High fuel prices, a cold snap, or a heat wave can cause your utility bills to bust your budget. But failure to pay can result in a shutoff notice from your energy supplier, followed by a feeling of panic.

A quick loan for utility bill financing can keep your phone, gas, or electric service functioning as you work out a more permanent solution. A loan is a good alternative if you don’t have a credit card or your credit card doesn’t offer a sufficient credit line.

We review loans and a pair of government programs that can prevent a phone or energy supplier from disrupting your life. You can qualify for any of these offers even if you have a bad credit score.

Personal Loans For Utility Bills

The following companies can arrange a personal loan you can use for gas, phone, and electric bill financing. You can then repay the loan in monthly installments that fit your budget. Make sure you pay on time to help build credit and avoid a late fee.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

2. Avant

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $2,000 to $35,000 | 9.95% – 35.99% | 12 to 60 Months | See representative example |

3. Upstart

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn’t impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% – 35.99% | 3 or 5 Years | See representative example |

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

5. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

All five companies are loan-finding services that work with networks of direct personal loan providers. You can submit a short loan request form to prequalify and receive one or more offers. The service is free, and the lender can put the loan funds in your bank account as soon as the next business day.

To prequalify, you must meet the following requirements:

- Minimum age of 18

- US citizenship or permanent residence

- Sufficient monthly income to repay the loan

- Social Security Number or equivalent

- A bank account in your own name

- A valid email address and phone number

Loan funds are available to consumers or small business owners with any type of credit. Many lenders welcome small business customers.

You’ll have a loan term of at least three months to repay the loan in equal installments. You can request a longer loan term to lower your monthly bill payments and reduce the risk of a late fee. Most lenders report your loan payment activity to at least one major credit bureau, giving you a way to help rebuild credit by paying the bill on time each month.

The maximum APR on personal loans is 36%, but you may receive loan approval at a significantly lower interest rate. You can also apply for a secured personal loan, in which you pledge your property as collateral to facilitate the loan.

Secured loans generally cost less than unsecured loans, and loan approval is much easier. If you encounter problems with a direct lender, you can contact the Consumer Financial Protection Bureau to lodge a complaint.

Other Options For Utility Bills

You have other solutions available to you besides a personal loan. These four suggestions can help you pay your utility bills and financial energy efficiency improvements when money is tight.

6. Credit Union PALs

Payday Alternative Loans (PALs) are unsecured loan products from credit unions for consumers who want to avoid the high costs of a conventional payday loan. The National Credit Union Administration (NCUA) created PALs to fight predatory payday loans by providing affordable short-term loans that you can repay in installments.

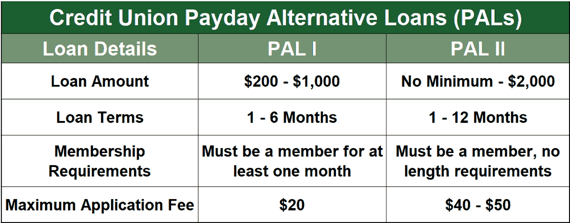

The following chart compares the two types of PALs:

Nearly every credit union offers PALs, although some may not offer both types. You can use the national credit union locator tool to find a nearby credit union that can provide you with a PAL loan amount of up to $2,000 with a loan payment term of up to one year at a competitive interest rate. Only credit union customers can qualify for a PAL.

As a utility customer, you may be able to use a PAL to pay for energy efficiency upgrades that provide energy savings. Those energy savings may offset the loan cost – customers can arrange an energy audit with their utility provider to quantify the savings from energy efficiency upgrades.

7. 401k Loans

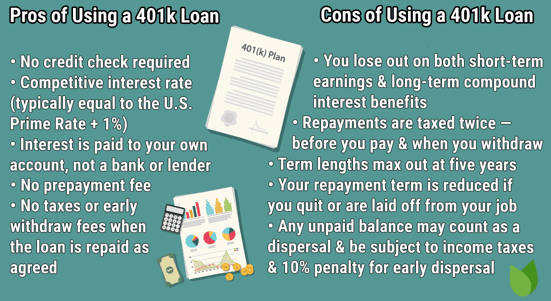

You can borrow from your 401k if your plan administrator permits it — not all do. You can borrow up to the lesser of $50,000 or half the balance. But you can borrow up to $10,000 even if that is more than half your balance.

