Valentine’s Day isn’t just about finding the perfect gift for your partner — it’s about creating unity and a stronger connection. Money can become a source of friction, whether you’re dating or married, especially when you’re dealing with debt.

Learning how to manage your finances together will provide much more joy and happiness in your relationship than any box of chocolates or a dozen roses ever could. To strike financial harmony with your partner, follow these nine steps to overcome debt together.

1. Approach the Topic with Empathy

Talking about money matters in an open and honest way is the first step toward creating financial harmony, especially when it comes to debt. In fact, debt usually brings along feelings of shame and embarrassment, so it’s important to discuss this with empathy and support instead of blame and anger.

Before you can create a plan to pay off debt and figure out ways to prevent accumulating it in the future, learning how to communicate and work as a team is the first step.

2. Set a Common Budget

Setting up a budget gives you and your spouse a chance to discuss which expenses are important — and which you can live without. Plus, you’ll learn how to make compromises in a way that supports each of your passions, hobbies, and needs.

This exercise will also help you pinpoint where you’re currently wasting money and how you can cut back so you can spend more on what brings each of you more happiness.

An app like HoneyFi can help you manage a budget together.

A budgeting app made specifically for couples can help manage your money together while holding you accountable for your spending and saving behaviors. Many options are available, such as Mint or HoneyFi, that will help you stay on the same financial page.

3. Choose Your Debt Repayment Strategy

When it comes to paying off debt, there are two strategies that can help you reach your goal faster. For instance, the Snowball method focuses on paying off the lowest balance first to get that feel-good quick win, which will create momentum, so you’re motivated to keep working toward your goal.

On the flip side, the Avalanche method suggests focusing on putting as much money as possible toward the debt with the highest interest rate to save the most on fees.

There’s no right or wrong option, but it’s important to sit down with your significant other to determine which debt repayment strategy will help you stay motivated.

4. Agree on Spending Rules

You’re less likely to make bad buying decisions or impulse purchases when you’re being held accountable or when you know your partner is watching. Though you don’t want to start nitpicking every dollar you spend, setting spending rules for big-ticket items is smart.

This means you and your partner discuss any purchase over a set dollar amount. This could be $100, $200 or $300, depending on your financial situation and budget.

5. Streamline Your Monthly Bills

When was the last time you really looked at all those small, recurring expenses you’re spending money on each month? Which are you actually using and which can you cancel?

Sit down with your partner to review all the subscription services and memberships you’re paying for. Do you both have an Amazon Prime membership or Netflix account? If so, you can share these accounts and save money by canceling duplicates.

If you both have separate gym memberships, some health clubs will provide deals to family members, so inquire about getting on the same account to save money. For other monthly bills that you can’t cut or aren’t willing to give up, such as auto insurance and cable, spend some time comparing rates with other service providers in your area. You may be able to score a promotion as a new customer.

BillCutterz will help negotiate the cost of your bills with your service providers.

For help, tap into tools like BillCutterz, which will negotiate your rates with your service provider, or Trim, which will pinpoint all the subscription services and monthly memberships you have and help you cancel the ones you aren’t using or no longer need.

6. Plan for the Unexpected

Not only is it crucial to have emergency savings set aside to avoid taking on debt that can cause tension in your relationship, but setting up life insurance is incredibly important, especially if you have children.

No one wants to think about death, but life insurance can help cover debts and reduce mortgage payments, pay for your kid’s college education, cover funeral arrangements, and simply make your family’s lives easier.

Even if one spouse stays home with the kids, life insurance can be used to cover the cost of childcare that will be needed if something happens to him or her. You can find a life insurance calculator at Ladder Insurance and set up a plan within five minutes without having to deal with an agent or face annual policy fees.

7. Consolidate Your Balances

If you and your partner are carrying debt across several accounts, chances are you have no idea how much in total interest fees you’re paying. Managing these balances can become increasingly difficult. Consolidating debt doesn’t just make it easier to manage your payments since you will only have one due date to remember, but you will save money at the same time.

You can usually score a lower interest rate on a personal loan from an online lender or credit union in which you would use to pay off all your credit card debt, then commit to only making one payment every month. When comparing personal loans, make sure to look at potential fees in addition to interest rates.

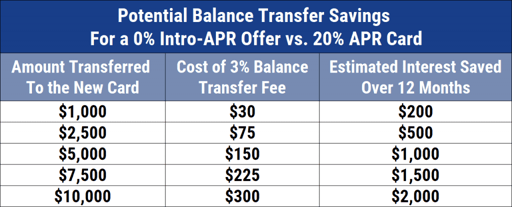

Another option for consolidating debt is opening a new credit card that offers a promotional interest rate of 0% for balance transfers for up to 18 months, typically. Keep in mind, this strategy is only a good option for those who will pay off the balance in full by the end of the promotional interest rate offers. Otherwise, you may be subject to retroactive interest on the entire balance transfer initially made.

If you choose this option, you also need to refrain from using the old accounts once the debt is transferred to the new account or you run the risk of digging yourself into deeper debt. So, look at both options to determine which is right for you.

8. Help Each Other Rebuild Credit

When you’re in debt, your credit score is likely suffering. Although it may seem like a long road to recovery, rebuilding your credit score with your partner will lead to many benefits down the road.

The better your credit, the more likely you are to get approved for an apartment rental, mortgage, or car loan, and the better the interest rates you will secure. Begin by checking your scores for free at sites like Credit Karma and set up monitoring alerts to stay on top of your progress.

You also get access to your credit reports from all three credit reporting bureaus for free every year. It’s important to check in on your credit reports to make sure there are no errors or fraudulent activity that is hurting your score.

9. Team Up on a Side Hustle

No matter how many expenses you trim or completely eliminate, sometimes it’s just not enough to find the extra room in your budget to pay off debt fast enough. Making more money can help you fast-track debt repayments so you can begin enjoying your life together debt-free.

This isn’t always easy, though, but you can team up on a side hustle to have fun while earning extra income.

For instance, go garage sale hunting on weekends to find small treasures or furniture to restore and flip at flea markets or online at OfferUp or Facebook Marketplace. If you both love dogs but don’t want to commit to getting your own just yet, you can make up to $1,000 every month by pet sitting through sites like Rover.com.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.