According to the Federal Reserve’s Economic Well-Being of US Households in 2022 report, 28% of people confirmed that the largest expense they could cover was less than $499. These people may also experience difficulty qualifying for bank and credit union loans.

One alternative to banks and credit unions is loan matching services, which partner with numerous direct lenders, some of which specialize in no credit check loans for people with bad credit. Prequalifying through any of these networks will present you with multiple loan offers you can compare, review, and apply for.

Continue reading to learn more about no credit check loans, qualifying for a loan with bad credit, and the easiest loans to get approved for, regardless of your credit history.

Our Top Picks for No-Credit-Check Personal Loans

The following companies are online lending networks that can help match you to a willing lender based on the information you submit. What’s nice about these services is that they’re free to use, and you can avoid having to sift through lenders to find one that is willing to work with you. These services do the heavy lifting to quickly connect you to a suitable direct lender.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual is a lending network that allows you to find and compare several loan offers with a simple five-minute prequalification form. Lenders on the platform offer up to $5,000 with same-day approval and direct deposits by the next business day. Plus, it has very relaxed eligibility requirements for bad credit borrowers, such as only needing to earn a minimum monthly income as low as $500.

Plus, MoneyMutual offers secure 256-bit SSL encryption outside its lender network to safeguard your data. It has also partnered with the Online Lenders Alliance (OLA) and the Community Financial Education Foundation (CFEF) to promote financial advocacy and reinforce its commitment to consumer best lending practices.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

In business for over 15 years, 24/7 Lending Group is a free referral service that partners with direct lenders offering no credit check loans. Expect smaller loan amounts of $2,000 or less without a credit check, though.

This network is one of our go-to sources for bad credit borrowers looking to take out personal loans, whether for debt consolidation or short-term cash needs. All you need to do is complete an online application asking for your requested loan amount, income, and other information before lenders provide real-time offers. It’s a free service, and you are under no obligation to accept any loan offer.

Funds can be deposited to your bank account within 24 to 48 hours, making it a valuable source of emergency cash for everything from unexpected healthcare expenses to overdue vehicle registration.

3. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

Affectionately known as “America’s Cash Network,” CashUSA.com is a loan option that matches borrowers with lenders offering $500 to $10,000 by the next business day with loan decisions made in minutes.

It’s an excellent source of short-, mid-, and long-term loans with repayment terms available from three months up to 72 months. This helps borrowers stretch their payments to achieve lower monthly repayments. Plus, it offers a quick prequalification form that instantly matches you with qualified lenders willing to work with you.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com is a lending network that offers loans from $100 to $20,000 with varying interest rates and loan terms, depending on the lender. You may qualify for a no credit check loan, also known as a cash advance, for almost any purpose, from emergency home repairs to childcare costs.

To apply for a quick loan, all you need to do is meet all eligibility criteria and complete a short, secure online prequalification form with loan decisions within two minutes. To qualify, you must be 18 years or older, a US citizen with a valid Social Security number, an open bank account, and a regular monthly income of at least $1,000.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

BadCreditLoans.com is a lender network that offers loans from $500 to $10,000. The no-credit-check variety will be on the lower end of that range.

Outside of loan options, Bad Credit Loans is an excellent resource with helpful information on avoiding financial scams. Its website contains informative topics such as how to spot a scam, how credit scores impact loan terms, and when to refinance an auto loan.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

Since 1998, CreditLoan.com has been offering subprime borrowers short-term loans from $250 up to $5,000. Every lender on the platform has different loan rates and repayment terms. To get started, complete its simple prequalification form to be matched with lenders that fit your criteria.

If you prequalify for a loan offer, the website will redirect you to the direct lender’s website to complete a formal online application. Once approved, you can receive the loan proceeds via direct deposit to your bank account by the next business day.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

Launched in 2018, InstallmentLoans.com offers quick and hassle-free loans from $500 to $5,000. This is possible thanks to an extensive network of direct lenders that you can access by filling out a simple five-minute form. If you and the lender express mutual interest, the direct lender will lead you to its website to sign a loan agreement to finalize loan approval. Loan funds are dispersed within one to three business days.

Our experts can vouch for its extensive network, favorable loan terms, and quick and easy loan application.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com allows you to prequalify for loans of up to $35,000. Of course, a loan that high would require a credit check and a good credit score, but this network still partners with lenders that provide all types of bad credit loans, including but not limited to short-term cash loans, secured loans, and peer-to-peer (P2P) loans, all with user-friendly terms, including no application or prepayment fees.

As long as you are 18 or older and earning a minimum of $500 a month, you may qualify for a loan offer through PersonalLoans.com.

What Is a Personal Loan with No Credit Check?

