When you are in a serious financial pinch, you may consider borrowing against your upcoming paycheck. Payday loans are available to people who have jobs and want a short-term advance on the money they will earn.

Although these advances can help you over a hump, the fees can be astronomical, especially if you renew the repayment term instead of paying the debt off within the typical two-week term. That’s why the National Credit Union Administration (NCUA) developed its own product that can help federal credit union members out of a jam. They’re called payday alternative loans, and here’s what you need to know about these products.

What Are Payday Alternative Loans?

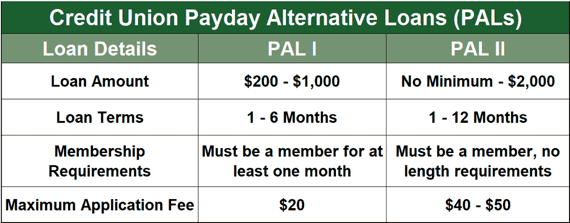

Payday alternative loans (PALs) are small, short-term loans from a federal credit union. The APR cannot exceed 28%, and in some cases, the credit union will charge a processing fee of up to $20. You can’t roll PALs over (as you can with a payday loan), and you are restricted from taking more than three out in a six-month time frame.

These loans come in two basic variations:

- PAL I. Loan amounts are between a minimum of $200 and a maximum of $1,000 and have repayment terms of up to six months.

- PAL II. Loan amounts are up to $2,000, and the repayment term is up to 12 months.

Depending on the credit union, you may even have a short grace period before you have to start paying.

How to Get a Payday Alternative Loan

Your first step in getting a PAL is to become a member of a federal credit union that offers them. Not all do, so be sure to check before you join. Go to MyCreditUnion.gov to find the appropriate credit union for you.

You need to open a deposit account (such as a checking or savings account, usually with a $5 minimum) at the credit union or pay a small membership fee to become a member. You will need to have been a member for at least a month to get a PAL I, though you can get the PAL II as soon as you become a member.

Most credit unions will allow you to apply for the PAL over the phone, though you may also do it in person at the branch.

To qualify for a PAL, you must show that you have the means to meet the payments and may be asked to provide two recent pay stubs. In most cases, you don’t need a minimum credit score for approval, but it’s always better to ask first.

You generally do not need good credit, but each credit union is free to set its own eligibility rules. For example, the credit union may deny you if you are currently past due on any other loans or have a negative balance in your deposit account.

Also, while only federal credit unions offer PALs, many state-chartered credit unions have similar products. If they do, the interest rate may be lower, but the eligibility requirements may be more stringent.

How to Manage a Payday Alternative Loan

Many federal credit unions will report the loan to the three major credit bureaus: TransUnion, Equifax, and Experian. If yours does, it is especially important to manage the loan properly.

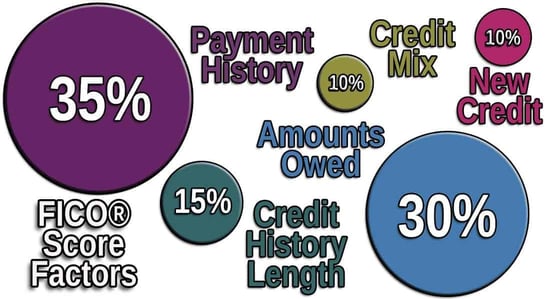

You can do this by making your payments on time, every time. This can help improve your credit scores because payment history is the most important scoring factor.

Even if your credit union does not furnish the credit bureaus with your account information, make every effort to make your payment on time anyway. In many cases, the credit union will charge you a late fee of between $10 and $40 if you are more than 10 days delinquent. Call the credit union if you are having trouble because these nonprofit financial institutions are there to help, not punish you.

You can also repay the loan early because you won’t be charged prepayment penalties.

Alternatives to Payday Alternative Loans

As helpful as PALs can be when you need money fast, they are still loans. That means you will have to come up with the payment every month until it is repaid, which can stress a tight budget.

That’s why it is important to evaluate whether you really need a loan or can get by without it. For example, you may want to do any of the following:

- Reduce spending. Review your budget very carefully and identify areas where you can lower costs. If you can find the money you’re looking for this way, you can revert to your normal spending when your cash crunch is over.

- Request a reprieve from your creditors. If you want the loan to pay off other debts, ask those creditors if they will consider giving you a break. For example, if you are faced with a doctor’s bill that you can’t afford to pay in full, ask whether they will accept small monthly payments.

- Sell unnecessary items. Look around your home, garage, or yard. Do you have anything valuable lying around that’s not in use? If you don’t need those items anymore, list them for sale and use the proceeds for what you do need.

- Bring in extra income. Evaluate all the ways you can earn additional money. If all you need is $500, think about how you can earn it instead. If you are an hourly employee, you may be able to increase your hours temporarily. Explore gig or side income such as delivery driving and taking care of pets or children. Ask older teenagers or relatives who live with you to contribute to the family fund.

- Get a personal loan. If you qualify for a regular personal loan, you may be eligible for a larger amount of money at a lower interest rate. Check your credit score to see where you stand, then look for the available loan options in your scoring range.

- Get a credit card. Another option is to use a credit card. If you have one already, you can charge what you need and then pay what you borrow as quickly as possible to keep the interest low. For example, if you charged $1,000 to a card with a 28% APR and paid it off in six months, the total interest paid would be $83. The interest would be the same for the loan, but you may be charged the $20 fee. And if you have good credit, you may qualify for a credit card with 0% APR for a fixed number of months, so there would be no financing fees.

Of course, there’s always the option to borrow from friends and family, but you must diligently stick to your agreed-upon repayment schedule to avoid damaging your personal relationship.

The Bottom Line on Payday Alternative Loans

When you need a little extra money to get you through a hard time and don’t have other reasonable options, a payday alternative loan may be right for you. It can also help you establish a great relationship with a credit union.

As a member, you may be eligible for other great products, such as low-cost mortgages and car loans. When you responsibly manage the payday alternative loan, you set yourself up for a positive financial future!