When emergency situations arise, legit cash advance loans online can be a major lifeline to help keep your life under control. Short-term loans can help you handle sudden unexpected expenses — like a flat tire, a broken window, or an injury or illness — quickly and without stress.

Our experts reviewed cash advance loan options, ranking them based on a variety of factors, including approval rates, reputation, and terms. The following companies all offer competitive loan terms and provide a different range of loan amounts to help you get through whatever financial emergency you find yourself in.

Online Cash Advance Loans

Finding legit cash advance loans online can be a tricky prospect, and if you’re in a financial emergency, you may not have the time to submit multiple applications. The easy solution is to work with a lending network, which submits your application to multiple lenders simultaneously.

This way, you can quickly compare offers and choose the right loan product for your needs.

These networks provide loans to people with a variety of credit ratings, so even if you have bad credit or poor credit, you can still find a personal loan for your unexpected expenses.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

Founded in 2010, MoneyMutual specializes in connecting borrowers with its direct lender network of short-term loan companies. The MoneyMutual network includes a wide range of lenders that offer cash advance loans of up to $5,000. The application is simple and fast: Most people can complete and submit it within five minutes.

MoneyMutual also boasts a strong reputation among borrowers, with over 2 million customers and a positive customer service record. The MoneyMutual site offers information and resources to help borrowers understand what they’re looking for and how to make the most of their loan.

2. Avant

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $2,000 to $35,000 | 9.95% – 35.99% | 12 to 60 Months | See representative example |

Avant is a legitimate and well-established online lending platform that has been in operation for several years. Avant has provided personal loans to numerous borrowers, offering loan options tailored to people of all credit types.

The company is licensed to operate in various states and complies with relevant regulations governing the lending industry. Additionally, Avant has garnered positive reviews from many customers who have used their services, further establishing its credibility as a legitimate online lender.

3. Upstart

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn’t impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% – 35.99% | 3 or 5 Years | See representative example |

Upstart uses advanced algorithms to increase its approval rates by up to 44% compared with traditional lending models. It partners with more than 100 banks and credit unions to help you find a willing lender with ease.

As long as you have a credit score, a bank account, and can prove you earn at least $12,000 per year, you qualify to apply for an installment loan you can repay over several years.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group can help match you with a payday lender or find you a payday loan alternative with a longer repayment period. You may also qualify for a bad credit loan that can be repaid over several years.

You can receive fast cash as soon as the next business day upon approval. Online payday loans charge exorbitant interest rates, so be sure you understand the loan agreement before signing for anything.

5. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

As with many lending networks, CashUSA helps prospective borrowers narrow their search for cash advance loans by submitting one application to many lenders. CashUSA sets itself apart in how it streamlines the process even further. Borrowers start by providing their zip code, birth year, and last four digits of their Social Security number.

From there, CashUSA uses additional information to identify the right cash advance loan company for you. While CashUSA has some negative marks in customer reviews, our investigation found that the majority of customers are very happy with the service. The only real mark against the company that we’ve found is that it may sell information to third-party marketing companies. Fortunately, it’s easy to get around this problem by opting out.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com can help you find online payday loans in a jiff. Fill out the short form with your personal information to be matched with a suitable loan offer.

You can get a quick cash loan within 24 hours of approval. The funds will be deposited into your bank account which you can then use your debit card to spend. Be sure to read the loan agreement carefully so you fully understand the repayment term and other details.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

Cash advance loan options can be limited for borrowers with bad credit, but Bad Credit Loans maintains a network of specialized lenders that work with bad credit borrowers to make the process easier. The company has been around since 1998 and has maintained a fairly stable reputation for its reputable network and more than 20 years of customer service.

In addition to offering competitive loan products through its network of lenders, Bad Credit Loans also provides borrowers with education and informational resources. The company’s blog is full of advice and sound recommendations for helping applicants build credit, improve their chances of loan approval and their loan terms. The lending network also has some of the most basic requirements of any company on this list, making the cash advance loan approval process easier.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

Although not the biggest cash advance loan network on this list, Credit Loan has been around for over 20 years. The company maintains a solid reputation by getting to the core of what lenders need: simple, straightforward options. Credit Loan uses automated systems to match borrowers to the right lenders in its network, any time of the day or night.

One of the major selling points for Credit Loan is its dedicated network of lenders that work with bad credit borrowers. While people with bad credit can apply for any of the networks in this list, Credit Loan maintains multiple networks and uses a soft credit check to help connect applicants to the right lender.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

Many credit companies use algorithms and automated systems to process loan applications, but PersonalLoans.com uses an algorithm to match borrowers with members of its network. This takes some of the guesswork out of finding a cash advance loan that fits their needs and speeds the process up.

PersonalLoans.com has a more competitive lending network than some of the other options on this list, with slightly higher credit requirements. On the other hand, the company offers a larger variety of loans, including peer-to-peer loan options. Casting a bigger net means that you’re more likely to find a lender willing to work with you, despite bad credit concerns.

