Instant approval payday loans are one of the internet’s biggest gifts to bad credit borrowers. Gone are the days when you had to get dressed up to go to a local bank — only to be turned down for a loan because of your credit score.

With the online lending networks below, you can submit an online payday loan or personal loan request at any time of the day or night and receive an instant approval decision. And you may receive multiple loan offers from which to choose.

If you qualify for an instant payday loan, you can complete your loan paperwork in an hour or less and receive funds in your bank account by the next business day. Some lenders offer same-day deposits for an additional fee.

The Best Instant Approval Payday Loans

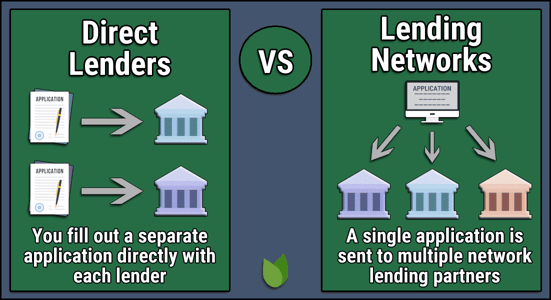

The lending networks below offer online payday loans that require quick repayment and installment loan options that allow you to pay your loan off through monthly payments. Each lender that partners with the various networks may send you a loan offer with a unique loan term, interest rate, and loan amount.

Be sure to study each offer carefully before deciding which is best for you. And though these companies can offer you a near-instant approval decision, there’s no such thing as a guaranteed payday loan — you’ll still need to meet the lender’s basic qualification criteria.

See representative example

1. MoneyMutual

Loan Amount

Interest Rate

Loan Term

Loan Example

Up to $5,000

Varies

Varies

MoneyMutual maintains a large direct lender network that makes it easy to find an online loan. Whether you’re looking for a bad credit payday loan or a small installment loan that you can repay over time, you can get fast loan approval within minutes and money in your checking account by the next business day.

Once you submit your loan request to MoneyMutual, the network will instantly send your form to every direct payday lender on its network. Your credit history won’t disqualify you from consideration, and you could receive more than one loan offer within minutes.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% - 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group can help you compare online loans from several reputable direct lenders at once. Fill out some basic identifying information to see whether you prequalify.

You’ll then be matched to four near-instant loan offers for you to read through the loan agreement and repayment terms before deciding which is best for you.

3. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

You may qualify for a cash advance loan or a larger personal loan with CashUSA. Every loan offer will come with a different loan term and interest rate, which will affect your total repayment amount.

Your initial loan request will require a soft credit check that will not harm your credit score. If you prequalify, the lender you choose to work with may conduct a hard credit check that allows access to your entire credit history. But fear not because this network’s lending partners specialize in bad credit loan products and won’t reject a borrower solely because of their credit score.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

InstallmentLoans.com offers quick loans with varying interest rates you can repay over time — but still provides fast loan approval and funding to your bank account. The lenders on the network will view your application and bid for your business by submitting a cash loan offer.

If you accept an offer, the lender may conduct a credit check with at least one credit bureau and then process your loan paperwork and initiate your payout.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan.com offers a host of installment loan options with a large range of loan amounts to accommodate any need. And since this network specializes in bad credit loans, you can feel confident that you’ll be matched with a lender that understands your financial situation.

And unlike many other online payday loan options, you won’t be stuck with a sky-high interest rate or fees that make your small loan a big headache. Instead, your payday advance will provide you with cash that you can repay over time.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 60 Months | See representative example |

As you may expect from its name, Bad Credit Loans maintains a direct lender network that provides cash advance options that won’t disqualify a borrower based solely on their credit score.

Instead, these lenders look at the bigger picture — including your income information, recent payment history, and loan purpose — to find you a loan that a bank or credit union likely wouldn’t offer.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com makes sure your loan application only goes to reputable lenders that are willing to work with you. The network accomplishes this by maintaining a dedicated group of lenders for applicants with good credit or excellent credit and a separate network of lenders that only deal with bad credit loans.

