Christmas loans for bad credit can mean all the difference during the holiday season. The most wonderful time of the year can be quite stressful for those with a less-than-ideal credit score.

Not being able to see the joy spread on the faces of our loved ones, especially our children, as they open gifts can cast a shadow on what should be an otherwise carefree, festive time.

Let’s explore some great options for a holiday loan in the form of personal loans and credit or retail store cards. We take a detailed look at 12 options below.

Personal Loans For Bad Credit

First, let’s examine six great lender matching services. The companies below don’t lend you money directly but rather connect your loan request with their respective networks of lenders. And if you need a fast short-term loan during holiday shopping crunch time, fear not — these providers typically offer quick turnarounds.

What’s more, these services are free, and you’re under no obligation to apply for or accept any loan offer provided to you.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

When it comes to quick and easy, MoneyMutual can’t be beaten. One of our top-ranked lending networks, MoneyMutual offers a simple form you can fill out in just minutes. And its online marketplace works fast to connect you with a personal loan provider within 24 hours.

2. Avant

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $2,000 to $35,000 | 9.95% – 35.99% | 12 to 60 Months | See representative example |

Avant offers beneficial tips and tricks on its site that help improve your chances of getting approved for a loan. This kind of consumer education is right in line with Avant’s model of providing expert assistance to those searching for fast Christmas cash.

3. Upstart

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn’t impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% – 35.99% | 3 or 5 Years | See representative example |

Upstart keeps things simple and, if approved, can arrange to have your personal loan deposited directly into your bank account. The company has a wide variety of lenders in its network, ensuring you get the best possible repayment term for your instant Christmas loans.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group can help you find the right loan with fair terms. Whether short term or long term, you can be matched with lenders that fit your financial profile to get the loan you need to help pay for all of Christmas’s expenses.

5. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com is another solid choice to connect you with a direct lender ready to help cover your holiday expenses. CashUSA can securely and safely find you the money you need to make your holiday merry and bright in just four simple steps. Though some lenders in its network will access your credit report, poor credit does not necessarily exclude you from being approved.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

The SmartAdvances.com network is ideal for those seeking a short-term loan they can repay quickly. It’s likely to be an expensive option, but if you can prove you can repay it as agreed, approval is lenient and funding is fast.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

This company’s name says it all: BadCreditLoans.com is an online lender well-versed in helping people with bad credit get the money they need. The company offers plenty of consumer education resources in addition to its fast, secure, simple process of connecting borrowers with a bad credit loan.

Credit Cards For Bad Credit

It is natural for people with poor credit to be leery of applying for a credit card. It is no secret that credit card debt can pile up fast if you are not careful.

But with just a little research and some basic, responsible debt management practices, some credit cards offer fast, easy relief from the burden of cash shortages. Let’s examine three great options below.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

The Aspire® Cash Back Reward Card offers a great way to secure much-needed cash for holiday spending and begin to bolster your credit score. This card is perfect for borrowing relatively small amounts of cash to get you through the holiday, and you can even earn cash back rewards. Make your monthly payment on time and watch your credit score climb.

- You don’t need good credit to apply.

- We help people with bad credit, every day.

- Just complete the short application and receive a response in 60 seconds.

- You can build or rebuild your credit: apply for a PREMIER Bankcard credit card, keep your balance low, and pay all your monthly bills on time.

- Don’t let a low FICO score stop you from applying – we approve applications others may not.

- FICO scores are used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any PREMIER Bankcard® product.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 4 minutes | See Provider Website | Yes | 9.0/10 |

The PREMIER Bankcard® Grey Credit Card is a great offering for the holiday shopper with a bad credit score. Choose a unique card design from several available options to add a personal touch to your wallet. Because your payments will be reported to the major credit bureaus each month, this is a great option for those looking to build* credit when used responsibly.

*Build credit by keeping your balance low and paying all your bills on time every month.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

- Fast and easy application process; results in seconds

- Online account access 24/7

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 29.99% APR (Variable) | Yes | 8.5/10 |

If you want to choose a card that offers a simple way to keep tabs on improving your bad credit, the Surge® Platinum Mastercard® may be a great option. This card offers free access to your Experian VantageScore, making it simple to track your credit-building progress. You can also get quick cash advances, and rest assured that you’re protected against fraudulent charges.

