My high-school friend, Cindy, was the envy of many when she got a car for her 16th birthday. Unfortunately for Cindy, she crashed that car not too long after, folding her hood like an accordion. Rather than fix the car right away, her parents decided to teach Cindy a bit of a lesson by having her drive the banged-up car to and from school each day. To the embarrassed Cindy, the car may as well have been a giant sign saying, “I can’t drive.”

In many ways, court judgments are the consumer credit world’s version of Cindy’s damaged car. Keep reading to learn how to remove a court judgment from your credit report. Essentially, when you default on a debt and a creditor or debt collector must take you to court to get paid, the resulting judgment appears on your credit report. To potential future lenders, that judgment effectively acts as a warning sign, one that (loudly) says, “I don’t pay my debts.”

On the bright side, there may be some things you can do to make that ugly judgment a bit prettier — or to get rid of it altogether — depending on your particular situation. Let’s explore some of the options available to folks who find themselves in this less-than-ideal situation and hopefully offer a glimpse of light at the end of the tunnel.

You Can Appeal for a Vacated Judgment

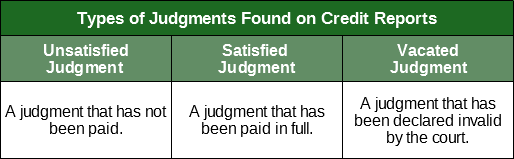

In some cases, it may be possible to have your judgment vacated, which erases it as if were never there in the first place. General grounds for receiving a vacated judgment can include debts that were really paid as agreed, debts that don’t actually belong to you, or some cases in which the creditor violated the Fair Debt Collection Practices Act.

A vacated judgment is essentially declared void, which means the credit bureaus are legally required to remove it from your credit reports. This can often be done with little trouble by disputing the judgment with the bureaus. Remember that you’ll need to file a separate dispute for each one of the three major credit bureaus — Equifax, Experian, and TransUnion — to remove the judgment from all three reports.

If your judgment doesn’t qualify for vacation, you can simply (or not-so-simply) pay the judgment. Paying off a judgment should automatically change its status to “Satisfied,” both in the public record and on your credit reports. A satisfied judgment is a lot better looking to future lenders than one that is unsatisfied, but it still isn’t doing your credit many favors.

Paying off the judgment may be something you do voluntarily, perhaps by directly paying the full amount or by negotiating a settlement. You may also decide to wait until the creditor is legally able to forcefully collect. The latter may be a painful process, as creditors can typically seize your assets and pilfer your bank accounts — all with the consent of the court.

Some Judgments May Expire After 7 Years

While a vacated judgment is typically the best-case scenario, the unfortunate truth is most legitimate judgments — satisfied or not — aren’t going away anytime soon. In fact, judgments will generally remain on your credit report for seven years from the judgment date (the day the judgment was filed) before expiring.

And, sadly, that may not be the end of the story if your judgment remains unsatisfied. Depending on the state in which you are a resident, creditors and debt collectors may have the ability to re-file the judgment, meaning it can stay on your credit report an additional seven years. In some states, unsatisfied judgments can be renewed indefinitely, potentially haunting your credit report for decades to come.

The moral of the story? Pay your judgments. The sooner you pay the judgment, the sooner you can start running out the clock on that judgment — and its effects on your credit scores. Happily, you may not need to wait the full seven years before you see your credit score improve. Most negative credit report items will start to lose their impact on your credit score as they age and more recent data take precedence.

Credit Repair May Remove Incorrectly Reported Judgments

Although judgments — particularly satisfied judgments — should fall off of your credit report after the seven-year limit expires, this doesn’t always happen. Vacated judgments may also sometimes be mistakenly included on your credit reports. In either of these cases, you can dispute the judgment with the credit bureaus to have it removed from your reports.

You can file credit report disputes on your own by writing a dispute letter to each credit bureau that displays the incorrect judgment. If you’d rather enlist the help of a seasoned professional, however, you can choose to hire a credit repair company to offer advice and/or act in your stead. Many of our top-rated credit repair companies have decades of experience helping consumers fix credit report errors.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

+See More Credit Repair Companies

Experienced credit repair companies can make the process smoother, particularly in cases where you need to find/furnish additional evidence to have a negative item removed from your reports. A credit repair company with experts who also happen to be legal professionals, such as those found at Lexington Law, may also be able to help you determine if your judgment meets the qualifications to be vacated.

Remember that credit repair isn’t a universal solution, however. Negative credit items that are proved legitimate, such as judgments that have been fully verified, will remain on your credit report until they expire, immune from the efforts of even the best credit repair companies.

Judgments Won’t Hurt Your Credit Forever

While seven years can seem like a long time to walk around with a judgment mucking up your credit reports, you won’t be stuck dealing with the consequences of that one mistake forever. Over time, the damage to your credit score will start to diminish, eventually fading entirely when the judgment falls off of your report.

So, instead of belaboring the negatives of a judgment on your credit report, perhaps you should instead consider it an important lesson to be learned — even if you did have to learn it the hard way. In many ways, it’s the hard lessons that make the biggest impressions and are remembered long after the evidence is gone. Just think — if you live with a credit judgment for seven years, you’ll probably do everything you can to avoid having to deal the same situation for another seven years.

That’s how it was it for Cindy, at any rate. Driving around in her disaster of a car made a definite impression on her teenage, appearance-focused mind. The embarrassment from being seen in such an ugly car was enough to change how she viewed her car, giving her a new respect for the steps she could take to make sure her car stayed in tip-top shape. Not only did Cindy become a better driver for the experience, but she became a better car owner overall. A lesson well-learned.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.