In a Nutshell: The Stock Market Game has been teaching students about finance through hands-on, practical learning since 1977. The simulation allows participants to choose their investments, manage their money, and learn about the inner workings of the market and the financial system. It helps them build skills to manage their money and avoid debt and even prepares them for success in independent business ventures.

We often think of games as a fun diversion. But there is a large body of research — in psychology, anthropology, and other disciplines — that shows a more practical value in playing games. They help people socialize, learn about cultures, and teach behaviors and skills relevant to everyday life.

In his 1974 book “Gaming: The Future’s Language,” Richard D. Duke argued persuasively for games as an educational medium. By simulating real-world phenomena in consequence-free settings, games can help people create cognitive models of reality and develop problem-solving skills to deal with complex situations.

As many investors know, there are few entities more complex than the stock market. The stock market, made up of companies with unique intentions and desires, is often volatile and unpredictable.

Modeling the stock market as a simulation or a game in which users compete against one another is a powerful way to motivate youth to learn about finances and investing. And the earlier they engage with it, the more opportunities they have to develop positive financial habits while avoiding negative consequences, including unnecessary debt. The Stock Market Game brings that experience to potential investors everywhere.

“The Stock Market Game is an online simulation of the global capital markets that teaches students in grades four to 12 about economics, investing, and personal finance. As a competition, it motivates students to learn and prepares youth of all backgrounds for financially independent futures,” said Melanie Mortimer, President of the SIFMA Foundation, which administers and maintains The Stock Market Game.

Twenty million students have participated in the Stock Market Game since 1977. Student teams each receive (an imaginary) $100,000 in their game portfolios, to invest in stocks, bonds and mutual funds, earn interest on their money, pay interest on debt, and learn about the complex financial system.

And the game’s resources aren’t limited to teachers and students. They are available to the public, providing a valuable educational resource to anyone who wants to learn. But the game’s greatest value is in its design as an immersive activity.

“The Stock Market Game offers young people a different way to learn,” Mortimer said. “They’re immersed in the markets and given the tools to research, make informed decisions and see how their investment choices perform. They get real-time feedback from the marketplace, from their peers who are also competing, and from their teachers. The Stock Market Game provides a safe space for youth to practice and prepare for the real world of investing.”

Flexible Design Brings Financial Literacy to Classrooms

The Stock Market Game began at Buffalo State University, where it caught the attention of a financial professional at the Securities Industry Association. The program received funding for expansion based on its potential to serve as a broad foundation for national financial education.

That came at a time when financial education was not as pervasive and accessible as it is now. Today, third-party institutions, including banks and credit unions, often provide financial education in schools. The Stock Market Game is a valuable tool that teachers can adapt to their classroom needs while providing a practical, hands-on experience.

“We started with the insight that while investing might be for adults, learning about investing should serve all ages,” Mortimer said.

Investing includes learning a host of generally useful information, including economic principles and mathematical proficiency. It also fosters an interest in current events and their impact on the economy, which can affect other areas of life.

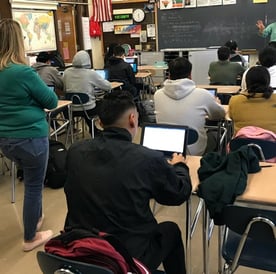

The Stock Market Game’s effectiveness is a result of its design. It is participant-driven, and grants students the agency to make their own choices and learn by doing rather than through rote instruction. It is flexible enough for implementation in any class, not just economics.

“Teachers can choose the time of year to participate and the duration of their Stock Market Game session,” Mortimer said. “They have access to Stock Market Game lessons that are mapped to subject matter requirements across the curriculum, so whether they’re an English teacher, biology teacher, or family and consumer sciences teacher, they can fulfill their teaching requirements. And so it doesn’t compete with what’s already offered in the classroom.”

Practical Teaching Preps Students for Entrepreneurship

Hands-on learning doesn’t just teach information in the abstract; it also helps develop problem-solving skills and inquisitive mindsets. Those can be more applicable to everyday life than knowledge gained from a book or a lecture.

“The Stock Market Game is hands-on learning at its best, enabling individuals to prepare for social, economic and civic opportunities, choices, and decisions they’ll be making in life,” Mortimer said.

Students become acquainted with complex subject matter, minus the intimidation factor, by participating in a stock market simulation. That complexity is broken down and manageable with information, guidance and practice built into the simulation and curriculum.

The Stock Market Game does more than teach about the stock market; it prepares students to apply their knowledge as entrepreneurs.

“Students learn that business start-ups can turn to the financial markets for capital and can also feed the markets by going public, building shareholder value, and eventually, providing their own employees 401K plans to save for retirement,” Mortimer said.

When people understand how businesses and economics work, they can participate and succeed in their ventures. And the more they succeed, the more financially healthy they can become. That can include elimination of more consumer debt.

“Understanding the role of the capital markets in business development is key to successful ventures,” Mortimer said. “The Stock Market Game introduces young people to these concepts and opens them to a world of opportunity.”

Learning About Money Management Leads to Stronger Financial Futures

The Stock Market Game also provides an education in personal finance, which everyone — businessperson or otherwise — will need throughout their lives.

“Students participating in The Stock Market Game exhibit and report better behavior around saving and adults who teach the program are more inclined to research and invest in their retirement,” Mortimer said.

Building savings early in life can be incredibly beneficial. In addition to establishing a positive behavioral pattern that will persist into adulthood, savings also reduces the need for loans or other debt later in life.

Investing is the next evolution of the savings habit. By investing early, individuals give their portfolios more time to grow and absorb risk, and they’ll likely have a stronger financial basis for meeting emergency expenses or preparing for retirement.

“FINRA found that only 34% of Americans can correctly answer four out of five basic financial literacy questions. How can we expect to make good financial choices if we lack the knowledge to do so,” Mortimer said. “Something needs to change, and that’s where SIFMA Foundation’s work becomes critical.”

Real Solutions for Pressing Problems

Education can provide a pathway to pulling the United States out of its financial doldrums. That has been the goal of many financial institutions and their community partners in recent years.

However, they often deliver instruction through classic, linear methods rather than through direct engagement.

“In 2020, financial illiteracy cost Americans $415 billion,” Mortimer said. “That blew my mind. That’s $1,600 per person lost. Now imagine if we could give that $1,600 back this country and back to people. What a better ending to our story.”

The Stock Market Game shows that hands-on education has a significant impact on financial attitudes and behaviors. Learning through engagement early in life can solve problems before they happen, from the bottom up instead of propping up a faulty infrastructure.

“We need to bring financial education into every elementary, middle and high school, so every child is exposed to personal finance early in life,” Mortimer said. “Their future depends on it and the health and welfare of our economy and our country depend on it.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.