Achieving a good credit score occurs through a combination of responsible borrowing, managing your debt levels, and making on-time payments. Likewise, bad credit is also a result of your actions around borrowing and debt management. If you find yourself on the negative side of the credit equation, it’s likely you know the reasons why.

But however you got here, take heart — bad credit is not a life sentence. No matter the condition of your credit score, there are ways to improve it. In this guide, we’ll walk you through the most effective ways we’ve found to repair bad credit, how long it can take, and the best ways to begin the rebuilding process.

Everybody’s situation is unique, so the best way to repair credit for you may not be the best way to repair credit for the next person. In the article below, we’ll present several approaches that can be used or combined in various ways.

Following these practical steps over a period of time can earn you an enviable credit score, and everything that comes along with it. While it won’t happen overnight, with the right approach and level of commitment, it can happen. Let’s take a closer look at some of the most effective ways we’ve found to repair and rebuild credit.

The “Best” Way Depends on Your Financial Situation

It’s worth noting that credit repair should be viewed differently from simply raising your credit score. Credit that needs to be repaired denotes some fairly serious negative entries of one type or another. It also needs to be said that a credit score in the 500 range will take longer to repair than a score in the 600s.

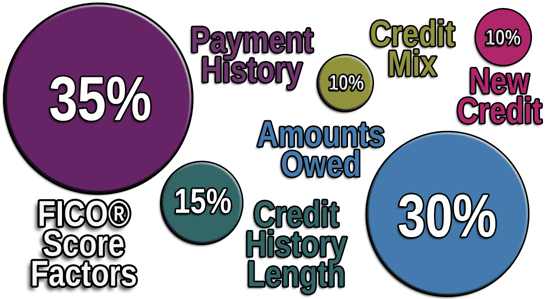

Factors like payment history, the length of time you’ve had credit, your total debt, even the type of debt you have, all impact your score. If you’ve had recent account charge-offs, collections, a foreclosure, or other serious negative marks, the impact on your score is likely to be deeper and require more work to overcome.

Your personal credit history is as individual as you are — no two are exactly the same. But for every low credit score, there are ways to fix it, or at least make it better. Some of these ways include:

- Reviewing your credit report for errors and disputing any incorrect entries.

- Committing to making timely payments.

- Paying down debt if you have a high credit utilization ratio.

- Consolidating debt or getting a low-interest loan to pay off higher rate cards.

- Negotiating directly with creditors to lower the amount you owe.

- Settling collection accounts in return for deletion from your report.

- Turning to a credit repair expert to help you resolve errors or negative items on your report.

Depending on your financial situation, some of these suggestions may apply to you and some may not. If your need for credit repair has to do with erroneous entries, late payments, or over-utilization of your credit, for example, you may be able to handle much of the work yourself.

If, however, your credit situation is more dire, a credit repair agency may be the best way to go. Reputable credit repair services can help you navigate the complex process of talking with creditors to get negative items removed from your report and disputing entries that shouldn’t be there. And while it’s true that credit repair companies don’t do anything you can’t do yourself given enough time, they do provide expertise and persistence in these negotiations.

The most obvious and effective first step in credit repair is to dispute any errors on your credit report. While you can go through this process on your own with each of the three major credit bureaus individually, it can be far more practical to let a trusted credit repair company do it for you. For a reasonable fee, these credit repair experts can effectively remove erroneous items, and can sometimes negotiate the removal or downgrading of negative entries.

How to Repair Credit On Your Own with Each Bureau

The Fair Credit Reporting Act (FCRA) passed by Congress in 1970 was meant, among other things, to promote the accuracy and privacy of information found in credit reports. A subsequent amendment to the FCRA — the Fair and Accurate Credit Transactions Act (FACTA) passed in 2003 — entitles consumers to a free copy of their report once a year from each credit reporting agency.

Disputing errors on your credit report is your right under these consumer protection laws, and is the basis for the agencies providing access to your report for free once every week, as well as addressing any errors you find. You can access your free credit reports at annualcreditreport.com.

