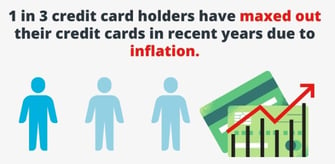

In a Nutshell: Federal Reserve data shows credit card debt rising to a staggering new high of $1.13 trillion as of Q4 2023. The 2024 Credit Card Debt Survey by Debt.com endeavors to find out why. More than one-third (35%) of survey respondents have maxed out their credit cards in recent years as inflation and interest rates have increased. More than 8 in 10 of those surveyed said they have used their cards to make ends meet due to price increases from inflation. Debt.com has a decade of history helping millions of Americans get out of more than $12 billion in debt. This new survey illustrates the risks Americans take to deal with inflation’s ongoing threat.

America’s credit crisis has reached alarming new heights. The Federal Reserve Bank of New York’s Household Debt and Credit Report for Q4 2023 measured total U.S. credit card debt at $1.13 trillion, up 4.6% over the previous quarter.

Those numbers suggest that rising consumer costs have put significant pressure on the credit system as the economy emerges from the COVID-19 pandemic. With the Consumer Price Index rising 0.4% in March 2024 and annual inflation on an upward trend at 3.5%, many Americans are struggling to make ends meet.

Debt.com‘s 2024 Credit Card Debt Survey probes the dynamics behind those trends to understand consumer pain points and explain why card debt continues to rise. The latest in an annual series, the 2024 report chronicles the average American’s financial struggle during a high inflationary period.

Debt.com is a leading U.S. credit counseling provider ideally positioned to deliver these insights. Founded by longtime debt-relief leader Howard Dvorkin in 2013, Debt.com has helped millions erase more than $12 billion in debt. It offers counseling, management, consolidation, and settlement services to consumers facing credit card, tax, medical, and student loan debt.

Debt.com surveyed 1,000 adults nationwide to produce its 2024 findings. Among many significant conclusions, more than one-third of respondents (35%) said they had “maxed out their credit cards in recent years while inflation and interest rates have increased.” More than 8 in 10 of those (85%) said “price increases from inflation made them use their credit cards to make ends meet.”

The amount of debt consumers are racking up adds significance to these numbers. One in five respondents (22%) reported carrying $10,000 to $20,000 in credit card debt, with slightly more than 5% holding more than $30,000.

“We get a good sample, dig through it, and ask questions,” Dvorkin said. “It’s clear that America’s ongoing love affair with debt has evolved.”

Changing Generational Attitudes Toward Debt

Dvorkin built a successful CPA career in the late 1980s, helping people escape bank debt. But he didn’t understand the extent of America’s credit problem until he got married and purchased a home.

His CPA clients were primarily wealthier people. As a homeowner, he began using credit cards liberally when he didn’t have cash available.

Then the chickens came home to roost. Dvorkin had been using credit cards to purchase everyday items like groceries and gas. Excess spending led to thousands in monthly bills. He realized consumers with less money than him faced an even bigger threat.

That’s the threat the 2024 Debt.com survey probes. The survey found a significant generational component regarding changing American attitudes toward card debt that partially explains the crisis.

More than 4 in 10 respondents (45%) reported that “price increases from inflation caused them to use credit cards to make ends meet.” That figure included 67% of the millennials and more than half (53%) of the Gen Xers surveyed.

“Parents drilled the lessons of the Great Depression into the heads of baby boomers like me: Debt is not something to live with,” Dvorkin said. “But Millennials accept it. Chances are, their parents are in debt, so they’re second-generation debtors.”

Dvorkin said the generational differences manifest most clearly in tolerance among younger generations for carrying what he considers bad debt. While mortgages, auto loans, and student loans yield positive results — home price appreciation, better transportation access, and educational advantages — bad debt funds purchases with no lasting value.

“Bad debt is charging a cup of coffee at Starbucks or buying clothes that quickly go out of style,” Dvorkin said. “Purchasing an expensive television at half price doesn’t make sense when the bank charges you 20% interest and you’re still paying it off after four or five years.”

How Post-Pandemic Spending Exacerbated Inflation

There’s also a generational component among respondents who reported maxing out their credit cards in recent years. Among the 35% who reported resorting to that strategy, 49% were millennials, 23% were Gen Xers, 17% were Gen Z members, and only 11% were baby boomers.

Among the more than half of respondents (55%) who reported using credit cards to pay for a financial emergency, nearly 73% were millennials (and 55% were women). More than half of respondents (51%) said inflation “caused them to carry a larger monthly credit card balance.” More than a third with at least $10,000 to $20,000 of card debt (41%) were millennials.

Dvorkin said younger Americans emerged from the COVID-19 pandemic in the mood to spend after consumption declined significantly during the shutdowns. When everyone could move about again, increased demand fueled inflation.

“What we call revenge travel is an example, and people are packing into restaurants and other public places,” Dvorkin said. “The excess — especially in the millennials we talked to — is going on their credit cards.”

Structural factors contribute to the added burden. Dvorkin said minimum wage hikes increase purchasing power and consumer costs. The hikes produce wage creep, where workers in higher earning tiers demand more.

“Businesses don’t absorb those expenses — they just pass them on,” Dvorkin said.

Relatively higher taxes are a factor in some states. Migration from high-tax to low-tax states such as Texas and Florida increases demand and costs in those destinations. Credit card debt is the counterproductive solution to this back-and-forth between higher costs and higher demand.

“Millennials are living a lifestyle on their credit cards,” Dvorkin said. “They’re trying to duplicate the lives they see online without the proper resources.”

Debt.com: Personalized Approach Helps Millions

Facing thousands in card debt, Dvorkin decided to put his financial expertise to work and do something about it. In 1993, he founded Consolidated Credit, now the world’s largest credit counseling agency. Consolidated Credit has helped more than 10 million consumers consolidate more than $9.75 billion in debt.

But there was more to do. Dvorkin searched for a business model that would allow him to help a larger percentage of consumers. The result was Debt.com.

Debt.com offers services to those overburdened by credit card, tax, student loan, and medical debt. The firm aims to provide something for everyone. The team treats each of the millions of consumers it has served as an individual.

“Our attitude is that everybody who comes in here is unique, and what’s good for one isn’t necessarily good for another,” Dvorkin said.

Copious financial education resources help consumers understand their predicament and prioritize steps to overcome it. Many turn to Debt.com’s Instant Debt Advisor for perspective.

The team evaluates personal income, household budgets, and debt loads to determine the right solution. The team offers free encouragement and education to some people. It also refers consumers to highly qualified professionals.

“We connect many to certified credit counselors who can guide them to the debt plan that’s right for them,” Dvorkin said.

Some consumers need debt management, which leaves their credit score intact but may take years to resolve. Others are best suited to a settlement solution in which a Debt.com professional negotiates a structured partial repayment. Even bankruptcy is sometimes a viable option.

For Dvorkin, the bottom line is that more people need help than ever. Recent Fed and consumer-price numbers back that up, and the Debt.com 2024 Credit Card Debt Survey reinforces them. Dvorkin urged American consumers to spend within their means. The consequences of excess credit card debt are too severe to ignore.

“Every segment of our population deals with debt a little differently,” Dvorkin said. “The challenge is in realizing when enough is enough.”