The great state of Florida has recently seen an uptick in its residents’ average credit score. But at 701, it still lags 13 points behind the 2021 national average. Several factors account for the difference, including the rising costs of senior housing, the high inflation rate, COVID-19’s impact on multi-income families, and the limited credit histories of recent arrivals to the US.

Floridians wanting to improve their credit scores can pursue various strategies, including credit repair. Our review of the best Florida credit repair services is a great starting place for residents of the Sunshine State to clean up their credit reports. Any one of these services can find and correct report mistakes, omissions, and unverifiable items.

Read on to discover the credit repair service that best fits your needs and budget.

Credit Repair Companies Serving Floridians

Some have headquarters in Florida, but all of these credit repair companies operate in the state. Generally, their services and costs are similar, although the details vary. All of them can improve your financial reputation by eliminating reporting errors that may hamper your access to affordable loan and credit card offers.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

We and many others consider Lexington Law the best credit repair company nationwide. The company has a long history of successfully helping clients clean up their credit reports.

Moreover, the company receives high marks for its well-trained paralegals and credit lawyers who work hard to put your credit history in order. When you hire Lexington Law, you aren’t adding a random customer service agent but rather an entire firm that will fight for your rights.

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

Based in Boca Raton, Florida, Sky Blue Credit Repair® is a close runner-up for the best credit repair company. It understands firsthand the credit challenges facing the state’s residents. The company commits to the number of items it will dispute on your behalf each month. Naturally, the schedule can extend the time it takes to complete your credit repair process if you need to challenge many items.

The company offers a convenient platform to pause, cancel, or restart your service anytime. This makes it easier to reconcile the cost with your budget.

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

CreditRepair.com is an online credit repair company that gives customers real-time updates on each credit dispute and regular credit score updates from at least one credit bureau.

The company has operated for a decade and removed millions of negative items from clients’ credit reports. CreditRepair.com resides in Utah and operates in Florida.

- Free online evaluation

- One-on-one action plan with a certified FICO professional

- Unlimited disputes of any questionable items on your credit reports

- 24/7 Access to your online client portal

- 90-Day Money-Back Guarantee

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 2009 | $69+ | 7.5/10 |

The Credit Pros provides three separately priced packages so you can customize your credit repair costs. Credit law experts founded the company in West Palm Beach. You can schedule a free consultation with The Credit Pros without obligation.

When you subscribe to the company, it will file all necessary dispute paperwork with each credit reporting agency. It also offers real-time updates on your disputes, debt validations, letters to creditors, and cease-and-desist letters to collection agencies.

- Credit Firm has helped consumers improve their credit scores for more than 20 years

- No hidden fees — just $49.99/month

- Credit Firm uses every legal tool and procedure allowable by law to remove as much derogatory information as possible from your credit reports to increase your credit scores

- 97% of our clients refer us to friends and family

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A | 1997 | $49.99 | 8.5/10 |

Since 1997, CreditFirm.net has provided credit repair services at fair prices with a staff that includes licensed attorneys. It has served more than 60,000 customers nationwide. At less than $50 per month, Credit Firm is more affordable than the competition.

When you sign up, you’ll send in your credit reports and receive a personal consultation to review your information, identify questionable items, and map out a plan. Services include credit report challenges, debt validation, goodwill interventions, and cease-and-desist requests.

What Is Credit Repair?

Credit repair aims to increase your low credit scores by removing questionable derogatory items from your credit reports. These items include unverifiable hard credit inquiries and false reports of late payments, defaults, collections, and bankruptcies.

Negative credit information can also hurt your prospects of landing a new job, renting an apartment, or getting a mortgage, among other things. Removing incorrect information can quickly improve your bad credit score, faster than creditworthy behavior alone.

How Much Does Credit Repair Cost?

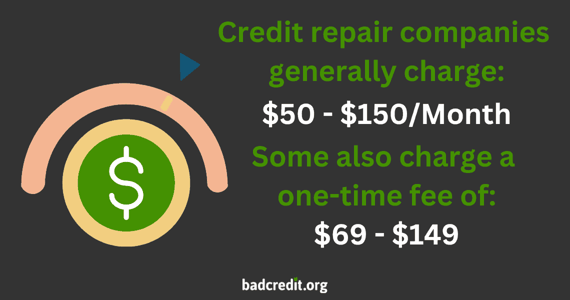

Most credit repair agencies charge a monthly fee between $50 and $150. Obviously, you’ll pay more if your services take longer to complete. If your reports require less fixing, you’ll need to make fewer monthly payments. Some companies also charge a first-work or account setup fee before starting on your case.

