In a Nutshell: Interacting and transacting online isn’t an option for consumers but a near necessity. That makes people more vulnerable to identity theft and the lasting financial and reputational damage it can cause. Unfortunately, confusing information security solutions leave many wondering how to protect themselves. IdentityForce provides a clear strategy to help consumers safeguard their identities and finances. That has earned the company our Editor’s Choice™ Award for its easy-to-use tools, personalized guidance, and up-to-date educational content.

They say money is the root of all evil, and that’s certainly true when it comes to identity theft. Although scams often directly aim to steal personal information for monetary gain, money is the motivator even when the threat is reputational damage from blackmail.

Either way, data breach threats put our growing online lives to a daily test as cunning criminals leverage technology to devise more sophisticated ways to take people’s cash.

Those who read the news are left wondering when an attack will come for them. Turning to the web for guidance unleashes a word salad of sales pitches for products that may or may not work as advertised. It’s enough to make stressed-out consumers give up and hope the inevitable never comes.

Instead of plugging their ears and saying la la la, people need to appreciate how IdentityForce, a TransUnion brand, stands out in the crowded information security space.

Offered by the Consumer Interactive group of the credit reporting agency TransUnion, IdentityForce is a comprehensive yet easy-to-use identity theft and financial protection solution. It combines advanced data protection and credit management tools with personalized guidance and educational content to confirm for people that they’re on the right track.

TransUnion Head of Consumer Credit Education Margaret Poe said the force behind IdentityForce is its acknowledgment that data identity and credit management are intertwined. IdentityForce collects all the relevant information and insights in one app to give users maximum control.

“So much of our lives are managed digitally today, and keeping watch over your personal data can take a lot of effort,” Poe said. “IdentityForce lets you manage your credit and identity in one place and move on with your life.”

That’s a recipe for peace of mind in today’s chaotic online world and why IdentityForce has earned our Editor’s Choice Award.

Identity Safety Score Provides Personalized Assessment

As one of the three major US credit bureaus, TransUnion collects copious amounts of consumer financial data and packages it into credit reports. These reports, in turn, inform the credit score.

Credit scores from TransUnion and the other two bureaus predict a consumer’s ability to repay loans, but they can impact other areas of life, too. Low credit scores result in more expensive credit, higher insurance rates, less access to reasonable rentals, and even reduced employment prospects.

Damage from an identity theft incident isn’t just a hassle to fix. When identity theft leads to fraudulent credit applications and debts in their names, consumers see damage to their credit scores. That’s why IdentityForce combines identity theft protection and credit management via one dashboard through a single app.

It’s also why IdentityForce distills the status of a consumer’s risk of fraud down to a single number, the Identity Safety Score. Like a credit score, the Identity Safety Score assesses users’ threat status based on their unique breach history and risk exposure.

“It shows the data breaches you’ve been impacted by, the severity of those breaches, and what they might mean for you,” Poe said. “It also knows the actions you’ve taken to mitigate the threats, combines and considers all of that, and gives you a score between one and 100.”

Then, it tells you what to do about it, offering personalized guidance to get you out of whatever mess you’re in regarding your fraud-threat status. Paired with that is 24/7 customer support, which can connect users to dedicated resolution specialists for human intervention in particularly sticky situations.

Consumers are used to credit scores, and many know how to obtain them from their bank or money management app. IdentityForce extends that model to identity theft and provides support when needed.

“Identity situations are scary, and people feel panicky and don’t know where to start,” Poe said. “Having those resources and guidance can really help a lot.”

A Full-Service Identity and Credit Management Solution

That’s not nearly all there is to IdentityForce. Poe said the app excels as a comprehensive data identity and credit management solution.

Identity theft monitoring looks for exposure relating to changes in personal address or SSN info, court records, credit reports, and activity on the dark web, payday loan sites, sex offender registries, and social media sites.

Alerts regarding activity regarding banks, credit cards, investment accounts, and changes in the monitoring attributes above occur via push notifications, text, or email.

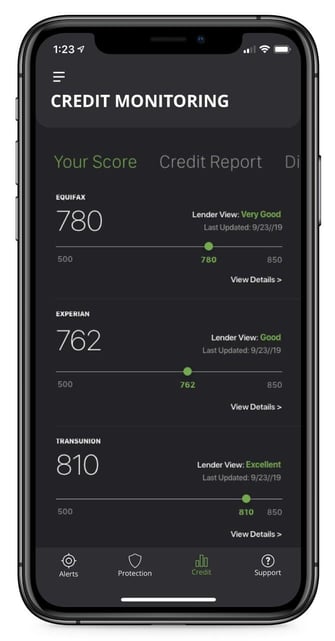

IdentityForce offers users control via access to credit reports and scores from the three bureaus and a tracking tool to integrate credit and data identity management. Users can dispute items on any report and initiate disputes through the app.

In addition to providing links to the three credit bureaus to initiate a credit freeze, IdentityForce also includes a tool to lock and unlock their TransUnion credit report with the touch of a button. Plus, a simulation tool helps users understand the effect of adding and discontinuing credit lines on credit scores.

“The simulation tool answers questions that come up all the time with consumers trying to clean up their credit,” Poe said. “There can be unintended negative consequences to shutting down cards, and we offer people friendly reminders about that.”

IdentityForce also offers recovery services in the unlikely event that a data breach occurs. Those include access to a restoration team, up to $2 million in identity theft insurance, encrypted storage for important personally identifiable information, a password manager, and many other tools and features to create a secure environment for online activity.

“It’s nice that everything’s bundled in one place,” Poe said. “People are thinking about credit and data identity at the same time, and you can just click through, look at everything, and make sure you feel good. If anything’s off, you can take action.”

Educating Consumers About Evolving Scams and Threats

IdentityForce lives up to its commitment to consumer education in many ways. That’s good, considering those out to perpetrate evil acts are endlessly creative.

Tooltips and experience popups clue users in when relevant topics emerge during app use. IdentityForce also plugs into TransUnion’s extensive research and content creation capability.

TransUnion pushes extensive educational content, including an annual fraud report, out to users and consumers over the web and via other channels. Content includes original research around fraud, including an annual report and other long-form pieces. The team produces infographics, webinars, and videos and generally tries to be as helpful as possible.

The idea behind TransUnion’s marketing and communications strategy is that people consume content in many ways, and the important thing is to be there when needed.

“We know people are out there looking for information but may not always be actively searching for it,” Poe said. “We try to connect with them where they happen to be.”

Recent TransUnion data indicates the average consumer cost of an identity theft breach is more than $1,300. Given that many studies show a majority of Americans don’t have sufficient emergency savings to cope with a sudden $1,000 expense, it’s clear that identity theft poses a significant short-term risk for many.

Longer-term impacts on credit scores box people out of opportunity and require extensive repair. IdentityForce pricing tiers let users balance cost and security by choosing protection levels they’re comfortable with.

With child identity theft on the rise, it’s increasingly apparent that families interested in securing their financial legacy need some form of proactive identity theft protection. IdentityForce ticks all the boxes for individuals and families looking for a set-it-and-forget-it solution.

“You feel like you have a system, you’re being proactive, and you’re checking in regularly,” Poe said. “IdentityForce gives you the comfort of having it all in one place.”