A personal loan without a credit check is also known as a payday loan or a cash advance. These loans can be obtained online or at local storefront payday lenders. They’re easy to qualify for if you have a steady income and a bank account, but they charge high fees for the convenience.

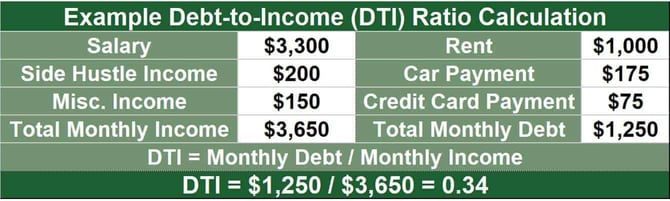

Factors that determine no-credit-check loan approval include your income, debt-to-income (DTI) ratio, and employment record — not your credit score. If your FICO Score is below 580, you can still qualify.

Characteristics of no credit check personal loans include limited loan amounts, typically below $1,500, higher than average interest rates, and short repayment terms. Depending on the lender, you may have to pay origination fees and prepayment penalties.

What Is the Easiest Loan to Get Approved For?

Payday loans are among the easiest loans to get approved for, but they aren’t available in all states. In our opinion, the loan matching services above offer the easiest loans to get approved for and are available online in most states.

Online lending networks offer the following benefits:

Prequalification: All you need to do to apply for a loan is complete a simple online loan prequalification form that asks for personal details such as your income and employment history. In as little as five minutes, each loan matching service may connect you with several direct lenders ready to work with you, although not every lender will offer your desired loan amount and interest rate.

Easy Lending Criteria: With MoneyMutual, SmartAdvances.com, and others, you do not need a 670+ credit score to take out a loan. All you need is proof of age (18 or older), an active employment record, and a bank account in your name to receive the loan funds and have payments withdrawn. No-credit-check loans almost exclusively require automatic payments.

You must also meet minimum monthly income requirements, typically starting at $500, but full-time employment is not required. Even most Social Security, government benefit, and disability recipients are welcome.

Quick Funding: Upon signing a loan agreement, your checking account will receive the proceeds within one to three business days. It can be sent by the next business day if you submit your application by a certain time.

How Do I Get a Loan with Bad Credit and No Cosigner?

One of the best ways to secure a loan with bad credit and no cosigner is by using a lender matching service.

Here are all of the steps required:

- Look Into Loan Matching Services. Consider using one of the best personal loan matching services based on your desired loan amount and loan term. Perform due diligence by inquiring about its network size, personal loan options, and customer service.

- Gather Documents. The next step is collecting all the documents needed to start an application, such as your pay stubs, electronic timesheets, and tax returns, if necessary.

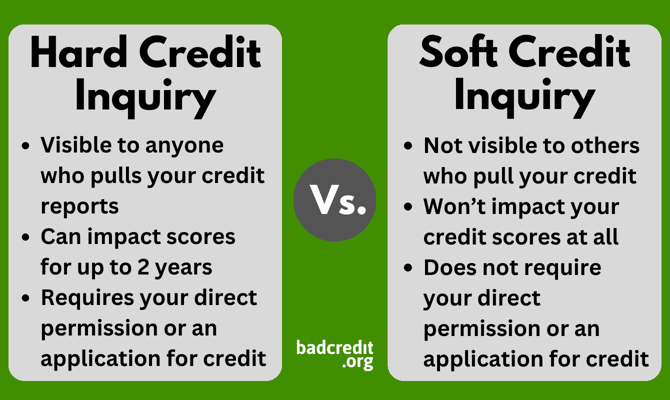

- Complete a Prequalification Form. Our recommended personal loan matching services have simple online forms that take little time to complete. The good news is that completing these forms will only trigger a soft inquiry, which does not affect your credit score. Once you submit a prequalification form, the loan matching service will verify your eligibility, disqualifying those who do not meet minimum income and scoring requirements. From there, you may receive several financing offers, including but not limited to personal loans to auto loans, which you can filter out very quickly.

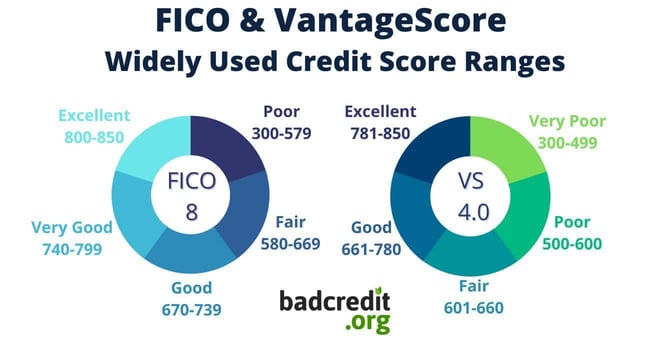

- Boost Your Credit Score. If you’re unable to secure a cosigner and you have time before your next installment loan, we recommend improving your credit score as soon as you can. Download free copies of your credit reports from annualcreditreport.com, thoroughly check them for errors, and dispute any errors if necessary. Be sure to familiarize yourself with how FICO calculates credit scores. With 35% of the calculation going toward payment history and another 30% toward how much debt you carry, paying down existing debts and never missing a payment will have the biggest effects on your scores.

