In American pop culture, lawyers seem to be almost equally depicted as both the righteous hero — and the diabolical villain. But whether you love them or hate them, the fact remains that attorneys are an important and necessary part of the legal system.

Of course, that doesn’t mean they’re necessary for every situation — not even in the extensively bureaucratic world of consumer finance. But how do you tell when you need a credit repair attorney to help with your financial issue? The short answer is, it depends on your problem.

When it comes to credit repair, deciding to use a credit repair law firm over a non-attorney company (or just doing it yourself) will depend on the extent of your disputes, as well as whether you may need additional legal help, such as filing for bankruptcy. In the following article, we’ll dive into this topic and look at what distinguishes credit repair attorneys, and we’ll also present some of our top picks for credit repair companies.

Law Firm vs. Company | Top Providers

What Makes Credit Repair Attorneys Different

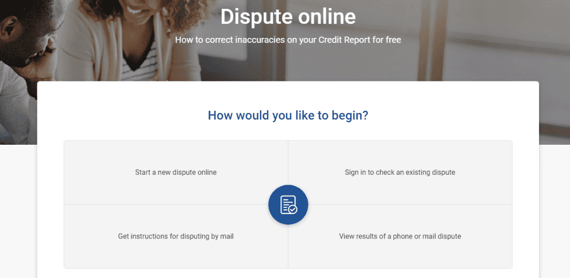

In general, a basic credit repair scenario involving one or two easy disputes may be best done yourself by filing individual disputes with each applicable credit bureau. Once things get more complicated, however, you may find it easier and more effective to hire a professional with more experience to handle your disputes.

You can file credit bureau disputes yourself through the bureau’s website.

Hiring outside credit repair help can be especially helpful if you have multiple items to dispute with each bureau or in cases where extensive research needs to be completed to properly support a dispute. Professional credit repair companies are often familiar with the steps necessary to obtain appropriate and sufficient evidence and how to obtain documents from creditors and other agencies.

That said, it’s here that you may find the first differentiator between an attorney-staffed company and one without legal professionals. Attorneys will often have more legal knowledge and may be more adept at utilizing legal tools to facilitate the process. Additionally, if you need to escalate any issues, it can be helpful to have a legal expert with whom to consult and take the next steps.

Additionally, contacting a law firm means you’ll have a legal attorney/client relationship with your credit repair provider. This can be beneficial in a number of situations like if your credit repair situation is extensive enough to require filing for bankruptcy or a creditor takes legal action against you. Having a lawyer already familiar with your problems may smooth the road and help make an unpleasant situation a little easier.

Our Top-Rated Credit Repair Providers

Deciding which route to take for credit repair — whether to hire a professional or do it yourself — is something only you can do. If you choose to dispute items yourself and fail to find success, a credit repair company is still an option. If you wish to hire a credit repair company, you can start your search with our expert-rated picks, which include Lexington Law, a credit repair law firm, as well as several other experienced companies.

Lexington Law | Other Companies

Lexington Law: A Credit Repair Law Firm

A true law firm staffed by real attorneys and legal experts, Lexington Law Firm was founded in 1991 and has been in the credit repair business for well over a decade. In that time, Lexington Law has helped thousands of clients repair their credit, helping remove more than 9 million disputed items for its clients in 2016 alone.

Despite being a law firm, Lexington Law prides itself on its affordable credit repair services, offering multiple levels of service depending on the features preferred by each client. The initial consultation is free and comprehensive, involving a look at your credit reports and helping you figure out your options for credit repair. Check out Lexington Law using the link below.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

Even if you don’t need the legal expertise of an attorney, the sheer amount of experience held by the professionals at Lexington Law will often outweigh that of other credit repair companies. When it comes to dealing with large entities, like the consumer credit bureaus and major consumer creditors, having the experience to hold your own may make a difference.

From an affordability perspective, Lexington Law’s rates are competitive with the rest of the credit repair market, and are charged monthly so you can cancel anytime. If you cancel your service within the first five days you’ll pay no penalties. Be aware that you’ll need to pay a one-time work fee when Lexington Law gets started that is separate from the monthly service fee.

Other Credit Repair Companies

If you don’t feel you need the services of a credit repair law firm, but still want the experience of a professional credit repair company, you still have a variety of options. Our top picks have decades of credit repair experience helping clients remove credit report errors, outdated information, fraudulent items, and unsubstantiated accounts.

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

- Free online evaluation

- One-on-one action plan with a certified FICO professional

- Unlimited disputes of any questionable items on your credit reports

- 24/7 Access to your online client portal

- 90-Day Money-Back Guarantee

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 2009 | $69+ | 7.5/10 |

+See More Credit Repair Companies

Comparing credit repair companies will be a matter of weighing experience and reputation with affordability. The most expensive companies are always the most effective — but cheap services can also mean cheap results. Investigate the company’s reputation within the industry and with consumer protection sites, such as the Better Business Bureau, to get an idea of whether the company is effective and, more importantly, trustworthy.

Clean Up Your Credit Reports & Boost Your Score

As often evidenced by television and movies, sometimes you really do just need a great attorney to solve your problem. At other times, however, pulling out your lawyer may be a bit of overkill. In credit repair, whether you need a law firm to handle your disputes is mostly a matter of your personal situation and the credit repair professional who makes you feel most comfortable.

No matter which route you decide to take, it’s important to remember that credit repair is not an overnight process. It will likely take at least 30 days, per dispute, to start cleaning up your credit report — and that’s for the easy stuff. If you have a large number of disputes or need to track down additional evidence to support your dispute, the process can take significantly longer.

Furthermore, you’ll have the best credit repair experience if you understand what credit repair can — and can’t — accomplish before you get started. While credit repair can often eliminate errors and unsubstantiated items, legitimate debts that can be backed up by your creditors are yours to repay, regardless of which type of credit repair company you hire.

No matter what, repairing your credit takes time and dedication. But once you’ve accomplished it, you’ll gain access to opportunities previously unavailable to you. And you’ll have the peace of mind that comes with knowing your finances are in good standing.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.