While the cost may seem significant, remember that the overall price is substantially less than what you’d pay for a loan or credit card when you have a credit score needlessly depressed due to incorrect report information.

More expensive packages include additional services, such as FICO score updates, credit counseling, and identity theft protection. You may also receive credit monitoring and educational materials to help you rebuild credit.

How Do I Obtain Credit Repair Services?

Credit repair companies address problems with your credit reports when you can’t or don’t want to do the work yourself. Most offer a free consultation to identify how they can help you.

You’ll usually sign up for a monthly subscription when you hire a credit repair company. The average subscription runs for about four to six months, but you can extend or cancel it anytime. Prices depend on the level of service you purchase.

It would be best to compare each repair service’s charges, including any initial setup fee. Note activities included at each service level and those that cost extra. Standard activities include:

- Reviewing your credit reports

- Initiating formal disputes with your credit bureaus and creditors

- Tracking disputed items until resolved

- Helping customers obtain good credit management skills

The repair firms try to fix several types of issues, including errors, expired items, unverifiable information, and fraud. Credit repair agencies compile an action plan and a schedule for the things they’ll dispute on your reports.

You can choose the company with the service level that best meets your needs. You may not need the extra services accompanying the more expensive packages, such as score analysis and tracking, access to financial tools, and identity theft repair.

What State Regulations Govern Credit Repair in Florida?

All US credit repair firms must comply with federal law. The Credit Repair Organizations Act (CROA) prevents unfair credit repair business practices, such as making false promises, charging for services never rendered, and advertising misleading costs. Under the CROA, credit repair agencies must provide a written contract for their services and substantiate their activities before billing.

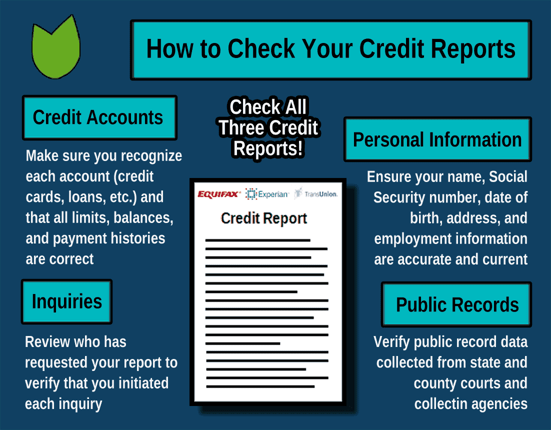

In addition, the Fair Credit Reporting Act (FCRA) is a federal law giving you the right to know what’s in your credit report, dispute report items, and receive free annual copies of your credit report. Consumers can also request a copy of their credit report in response to specified events, including cases of identity theft or fraud. The Act also regulates who can access your credit report, how long items can remain on your report, and what information employers and businesses can use against you.

The Federal Trade Commission enforces the terms of the FCRA and the CROA.

Floridians also receive protection through a credit repair law banning misconduct or fraud: The Florida Department of State and the Attorney General are responsible for enforcing the Florida Credit Service Organizations Act (FCSOA). Under Section 817.704, the Florida statute prohibits:

- Charging for services until the company completes delivery. If the company puts up a surety bond, it can bill before delivering all services but must deposit the money in a trust account until final delivery.

- Charging for credit account referrals that are available to the general public

- Making false, misleading, or incomplete statements of material facts to the credit bureaus or creditors

- Undertaking fraudulent or deceptive practices

In addition, the Florida statute includes the following requirements:

- Surety Bonds: This is a third-party agreement legally binding the credit repair company to cover damages and losses. The bond amount is $10,000, but the credit repair company typically pays between $100 and $1,000 yearly for the bond.

- Licenses and Permits: Currently, the state has no credit repair license requirements. But cities and counties may require a local business license, permit, tax receipt, or local professional license.

- Contract Requirements and Disclosures: Credit repair companies must observe the provisions of Section 817.704, as described above.