If you decide to go the DIY route with your credit repair, you’ll be dealing directly with the credit agencies to identify items that don’t belong on your credit report. All three agencies have online dispute centers where you can submit a dispute or follow up on one you’ve already submitted. Here’s how to get started with each of them.

Equifax

Equifax offers consumers a wide range of products and services, some of which carry a fee. Disputing something on your Equifax credit report, however, is free.

To begin, obtain a recent copy — no more than 30 days old — of your report. Search every section carefully and identify any items you don’t recognize, late payments you believe to be erroneous, or any personal information that is incorrect. Highlight each disputed entry and the exact description.

Finally, complete the dispute form by clicking the ‘Submit a Dispute’ button. Equifax, as well as the provider of the data, are required by law to investigate disputes and correct inaccurate or incomplete information within 30 days of receiving notice. You can also contact Equifax by mail or phone using the following contact information:

Mail disputes: Equifax, P.O. Box 740256, Atlanta, GA 30374

Phone disputes: 1-866-349-5191 (reference the number on your credit report)

Experian

Experian also offers products and services for consumers, as well as a detailed guide on how to dispute credit report information. After getting a current copy of your credit report, the place to start is the Experian online Dispute Center.

For each item you wish to dispute, select a reason for the dispute from the drop-down box. You can also enter comments for the dispute in an explanation box.

Once the dispute is submitted and confirmed by Experian, the company will send email updates and status reports. Expect a response within 30 days. You can also check the status of your dispute online through the Dispute Center. If you prefer to use mail or phone, here is the contact information:

Mail disputes: Experian, P.O. Box 4500, Allen, TX 75013

Phone disputes: A phone number is provided on every Experian credit report. To request a copy of your credit report in the mail, call: 866-200-6020

TransUnion

As with the other two major credit bureaus, TransUnion provides fast and easy online access for filing a credit report dispute. A button labeled ‘Start Dispute’ is prominently displayed on the Disputes page, which also provides a detailed FAQ section for consumers.

As with the other two credit bureaus, TransUnion charges a membership fee, but there is no cost to file a dispute.

When you submit a dispute with TransUnion, it will investigate the claim and respond within 30 days, either electronically or through the mail if you filed by phone or mail. You can also check the dispute status online. If you disagree with the results of a dispute investigation, TransUnion also provides detailed information on the steps to take for further action. Here’s how to contact the agency by mail or phone.

Mail disputes: TransUnion, P.O. Box 2000, Chester, PA 19016

Phone disputes: 800-916-8800 (8:00 AM – 11:00 PM ET)

How Long Does it Take to Rebuild Your Credit History?

Realistically speaking, rebuilding your credit should be viewed as a process rather than an activity in and of itself. The factors that have contributed to your distressed credit didn’t happen overnight, and you shouldn’t expect the rebuilding process to either. How long it takes to rebuild your credit depends on just what got you here in the first place.

If your low credit score is the result of incorrect items listed on your credit report, the remedy may be fairly quick. However, if you have been the victim of credit card fraud, identity theft, or if you’ve had a lot of adverse actions like defaults or collections, the rebuilding process can take much longer.

Sometimes, a negative credit history is the result of neglect or inattention — such as not making your credit card payments on time. Or maybe you’ve over-extended yourself by simply charging too much on one or more of your cards. If that or something similar is the cause of your negative credit, only time and changing your habits will fix it.

The best and most effective way to rebuild your credit history is to begin doing things the right way. Make all of your payments on time, since payment history is 35% of your score. Don’t use all of the available credit you have because credit utilization accounts for another 30%. By focusing on these two things alone, you can fix a lot of the problems with your credit history… in due course.

How Can I Raise My Credit Score Fast?

Sure, it’s tempting to want to speed up the process of raising your credit score, but there are some things to be aware of. The credit report dispute process is a right that’s been granted to us under consumer protection laws. However, disputes are thoroughly investigated by the reporting agency, as well as by the creditor that submitted the information.

