If you think free money is a drunken dream, sober up and think again! We are about to blow your mind with 19 ways to put money in your pocket for free (or, more precisely, with minimal effort).

The providers of this largesse include government agencies, businesses, and your fellow humans. All these schemes are legit, and you can take advantage of them with a clear conscience.

So without further ado, here are 19 ways to fatten your wallet. Cocktails, anyone?

1. Seek Unclaimed Money

Money – lots of it – is sitting unclaimed in various government and business accounts, waiting for the rightful owner to step forward. If you’d like to learn whether any of it is yours, start with a thorough search.

Two official government websites handle unclaimed funds:

- Unclaimed.org: The National Association of Unclaimed Property Administrators (NAUPA) runs Unclaimed.org. The website claims that 1 in 7 people have unclaimed property and that states return more than $3 billion in unclaimed money annually. By entering your name and the state you live in on the site, you may find unclaimed funds belonging to you. These funds stem from various sources, including security deposits, uncashed checks, unclaimed safe deposit boxes, inactive brokerage accounts, and overpayments.

- MissingMoney.com: The NAUPA endorses MissingMoney.com, another website that allows you to claim inactive financial assets residing in state coffers. MissingMoney.com discloses that online filers are responsible for 95% of all claims, which average $2,080 each. That kind of money can really improve your personal finances.

Many states have unclaimed property databases. You can visit a state treasury’s unclaimed property website and search for any funds in your name. Expand your search to include states where you previously lived or worked and, if applicable, your former name and the names of deceased relatives.

Be cautious of potential scams while searching for unclaimed money. Some scammers may try to trick you by claiming they have found unclaimed funds belonging to you and asking for money and checking or savings account information to process the claim.

2. Apply For a Scholarship or Grant

Students apply for grants and scholarships based on their financial need or their academic achievements, extracurricular activities, and field of study, among other reasons. The U.S. Department of Labor offers an online tool to search for nearly 9,000 scholarships, grants, student loans, and other financial aid award opportunities.

If you’re seeking a college grant, you can apply for a Federal Pell Grant of almost $7,400 for the 2023–24 academic year. You may qualify for the assistance based on your enrollment status, the cost of attendance, and financial need.

Students can apply for a Pell Grant when they submit their Free Application for Federal Student Aid, or FAFSA. This application for student loans can also qualify you for various state and institutional scholarships and grants.

Other sources for college grants include the Teacher Education Assistance for College and Higher Education Grant and the Federal Supplemental Educational Opportunity Grant.

You may be surprised at the many obscure sources for scholarships. One club offers funding to tall people. Another rewards high schoolers who excel at calling ducks. Someone is going to get that money — why not you?

3. Earn a Credit Card Signup Bonus

The best credit cards offer signup bonuses that can quickly put money in your pocket, either directly as cash or through money-saving points and miles. These bonuses may be worth hundreds of dollars — all you have to do is satisfy the card’s initial spending goal within the specified period (typically the three months after account opening).

The bonus is only “free” if you use your new card for purchases you would have made anyway. Doing otherwise may put you into debt you can’t easily repay, so choose a card that has an achievable spending goal. Remember, you must be a new cardmember to earn the bonus.

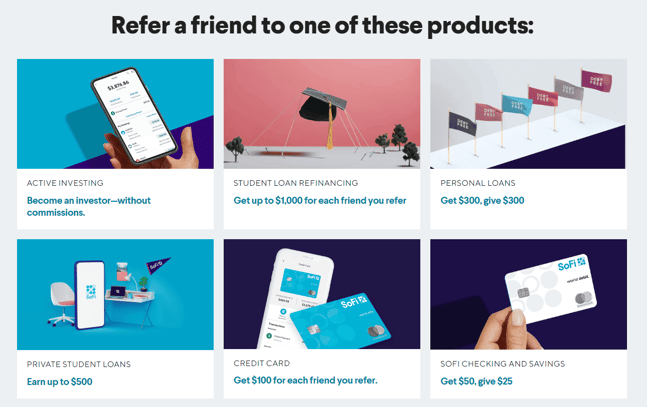

4. Earn a Referral Bonus

Hundreds of businesses and financial institutions will pay you cold hard cash when you refer someone who becomes a new customer. We’re talking about banks, credit card issuers, phone carriers, magazine publishers, etc. They’re all hungry for new customers and are willing to pay for solid leads that pan out.