- Cancellations and Refunds: Florida gives credit repair customers five business days to cancel their contracts. Upon cancellation, the credit repair agency must issue a full refund within 10 days.

In addition, Section 817.703 of the state law requires credit repair services to provide customers with an information statement explaining the following:

- An accurate and complete account of the buyer’s rights to review their credit bureau files

- The right to freely access credit bureau files within 30 days of a credit denial

- The price the credit bureau will charge for providing the buyer’s files if not free

- An accurate and complete statement of the buyer’s rights to dispute items on their credit reports

- Acknowledgment that the major credit bureaus cannot permanently remove accurate information from their files until the expiration date

- A detailed and complete description, including costs, of the work a credit service organization will perform

- Notification that buyers can proceed against the credit repair company’s surety bond or trust account

- The name, address, and account number of the trust account depository or surety bond issuer

Credit repair organizations must keep on file for five years an exact copy of each issued statement, personally signed by the buyer acknowledging receipt of the document.

Is Paying Someone to Fix My Credit Worth It?

Considering the modest cost, paying a legitimate company to fix your credit reports isn’t that risky. At worst, you’ll pay a few hundred dollars.

Most credit repair companies offer a free upfront consultation, which should reveal how much repair your credit reports may need. You can then decide whether it’s worth the expense of a subscription.

In Florida, you can cure buyer’s remorse within five days of signing the contract by canceling it and receiving a full refund.

You can do the repair work yourself by reviewing your credit reports and filing disputes directly with the major credit bureaus. AnnualCreditReport.com can send you free copies of your credit reports once per week (previously once per year). In addition, Florida law lets you request free copies within 30 days of a being denied for credit.

Ultimately, you must decide if your reports require fixing and whether you want a DIY or third-party solution. You must balance the money you’ll save by doing it yourself with the extra time and effort required.

Can a Credit Repair Company Hurt Your Credit?

No, credit repair companies don’t do anything to harm your score since you have the right to dispute items on your credit reports. Hiring a credit repair company will not appear on your credit report, and your credit history will not receive any negative marks from working with a credit repair firm.

But beware of other services, such as debt settlement, that can significantly damage your credit score.

In-Person Options for Credit Repair Services in Florida

Although we’ve covered the best nationwide credit repair services, residents can choose from dozens of competing companies, including many in-person options. You should check out any credit repair agency before using it because the field has a somewhat unsavory reputation due to fraud and misconduct.

We only recommend credit repair companies that we believe to be legitimate and honest. Here are some in-person options for credit repair services in Florida:

A Plus Credit Services LLC

8459 Coral Wy

Miami, FL 33155

Credit Repair Expert Help

25 N Market St

Jacksonville, FL 32202

Elite Credit Solutions

1936 W Dr Martin Luther King Jr Blvd Suite 215

Tampa, FL 33607

Mr. Credit

5205 S Orange Ave Ste D

Orlando, FL 32809

Financial Resurrection

7901 4th St N

St. Petersburg, FL 33702

Credit360 Credit Repair Services

1400 Village Square Blvd #3-81121

Tallahassee, FL 32312

Best Life Solutions

5475 NW St James Dr #419

Port St. Lucie, FL 34983

Credit Vision LLC

1222 SE 47th St Ste 306

Cape Coral, FL 33904

SW Group Credit Repair

1 E Broward Blvd Ste 700

Fort Lauderdale, FL 33301

Fix My Credit

2330 Polk St

Hollywood, FL 33020

Destiny Infinity Financial

1020 NW 23rd Ave

Gainesville, FL 32609

Financial Building Solutions LLC

1023 NE 14th St

Ocala, FL 34470

Unique Financial Solutions LLC

551 Creighton Rd Ste D104

Pensacola, FL 32504

Credit Medic

12771 World Plaza Ln Suite 1-C

Fort Myers, FL 33907

New Generational Wealth Solutions

1864 Dr Martin Luther King Way Ste. 108

Sarasota, FL 34234

Credit360 Credit Repair Services

2500 W Intl Speedway Blvd Ste #900 Rm #1098

Daytona Beach, FL 32114

Credit Card Management Services, Inc.

1325 N Congress Ave

West Palm Beach, FL 33401

CareOne Credit

914 Florida Ave S

Lakeland, FL 33803

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.