What Is a Cash Advance Loan?

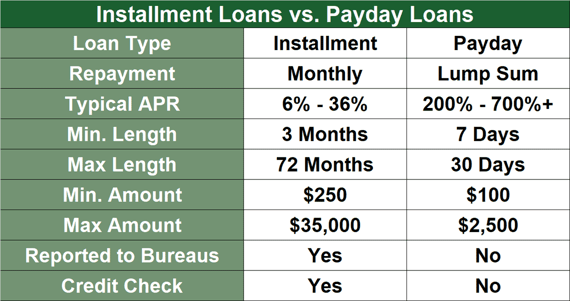

A cash advance loan, sometimes referred to as a payday loan or a cash loan, is an unsecured, short-term personal loan that is usually for a relatively small amount of money.

Unlike mortgages or auto loans that extend your credit up to tens or hundreds of thousands of dollars, cash advance loans are more of an emergency loan option. The loans in this category help you cover an unexpected expense as opposed to making a major purchase.

Cash advance loans are a quick solution for cash you can use to cover a car repair, a medical bill, or even utility bills and other expenses that can come up unexpectedly. Since they’re generally for a smaller sum of money, the interest rates tend to be on the higher side and you may be charged an origination fee.

Payday lenders set repayment terms that are shorter and stricter than those available with installment loan options.

How Do I Apply For a Cash Advance Loan Online?

Applying for an instant cash advance online is very easy, especially if you work with a lending network that submits your application to many banks and loan providers at the same time.

All you have to do is fill out a form that includes your address, income, and a few other details. You’ll also need to verify your identity and address and any other information the lender needs.

With that information, the online lender or other financial institution will be able to give you an approval decision, and you can generally receive your cash advance within one business day.

What Are the Requirements For Getting a Cash Advance Loan?

Specific requirements may vary from one lending company to another, but just about every cash advance company has the following minimum requirements:

- Age: You must be 18 years old or older to qualify for a cash advance loan.

- Citizenship: You must be a U.S. citizen or legal resident with a valid Social Security number.

- Income: While different lenders have different guidelines, every lender has a minimum income requirement, which you must prove either through pay stubs or other documentation if you receive government benefits or other recurring income.

- Bank Account: You must have an active and valid checking account with either a bank or a credit union.

- Identification: Your identification documents must confirm your citizenship status, your address, and that you are over 18.

- Credit Score: Your credit score doesn’t have to be perfect to get an emergency loan, but some lenders do require a minimum credit score for approval. Payday loan providers don’t usually run a credit check. It depends on the direct lender you work with.

Cash advance loan companies may have additional requirements, but the ones listed above are universal across legit cash advance companies. Note that there is no such thing as guaranteed payday loans — all lenders have at least some basic requirements for loan approval.

How Much Can I Borrow?

How much you can borrow depends on a few different factors. Your monthly income plays a major role in deciding how much you can borrow, for the obvious reason that lenders aren’t comfortable with the idea of borrowers owing a sum they can never pay back.

Your credit history doesn’t generally play a direct role in the decision, but if you have outstanding short-term loans that you’re still paying off, that can result in you qualifying to borrow a lesser amount. A checkered payment history can also lead lenders to offer a smaller loan amount rather than a larger amount.

Cash advance loans are meant to pay for relatively small emergency expenses, and cash advance lenders tend to limit the size of the loan they approve as a result. Payday lenders are also subject to state statutes.

Some personal loan lenders provide a maximum loan amount of $35,000, which would be an installment loan that you repay over several years. Minimum loan amounts can be as low as $100. On average, loans of $500 to $1,000 are the norm.

What Is the Best Cash Advance Loan Website?

Of the cash advance loans on this list, we think that MoneyMutual offers the best products and services to meet the diverse needs of every borrower. Our experts have reviewed the processes, policies, and other factors of each company on this list, and MoneyMutual comes out on top for a few reasons.

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

The application is very easy to fill out and only takes about five minutes to complete. You will get an instant approval decision within minutes of submitting your application.

While it doesn’t offer the highest maximum loan amount, MoneyMutual’s network of lenders offers a variety of loan products to fit most needs, and the requirements are not as stringent as those of some of the other lending networks on the list.

Compare Legit Cash Advance Loans Online

When you’re in the middle of an emergency, you don’t always have the time to scrape together your own money, ask friends, or put together a fundraiser to cover the expense. This is where legit cash advance loans online can make a big difference.

A payday advance can help bridge the gap between paychecks and give you a temporary financial boost to cover an unexpected expenditure, whatever the nature of your emergency. Compare each online loan offer carefully and choose the best cash advance loan to meet your needs, and make sure to review the terms before you sign your contract. You can have your emergency funds within 24 hours and take back control of your situation.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.