For example, Capital One offers referral bonuses when you recommend a friend or family member who applies and is approved for a credit card. Your friend must sign up using your referral link for you to collect your free money.

5. Open a Bank Account

Banks want you to open an account with them. Some, including Chase Bank and Discover Bank, offer rather generous $200 bonuses to new customers.

As always, the devil is in the details. You may have to satisfy deposit minimums and other requirements to qualify for the bonus. For example, you must set up direct deposit within 90 days after opening a Chase Total Checking Account to qualify for the bonus.

If you have $300,000 burning a hole in your pocket, you can use it to open a Citi Checking Account and collect a $2,000 bonus.

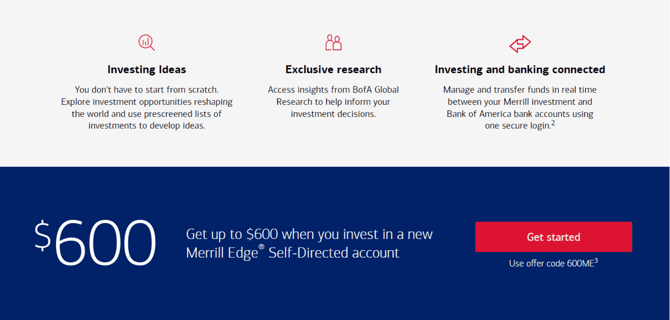

6. Open a Brokerage Account

Banks aren’t the only financial institutions jonesing for new customers. Brokerages aggressively push for new customers to start investing and back up their efforts with cash signup bonuses.

These aren’t just no-name wannabees looking for a piece of the action. Schwab, Fidelity, Merrill, and J.P. Morgan offer new-account bonuses that range from $50 to $1,000. You also may be able to start investing with free stock trades when you sign up.

Naturally, you must deposit enough money to qualify for a big bonus in cash and free stock trades. When a client refers you, Schwab will give you $1,000 after you deposit $500K.

Looking for something less grand? Deposit $50 into a new Fidelity account and collect a $100 bonus. That is real money for free.

7. Receive 401k Matching Funds

401k accounts are terrific. You can divert some of your income tax-free, let the money grow tax-deferred, and only pay taxes when you withdraw money later.

But one of the best features of 401k accounts is employer matching. Your employer can add money to your 401k to match a percentage of your contributions. In some cases, 401k plans allow employers to contribute up to a fixed dollar amount regardless of employee compensation.

The amount of the match is up to the employer. The match may vary from 0% to 100% of employee contributions. Your task is straightforward – annually contribute enough to your 401k to maximize your employer’s matching funds.

For 2023, the total contribution allowed for an employee’s 401(k) account is $66,000, or 100% of compensation, whichever is less. The employee can kick in $22,500, while the employer can contribute the rest. If you are 50 or older, you can also make a catch-up contribution ($7,500 in 2023).

Some plans allow employers to contribute to your 401k even if you don’t. Be sure to check your 401k’s vesting schedule, which specifies how many years of employment with the company it will take you to own 100% of your employer contributions.

8. Get a Premium Tax Credit for Healthcare

You can get free money in the form of reduced premiums when you buy coverage from the Health Insurance Marketplace. The amount of your premium credit depends on your income.

In 2023, the minimum income is 100% of the poverty level, equal to $13,590 for individuals and $27,750 for a family of four. There is no maximum income limit for the premium tax credit through the end of the 2025 coverage year.

To qualify, you must pay benchmark premium costs that exceed 8.5% of your household income. Your tax credit equals the premium cost of the second-lowest-cost Silver Marketplace Plan available to each eligible household member minus your expected contribution toward the cost of premiums.

The following table indicates the size of your 2023 monthly expected premium contribution after your premium tax credit (PTC), based on your income.

