Thanks to the Fair Credit Reporting Act (FCRA), consumers have the right to view their credit reports and take action if the information on those reports is inaccurate or unsubstantiated. Often referred to as credit repair, this process allows you to take control of your credit report and dispute unfair accounts.

Congress designed the FRCA to protect the integrity and privacy of credit data. It requires the credit reporting industry to ensure your information is fair, accurate, and confidential. The FCRA guarantees your right to monitor and correct inaccuracies in your credit reports.

For many, the easiest way to benefit from credit repair is by hiring an experienced credit repair company to act on their behalf. Unfortunately, figuring out which company to trust with your credit and cash can be challenging.

That’s because some parts of the credit repair industry have occasionally been known to engage in unscrupulous business practices or employ questionable or illegal practices to improve credit scores.

That’s why Congress passed the FRCA: to protect consumers and remove unscrupulous companies from the marketplace.

Established in 1997, CreditRepair.com has been helping people resolve their credit report issues for 20 years. Read on for our CreditRepair.com review. According to Scott Smith, the company’s president, CreditRepair.com is more than a dispute mill; it “leverages a whole range of consumer protection statutes in the service of improving somebody’s credit reports — and this goes beyond simple disputation.”

In this article, we’ll offer our take on the credit repair company, explore consumer reviews, and give readers an idea of what to expect should they choose to work with CreditRepair.com.

Our Take | Consumer Reviews | What to Expect

Flat-Rate Pricing, Tons of Access, and a Transparent Process

Given that the consumer credit industry is heavily monitored and regulated, one of the first indicators of a company’s quality and reputation is endurance. For a company to have reached its 20th year in the industry implies a certain level of commitment to staying within the rules that can be comforting to many.

More than that, however, CreditRepair.com’s two decades of credit repair represent extensive experience that can be put to use in helping you deal with your credit report problems. In fact, a study of CreditReport.com clients saw an average of 11.6 removals across their three credit reports.

Perhaps one of the biggest draws of CreditRepair.com’s services is the simple, flat-rate pricing. The company charges every client a single monthly rate for its services, with no long-term contracts or obligations. And while you’ll pay a one-time fee for the initial obtention of your credit reports, the company won’t charge any hidden fees.

And before you even get started in the program, you’ll receive a lot of freebies, starting with your free, personalized credit consultation. You’ll also get free access to your credit report summary, an audit of your accounts, and a free credit score evaluation, complete with recommended solutions.

Additionally, CreditRepair.com makes it easy to access your account and check on your credit repair process at any time. You can log into your personal online dashboard 24/7 and access your information on the go with the mobile application, which works on Android and iOS devices. The credit score tracker and analysis can help you stay on the right path, and clients can even set up text and email alerts to ensure their report stays in top shape.

CreditRepair.com tries to maintain a transparent process, laying out on its website exactly what clients should expect from the company’s three-step credit repair process. Visitors can also find a wide variety of credit education resources, including articles and guides on everything from improving your credit to dealing with identity theft.

A 7.1 User Score from BestCompany Reviewers

Of course, while you’re welcome to take our word for it, all reasonable financial due diligence should involve seeking out a variety of opinions for the best results. Thankfully, the internet has opinions to spare. In fact, CreditRepair.com’s website has dozens of customer reviews.

And on BestCompany.com, you can find more than 1,600 CreditRepair.com reviews from clients across the country — reviews that add up to a solid 7.1 user score. The general consensus? Clients love the knowledgeable staff and positive results.

“These guys go the extra mile to try and get positive results for people like me. They explain everything precisely; any questions you may have, feel free to ask. They are very patient and no question is a stupid one. They explain what and why, and when the next step is. No one will be disappointed!” – Sharon, BestCompany.com Reviewer

Another BestCompany.com reviewer praised CreditRepair.com’s excellent customer service and frequent updates.

I’m so happy that I made the decision to start working on my credit with credit repair. Because the customer service is really good and they’re always giving me updates about my credit. I really appreciate all the hard work and help that I’m getting with credit repair. – Angela, BestCompany.com Reviewer

As with just about any business, however, it’s not all rainbows and happy trees in CreditRepair.com’s reviews. The majority of the negative reviews are from customers who didn’t see the progress they hoped, with most complaining that the process took too long or didn’t improve their score as much as they anticipated.

