Finding an online lender is among the easiest ways to secure a quick loan. There’s no shortage of lenders online waiting to accept your application, even if you have bad credit. And while these loans may be easy and fast, they’re not always the cheapest option, and not all lenders can fund your request within an hour.

Most lenders state that you’ll receive your money within one business day, but some can expedite your deposit for an additional fee. Applying early on a business day also helps your chances of receiving the loan on the same day, as not all banks will clear your funds on a weekend. Note that this is a restriction of your bank, though, and not the lender.

Get Approved in Minutes With These Loan Networks

The following companies partner with lenders that will initiate a deposit into your bank account soon after you’re approved for a loan. It’ll take some due diligence on your part to ensure you choose a lender that offers quick deposits.

Read the loan offer carefully to see whether expedited deposits are an option – comparing loans won’t hurt your credit, and there’s no obligation to accept a loan offer if it doesn’t fit your needs.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual is a trusted provider of short-term loans. It is not a direct lender, but it has a vast network of lenders that will receive your single application and make you an offer if you meet their requirements. Its website states that “Cash transfer times may vary between lenders and may depend on your financial institution.”

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

The 24/7 Lending Group partners with direct lenders that can offer you a quick short-term loan or a large installment loan you repay over several months or years. It’s been in business for more than 15 years and has an excellent Trustpilot rating based on more than 2,000 reviews. Its site says, “The entire process from form submission with us, obtaining and accepting rate quotes to having your loan fund[ed] is often 24 hours or less.”

3. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com is another lender network that allows you to borrow up to $10,000, depending on your credit and income. You must be employed for at least 90 days and have a checking account in your name to qualify for a loan offer from this network. Be sure to review the lender’s terms to see if it offers an expedited deposit service; otherwise, you may not receive the money until the following business day.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

The InstallmentLoans.com website states that “If you get started today, you will receive a quick response. If you are connected with a lender, your funds could be in your account as soon as tomorrow. Money transfer times may vary between lending partners and may depend on your individual financial institution.” There’s no obligation to accept a loan offer if the deposit time frame doesn’t fit your needs.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

As with other lender networks, CreditLoan.com states that “Your funds will be deposited into your account in as little as 24 hours. Please note that money transfer times vary by lender and may depend on your individual financial institution.” This seems to be standard legalese, but know that some lenders can expedite loan funding; you’ll just have to explore the terms and see if that’s an option.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

As its name implies, BadCreditLoans.com helps borrowers with subprime credit get approved for loans. The money can be submitted to your bank account upon loan approval, but how long it takes for the check to clear is up to your bank. Applying early on a business day may help, as can depositing the funds to an account that processes direct deposits faster than traditional bank accounts, a feature of many online bank accounts.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com prefers borrowers with at least a fair credit score, though you can still apply for a small personal loan if you have poor credit. PersonalLoans.com states that “If we can’t find a lender in our direct lender network that may be willing to offer you a loan, we then send your request out to our extended network of third-party non-lender lender networks to try to find a lender in their network that may offer you a loan.”

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com offers personal loans as small as $100. The money can be deposited the same day you apply, though your bank may not clear it until the next business day. SmartAdvances is a member of the Online Lenders Alliance, as are the rest of the loan networks we recommend, and is committed to a responsible lending policy that complies with federal law.

What Is a Cash Loan?

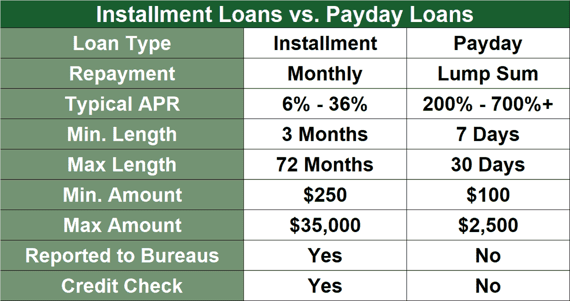

A cash loan is another name for a payday loan or cash advance, they’re all one and the same. They’re small personal loans that may require repayment in one lump sum by your next payday, though some cash loans can be repaid in installments over a couple of weeks or months. These details vary by lender and state regulations.

A personal loan is a general term for larger loans that can be repaid over months or years. But a personal loan is defined by how the money is spent — the funds can be used for any purpose, meaning cash loans are also technically personal loans because there are no spending restrictions.

For example, car and student loans have specific purposes, whereas personal loans can be used for anything, whether it’s a medical emergency or your next vacation.

Cash loans are a bit easier to get approved for than some personal loans because:

- The loan amount is smaller

- The repayment period is shorter

- The credit and income requirements are less strict

You can get a cash loan online or at a payday lender storefront. Cash loans you apply for online can be deposited into a bank account the same day you apply, though the funds may take a few days to clear. Whereas you can walk out the door with cash in hand when you apply for a loan from a local payday lender.

What Are the Requirements to Receive a Cash Loan?

There are a few basic requirements that every online lender expects borrowers to meet. These include being at least 18 and having a bank account in your name, proof of income and pay schedule, and a valid phone number.

