The credit scores that most lenders use in the United States range from 300 to 850. This is the common score range or “scaling” with FICO and VantageScore’s credit scoring models. Generally speaking, a credit score in the 700s is considered to be a good score at any age and can lead to loan or credit card approvals.

Earning good credit reports and credit scores takes time, especially if you’re working to rebuild your credit or establish credit from scratch. And, if you are on a journey to build your credit reports and scores, it’s natural to wonder how your credit measures up to that of other consumers similar to you.

For example, in 2022, the average FICO score in the United States was around 716. Yet, as you would imagine, some age groups outperformed others in terms of credit score health.

Below is a look at the average FICO score across different generations in the United States. We also offer insight into common credit milestones you may experience throughout your consumer credit life cycle and how those changes can impact your credit scores along the way.

Ages 18-25: Average FICO Score of 679

Generation Z had the lowest average credit score in 2022. According to Experian data, consumers between the ages of 18 and 25 had an average FICO Score of 679. That’s about 35 points below average.

Of course, this is the age range most consumers are in when they open their first credit card or start to establish credit in other ways, such as with student loans. In fact, the majority of 18-year-olds (61%) have at least one credit card, according to Experian.

It’s interesting that so many 18-year-olds have credit cards. Because of the CARD Act of 2009, credit card applicants must be 21 years old to open a credit card unless they can meet one of the following exceptions:

- Provide proof of a steady job and income to afford credit card payments on your own.

- Provide a co-signer on your credit card application.

In addition to credit cards, consumers between the ages of 18 and 25 often take out other forms of financing. Most Gen Zers (72%) have at least one active auto loan — more than any other generation.

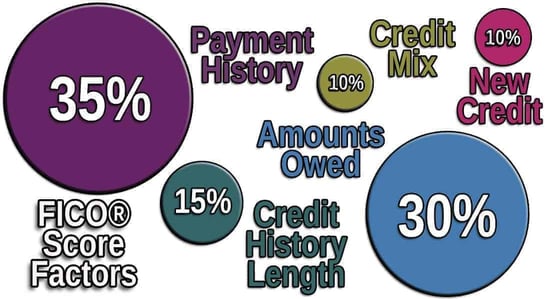

Regardless of the type of credit obligation you’ve incurred, you should be responsible if you want to protect your credit score at a young age. On-time payments are essential since payment history is worth 35% of the points in your FICO scores.

And you should also be sure to use your credit cards responsibly by paying off your full statement balance each month. This approach should keep your credit utilization rate low, and help you to avoid expensive credit card interest.

If you want to know why Gen Zers have the lowest scores, you don’t have to look far. One of the factors in credit scoring is the length, in years, of your credit reports. Another is the average age of your accounts. Clearly, someone who is younger isn’t going to do well in these scoring metrics, which contributes to their lower scores.

Ages 26-41: Average FICO Score of 687

Millennials had the next lowest credit scores in 2022. Experian data showed that consumers in the United States between the ages of 26 and 41 had an average FICO Score of 687. And while 687 is higher than the Gen Z average, it’s still below the national average.

This is the age range where many people start to think about purchasing a home. According to the National Association of Realtors (NAR), the typical first-time homebuyer was 36 years old in 2022.

Adding a mortgage to your credit report has the potential to add diversity to your credit mix. Credit mix is worth 10% of the points in your FICO score. Demonstrating that you have the ability to manage a variety of loan types responsibly can have a positive impact on your credit score over time.

Of course, it remains important to follow smart credit management habits at this stage of life as well. Paying on time and keeping your credit card balances as low as possible will always be essential if you want to maintain good credit on a long-term basis.

Ages 42-57: Average FICO Score of 706

Generation X was next on the list in terms of average credit scores. In 2022, Experian data showed that consumers between the ages of 42 and 57 had an average FICO Score of 706.

By now you’ve probably noticed that the average FICO Score has been trending upward with each age group on the list. Therefore, it’s important to point out that your age itself isn’t a factor that credit scoring models consider when calculating your credit scores.

But your experience managing credit and the age of the accounts that appear on your credit reports play a role in the calculation of your credit scores. In general, the older the accounts that appear on your credit reports, the more points you’re going to earn in your credit scores.

It can take time to build a solid credit score. Again, credit scoring models like FICO and VantageScore consider both the average age of the accounts that appear on your credit reports as well as the age of your oldest account. The age or “length” of your credit history is worth 15% of your FICO score points.

Ages 58-76: Average FICO Score of 742

Baby boomers had significantly higher average credit scores compared with scores for the three previous generations. Consumers aged 58-76 had an average FICO Score of 742 in 2022, according to Experian data. That’s above average and is often referred to as being a great credit score.

Predictably, baby boomers tend to seek new credit less frequently than their younger counterparts, simply because of where they are in their consumer credit life cycle.

For example, TransUnion data reveals that just 21% of new credit card originations came from baby boomers in 2021. By comparison, Gen X opened 29% of new credit cards that year and millennials were responsible for 33% of new credit card originations.

| Generation | Q2 2021 | Q2 2020 | Q2 2019 | Q2 2018 |

|---|---|---|---|---|

| Gen Z (1995 Onward) | 14.2% | 13.3% | 9.5% | 7.5% |

| Millennials (1980-1994) | 32.7% | 32.6% | 29.7% | 30.0% |

| Gen X (1965-1979) | 28.8% | 28.0% | 28.7% | 28.8% |

| Baby Boomers (1946-1964) | 21.3% | 22.5% | 26.9% | 27.8% |

| Silent (Prior to 1945) | 3.0% | 3.6% | 5.2% | 6.0% |

| Total Originations | 19.3M | 8.6M | 16.4M | 15.8M |

Likewise, consumers aged 58-76 have fewer auto loans on their credit reports. Nearly half of baby boomers (49.9%) have zero auto loans, according to Experian data.

The fact that older generations are seeking new credit and debt less often is a contributing factor to why their average credit scores are higher.

Ages 77 and Over: Average FICO Score of 760

The Silent Generation, also known as the children of the Great Depression, had the highest credit scores of all consumers in 2022. Experian data revealed that consumers 77 and over had an average credit score of 760 — a fantastic credit score.

Like baby boomers, consumers aged 77 and above applied for credit less often than did younger generations. Only 3% of new credit card originations in 2021 came from this age group. Meanwhile, just 31% of Silent Generation consumers had an active auto loan on their credit report in the first quarter of 2022.

The Bottom Line

Regardless of your age, you need to practice the same basic habits to earn and maintain solid credit scores. If you pay your bills on time, manage credit cards responsibly, and avoid seeking excessive new credit, you will be off to a great start.

Remember to review your three credit reports often to make sure they contain accurate information, and you’ll be doing better than the majority of your peers, regardless of the age group to which you belong.