In a Nutshell: Loans can help businesses fund their daily operations and take advantage of growth opportunities. QuickBridge offers tailored loan programs to small businesses. The company serves clients across the U.S. and provides solutions to businesses in various industries. QuickBridge offers businesses an efficient loan application they can complete in minutes.

An airtight business plan doesn’t always translate to a successful business. Sometimes, the difference between a business’s success or failure comes down to timing. The right word of encouragement to a business owner or a timely cash infusion can be the catalyst to propel a business toward long-term success.

Businesses often require outside financing to fund their operations, but accessing lending isn’t always a straightforward process for businesses. QuickBridge, as its name implies, offers tailored lending solutions that help small businesses bridge the financial gap when their cash flow isn’t as steady as they’d like it to be.

We spoke with Luke O’Dell, QuickBridge’s Vice President of Sales, and Chrissy Ingalls, its Chief Marketing Officer, to learn more about the company and its practical and innovative loan programs.

QuickBridge started in 2011. O’Dell said the financial crisis of 2008 made banks less willing to lend money, and they were particularly hesitant to lend to small businesses. He said QuickBridge’s founders noticed an opportunity to serve small businesses with loans that could improve their ability to take on new opportunities or cover expenses during a time of need.

QuickBridge provides businesses with loan terms of up to 18 months. The company offers options for the repayment structures of its loans. O’Dell said businesses can use QuickBridge’s loans to help finance new projects and maintain daily operations.

“A lot of our customers have just secured a new contract, and they need to hire a team and buy new materials before they get started on it,” O’Dell said. “If it’s a larger contract than what they would usually land, then they can have a lot of upfront costs and burdens that they need help to cover. We also have customers who need to replace a piece of equipment quickly. People use the funds we provide to keep their businesses going and take advantage of new opportunities.”

Fostering Impactful Relationships With Business Owners

O’Dell said QuickBridge works with businesses in various industries, such as the automotive, retail, and professional services spaces. He said the company also serves clients in the transportation industry, including trucking businesses.

QuickBridge has clients across the U.S. O’Dell said approximately one-third of the company’s clients have been in business between two and four years, and 20% have operated their businesses between five and seven years.

He said QuickBridge offers programs for clients who’ve been in business for as little as six months, and the company helps them grow their business and maintain a stable cash flow. O’Dell said the businesses QuickBridge serves generally have fewer than 50 employees each and owners have credit scores ranging from fair to excellent.

Ingalls said QuickBridge attracts businesses through its marketing efforts. She said the company also enjoys a strong renewal business.

“Customers come back to us because they appreciate our products,” Ingalls said. “Our products have worked well for them and their businesses, and they’ve developed relationships with the members of our team they’ve worked with.”

QuickBridge aims to be an extension of its customers’ businesses and an essential factor in their growth. O’Dell said QuickBridge assigns a dedicated team to each business the company works with, and the company acts as a consultant to its clients. He said QuickBridge helps its customers become aware of industry trends and how they may affect their business.

“A lot of business owners get so busy that they tend to focus on daily issues and have a hard time pulling back and seeing the big picture,” O’Dell said. “Over time, we develop a solid, symbiotic relationship with our customers. They use the capital we provide to help grow their businesses, but they also get a tremendous amount of information and knowledge from us.”

Customer Feedback Informs QuickBridge’s Methods

QuickBridge has many competitors in the business financing arena. O’Dell said the company’s customers feel they receive a fair product worth the time they’ve invested in applying for QuickBridge funding.

He said that a majority of the company’s clients who shop for a better financing option for their business ultimately return to QuickBridge because they discover that the company’s programs are better than those offered by its competitors, or close enough to favor the relationship over a small improvement in program. O’Dell said QuickBridge’s customers have peace of mind knowing they’re working with a trustworthy lender.

The interest rate environment can influence the rates lenders offer to borrowers. O’Dell said the current rate environment has caused some lenders to become more conservative in their lending practices or to stop offering loans to small businesses altogether.

“We have clients who have been around for years who tell us one of their lenders called and told them they need to begin making monthly payments on their line of credit,” O’Dell said. “Banks aren’t as willing to lend as they once were. Business owners used to be able to walk into a small-town bank, talk with a loan officer, and walk out with a loan. That just isn’t the reality now. Companies like ours are becoming the new mainstay for small business lending.”

QuickBridge maintains contact with its customers to ensure its programs and services meet their expectations. Ingalls said the company asks its customers to evaluate their experience working with QuickBridge to help the company assess its performance and identify areas where it can improve. She said QuickBridge’s team reads online reviews its customers write to understand their impressions of working with the company.

“We’re here to help the small business and make things as easy as possible for them,” Ingalls said. “We get great feedback from online reviews — both good and bad. And we take that feedback into account and discuss it with our customer-facing team.”

Tailoring Products to Meet Businesses Needs

O’Dell said clients sometimes ask QuickBridge to make an accommodation to a loan they have with the company, and QuickBridge employs a team dedicated to helping customers with requests of this nature. He said he engages with QuickBridge’s leadership to evaluate customer feedback and identify potential product enhancements.

O’Dell said QuickBridge has funded more than 40,000 loans totaling more than $1 billion. He said the company aims to help as many businesses as possible.

“We’re always looking at how we can improve our products in a way that will benefit our customers, whether that means bettering our credit model or developing products for businesses that may not qualify for some of our other programs,” O’Dell said. “Our task is figuring out how we can help the most businesses possible while maintaining the health of our company and keeping our losses in check.”

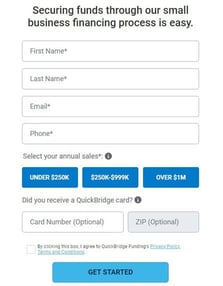

O’Dell said that to better understand a prospective customer’s business, the QuickBridge team reviews a prospective customer’s cash flow, the number of years it’s been in business, and overall management strategies learn more about them. QuickBridge offers customers a straightforward application process they can complete in minutes. The company can provide funding to customers in as few as 24 hours and offers loans of up to $500,000.

“From the beginning, we’ve been a business that looks beyond the numbers to assess a business and provide funding to it,” O’Dell said. We examine a business to find the qualities that make us interested and willing to believe in it.”