It can be quite a challenge to find home loans for bad credit. Fortunately, you have several loan options despite your low credit score.

We’ve assembled the answers to nine frequently asked questions that can help you understand your borrowing alternatives. The bad credit home loan providers we identify regularly approve applicants with low credit scores.

Mortgages and home equity loans are available to consumers with bad credit. First mortgages pay for the purchase of a home, whereas home equity loans (or second mortgages) let you cash out some of the equity you’ve built since you bought your home.

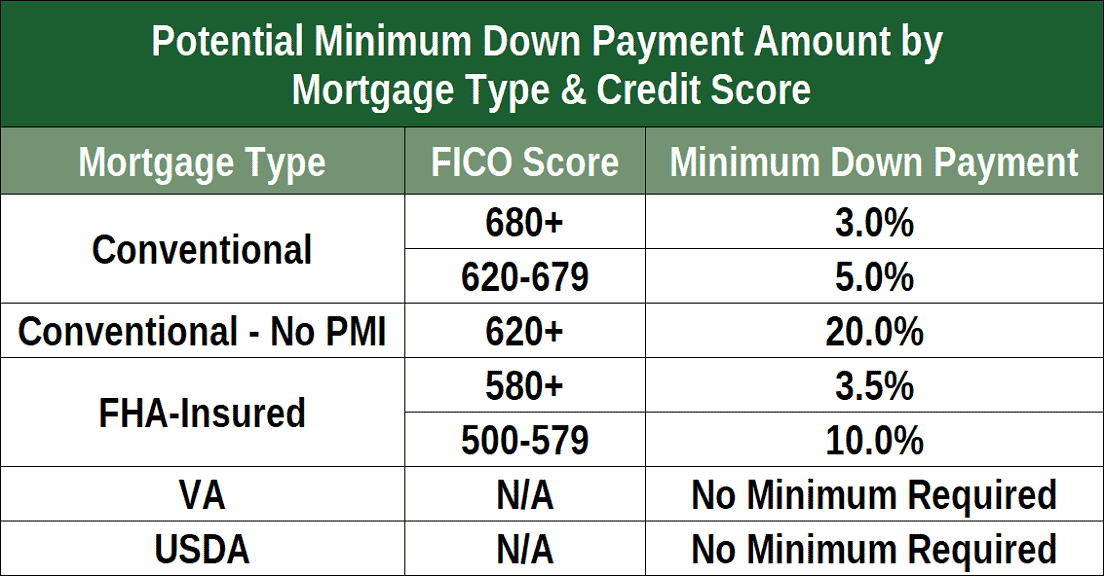

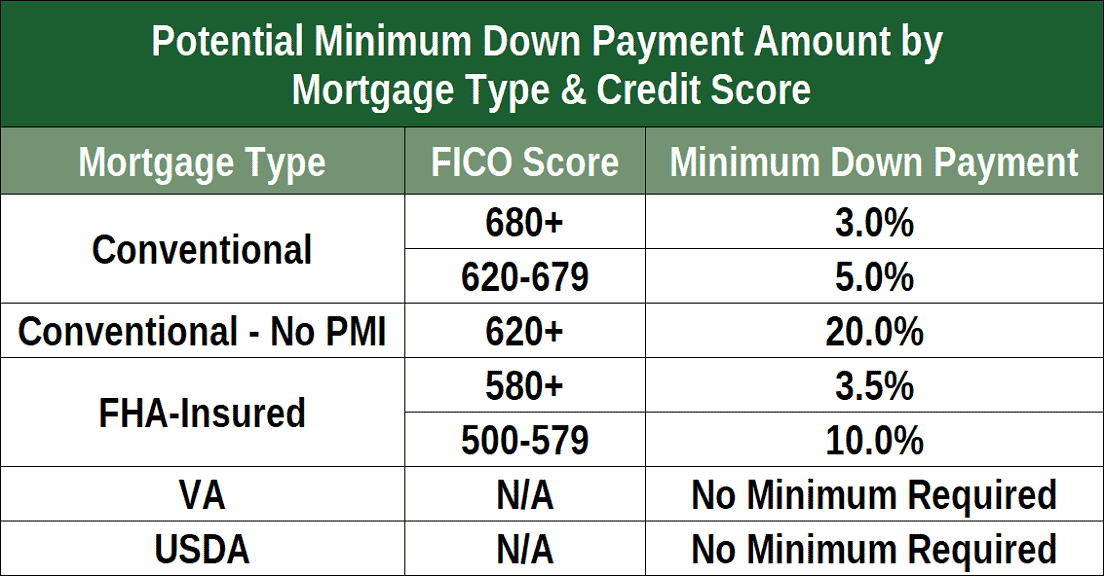

Bad credit mortgages may have features that make home purchases easier. For example, federally guaranteed mortgages often have low minimum down payments.

Consumers with poor credit (i.e., FICO scores below 600 within a 300 to 850 range) can access mortgage loans but may have to pay higher interest rates. Many mortgage lenders tolerate less than perfect credit, but only up to a point.

Federally sourced or guaranteed mortgages generally accept lower scores than do private ones.

Private lenders also offer mortgages for folks with bad credit. Some have features unavailable from federal loans, including 100% financing (i.e., no down payment), seller contributions, no income limits, and no mortgage insurance requirement.

When shopping for a bad credit mortgage, keep a few things in mind:

- Minimum credit scores vary among lenders.

- You must generally be two or more years past bankruptcy and three years from a home foreclosure.

- You won’t be eligible if you owe back taxes to the IRS or are behind on your student loan payments.

Less than perfect credit, especially with outstanding debt, can limit the loan amount even the best mortgage lender will offer you. If your home shopping can wait, you can use the time to raise your low credit score by paying your bills on time and reducing your debt. Doing so will broaden your mortgage options and may lower the mortgage rate you’ll have to pay.

Almost all mortgages, including federally guaranteed ones, originate from banks, credit unions, or thrift institutions. In addition, federal agencies act as the direct lender for a few types of mortgages.