You must:

- Be a US resident or legal citizen

- Be 18 or older

- Be employed for at least 90 days

- Meet the income requirements and provide pay stubs

- Have a bank account in which the lender can deposit and withdraw payments

One nice thing about fast cash loans is that they generally don’t require a credit check for approval. They are instead based on the above criteria and your ability to repay the debt. But while fast cash loans don’t initially affect your credit, they can still be reported to the credit bureaus if you fail to make payments as agreed.

How Can I Instantly Borrow Money?

There are a few ways to instantly borrow money if you have collateral, items to sell, a credit union membership, or friends and family you can depend on. Otherwise, you may have to apply to a lender and wait one business day or longer to receive a loan, depending on the lender and your financial institution.

- Pawnshop Loans: These are a type of secured loan you can get at any local pawnshop. If you have an item worth some money, usually jewelry, electronics, and firearms, you can pawn it in exchange for a loan. Your item becomes collateral for the loan. The pawnbroker will lend you cash the same day you drop the item off, but the amount you receive will only be a portion of what your collateral is worth. If you don’t repay the loan, your item will be sold in the pawnshop so the pawnbroker can recoup the money they loaned you, plus some extra. This is why you only receive a portion of what your item is worth, so the pawnshop can make a profit if you default on the loan.

- Sell Items Online: You can also try to sell items online if you no longer have use for them or just really need to earn a quick buck. Sites like Facebook Marketplace and Craigslist make it easy to post items for sale, and hopefully, you’ll receive some interest the same day you list the item for sale.

- Cash Advance Apps: These handy apps are one of the best ways to borrow money. They can instantly advance you a small portion of your next paycheck. Kind of like a payday loan, but these apps usually advance less money and charge much less interest, sometimes none at all. The drawback is that if you’re a new app user, there’s usually a verification period in which your bank account and employment information are confirmed. Your first time borrowing may require a period of at least one day before you can accept an advance.

- Credit Union PALs: Speaking of the best ways to borrow money, credit unions notoriously offer lower interest rates and fees than traditional banks and online lenders. Credit unions offer a product called Payday Alternative Loans (PALs) that let you borrow up to $2,000 over a 12-month period, and the interest rate is capped at 28%. These loans were created by the National Credit Union Administration as an alternative to predatory lenders that charge triple-digit interest rates. The drawback is that you must be a member of a credit union that offers these loans to qualify. But you may be able to apply for membership and a loan on the same day. You can use this credit union locator tool to find one near you, after which you’ll have to explore the credit union’s website or call to see if 1) you qualify for membership and 2) it offers PALs.

- Friends and Family: Some people have friends or family members they can depend on when money’s tight. If you’re one of these fortunate few, borrowing a couple hundred dollars from someone you know is a lot easier without a credit check or high interest fees. It’s worth the ask, but know that if you don’t repay as agreed, you risk your relationship with the lender.

- Title Loans: This is the riskiest loan on this list and we do not recommend them. But if you’re really in a bind and are certain you can repay the debt on the lender’s terms, it may be an option. You must have a car title in your name to qualify for this type of loan. The car serves as collateral for the loan, and if you fail to make payments, the lender can seize your vehicle. The Consumer Financial Protection Bureau found that 20% of title loan borrowers default on their loans. Unless you can afford to lose your vehicle, we advise you to avoid title loans.

As you can see, even if payday lenders deny your loan request, several other viable options exist to help you get the fast cash loan you need.

What Are the Risks of Short-Term Loans?

There are certain risks associated with short-term loans, not the least of which is the cost. Short-term loans are expensive because the repayment period is short; The lender can’t make as much profit with low-interest loans that are quickly repaid and can legally charge triple-digital interest rates in some states.

- Expensive: Payday loans don’t charge interest the way other personal loans do. They charge finance fees in the range of $15 to $30 for every $100 borrowed. So if you borrowed $500 with a two-week loan term at a finance fee of $20 ($20 x 5), you’d repay the lender $100 more than what you borrowed. This would equate to an APR of just over 521%.

- Quick Repayment Periods: The example above shows you what you’d pay for a two-week payday loan. Can you afford to pay $600 in two weeks and still be able to cover other necessary expenses, such as groceries and utilities? The brief repayment periods of most short-term loans can put a strain on any budget.

- Overdrawn Accounts: Speaking of strain, if you don’t have the $600 in your account come repayment day, your account may be overdrawn, incurring overdraft fees from your bank. And if the payment doesn’t clear, you’ll face fees from the lender and be forced to roll over your debt.

- Debt Spirals: Once you accept one payday loan rollover, it’s difficult to get caught up because the payoff amount keeps getting more expensive. Some states limit the number of times you can roll over a payday loan to prevent the debt from snowballing out of control. These are called debt spirals and are a very precarious situation to be in.

These risks are why you should never accept a quick cash loan you can’t afford to repay as agreed. The debt can spiral out of control faster than you can save up to repay it, which can also inflict credit score damage.

Quick Cash Loans Are Available Online

Online payday loans, cash loans, cash advances, or whatever the lender wants to call them, are easy to be approved for if you meet the basic requirements. But while cash loans wired in 1 hour are certainly a convenience, they can be expensive.

Personal installment loans may be a better option if you care to save on fees, but we understand that sometimes an emergency loan is in order. Do your due diligence and carefully compare each loan offer you receive to ensure it’ll be delivered when you need it and at a price you can afford.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.