Expected Premium Contributions at Different Income Levels (2023) | |||

| Income | Expected Premium Contribution Remaining After PTC | ||

| Percentage of the poverty line | Annual dollar amount | Premium contribution as % of income (in 2023) | Monthly contribution |

| Family of four | |||

| $41,625 | 0% | $0 | |

| 200% | $55,500 | 2% | $93 |

| 250% | $69,375 | 4% | $231 |

| 300% | $83,250 | 6% | $416 |

| >400% | $111,000 | 8.5% | varies |

| Individual | |||

| $20,385 | 0% | $0 | |

| 200% | $27,180 | 2% | $45 |

| 250% | $33,975 | 4% | $113 |

| 300% | $40,770 | 6% | $204 |

| >400% | $54,360 | 8.5% | varies |

9. Receive Child Care Assistance

Caring for an infant can cost tens of thousands of dollars, so some assistance would be most helpful. Low-income families can benefit from the Child Care and Development Fund from the U.S. Department of Health and Human Services (DHHS).

This resource funds state programs that distribute money for children’s health care. Typically, families with children under 13 are eligible for these income-based grants. Contact your state government to apply for grant money from this fund.

DHHS also administers the Home Care and Family Support Program, which is open to all eligible American citizens. The program provides financial support through government-registered checks the DHHS delivers to applicants’ home addresses.

The following grants are available:

- Cash grants

- Business grants

- Federal and state grants

- Private foundation grants

- Grants for women

- Housing and new home grants

You can contact an online agent to assist in applying for a DHHS grant.

10. Earn Money From Shopping

Inflation continues to take its toll on shopping budgets across the country. You can fight back by signing up for one or more shopping apps that offer you cash back, digital coupons, and other money-saving deals.

You can combine these apps with a cash back credit card to maximize your savings, but it’s best to pay your entire balance each month to avoid expensive interest charges.

Downloading the app or browser extension from your favorite grocery store is an excellent place to begin. Many chains, including Kroger, Albertsons, and Meijer, offer mobile apps where you can browse for items on sale, clip digital coupons, and earn reward points.

Rakuten and Ibotta are two leading cash back shopping apps. They offer up to 100% cash back on select items from stores where you normally shop. Other popular apps, including The Krazy Coupon Lady, Flipp, and Fetch Rewards, offer savings in one or more ways.

Some apps require you to scan your receipts to collect your cash rewards. Others offer coupons or discount codes for in-store and online shopping.

Dosh provides an exceptionally convenient way to collect free money online. You link your cash back credit card to the Dosh app to receive immediate rebates on eligible purchases. This cash app works with more than 10,000 retailers and 600,000+ hotels globally.

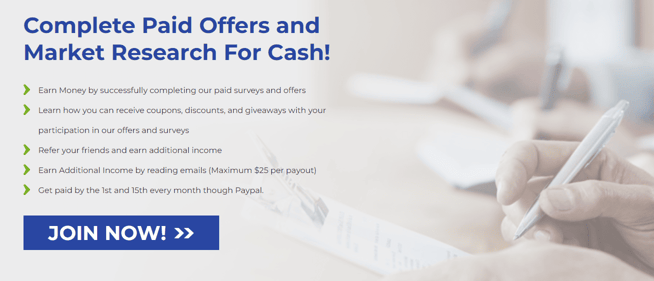

11. Participate in an Online Survey or Focus Group

You can earn extra cash by participating in a survey site or focus group. Market research companies will pay you almost-free money (you’ll need to invest a little time) when you offer your opinions on products and services.

You can earn money by answering survey questions, watching videos, taking daily polls, or joining other focus group members around a table to discuss your opinions.

Some popular ways to get free money online in this lucrative market include:

- Swagbucks: This is an alternative search engine where you can earn points for each inquiry. You can also complete online surveys and watch videos to earn extra income (i.e., up to $150/month).

- Survey Junkie: More than 10 million consumers worldwide earn virtual points on Survey Junkie by sharing their opinions on the survey site. You can redeem your points for free gift cards or PayPal cashouts.