Online mortgage sites, such as Rocket Mortgage, New American Funding, and Quicken Loans, may directly originate loans, but others (e.g., eMortgage) match loan requests to a network of lenders.

To get some sense of the enormity of the national mortgage industry, consider these statistics for 2021:

- Total originations: $4.4 trillion, a record

- Purchase loans: $1.7 trillion, also a record

- Total refinancings: $2.7 trillion, of which $1.2 trillion were cash-out refis, the most since 2005

- Equity cashed out: $275 billion

The average mortgage rate in 2021 was 2.96%.

Definitions

The mortgage industry has its own lingo:

- Conventional Loans: Home loans that the federal government does not guarantee.

- Conforming Loans: These loans adhere to FHFA (Federal Housing Finance Agency) standards governing maximum debt, minimum credit, and maximum loan amount. In 2022, the baseline conforming loan limit is $647,200 but reaches $970,800 in high-cost areas.

- Non-Conforming Loans: Loans that don’t conform to FHFA standards. For example, the home may cost more than the maximum conforming loan amount, or the borrower may have subprime credit.

- Jumbo Loans: These non-conforming loans are for amounts above the FHFA limit.

- Government Insured Loans: Includes VA, USDA, and FHA loan programs, as described below.

- Fixed-Rate Mortgages: Loans that do not enact a lower or higher interest rate throughout the loan term. Your monthly mortgage payment doesn’t change unless you refinance.

- Adjustable-Rate Mortgages (ARM): The interest rates on these loans can change over time according to market conditions. ARMs often have a fixed interest rate for the first few years before switching to a variable, higher interest rate. The variable rate may have yearly and overall caps.

- Loan Term: The amount of time borrowers have to repay the loan. Typically, loan terms vary between eight and 30 years, but other periods are possible. Mortgages may impose penalties for early pay-off.

- Debt-to-Income Ratio (DTI): DTI equals your monthly debt payments divided by your monthly income. Your DTI should be below 46% to qualify for a mortgage.

- Loan to Value Ratio (LTV): LTV equals the mortgage size compared with the home’s value. The larger the down payment, the lower the LTV.