Store Cards For Bad Credit

Getting a store-branded credit card can be an excellent option for much-needed holiday spending money. But be advised — the three cards we’ve featured below are closed-loop cards, which means you can only use them at the issuing store.

But when you consider that you can easily knock out your entire shopping list at any one of the retailers we have outlined below, that should not be much of an issue.

11. Target RedCard™

The Target RedCard™ is a great option for borrowers during the holidays. Not only is there a Target in or close to practically every suburb in America, but this card also offers discounts on every purchase in-store and online.

You also get free two-day shipping for online orders, access to exclusive offers, and approval should be no problem, even with a spotty credit history.

12. Macy’s Store Card

Another excellent option for a fast Christmas loan is the Macy’s Store Card. This is another relatively easy card to get, regardless of your credit rating, and it comes with some pretty solid rewards. It also offers fantastic discounts on purchases made on the same day you open your account.

Be aware that the interest rate is a little on the high end.

13. Sam’s Club Credit Card

Sam’s Club has more to offer than just giant boxes of snacks. The Sam’s Club Credit Card is a great choice with no annual fees and cash back rewards on in-club purchases. The credit card doubles as your membership card and is also accepted at every Walmart store.

This card is a great option for chipping away at that holiday shopping list.

What is a Christmas Loan?

There’s nothing complicated about it — a Christmas loan is simply a personal loan used for holiday expenses. The options we’ve outlined here are more convenient to get than visiting a brick-and-mortar bank or credit union.

Several types of loan options are available through the networks above. These include long-term installment loans with a monthly payment, short-term loans from payday lenders that require a lump sum repayment on your next payday, and secured loans that require collateral for approval.

Do your homework and be sure you know the differences in the types of loan offers you receive. An unsecured personal loan with a fixed repayment amount can help you better budget your holiday spending.

Can I Get a Loan to Buy Christmas Gifts?

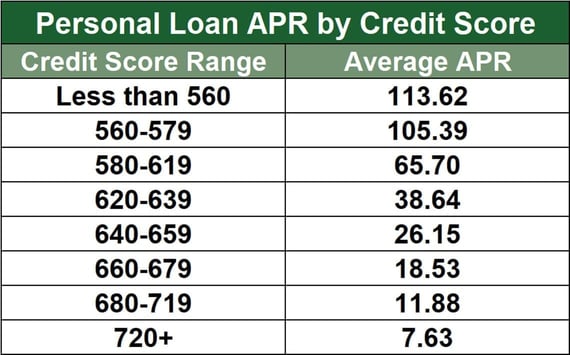

The short answer is yes — any of the options we’ve reviewed here will ensure you a guaranteed Christmas loan, for the most part. The loan term, loan amounts, and interest rate you receive will depend on your credit rating.

And, in most cases, what you do with the money is entirely up to you — just remember to do your homework before committing to a loan provider.

Can You Get a Christmas Loan With Bad Credit?

Most borrowers will qualify for any of the options discussed here, regardless of whether they have good credit. And if these options are pursued responsibly, they are better alternatives than payday advances.

Payday lenders often charge a very high interest rate for a cash advance, and it is easy to do more harm than good if you are not careful.

How Much Will a Christmas Loan Cost?

The final cost of your Christmas loan depends on many factors, most of which we’ve covered above. Christmas cash loans, for example, can come with a short repayment term and a high interest rate.

Getting a credit card is almost always a better idea than seeking a cash advance and can be more convenient than driving to your local credit union.

Again, for the most part, the final cost of your holiday loan is relative to many things, some of which you have great control over, and others not so much. The important thing is to understand the amount you are borrowing and whether you can take on the debt without harming yourself financially.

Compare Christmas Loans For Bad Credit

Christmas loans for bad credit from an online lender or another reputable loan provider, such as those we’ve outlined here, can go a long way in helping you avoid the holiday blues. Not having good credit is no reason to forgo the joys of holiday gift-giving, and Christmas loans can be quite handy if you choose them wisely and always make your monthly payment on time.

The options we’ve laid out here are ideal for most people looking to take out a bad credit loan. So, spend some time figuring out your holiday spending forecast, explore some of our recommendations, and get ready to spread some holiday cheer!

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.