When the unexpected occurs, you may need an emergency loan you can get today. The ability to access cash quickly may seem complicated if you have bad credit, but the lending companies reviewed below make speed a priority no matter what your credit profile or loan purpose.

Whatever the reason you need a same-day emergency loan, never rush past understanding the costs and terms imposed by the lender.

Personal Loans You Can Get Today

The following six loan-matching sites specialize in getting you a loan funded either the same day or the next business day. All six work with networks of direct lenders who are experienced in lending to bad-credit consumers.

While not as quick as a credit card cash advance, a personal loan (also called a signature loan) is usually less expensive and more flexible.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual can swiftly arrange a personal loan even if you have bad credit. Everything about its operation is geared for speed, starting with quick prequalification without a time-consuming credit check.

To prequalify, you must be age 18 or older, have a bank account, and receive a reliable income of at least $800/month.

2. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

It takes only a few minutes to fill out the CashUSA loan request form, after which you’ll be instantly forwarded to the most appropriate loan provider who may grant you immediate loan approval. Your loan proceeds should appear in your bank account in about one business day or sooner.

You must be a U.S. citizen or permanent resident, 18 or older, and have an after-tax monthly income of at least $1,000, a valid email address, and a bank account.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan can rapidly prequalify you for a loan without checking your credit. It takes only a few minutes to complete the loan request form and receive an offer from a direct lender.

Many applicants receive instant loan approval and obtain the loan proceeds on the same or the next business day. The direct lenders on the CreditLoan network specialize in working with folks who have bad or scant credit.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 60 Months | See representative example |

The loan providers on the Bad Credit Loans network routinely approve loans to consumers with low credit scores or no credit history. Simply fill out a short loan request form, receive approval, agree to the loan, and collect the money in your bank account within 24 hours.

To qualify, you must be a U.S. citizen or resident, age 18+, with regular income, a bank account, an email address, and a valid phone number.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

You can complete the short PersonalLoans loan request form in a few minutes. If a direct lender offers you a loan, you can see your money deposited in your bank account as quickly as one business day or sooner.

To prequalify, you must be 18 or older, a citizen or permanent resident, with an active bank account, a Social Security number, and a reliable monthly income.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% - 2,290% | Varies | See representative example |

CashAdvance can prequalify you for a small personal loan within a few minutes and immediately forward you to a direct lender. If you accept a loan offer, your money will be available in your bank account as soon as the next business day — perhaps sooner.

To prequalify, you must be a U.S. citizen, age 18 or older, have an income of at least $1,000 a month after taxes, a valid email address, a checking account, and a working phone number.

All of these lending companies follow a similar operating scheme:

- You select one of the loan-matching services and fill out a short loan request form. The form will accept data about your identity/age, your residence, your job, your bank account, your email address and phone number, and your income. You also may have to divulge your Social Security number and/or the purpose of your loan.

- The loan service informs you whether you prequalify for a loan and will ask you whether you want to proceed.

- If you reply “yes,” the loan service will match you with a direct lender on its network and transfer you to the lender’s website.

- The direct lender will collect additional information and may perform a hard inquiry on your credit report.

- You should receive a decision within a few minutes.

- If you are approved, you’ll be sent a loan agreement that you should carefully read over.

- To accept the loan, electronically sign the loan agreement.

- The lender will deliver the loan proceeds to your bank account, usually within one business day. If you apply for a loan early in the day, there is a possibility that your money will be available on the same day.

Although it’s tempting to skip the fine print, please don’t! You will kick yourself if you run afoul of some arcane rule, such as prepayment penalties. Specifically, understand the rights you are giving up by agreeing to the typical arbitration clauses included in these loans.

How Can I Get a Loan Today?

Personal loans are pretty quick, but you generally must wait one business day to receive the signature loan proceeds. If you need the money immediately, consider a loan from a revolving credit account – a credit card or home equity line of credit. Both loan options offer instant cash based upon your account balance and the established credit limits.

Not all revolving account types offer loans. You can’t borrow money from a gas card or a department store card. Also, some credit cards do not permit cash advances.