- Private Mortgage Insurance (PMI): Lenders usually require you to buy PMI when your down payment is less than 20%. Once you achieve 20% equity, you can cancel your PMI.

- Mortgage Insurance Premium: The FHA loan program equivalent to PMI.

- Seller Concession: The seller pays some or all of the buyer’s closing costs, including title charges, state and local government fees, lender costs, and home/pest inspections.

When shopping for a mortgage, consider the credit requirements, interest rate, fees, loan size, loan term, rate adjustability, and required down payment.

It’s an excellent idea to prequalify for a mortgage before starting your home search so you can make an immediate offer when you find the right property. Sellers usually prefer bids backed by preapproved funding.

Conventional Mortgages

A bank, credit union, or similar mortgage lender often sells its conventional loans to government-sponsored enterprises (GSEs), such as Fannie Mae and Freddie Mac, that impose specific baseline requirements.

Conventional mortgage providers require borrowers to meet higher credit standards because the federal government doesn’t insure these loans against default. By selling their mortgages to GSEs, lenders remove uninsured loans from their portfolios and receive an immediate cash payment.

The minimum GSE-imposed requirements for conventional conforming loans are:

- A credit score of at least 620

- A debt-to-income ratio of no more than 45%

- A minimum down payment of 3%, or 20% with no PMI

- A real estate appraisal verifying the home’s value and condition

If you require a mortgage that exceeds the conforming limit, you’ll need to increase your down payment or apply for a jumbo loan.

GSEs offer multiple conventional loan programs with differing requirements. For example, a Fannie Mae 97% LTV Standard Mortgage requires one borrower to be a first-time homebuyer.

Freddie Mac Home Possible Loans do not have the first-time homebuyer requirement but limit eligibility to borrowers with very low, low, or moderate income.

If the home you want to buy receives an appraisal for less than the contract price, your options include:

- Renegotiating the price

- Increasing your down payment

- Appealing the appraisal

- Applying for a larger mortgage

- Withdrawing your bid

If you fail to keep up with your payments, the mortgage lender may initiate foreclosure proceedings. Unless you immediately get current on your payments, the lender will foreclose on your home, and you’ll lose all your equity.

FHA-Insured Home Loans

The Federal Housing Administration backs loans from conventional mortgage lenders. The FHA encourages loan officers to approve subprime borrowers by insuring loans.

The requirements for FHA mortgage insurance include:

- A down payment of 10% for credit scores between 500 and 579

- A down payment of 3.5% for credit scores of 580 or higher

- An MPI when your down payment is less than 20%

- A DTI below 44%

- A minimum credit score of 500

- A two-year history of steady income and employment

- An FHA-approved appraiser’s inspection report on whether the real estate meets the minimum standards for safety, security, and soundness

- The home must be your primary residence

- You must occupy the home within 60 days of closing

Each year, the FHA sets mortgage size limits for low- and high-cost areas. In 2022, those limits are $420,680 and $970,800, respectively, for one-unit properties. If you live in Alaska, Hawaii, Guam, or the Virgin Islands, the limit is $1,456,200.

VA Home Loans for Veterans

The Department of Veterans Affairs (VA) guarantees mortgages for the US military’s active and retired members (and eligible surviving spouses). VA loan programs have lenient requirements that include:

- No minimum credit score, although lenders generally require a FICO score above 620

- No need for a down payment or PMI

- A DTI below 42%

VA loan programs feature low interest rates and closing costs. The agency also offers refinancing loans (cash-out or interest rate reduction), and direct loans to Native Americans are available.