This ensures you’ll get good customer service and only work with the right lenders for your needs and financial situation.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com is another network of direct lenders. Its best matches will come forward once they receive your information. This helps speed up the approval process by having lenders come to you rather than the other way around.

Whether you’re looking for the best payday loans or a larger installment loan you can repay over time, SmartAdvances can hook you up with a lender that can get you fast cash as soon as tomorrow.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% - 2,290% | Varies | See representative example |

CashAdvance.com offers instant cash advance products from a traditional payday lender. These same day loan products charge a much higher interest rate than the personal loan networks listed above.

Your payday lender may also skip the credit check process if you can provide proof of enough income to comfortably repay your debt within seven to 30+ days, depending on where you live.

What is a Payday Loan?

A payday loan — also known as a cash advance — is a short-term loan that requires repayment in one lump sum, usually within a week or month, depending on your state’s laws.

As its name suggests, these loans are designed to act as a bridge between paydays. This means you’ll usually have to repay your entire loan on the date of your next paycheck.

These loans often have a higher interest rate than that of a traditional personal loan and may include other fees that make them quite expensive. That’s why we typically suggest searching for a traditional personal loan before accepting a payday loan.

With a personal loan — otherwise known as an installment loan — you can repay your debt over a series of fixed monthly payments. This loan type will require a hard credit check, but many lenders won’t disqualify you because of a poor credit score.

How Can I Get an Instant Payday Loan?

The easiest way to apply for an instant payday loan is to submit a loan request through one of the lending networks listed above.

These networks accept applications at any time of the day or night and can return a loan decision within seconds — no matter where you are. That saves you a trip to the bank or loan center and lets you apply on your own schedule.

The network will send your loan request to every lender it partners with. Thanks to automated underwriting, each lender can make an instant credit decision — even after business hours.

Within a few minutes, you’ll receive an email that may contain multiple loan offers to choose from. If you accept an offer, the network will forward you to the lender’s website to complete your official loan paperwork.

Once you’re done, the lender will initiate a funds transfer to deposit your borrowed funds into a linked checking account by the next business day. Some lenders provide same-day funding for an additional fee.

What is the Easiest Loan to Get Approved For?

The easiest loans to get approved for are secured loans because they require collateral that provides the lender with some protection if the borrower stops making payments or defaults on the loan. This takes much of the risk out of the lender’s hands and places it square with the borrower.

Examples of a secured loan include a pawnshop loan, an auto or title loan, a secured credit card, or any other loan that requires you to place an item of value the lender can keep or repossess if you don’t repay your debt.

For example, a title loan forces you to hand your vehicle’s title over to the lender. If you don’t repay the debt, the lender can repossess your car or truck.

While gaining approval for these loans may be easier than it is to be approved for a traditional loan, they’re risky for borrowers and may charge expensive fees for the convenience.

What Credit Score Do I Need to Qualify For a Loan?

Lenders don’t always have minimum credit score requirements for loan approval. The lenders that partner with the networks listed above all specialize in bad credit loans and claim that they can typically find a loan option for you — even if you’ve been denied elsewhere.

Instead of setting a credit score floor, these networks will examine your income, payment history, requested loan amount, and current debt load to see whether you can afford to repay the loan. If you can pass those qualifiers, the lender will likely look past your poor credit score and approve you for a personal loan or payday loan.

A lender that conducts a hard credit check will use your credit score to determine the APR you qualify for. The pictured APRs below represent the average interest rate borrowers can expect to pay for a personal loan (payday loan rates will be higher):

The lender you work with — not the network you use to find the loan — will set the terms of your loan.

Get Approved for Instant Approval Payday Loans Online

Everyone experiences times when they need quick money to cover an unexpected expense. While these circumstances are inconvenient, they don’t have to be difficult.

With the online lending networks listed above, you may qualify for instant approval payday loans or short-term installment loans that provide you the funding you need without overstretching your budget.

And since these lenders specialize in bad credit loans, you don’t have to worry about embarrassing rejections when you submit your loan request. Instead, you can fill out your loan application from anywhere and at any time, and receive a loan decision within seconds.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.