Credit Card Cash Advance

The fastest way to get a same-day loan is through a credit card cash advance. You can simply walk up to a cash machine, swipe your card, and enter the amount of cash you’d like, up to your available limit. If all goes well, you will be on your way within five minutes with the proceeds from an unsecured loan.

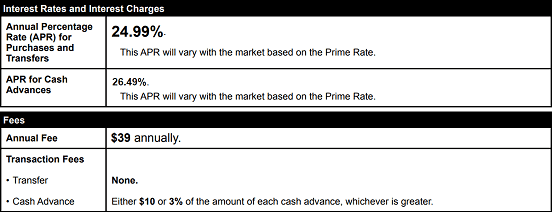

While a credit card cash advance may be fast and convenient, it may not be your best choice for the following reasons:

- You need a credit card: If you don’t already have a credit card, it can take a week or longer to get one and then use it for a cash advance. You may already have a credit card geared toward bad-credit consumers but check to see whether it even allows cash advances.

- Amounts may be limited: Your credit card may have a low credit limit. Cards for bad-credit consumers often have a starting credit limit of $300 minus the annual or initiation fee. If you needed to borrow $1,000, you may need several credit cards to come up with the necessary account balances. You’d then be saddled with multiple minimum payments due in each billing period until you repay the loans or perform a debt consolidation.

- They are expensive: Cash advances typically have APRs in the 20% to 35% range, and they start accruing interest from Day One — there is no grace period. Most cards charge a minimum cash advance fee of $10, but the fee can be considerably higher.

You also may have to pay an ATM fee with a credit card cash advance, and if you don’t make the minimum repayment by the next monthly payment due date, you’ll probably be hit with a late fee and perhaps a higher APR.

Home Equity Line of Credit

A home equity line of credit, or HELOC, is a revolving secured loan account collateralized by the equity in your home. Your equity is equal to the current value of the home minus your mortgage balance. Thus, your home serves as collateral for a HELOC, which means you can lose your home if you default on the secured loan.

Typically, the loan amount available from a HELOC is less than the equity in your home. For example, a HELOC may offer a credit limit equaling 80% of your equity. The remaining 20% represents the lender’s requirement for a down payment on the property. This requirement varies by lender and type of mortgage.

A HELOC is similar to a home equity loan except for the following differences:

- Payout: A home equity loan provides a lump-sum distribution of the loan proceeds. It is essentially an amortized second mortgage with monthly fixed payments. A HELOC is a revolving credit account allowing you to borrow any amount up to the credit limit at any time. You must repay at least the minimum amount each month. You only pay interest on the account balance.

- Repayment term: The typical home equity loan has a repayment term of five to 15 years. Normally, a HELOC expires after 15 to 20 years.

- Interest type: A home equity loan uses a fixed interest rate, whereas a HELOC is a variable-rate loan.

When you want to borrow from a HELOC, you enter an online transaction to transfer the loan amount from the HELOC account to your checking account. The transfer may go through instantly, but some banks may require more time.

The biggest problem with HELOCs is that you must own a home and have equity in that home. If you are a tenant, you’re out of luck.

Other Same-Day Loans

Two same-day loan options we don’t recommend are a payday loan and a car title loan, products offered by predatory lenders.

Payday loans are short term cash advances that you secure with your next paycheck, which is when the loan must be repaid or extended. Payday loans are extremely expensive, featuring triple-digit APRs and high fees. If you must regularly extend the payment date, you run the risk of falling into a debt spiral that may lead to bankruptcy at the hands of predatory lenders.

A car title loan is collateralized by the title to your car. If you fail to repay the loan on time, the lender can repo your car. These loans also suffer from high interest rates and fees.

The personal loan services reviewed here can approve your loan on the same day and quickly deposit money into your bank account by the next business day or sooner.

What is the Best Online Loan?

Our top choice for online loans is MoneyMutual. You can get a short term loan up to $2,500 from this online lender marketplace that has served more than 2 million customers.

Loans are usually rapidly approved and funded. The folks at MoneyMutual match you to a direct lender immediately, a real time-saver compared to finding and evaluating appropriate lenders on your own.

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual has the flexibility to find you an installment loan or a cash advance. You repay an installment loan in a series of monthly payments. These fixed payments consist of principal and interest, making it easy to plan your payments on your calendar.