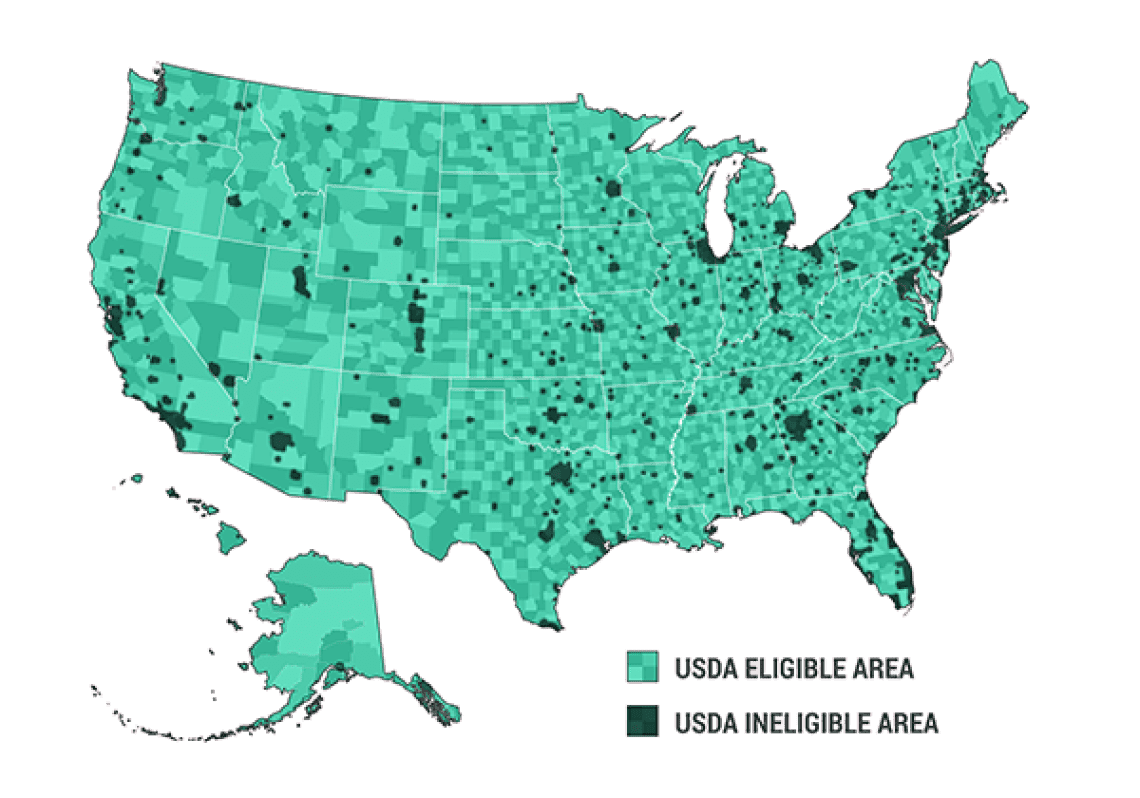

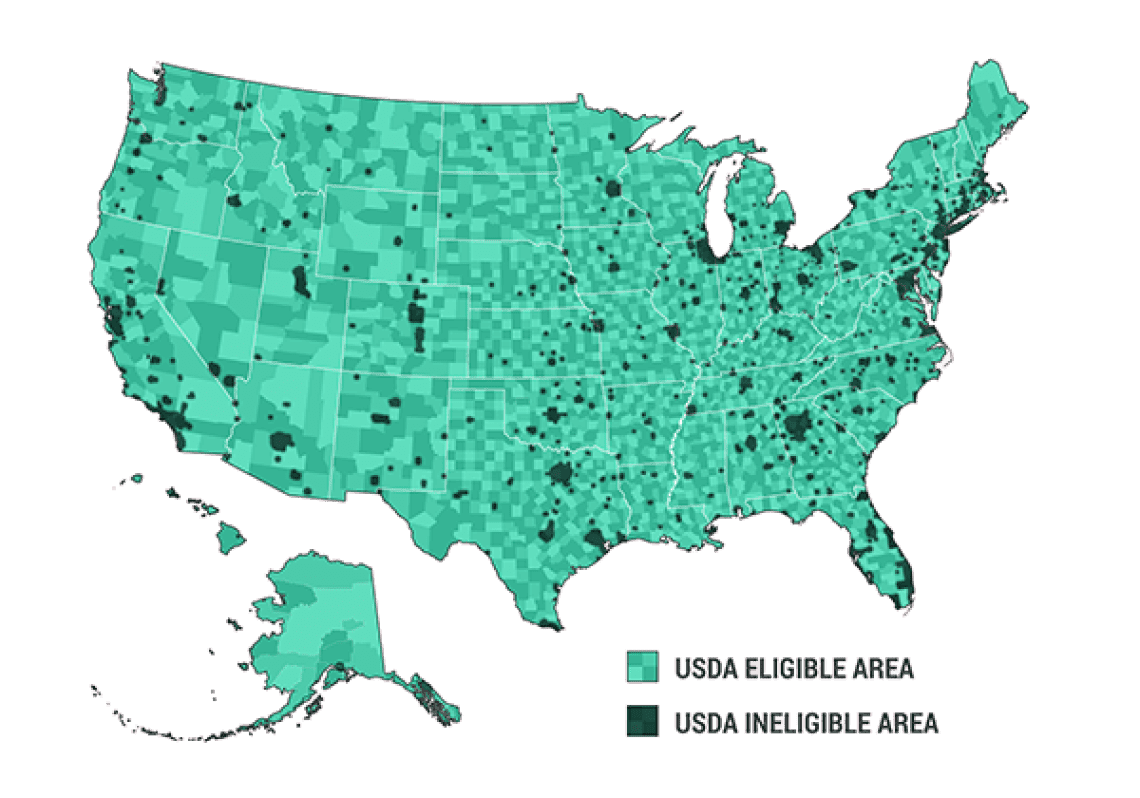

USDA Rural Home Loans

The United States Department of Agriculture offers direct and guaranteed rural home loans to homebuyers with low or average incomes. USDA loan requirements include:

- The property must be your primary home and be located in an eligible rural area (typically, an area with a population below 20,000)

- No need for a down payment

- Your income cannot exceed the local median by more than 15%

- PMI when equity is below 20%

- No minimum credit score nor requirement for a credit history

- The maximum DTI is generally 41%, but higher ratios may be acceptable if you have a good credit score and stable employment

- No fixed loan size limits. Instead, your loan limit depends on your income and DTI ratio.

- All mortgages are 30-year, fixed-rate loans

USDA loan programs charge low interest rates, sometimes even lower than FHA mortgage rates. These loans permit seller concessions, and buyers can receive gifts to help pay closing cost expenses.

Mortgages are amortizing loans, meaning:

- A portion of your monthly mortgage payment reduces your loan principal, and the remainder is an interest charge.

- For fixed-rate mortgages, the monthly payments remain the same throughout the loan term. The monthly amount may change if you have an adjustable-rate mortgage.

- The payment principal and interest proportions vary over time. In the first few years, payments overwhelmingly consist of interest charges, but, eventually, principal payments predominate.

- Your mortgage documents will include an amortization schedule specifying each payment’s principal and interest amounts.