- User Interviews: This company offers participants one of the best ways to earn an average of $65+ in real money per study. It launches more than 2,000 studies per month, and you can browse for exciting opportunities online.

You can also search for local companies that conduct in-person focus groups.

12. Get Paid to Play Games and Watch Videos

This opportunity may be better than free cash — it pays you to play games and watch videos. This is a fun way to earn extra income.

Typically, you download an app that lets you play a game and submit feedback about the experience. The games may pit you against other contestants for prize money.

You can compete for easy money on many game apps, including the following:

- Solitaire Cash: Use your skills to win up to $83 per game. You can pay for free or join pay-to-play tournaments.

- Blackout Bingo: You can earn $5 just for downloading and playing this game. Join in for free or ante up to win money.

- Mistplay: Get paid for playing games on this app. Winners collect units that they can cash out for gift cards. The game has given away more than $51 million in easy money to date.

You can collect passive income from your couch by watching videos online or on mobile devices. For example, Nielsen Computer and Mobile Panel will pay up to $60 annually in points you can exchange for free gift cards when you download the app and watch select feeds on your electronic devices.

13. Sell Your Personal Data

In an era when many people have multiple social media accounts, data brokers are willing to pay you to share data about your activities and interests. The brokers often aggregate and anonymize social media data before selling it to businesses.

Your profile data is valuable. You can explore platforms and apps that allow you to turn that data into money.

For example, Monetha lets you fill in your interests profile and earn up to 80% additional cash from hundreds of shops. When you share your data with stores on the Monetha partners network, you can harvest bigger and more tailored benefits as you shop.

Evidation lets you connect a health or fitness app, share your data, and get paid. You earn points when you track your actions (e.g., walking, sleeping, logging food, taking an online survey, reading health-related articles, participating in health programs and research, etc.). You can redeem your points for cash or donate them to your favorite charity.

14. Read Emails

It seems impossible that anyone would pay you to read emails. But it’s a real thing. Market research companies will pay you to read and review marketing emails.

For example, Inbox Pays lets you earn Cash Mail Credits by reading and confirming emails it sends to you. Members can receive up to three emails per day. You can redeem your credits through PayPay after you accumulate at least $25.

Here’s another somewhat-related money-maker. Small Business Knowledge Center (SBKC) will pay you for forwarding junk email and regular direct mail to it. You place your qualifying direct mail in the postage-paid envelopes SBKC provides and return them to SBKC about once a week.

Frequent participants will find it one of the best ways to earn as much as $20 every six to 10 weeks. Business owners and the self-employed can earn rewards even faster.

15. Get Financial Assistance For Utility and Grocery Bills

You gotta eat, stay warm, and communicate. Get free cash to help with these necessities through this trio of programs:

- The Low Income Home Energy Assistance Program (LIHEAP) helps eligible individuals and families afford to heat and cool their homes, especially during extreme weather conditions. The Department of Health and Human Services issues LIHEAP grants to states that distribute the funding. Each state sets eligibility requirements, income levels, benefit amounts, and application processes. LIHEAP prioritizes help for vulnerable populations, including households with elderly individuals, young children, and people with disabilities. You can use the program’s contact listing to get each state’s public inquiry phone number and learn more about the program.

- The Supplemental Nutrition Assistance Program (SNAP) from the U.S. Department of Agriculture is for families who meet their state’s income requirements. People often call it the food stamps program, but it no longer uses stamps. Instead, families receive monthly benefits on an electronic benefits transfer card, similar to a debit card that recipients can use in authorized stores. You can contact your local SNAP office to apply for benefits or learn more about the program.

- The Federal Communications Commission (FCC) provides the Lifeline Program to help low-income consumers pay for mobile and landline telephone services. Some consumers may qualify for a free phone — you can contact your local provider’s customer service department for details. You may also be eligible for free monthly data, unlimited text, and monthly minutes. You can use the interactive directory to see your state’s offer.

The federal government funds all three programs, but the states administer them.

16. Share Your Home

You can make money by renting out a room or your entire home to guests for short-term stays. Airbnb is the most popular platform, but others are also available.

