If you’re searching for information on how to check a FICO score, you’ve come to the right place. Below, we’ll provide an overview of FICO scores in general, and cover a few different ways you can get your score.

Your FICO Score is a credit score that is used by 90 percent of lenders. When you’re applying for a loan or credit of any sort, it is highly probable that the lender will look at your FICO Score as opposed to other types of credit scores.

You’ll see a lot of advertisements for free credit scores, but those are not FICO Scores. They are generally educational credit scores to help consumers understand their credit and are not used by lenders to determine creditworthiness.

3 Ways to Get Your FICO® Credit Score

To find your actual FICO credit score, you have a few options. You can go directly to the source at FICO, or you may be able to obtain a free FICO Score from your bank, credit union, or credit card issuer. You can also sign up for credit monitoring services.

1. Directly From FICO® at myFICO.com

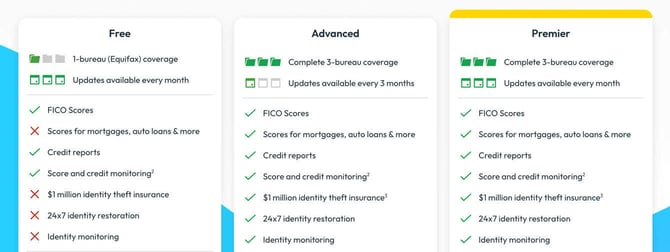

Each bureau — Experian, Equifax and TransUnion — has its own record of your credit history (credit report) and FICO Score. Visit myFICO.com, the official FICO website, where you can get your FICO Score and Equifax report for free.

You can also sign up for its Advanced or Premier level, for a monthly fee, to receive access to all three bureau reports and more credit tools.

Keep in mind that while the FICO Score 8 is the most widely used score, mortgage, auto, and credit card industries may use a different type of FICO score. Your report from myFICO.com will include your FICO 8 Score, along with additional industry-specific FICO scores.

2. Sign Up For Credit Monitoring Services

There are many credit monitoring services that offer FICO Scores and credit reports.

Experian even offers free credit monitoring. This includes your Experian FICO Score, credit report, and credit monitoring.

Consumers can also monitor their own credit profiles with free access to their reports from all three bureaus on AnnualCreditReport.com. Users can receive updated reports each week thanks to a policy that the bureaus enacted during the pandemic and allowed to continue.

3. From Your Credit Card Issuer

Many credit card issuers offer their members free FICO Scores nowadays.

They may also grant you access to each bureau’s calculated FICO score. Your credit scores should be similar, so if you find that one is significantly lower, that’s a red flag.

It could mean that there is an error present on one of the bureau’s credit reports, which is why it is important to know all three FICO Scores and check your credit reports at least once annually. In the event that you do find an error, here’s how to dispute it.

Credit Cards

These are the credit card issuers that offer free FICO Scores to their members who carry certain cards, as well as which bureau’s FICO Score they provide.

| Issuer: | Who Qualifies: | FICO Score: |

|---|---|---|

| Bank of America | All cardholders | TransUnion |

| Barclaycard | All cardholders | TransUnion |

| Citibank | All cardholders | Equifax |

| Discover | Anyone | TransUnion |

| Synchrony | Primary cardholders | TransUnion |

Don’t Be Fooled by “Free” Credit Reports & Scores

Annualcreditreport.com is the only source for free credit reports that is authorized by federal law. You are allowed a credit report from each of the three bureaus — Experian, Equifax and TransUnion — once every week. Your credit score, however, is not included with your credit report.

Free credit scores can be very helpful for getting a general view of where your credit stands, but those scores are calculated differently than FICO Scores. Therefore, the number you’re seeing from a free credit score may be far from what your FICO Score is. You don’t want to get caught off guard thinking your score is something it’s not when it’s time to apply for a loan.

Photo credits: beatdebt.info