The mortgage principal equals the home’s purchase price (plus any fees rolled into the loan) minus your down payment. For example, suppose you purchase a home for $380,000 and put down 20% ($76,000). If you take out a 30-year, fixed-rate loan for $304,000 with a 5% interest rate:

- Your monthly payment will be $1,631.94, plus any escrow amounts (for property taxes, homeowners association fees, homeowners insurance, etc.).

- Your total mortgage interest will be $283,497.58 if you pay off the mortgage in 30 years (i.e., 360 payments).

- Your total mortgage payments will be $587,497.58, almost double the original loan principal.

You must repay the entire loan principal to retire your mortgage. If you repay the mortgage ahead of time, you’ll save on interest charges, but the lender may impose a prepayment penalty fee to discourage you.

Lenders want to collect the total interest due unless prevailing rates have risen above your contract rate. In that case, lenders make more money by issuing new mortgages instead of collecting interest on existing ones, and they may waive the penalty.

Mortgage providers consider several factors when deciding how much to lend you, including your income, current debts, credit report, and the required monthly payments.

Income

It’s advantageous to list all income sources when applying for a mortgage. Include available income from other household members and non-work sources, such as savings, investments, annuities, and retirement accounts.

Lenders value reliable income (i.e., stable and increasing over the previous two years). You will probably have to document your income by providing tax returns, pay stubs, W-2 forms, and brokerage, bank, or credit union statements.

