Mistakes on credit reports can happen from time to time, and if you need to contact Experian, dispute errors, or learn more about the information on your count, read on.

As consumers, we rely on our credit reports for getting a loan, qualifying for a mortgage, and even landing a job. Unfortunately, credit reports aren’t always accurate. The Federal Trade Commission found one in five Americans have errors on their credit report and that one in 20 of these are severe enough to affect the interest rates they’re charged.

The three major rating agencies have credit files on over 200 million American consumers — which means as many as 10 million people could be paying more in interest charges than they deserve.

If you’ve checked your Experian credit report and found errors on it, you have a right to dispute these mistakes. You can use Experian’s dispute tools online or get assistance from a credit repair agency. Let’s take a more in-depth look at Experian’s online dispute tool, walk through how to put a freeze on your credit report, and look at some professional credit repair services.

1. Use Experian’s Online Dispute Tool

Experian lets consumers identify and remove credit report errors in seven quick steps:

- Obtain an online copy of your credit report from Experian (you’re entitled to one free credit report every year).

- Review the information, looking for errors.

- Dispute mistakes by highlighting the entry and clicking the “Dispute” button.

- Select the reason you feel the information is inaccurate.

- You can bolster your claim by uploading any relevant documentation or making additional comments.

- Add an optional “Personal Statement” that will be visible to anyone reviewing your credit report.

- Once you’re finished entering all information on your dispute(s), click “Submit” to start the process.

After submission, the dispute notice is sent to the source of the information for verification. It will generally take less than 30 days for the review, and Experian will notify you of the results (all for free).

Once an entry is verified to be inaccurate, it will be removed from your credit report.

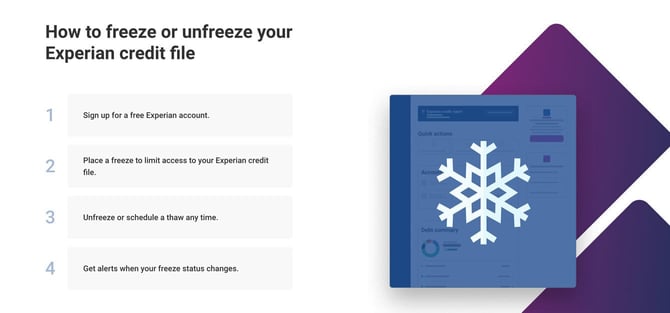

2. Place a Security Freeze on Your Experian Credit Report

A security freeze means that any potential lender or agency won’t see or have access to the disputed entry in your file. However, a security freeze may delay the processing of your credit or loan requests. An Experian security freeze is designed to prevent the release of your credit report unless you give your consent.

Experian’s online tool provides a quick and easy way to put a security freeze on an Experian credit file.

This is especially useful for anyone who has identified an error on their credit report, but hasn’t yet seen it removed. When placing a security freeze on your Experian file, you’ll be given a secure password or code that unfreezes the account. This code also provides you with a temporary one-time access to your file.

3. Call or Write to Experian

If you’d rather not deal with this issue over the web, you can send your dispute request in writing to:

Experian

P.O. Box 9701

Allen, Texas 9701

The Federal Trade Commission offers a helpful sample letter for disputing errors on your credit report in writing.

Or, you can call 1-888-397-3742 to speak with a representative directly.

4. Don’t Go It Alone — Get Help From a Repair Service

Although the Experian dispute process is fairly straightforward, some people may prefer to have a professional credit repair service manage it for them. Credit repair services can benefit anyone who wants to leave the credit report dispute process to the experts.

Do your research to find a reputable and trusted organization with experience helping people remove erroneous credit report entries from all three credit bureaus. Some have a long history of advocating for consumers like you and saving you time and energy.

Ensure Your Credit Report is What It Should Be

Taking these steps will ensure you’re not one of the millions of Americans with errors on their credit reports, helping to secure the loan, mortgage, or job you’re after. And as one of the largest credit reporting agencies in the world, Experian has thankfully made disputing errors simple.

Experian is working hard to provide the most accurate credit reporting system possible by allowing us the opportunity to remove errors from our credit file — and whether you do it yourself in seven steps online, call, write, or get help, take the necessary measures to ensure that your credit report is what it should be.