You may not have to spend much money to set up a home-sharing operation. Before you begin, get familiar with the local laws and regulations regarding short-term rentals in your area. Some locales may have specific rules or require permits for home sharing.

If all is well, prepare the rental space, which should be clean, well-maintained, and appealing to potential guests. It could be a spare couch, a guest bedroom, or an entire home. The larger the space, the more you can charge.

It would be best if you prioritize your guests’ safety and security. This may require you to install smoke/CO2 detectors and add fire extinguishers. Consider beefing up your homeowner’s or renter’s insurance to protect yourself and your property.

You must select a platform to list your space. Popular ones include Airbnb, VRBO, Booking.com, and HomeAway. You can compare the platforms’ fees, booking procedures, and user reviews to see which appeals to you most.

Place your listing on your chosen site and provide a detailed description of your space, including its unique features, amenities, and nearby attractions. Be transparent about any limitations or house rules. It helps to add nice photos of the space.

You’ll have to set a price for the rental space. Consider location, demand, amenities, seasonal variations, events, and local market rates.

Now you’re ready to accept bookings through the platform you chose. It should help you keep track of reservations, calendar availability, and guest emails. The platform will handle the financial transactions, deduct fees, and transfer your earnings to your payment account.

The sweat equity you contribute upfront can produce handsome earnings. While the money isn’t exactly free, your out-of-pocket expenditures may be quite low — maybe just sprucing up the space and increasing your insurance coverage.

17. Receive Gasoline Rebates

Gasoline prices are volatile, but a rebate is always welcome. The Upside app lets you save money on fuel by paying you a refund at select gas stations in your area. You pay however you usually do (with a credit or debit card), and Upside will deposit cash back directly to your account.

The Upside app directs you to nearby participating gas stations and displays the rebate offer at each. After you fill the tank, print the receipt and scan it with the app. It may take an hour or two, but eventually, the app will update your balance.

You can cash out anytime via free PayPal money, gift cards, or direct deposits to your checking or savings account.

You can also get some of the best credit cards from the major refineries that provide refunds and discounts of varying sizes. But gas cards can only be used at the issuing station, so you may need several if you aren’t loyal to a particular brand.

18. Get Paid For Walking

Walking is good for your health. It can also be healthy for your wallet, thanks to activity-related apps that reimburse you for your steps. Here are a few popular ones:

- Miles is a universal rewards app that allows anyone to earn miles automatically for all modes of transportation. It rewards you with miles, its version of points, whether you walk, bike, drive, or ride the train. You can redeem your miles for exclusive rewards, gift cards, top deals, credit, discounts, and savings on well-known brands.

- StepBet lets you bet on how much you’ll walk by choosing a game to accomplish your goals. If you succeed every week for the entire game, you’ll win back your bet plus a profit. StepBet works with various fitness trackers, including Fitbit, Garmin, and Apple Watch.

- Paidtogo rewards your walks or runs with coins you can redeem through free PayPal money or Bitcoin payouts. The app claims top users earn up to $75 monthly.

Any way you slice it, getting paid to walk is a win-win.

19. Earn Rewards For Weight Loss

If you signed up for a step-reward app (or even if you didn’t), you may want to get an app that pays you money to lose weight. This kind of app can motivate you to reach a weight-loss goal.

For example, HealthyWage offers weight loss challenges and cash prizes worth up to $10,000. Each participant pays an entry fee, which fattens the prize pot (less HealthyWage’s 25% admin fee).

Every participant or team (depending on your selection) that achieves a weight loss of 6% or more wins an equal share of the pot. Winners typically double their entry fee.

DietBet is a similar weight-loss app in which participants who lose 4% of their body weight in four weeks split the betting pot. You submit before and after pictures of yourself on your scale to prove your weight loss and collect your winnings.

Get Your Money For Nothing!

Any of this article’s money-making schemes can provide a refreshing pick-me-up for your bank account. But imagine combining several at the same time! We’re not saying you’ll be able to quit your day job, but the extra money may help you make ends meet.

Consider creating and following a monthly budget to maximize the utility of your money, including the amount you earn the easy way.