available for consumers who face an unexpected expense or are experiencing temporary cash flow problems. Most people are familiar with payday loan products, which work somewhat like an advance on their next paycheck, but other loan types offer a short repayment term as well.

Options can be limited when it comes to finding a personal loan if you have a low credit score, but several lending networks are available to help you find the right lender for your needs. These seven lending networks are rated as the best by our experts.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

Many people across the country are one emergency away from financial trouble. Times are tough, and it’s impossible to plan for everything. While ideally, we would all have some savings set aside to cover emergencies, sometimes that’s just not possible.

MoneyMutual uses an online lender network to connect potential borrowers with a wide range of lenders that may help them find the right loan. The company launched in 2010 and has provided more than 2 million people with access to lenders willing to give them a chance.

Because MoneyMutual is a lending network and not a direct lender, it doesn’t make the final decision on loan approval. But the company can direct borrowers to the best fit for a personal loan.

2. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA uses an online lender network to provide short-term personal loan options to people in need of temporary financial relief. The company partners with lending companies to connect even consumers with bad credit with the best-suited short-term loan, including options for a cash loan, secured loan, and other online installment loan options.

CashUSA also provides borrower education, including information about which loan types best fit a given situation, how to manage your loan repayment term and monthly payment when the unexpected comes up, and understanding annual percentage rate calculations, among other things.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

InstallmentLoans.com maintains a lower profile than do most of the lending networks on this list. However, some buzz for the company has come from a few different corners, but because the company is newer, there aren’t many reviews from borrowers. This network is still building its reputation within the bad credit lending network industry.

Since it has a trustworthy network of lenders and offers a range of personal loan options for people with a bad credit history or minimal credit history, it is still a solid choice.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

One of the longest-running online loan networks on this list, CreditLoan has earned its reputation. Since 1998, the company has been working with borrowers from all walks of life to find options to get a little more cash in their bank accounts.

CreditLoan doesn’t only work with one network of lenders. Instead, borrowers get answers from one of two networks that CreditLoan works with, depending on their credit status and history.

Would-be borrowers from New York or Connecticut cannot access CreditLoan’s services. But if you don’t live in either of those two states, CreditLoan may be an option for you.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

Another long-time network for those with bad credit, Bad Credit Loans first launched in 1998. Its network of lenders means that borrowers have multiple options to choose from, including lenders for those seeking a short-term business loan or an auto title loan.

In addition to the lender networks, Bad Credit Loans offers borrowers educational resources that inform them on topics like best practices for rebuilding credit and avoiding loan scams, credit bureau information, and understanding annual percentage rates, among others.

This resource can be very helpful for borrowers who need extra information to help them decide whether a loan offer they receive from the Bad Credit Loans network is worthwhile.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com sets itself apart from the competition through technology. All lenders use a variety of factors to determine whether to approve a loan request. PersonalLoans.com uses algorithms to determine which short-term loan application works best for which lender.

PersonalLoans.com also offers a wide variety of loans through its network, including personal loans, installment loans, signature loans, cash advance loans, and peer-to-peer loans. The company also emphasizes its dedicated customer service staff to help would-be borrowers navigate the site and improve their experience.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% – 2,290% | Varies | See representative example |

If you only need a small amount of emergency cash, CashAdvance.com is a likely candidate. This online loan platform specializes in connecting borrowers with cash advance loan companies for unsecured loan options in smaller lump-sum amounts than what some of the other options on this list offer.

Cash advance loans are often a go-to solution for minor cash flow issues: The unsecured loan is enough to cover a small expense that doesn’t fit your budget right now, and it provides less risk of the debt developing into a bigger issue than the original emergency.

This type of loan is also sometimes easier to get for people with a bad credit score. By applying through CashAdvance.com, you get results more quickly than you would working with direct lender companies one at a time.

What Is a Short-Term Loan?