You may also decide to try credit counseling services to help you improve your financial situation.

Can I Get a $5,000 Personal Loan With Bad Credit?

Yes, getting a $5,000 unsecured personal loan is possible. One of the best ways to do it is through free loan referral services such as 24/7 Lending Group and CashUSA.com, which do an exceptional job of matching subprime borrowers with competitive offers.

Complete a loan request form and you may receive multiple offers with different loan amounts, interest rates, repayment periods, and fees (e.g., origination) before deciding which offer is the best.

Remember, prequalifying for an unsecured loan using a lending network is not binding, and you are not obligated to sign anything. Furthermore, this prequalification process will only trigger soft inquiry with no effect on your credit score.

After prequalifying, you will automatically be redirected to the lender’s website to finalize the paperwork. Most will run a credit check, but there are some exceptions.

Can I Get a Loan With a 500 Credit Score?

Yes, getting a loan with a 500 credit score is possible. But having a lower credit score will decrease your chances of qualifying for loans from traditional banking institutions like Chase and Wells Fargo. Instead, you can rely on matching services such as MoneyMutual, 24/7 Lending Group, and CashUSA.com to fill the void.

These networks all specialize in lending to individuals with low credit scores, assessing a borrower’s ability to repay using income instead.

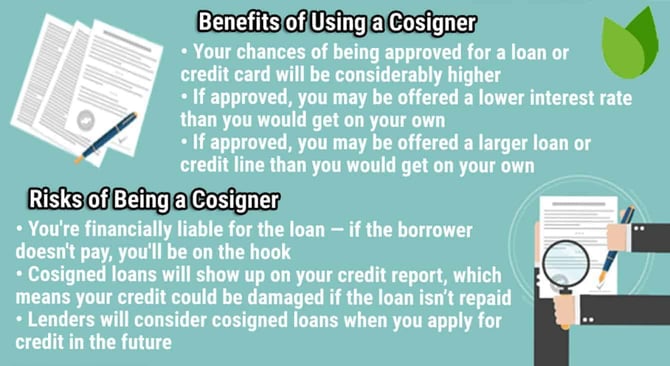

If no credit check loans are not an option, you may also apply for a secured personal loan, which requires collateral such as a vehicle or savings account. You can also enlist the help of a cosigner with a good credit score, who can assume joint responsibility in paying back the loan.

We strongly suggest avoiding any payday lender and taking time before your next loan to improve your credit score. Criteria used by FICO for calculating credit scores consist of payment history (35%), amounts owed (30%), length of credit history (15%), credit mix (10%), and new credit inquiries (10%). Prioritize consistently making on-time payments and lowering the amount of available credit you are using.

If you find it difficult to pay multiple high balances every month, a debt consolidation loan may be an excellent fallback option.

To see the bigger picture, here are FICO 8 and VantageScore 4.0’s credit score ranges:

Do not forget to check your credit report regularly. You may obtain free copies of your credit report from each credit bureau (TransUnion, Experian, and Equifax) by visiting annualcreditreport.com.

What Credit Score Do You Need for a Personal Loan With a Cosigner?

If you’re applying for a personal loan with a cosigner, the credit score needed depends on the lender, type of loan, loan amount, and minimum credit score requirements.

Typically, cosigners should have a good to excellent credit score of at least 700. The higher the score, the higher your loan offer and the lower the interest rate.

Outside of credit score, direct lenders also consider the borrower’s and cosigner’s credit histories. Expect borrowers with consistent on-time payments and low credit utilization ratios to have increased chances of loan approval.

Remember employment verification as well. Steady employment and a regular income show lenders you have the ability to repay your no-credit-check loans.

Cosigner loans have equal joint responsibility by both borrower and cosigner. If you’re using a cosigner, ensure they are fully aware of all terms and conditions and implications of non-payment before they sign the dotted line.

Getting Started with a No Credit Check Personal Loan

Top-rated loan referral services such as MoneyMutual and 24/7 Lending Group fit the bill if you want to apply for a no-credit-check loan. They offer instant lending decisions and funding as soon as the next business day. Don’t let a low credit score handcuff you into limited options. Our recommended alternatives can match you with a lender in minutes.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.