Disputing items on your credit report can potentially get them removed, but if they’re valid entries they will return. Don’t take this tempting shortcut to raise your credit score — it will eventually catch up with you. That said, disputing verified erroneous entries on your report can be the fastest way to raise your credit score.

Since the credit agencies must investigate disputed entries within 30 days, it’s possible to see results in a relatively short amount of time. Within a couple of months, you could begin to see improvements in your credit score if the disputed items are removed. Your credit score may then begin to increase if those erroneous items were holding it back.

There are, of course, other ways to quickly raise your score that don’t involve disputing entries on your credit report. Here are some suggestions.

- Do whatever you need to ensure you pay all loans and credit accounts on time.

- Automate recurring monthly bills so you don’t inadvertently miss a payment.

- If possible, pay down credit cards to less than 30% debt to available credit.

- Become an authorized user on a card or cards of someone with good credit.

- Consider using a credit card in place of a debit card — but pay the full balance when due.

Because on-time payments account for 35% of your FICO credit score, paying your bills on time every month is the easiest and quickest way to improve your credit score.

Does Paying Off Collections Improve Your Credit Score?

Old debts that have gone to collections can have a major negative impact on your credit score. Credit card charge-offs, unpaid utility bills, medical debts that are far overdue — all of these can send your score into the basement. But, should you pay them off? Actually, that question isn’t as easy to answer as it may seem.

If you’ve had a debt go to collections, the original creditor has charged it off. A collection agency has acquired the debt for a percentage of its value, and you now owe them. It shows on your credit report as a collection account. This is a serious negative entry that can cost you as much as 100 points or more from your credit score.

Simply paying off a collection account, even in full, doesn’t guarantee the removal of the entry from your credit report. An entry on your report of a debt that’s gone to collections can remain even after the debt is paid in full. You’ll need to take an extra step to ensure that paying it off has the positive effect on your score that you’re looking for.

Request a pay for delete letter from the collection agency prior to paying a collection account in part or full. If the collection agency is willing to provide that letter, you then have recourse with the credit bureau to remove the entry when it’s paid.

Collection agencies will sometimes say they can’t delete a collection entry from a credit report. However, if the original debt was disputed and subsequently resolved, i.e. paid off, then they can request the credit bureau remove the entry.

The Consumer Financial Protection Bureau (CFPB) has sample letters you can use to request information about a debt, notify a collection agency that a debt is not yours, or to request they prove they are the legal holder of your debt.

Is Debt Forgiven After Seven Years?

Anyone with negative credit entries like collection accounts, unpaid loans, bankruptcy, repossessions, or other adverse events, has surely heard of the seven-year rule. Conventional wisdom says debt is eliminated and falls off your credit report after this magical period of time. But is that true?

According to the CFPB, if you owe a legitimate debt, it does not expire or disappear until after you pay it. However, debts in most states have a statute of limitations on collection of anywhere from three to seven years, or more in a few cases, after which you may have a legal defense if you are sued to pay. The confusion arises when we’re talking about entries on your credit report.

Unpaid debts, late payments, and other negative items listed on your credit report are supposed to age off after seven years in most cases. Under FCRA rules, a delinquency can no longer be legally included in the credit history of an account seven years from when it first occurred.

But what if you decide to make a payment toward a past debt? In many cases, this can restart the seven-year clock. So unless you plan to pay a debt in full, and until you get assurance the negative entry will be removed from your credit report, it may be best to let sleeping debts lie.

You Can Save Money and Time if You DIY with an Expert

As with so many things, credit repair is a matter of understanding the details and how they apply to your personal financial situation. Education and awareness of the options available are key.

In a sense, credit repair is not unlike fixing mechanical problems with your car. You can choose to do the work yourself rather than go to a mechanic if the problem isn’t too severe, and this can be an effective solution. But if you’re dealing with more complex financial issues, you may want to consider the help of a professional credit repair company.

Another option is to take a hybrid approach by engaging the help of an expert while doing your best to resolve the credit issues you can on your own. In either case, the more committed you are to repairing your credit, the better your chances of success.