A MoneyMutual cash advance works a little differently. These are short term loans, usually lasting one or two weeks. You repay the loan and associated fees in one lump sum. This type of loan may be a perfect alternative to a payday loan at a far lower cost.

Can I Get a Loan with Bad Credit?

Do you know your credit score? If not, you belong to the 43% of consumers who haven’t recently checked their scores. That’s kind of shocking — how can you fix bad credit if you don’t know you have it?

Fortunately, it’s easy to check your credit score for free, a practice we strongly recommend, especially if you want a loan.

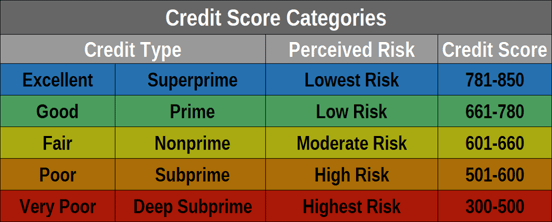

Approximately 11% of U.S. borrowers have FICO credit scores below 550, indicating ultra-high risk. It would be unthinkable for the lending industry not to serve such a large population segment. That’s why being below the minimum credit score doesn’t automatically lock you out of the loan market.

The personal loan services in this review do not require you to have good credit. In fact, they can prequalify you for a loan without even checking your credit score. That’s perfect for consumers with no or poor credit.

It is only when a loan service forwards you to a direct lender that your credit score may come into play, and even that is not necessarily assured.

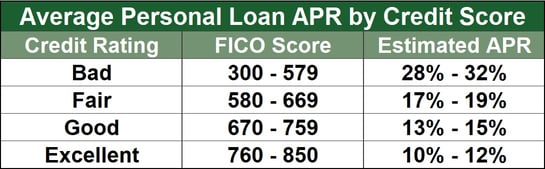

There is also the group of borrowers with slightly higher credit scores (i.e., about 20% of Americans in the 580 to 669 subprime range) that can more easily access credit, although still at a stiff cost — higher APRs and fees. If you can rebuild your score above 670, then you can qualify for lower APRs and larger loan amounts.

Clearly, your access to credit improves with your credit score. You can improve your score by adopting creditworthy habits, such as always paying your bills on time, keeping your credit utilization ratio low, not applying for credit too frequently, and having a wide mix of credit account types. You can also adopt auto-pay to ensure you never miss a payment.

Whatever your credit score, you can seek to raise it by removing derogatory items from your credit reports maintained by each major credit bureau (Experian, TransUnion, and Equifax). According to the Federal Trade Commission, about 5% of consumers have mistakes on their credit reports that hurt their credit score.

It pays to find out if you are one of the unfortunate 5%. Start by ordering your credit reports at AnnualCreditReport.com, the only source authorized by federal law for your free credit reports. If you identify inaccurate information, you can dispute it with documented facts and have it removed, which should give your score a boost.

Alternatively, you can use a credit repair service to help identify and remove erroneous information from the credit reports maintained by each credit bureau.

There is another strategy to improve your credit score and with it your chances of getting a loan. You can use a service like Experian Boost to add some points to your credit score. The improvement may be modest, but it can still make the difference between having your bad credit loan application approved or declined.

What Will My Interest Rate and Loan Term Be?

The six loan-matching services can only give you broad guidance about your loan’s interest rate and term. The exact information can only come from the direct lender chosen by the loan-matching service.

Generally speaking, lenders maintain different pricing tiers based upon an applicant’s credit risk (i.e., expressed by a credit score), as well as income, expenses, and other factors.

If you have bad credit, you’ll be subject to the pricing and terms of a lender’s highest-price tier, assuming you qualify for a loan in the first place. That’s the chief value of the loan-matching services: They work with networks of direct lenders that are comfortable offering loans to consumers with bad credit or no credit.

Before you agree to any loan, make sure you understand the loan amount, fixed or variable interest rate, finance charges, dates of repayment, penalty fees, and other critical factors. According to the 1969 Truth in Lending Act, the lender must provide you this information in writing and you can (and should) take the time to read the fine print, ask questions, and discuss the offer with a knowledgeable person.