“They were able to get less than 10 accounts deleted in 5 months out of 60 and no major accounts that made a significant impact on my credit score like deletion of repos, or civil or major accounts with negative impact.” – Junior25, TrustPilot Reviewer

Despite being clear on the fees it charges, a number of reviewers are also unhappy about the cost of the service. And similar to most services based on subscription payments, a number of the complaints center on the service being difficult (i.e., involve a long phone call) to cancel.

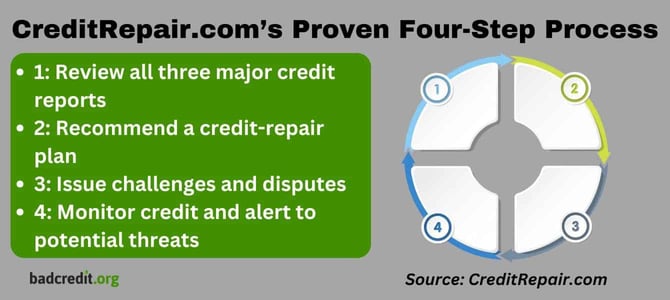

CreditRepair.com Uses a Four-Step Process

By reading the reviews, it’s clear that a big part of finding success in the credit repair process is to know what to expect before you get started. At CreditRepair.com, the team uses a four-step process to address each client’s overall credit situation.

It all starts with step one, the review. When you sign up, your representative pulls your reports from the three major U.S. credit bureaus and organizes the information to enable you to identify the items you’d like to dispute.

Items for potential dispute include report entries that have a negative effect on your credit scores, inaccurate information in public records that could impact scores, and open or closed accounts erroneously attributed to you.

Because reporting quality varies widely among organizations working with credit bureaus, the review also checks account opening dates and debt balances for accuracy.

Then, with information on your credit situation and goals, the team recommends a personalized game plan to fix your credit.

Every plan recommendation from CreditRepair.com includes a credit report analysis to explain why the team is making its recommendations. Users receive access to a case management dashboard to monitor how Credit-Repair.com handles the disputed items.

With a plan of action in place, the next step is to issue challenges and disputes. CreditRepair.com has issued over 23 million challenges and disputes on behalf of its members since 2012.

During the challenge step, CreditRepair.com initiates an ongoing conversation between the client, the client’s creditors, and the credit reporting bureaus. The company’s experts communicate directly with each party to address issues, asking tough questions to probe deeply into report details.

Negative items must be removed when there is no proof that they are fair and accurate. The CreditReport.com team constantly stays in contact with the bureaus to ensure that agreed-upon changes have actually been made to your reports.

In step four, Creditrepair.com ensures situations don’t arise again in the future by monitoring your credit and alerting you to potential threats. Every plan includes up to $1 million in identity theft protection with alerts of possible security risks.

On average, CreditRepair.com clients see 7% of the negative items on their credit reports removed each month. Additionally, CreditRepair.com aims to have an enduring positive impact on your credit health that extends beyond your time with them, providing credit score monitoring and educational resources to help you stay on track.

An Average Credit Score Increase of 40 Points in 4 Months

Credit repair can be a simple way to remove mistaken, outdated, or unsubstantiated information from your credit report, and the credit repair process can be an effective way to improve your credit score.

For example, the typical CreditRepair.com client experiences an average credit score increase of 40 points over four months of service. Depending on what your score is to begin with, a 40-point increase can potentially boost you into the next credit tier and open up a new range of credit or loan offers to you.

It’s difficult to overestimate the importance of a good credit score. The relatively minor cost of working with the team at CreditRepair.com can result in lower interest rates on credit and loans, higher credit limits, lower insurance premiums, easier approval for rental housing, and better job prospects.

The key thing to keep in mind when considering credit repair, regardless of which company you select, is that the process is very individualized. The actual results, including how long the process takes and the number of points your score increases, can vary significantly based on your circumstances.