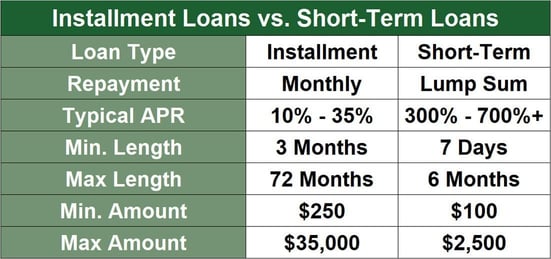

A short-term loan is a loan that you pay off over the course of weeks or months rather than over years as you would with an installment loan. The loans are typically for smaller amounts of money than what you would borrow for car or home purchases.

Short-term loan types like a payday loan, cash advance loan, or even instant loan options often have higher interest rates, but they are good options if you need a lump sum of cash in your bank account within days.

The easiest loans to obtain are a cash advance through your credit card, though these advances typically charge a high interest rate and a cash advance fee. Plus, you’re limited to the credit you have available on your card.

How Do I Apply For a Short-Term Loan?

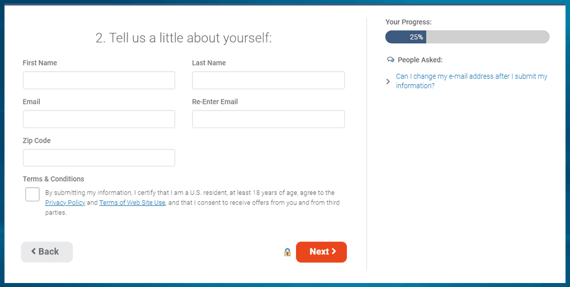

The short-term loan application process is pretty simple: most forms require proof of income, an address, ID, and bank account information. Unlike long-term loan types, such as mortgages or auto loans, short-term loans don’t have overly rigorous credit requirements.

The sites on this list allow you to submit your loan request to several lenders, including various payday lender, credit union, and online installment lender companies. That way, you don’t have to spend as much time applying individually with different lenders to get an answer.

What Credit Score Is Required For a Short-Term Loan?

Almost all short-term loan options involve a credit check before the lender approves the loan request. However, a credit check may not be required to secure a payday loan.

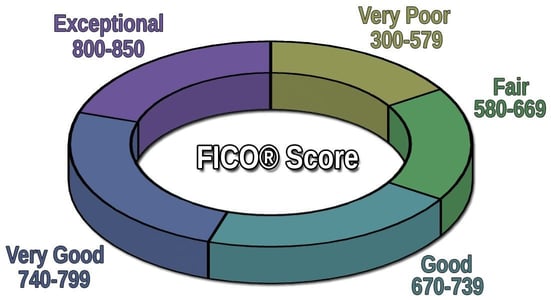

The credit score you’ll need for a given loan option depends on several factors, including the size of the loan and the duration of the loan term. But all of the lending networks above specialize in working with consumers who have bad credit — generally defined as a FICO Score below 580.

Some loans, such as online installment loan options, may have bigger hurdles than payday loans do when it comes to the credit check.

Are Short-Term Business Loans Available?

If your instant short-term loan needs include business expenses, some lenders provide these loans. It’s definitely a good idea to choose a business loan instead of working with payday lenders when it comes to maintaining cash flow in your business.

The requirements are a little different for a business loan, and you should prepare for the possibility of an origination fee for this loan type. But you can get a direct deposit to your bank account for business loans almost as readily as you would a personal loan.

What Information Will The Loan Application Request?

Depending on the type of loan you seek, more or less information may be required. Payday lenders often don’t need much more than proof of address and an ID, pay stubs, and your bank account details to make a direct deposit.

Other lenders may do a hard credit check to determine factors like your credit card usage, long-term income, and more details before approving a loan. Instant loan options tend to require the least amount of information but count on needing some form of ID, a Social Security number, proof of address, and your income for any loan application.

Carefully Compare Short-Term Loans Online

When you’re facing a short-term financial emergency, it’s not a good idea to run up debt on your credit card, especially not through cash advance transactions. Instead, opt for one of the best short-term loans online to get you through the emergency.

Before you jump in, compare the loan term and interest rates, along with other factors that can play a major role in your ability to repay the loan you accept. By choosing the right loan type for your needs and not borrowing more than you can easily pay back, you can get through your emergency without endangering your credit history.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.