The small personal loans in this review are installment loans, with terms usually ranging from 3 to 72 months, depending on the lender. None of the loan-matching websites charge you for their services. Rather, they are funded by the lenders on their networks.

Note that two of the matching services (MoneyMutual and CashAdvance) also facilitate cash advances, which are short term loans lasting a week or two and repaid all at once on the due date. Cash advances usually have higher interest rates than do installment loans.

Credit card cash advances are a different story because you know the APR and origination fee when you accept the credit card. The cash advance APR may be equal to or greater than the purchase APR – we’ve seldom seen a case where the cash advance APR was lower than the purchase APR. We do regularly encounter credit cards geared toward bad-credit consumers that do not offer cash advances at all.

The rates and fees you’ll be charged for credit card cash advances are laid out in your credit card’s terms and conditions.

You won’t find a fixed term for a credit card advance because you can keep it going as long as you pay the minimum monthly payment on time. Interest accrues daily on the loan balance, starting from the first day of the loan.

Typical APRs for credit card cash advances range from 25% to 36%. You may also be hit with a cash advance origination fee (e.g., the greater of $10 and 3% of the cash amount), although sometimes the origination fee is waived for the first year.

You will usually get better terms on a cash advance from a secured credit card. For example, the OpenSky® Secured Visa® Credit Card charges a cash advance APR well below 20% with lower-than-average fees. It makes sense for secured cards to offer better interest rates since they are collateralized by your cash deposit.

Can I Get a Same-Day Loan from a Credit Union?

Credit unions are like really friendly banks. Each customer must be a member of the credit union, and members run the organization for their own mutual benefit. Compared to banks, credit union loan policies are more flexible, and the loans are usually cheaper.

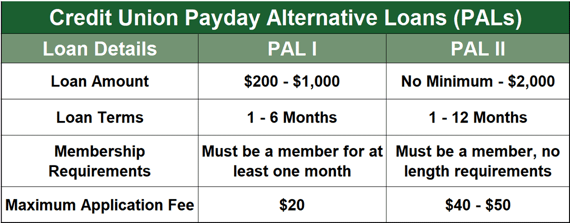

Two specific bad credit loan products offered by federal credit unions are Payday Alternative Loans (PALs) I and II.

PAL II offers same-day loans to credit union members and is a more relaxed version of PAL I.

PAL I

The original PAL I functions as an alternative to expensive, small payday loans. PAL factoids include:

- A borrower must belong to the credit union for at least one month before receiving a PAL I.

- Loan amounts can range from $200 to $1,000.

- The loan term can range from one to six months.

- The typical APR for a PAL I is 28%.

- You can take up to three PALs within a six-month period as long as they do not overlap each other, and no PAL is rolled over.

- The processing fee must reflect actual costs and cannot exceed $20.

- The loan is fully amortized.

You can consider PAL I to be a same day loan as long as you’ve been a member of the credit union for at least 30 days.

Note that these PAL 1 parameters represent the minimum requirements allowed. A credit union can set stiffer standards, such as a longer membership, longer employment, regular payroll deductions, and other requirements.

PAL II

In September 2019, the National Credit Union Administration approved an additional payday alternative loan named PAL II. The new PAL II does not replace the original PAL I. PAL II has the following requirements:

- You can take a PAL II loan as soon as you become a member of the credit union.

- Any loan amount up to $2,000 is permitted.

- The loan term can range from 1 to 12 months.

- The credit union can only offer a member one PAL at any given time.

All other PAL I requirements also apply to PAL II. These include full amortization, the maximum number of loans within a six-month period, and the ban against rollovers and overlaps.

Easily Find Loans You Can Get Today Online

Our review of six loans you can get today focuses on personal loans arranged by online loan-matching networks. When speed is important, these networks can find you a willing lender in minutes. You simply fill out a short loan request form with a few essential data items and let the loan network find the right lender for you.

These loan services routinely work with borrowers who have bad credit. They don’t perform hard inquiries on your credit reports, although the direct lender may. If you can satisfy the requirements for income, residency, account ownership, and age, you stand a good chance of receiving a personal loan offer despite your low credit score.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.