Budgeting for the holidays seems simple, but it can be a rather complicated process when you consider the endless seasonal expenses that creep up this time of year, many of which are easy to overlook. While planning for gifts is a no-brainer, other costs and activities — such as a hostess gift for a last-minute holiday party or a fundraising event at your child’s school — can pop up without much notice. Even those with the best spending intentions may find themselves carrying a heavy credit card load, leaving them feeling more stress than joy.

A recent holiday spending study from CardRates.com found that 45% of consumers planned to budget $250 to $500 for holiday expenses, with 6 in 10 of these shoppers saying they would dedicate 50% or less of this amount to gifts. While this may seem like an adequate amount to put toward seasonal festivities and purchases, stubborn inflation, and unplanned expenses can quickly eat away at this budget.

But whatever the reason for overspending this season, quickly paying down holiday debt should be on the top of your list once all the gifts are unwrapped. Follow these five simple steps to pay down holiday debt quickly.

1. Create a Repayment Plan

Paying off holiday debt can feel like an unattainable goal if you don’t have a detailed plan to keep you on track. Figure out how much you can afford to pay each month and set mini milestones along the way to give you a sense of accomplishment and motivation.

Tapping into apps like Debt Payoff Planner can make the debt repayment process less overwhelming. It will show you how long it will take you to pay off your balances and recommend which cards to focus on first to make the biggest impact on your budget.

2. Transfer Your Balances

Thanks to high credit card interest rates, which are now hovering over 24%, paying down debt is harder than ever. Using a balance transfer card can give you some temporary relief against these high rates, allowing you to pay down balances faster and save money on fees.

| Amount Transferred to the New Card | Cost of 3% Balance Transfer Fee | Estimated Interest Saved Over 12 Months |

|---|---|---|

| $1,000 | $30 | $200 |

| $2,500 | $75 | $500 |

| $5,000 | $150 | $1,000 |

| $7,500 | $225 | $1,500 |

| $10,000 | $300 | $2,000 |

Balance transfer cards offer an interest-free repayment period that can range from 12 to 21 months, depending on the promotional offer. During this time, your entire payment goes toward shrinking your credit card balance so nothing is wasted on interest fees, allowing you to pay off your debt faster.

Before applying, compare balance transfer cards to find an option with the longest no-interest term that meets your credit rating — and watch out for any fees.

3. Go on a Spending Diet

Spending diets are a great way to reset your finances and kick-start the debt repayment process. Whether you opt to cut spending for a week or month, the same rules will apply — make a detailed list of your daily necessities and cut spending on the rest during this period.

Not only will this free up extra cash in your monthly budget to put toward your credit card balances, but it will also give you time to reflect back on the poor habits that caused you to rack up debt in the first place.

4. Cut Monthly Bills

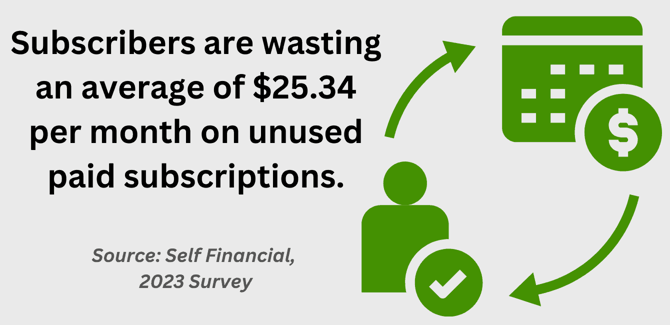

Monthly bills are likely your least favorite way to spend your money, making it the easiest place to hack spending, especially if you’re paying for a service you aren’t using. According to a survey from Self Financial, nearly 55% of consumers say they have at least one unused paid subscription.

Spend time reviewing monthly bills and cancel services you don’t need or use. Negotiate with current providers to see if you qualify for a lower rate, ask about bundling insurance plans for discounts on premiums, or consider switching services completely if you find a better price at a competitor. The extra cash you save on these monthly services will go far in reducing your holiday debt.

5. Boost Your Cash Flow

There’s only so much you can save by limiting daily purchases and cutting monthly bills. If you still can’t find enough wiggle room in your budget to make a bigger dent in your credit card balances, think about how you can make some extra cash.

There are a variety of side hustles you can do from home and in your spare time to bolster your budget. For instance, if you enjoy animals, pet sitting can be a lucrative and fun gig. Sign up through sites like Rover.com, which says you can make up to an extra $1,000 a month. Virtual tutoring is another flexible option, paying between $20 to $50 per hour.

You can rent a spare bedroom to travelers on Airbnb, your car when it’s not in use via GetAround.com, and baby gear through BabyQuip.

Finally, don’t overlook all your new holiday gifts as a source of potential cash flow. If there’s something you really don’t like and don’t plan to use, sell it for cash online. You can even get cash for unwanted gift cards through secondary gift card marketplaces like Raise or CardCash.

Holiday debt doesn’t have to wreak havoc on your finances as long as you take control and commit to a repayment plan.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.