Current Debts

Income has relevance only in the context of your financial obligations — the amount you spend each month to pay debts, housing costs, and other required amounts. Mortgage lenders rely heavily on DTI ratios to gauge your ability to make the required monthly home loan payments. Paying down existing debts before applying for a mortgage is a wise move.

Credit History

Your low credit score does not instill lenders with the confidence that you’ll repay a loan on time. Nonetheless, many lenders specialize in home loans for subprime consumers.

These lenders reduce their exposure to default risk by limiting loan amounts and charging higher interest rates and fees.

To some extent, a credit report free of recent negative items can help overcome earlier financial mistakes. Better yet, you’ll access better home loans if you can first raise your bad credit score by paying your bills on time, reducing your debt, and fixing derogatory errors in your credit file.

Property’s Monthly Principal, Interest, Taxes, and Insurance

A mortgage loan must be large enough to pay for your property purchase (minus your down payment) plus any rolled-in charges such as closing cost fees. You can reduce your out-of-pocket expenses when you roll fees into your mortgage principal. But keep in mind that you’ll pay interest on those fees for the life of the mortgage.

When considering your application, even the best mortgage lender looks at your total monthly payments to the loan processor, including escrowed and other expenses. Your monthly bill will include these expenses, which may add hundreds of dollars to each payment.

The loan officer must evaluate whether you can afford the total monthly bill, not just the loan principal and interest.

A down payment reduces the size of the loan you need. The larger the down payment, the less principal and interest you’ll have to pay back.

Many lenders require mortgage insurance when your down payment is less than 20%. This insurance repays the lender if you default on your loan. You can cancel the insurance when your equity in the property reaches 20%.