You must repay your loan, with interest, within five years. The loan interest, minus fees, goes back into your account.

Borrowing from a 401k for utility bill financing may not be an available solution for any of the following reasons:

- You don’t have a 401k account

- Your 401k administrator does not permit loans

- It can take weeks to arrange a 401k loan

- Most 401k loans charge a fee

- The money you borrow doesn’t earn interest-free growth until you repay it

- The IRS will treat the unpaid loan amount as a taxable withdrawal if you don’t repay by the deadline.

If you can overcome these challenges, your 401k may be helpful when you need low-cost utility financing to help pay the bills or finance energy efficiency improvements.

8. Low Income Housing Home Energy Assistance Program

The Low Income Housing Home Energy Assistance Program (LIHEAP) helps needy families with high energy costs stay healthy and safe. It offers financial assistance for:

- Home energy bill payments

- Installing an energy efficiency measure

- Weatherization

- Energy upgrades

- Switching to renewable energy sources

- The effects of an energy crisis

- Minor home repairs related to energy

Financial assistance is available for closing costs, and rental housing units are eligible for this payment plan.

A LIHEAP payment plan can help households with low incomes, particularly those with steep home energy costs (i.e., a high percentage of income that goes to energy bill payments) and/or members who are disabled, elderly, or young children. The federal government funds LIHEAP through grants to the states, which administer the program in conjunction with the state’s utility companies.

According to the Department of Housing and Human Services:

“Grant recipients [i.e., states] must target benefits to households with low incomes. They may set their own LIHEAP income-eligibility limits; however, they must cap those limits at (1) no more than the greater of 150% of the Federal Poverty Guidelines (FPG) or 60% of the State Median Income, and (2) no less than 110% of FPG. They must also give higher benefits to households with the greatest home energy need in relation to household income and number of household members.”

For help obtaining a payment plan for unaffordable monthly bill amounts or financing energy upgrades, find your local intake providers using LIHEAP’s local office search tool. You can also contact the customer service desk of your utility provider in an emergency or to find out about renewable energy alternatives.

9. Lifeline

The Federal Communications Commission (FCC) offers the Lifeline Program to help low-income consumers pay for mobile and landline telephone services. Some people may be eligible for a free phone — you can contact the utility customer service department of your local provider for details.

As of December 1, 2021, qualified families can receive monthly stipends of $5.25 for voice and $9.25 for broadband. An eligible consumer may receive a discount on either a wireline or wireless service, but not both. In addition, the program promotes access to wifi devices, and up to 75% of these devices must have hotspot functionality.

You may be eligible for Lifeline if your income is at or below 135% of the Federal Poverty Guidelines or you receive support from any of these programs:

- Supplemental Nutrition Assistance Program (SNAP)

- Supplemental Security Income (SSI)

- Medicaid

- Federal Public Housing Assistance

- Tribal-specific programs: Bureau of Indian Affairs General Assistance, Tribally-Administered Temporary Assistance for Needy Families (TTANF), Food Distribution Program on Indian Reservations (FDPIR), Head Start

- Veterans Pension and Survivors Benefit Programs

You can contact your eligible telecommunications carrier to learn more about its current low-cost offerings.

Keep Your Utilities Working With the Right Loan

Losing your access to phone, heat, or electricity service is more than a nuisance — it can endanger your life. Loans for utility bills help you get through those times when you can’t afford to pay alone. These loans are available even with a bad credit score.

You can also apply for government programs that help low-income families pay the bills from utility companies. As climate change makes winters colder and summers hotter, know all your utility payment alternatives to keep your family safe, whatever the weather.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.