How often do you check your bank account? If you’re like most Americans, you probably log into your mobile banking account or mobile app regularly to check that your balance is where it should be — especially after a particularly “active” shopping period. Despite this diligence, these same consumers often fail to apply the same level of responsibility to their credit reports.

But while the information on your credit reports can have less impact on your daily life as that in your bank accounts, the health of your credit report is directly correlated to your overall financial well being — so it’s about time you took notice. If your credit has slipped — either through financial missteps, reporting mistakes, or outright fraud — you may not realize it until you go to make a large purchase and are turned away. Here are three reasons it’s important to monitor your credit report and check it at least once a year to avoid needing to fix your credit down the line.

1. Your Credit Reflects Your Overall Financial Health

Each US consumer is entitled, by law, to a free copy of their credit reports, one from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Additionally, a variety of free and paid apps and websites provide credit score and report tracking and monitoring services.

There are several reasons to check your credit report regularly, but the first, and, arguably, most important, is that being knowledgeable about the state of your credit report is a fundamental part of being an informed consumer. Put simply: if you’re not checking your credit, you can’t truly know where you stand financially.

This can be particularly important in light of the fact that your credit score is based entirely on the information in your credit reports. The impacts of poor credit are far-reaching, and credit report problems can affect many areas of your life, including:

- Interest Rates & Fees — Your credit reports and scores are used by lenders to determine your creditworthiness, which is essentially your ability (and likelihood) to repay a loan. A low credit score indicates a high credit risk, which can result in higher interest rates and fees.

- Qualifying for Credit Lines — Similarly, without a sound record of repaying your debts on time and as agreed, lenders might choose to deny you for approval.

- Car insurance, utility bills, etc. — Poor credit can have lasting effects on areas of life you may have never considered. For example, credit scores factor into auto insurance premiums in nearly every state. The same goes for utility deposits. Many industries use your credit score as a measurement of your risk when it comes to paying your consumer debts.

For better or worse, your credit score has much more significance than whether you’ll get approved for that killer cash back credit card. However, a little proactive monitoring can help mitigate credit issues before it’s too late. The last thing you want is to be surprised by a credit score dip when applying for an important line of credit.

2. Regular Checks Can Stem Identity Theft

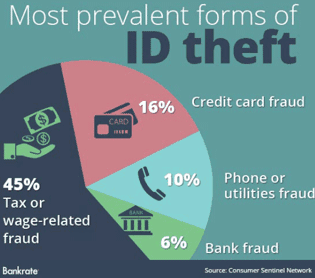

Identity theft is one of the most pervasive crimes in America each year. In total, over 17.6 million Americans are victims of identity theft annually — and 86% of these cases included fraudulent use of credit cards or bank account information. An Equifax report estimates that an identity is stolen every two seconds in the US.

This chart from Bankrate shows the most common forms of identity theft.

These figures are staggering, but you know what’s even worse? You, the consumer, may be complicit in identity theft if you aren’t taking the proper measures to protect your information. Malicious crooks are clamoring for your sensitive information, so prevention begins and ends with the individual.

By monitoring your credit report you are establishing a crucial first line of defense against identity theft. The sooner you are able to spot a case of identity theft, the more likely you are to prevent extensive damage.

And if you might be inclined to reassure yourself, “How much damage could one thief really do to my credit?” The short answer is: a lot.

When your personal information is exposed to someone who means to exploit your finances, the potential negative implications are endless. An identity thief basically has a blank check in your name, and will spend it as selfishly as they choose. Warning signs to watch out for on your credit report can include:

- Names you don’t recognize

- Unknown Social Security numbers

- Questionable bank accounts or unfamiliar bank names

- Credit lines you didn’t open

- Hard inquiries you didn’t approve

Be your own credit watchdog and keep a mindful eye on your credit report to fend off malice. In the event you do find something unusual, do your due diligence. Dispute erroneous or fraudulent credit report items with the individual credit bureaus to have them removed from your report. If you believe your identity has been compromised, be sure to file a report with the proper authorities.

3. Your Credit Report May House Inaccuracies

Of course, identity theft isn’t the only reason you may have inaccuracies on your credit report. Your credit report may house a variety of errors that can drag down your credit score, including misspellings, misreported balances, or outdated information.

Your credit report contains sensitive information — such as where you live, how you pay bills, whether you have been sued, etc. — and that information is sold to creditors, insurers, or employers looking to evaluate your identity as a consumer. With this in mind, it is very important all information is reported accurately and fairly, but sometimes errors can negatively mark your credit without your knowledge.

The Federal Fair Credit Reporting Act (FCRA) laid down powerful consumer protections that allow individuals to question items on their report they feel misrepresent them. Thanks to the FCRA, consumers can double check that their information is accurate, complete, and up-to-date.

If you identify information in your file that is incomplete or inaccurate, and report it to the consumer reporting agency, the agency must investigate unless your dispute is frivolous. — Experian.com Blog

But, what if you don’t know how — or simply don’t want to take the time — to dispute inaccurate credit report items? That’s where professional credit repair services come in. If you think it’s time to take control of your credit record, credit repair services can be a good way to clean up a previously ignored credit report and get your finances back on track.

Many credit repair professionals are able to leverage legal expertise to ensure your credit report is the best, most accurate, representation of your consumer identity. Some credit repair companies report that clients see as many as 7% of negative items removed from their credit report each month.