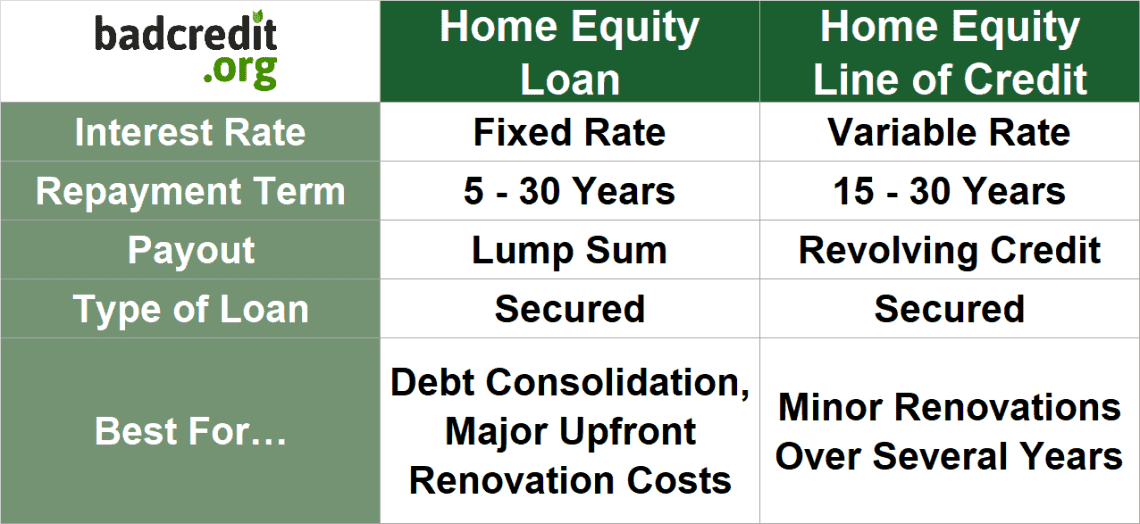

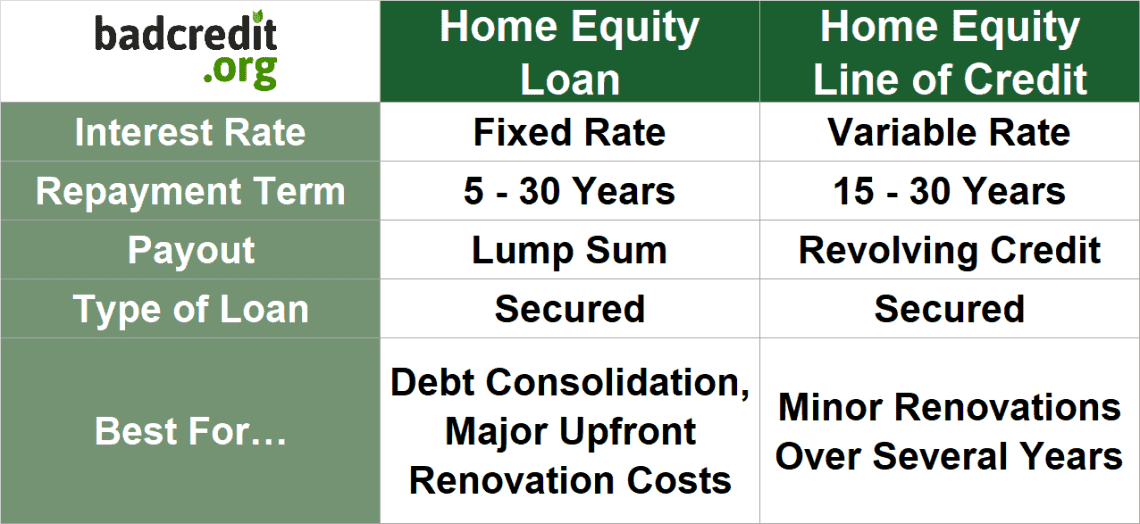

A home equity loan, or second mortgage, is an additional loan collateralized by your home. Your equity is the current value of your home minus the money you owe on the property (including home equity loan balances, if any).

The two contributors to your home equity are:

- The principal portion of your monthly mortgage payments, which in the early years is small compared with your interest charges

- Any increase in the price your home could fetch if you put it up for sale

For example, suppose your home can sell for $300,000, and you owe $220,000 on your mortgage. Your current equity is ($300,000 – $220,000), or $80,000. You can usually cash out up to 80% of your equity through a home equity loan, as lenders usually want a cushion against unforeseen expenses or sudden decreases in the home’s selling price.

A home equity loan provides you with a lump sum cash payment to use however you want. Your increased debt means you’ll face two monthly housing bills, assuming you haven’t already repaid your first mortgage. Failure to repay your home equity loan can precipitate foreclosure proceedings.

A home equity loan term can range from five to 30 years. As with a first mortgage, a home equity loan is an amortizing debt with a payment schedule consisting of principal and interest.

Alternatively, you can cash out your home equity by refinancing your mortgage. A cash-out refi involves taking out a new mortgage for an amount greater than your current mortgage balance. You use part of the new loan to repay the old one and the rest as you please.

Expect to pay closing costs, such as origination and title search fees, when refinancing a mortgage.

A home equity line of credit, or HELOC, shares characteristics with home equity loans and credit card cash advances. As with an equity loan, a HELOC uses the equity in your home as collateral.

You can establish a line for up to 100% of your equity, although many lenders require a lower LTV ratio.

Similar to credit card cash advances, a HELOC lets you draw from a substantial revolving line of credit. You only owe interest on the amount you borrow. You must pay at least the minimum amount due each month.

A HELOC open balance reduces the remaining amount you can borrow. As you repay the credit line, your available credit increases. Conversely, you can continue to draw down your HELOC until you exhaust the remaining credit or your draw period ends. That’s fine as long as you make your monthly payments on time.

Only a few lenders will greenlight a bad credit home loan to a borrower with a 400 credit score. It may be possible in a few circumstances:

- The VA and USDA do not impose minimum credit score requirements on the home loans it guarantees. But the underlying lender may (and probably does) specify a minimum score. USDA mortgages are available in about 97% of the geographical United States.

- You may be able to overcome a lower credit score if you substantially overcollateralize the loan. If you keep the LTV low (e.g., 50%), the lender will be better assured of repayment should you default on the loan.

- A cosigner with solid credit can work magic. Lenders value cosigners because they are another payment source should you fall behind. Cosigners can make your bad credit score irrelevant.

On the positive side, if you do land a mortgage despite your low credit score, you’ll boost your score by paying your loan on time. But late payments can sink your score even deeper.