In a Nutshell: Even the most cautious and organized consumers can find themselves in dire straits when financial emergencies strike. Lending Bear extends a hand to help consumers who require fast access to cash. The company meets the needs of borrowers by offering numerous lending solutions, including payday, pawn, and title loans. Consumers can access Lending Bear’s products online or visit one of its offices in Alabama, Florida, or Georgia.

Unforeseen circumstances have thwarted humankind’s plans throughout history. For example, the National Hockey League planned to hold its Stanley Cup playoff tournament in the spring of 2020. But the pandemic temporarily made in-person gatherings off limits, forcing the league to cancel the plans for its traditional tournament.

On a smaller scale, gardeners eager to plant spring flowers have been caught off guard at times by vexing late-spring frosts that can cause plants to wither prematurely.

Financial emergencies can similarly frustrate consumers. Regardless of how much a person saves or plans their finances, unexpected expenses can leave them scrambling for fast access to money. Some lenders offer solutions that can help borrowers who need cash quickly.

Lending Bear first opened its doors for business in 1990. The company started in Florida and soon expanded its operations to Georgia. We caught up with Tim Buckley, Lending Bear’s Vice President of Online Operations, to learn more about how the company’s solutions can help consumers in need of fast cash.

Buckley said Lending Bear’s management emphasizes treating customers and employees with respect. The company prides itself on the number of five-star reviews it receives from customers online.

“The way we believe in treating our customers is one of the reasons that we receive five-star reviews,” Buckley said. “For a small company, I don’t know if anybody has generated the amount of five-star reviews we have. And we’re a company that operates in a tough industry.”

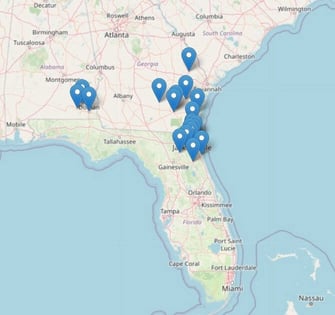

Lending Bear has sought to increase its online presence over the past six years, Buckley said. The company has offices in Alabama, Florida, and Georgia. Buckley’s responsibilities include expanding the company’s online reach beyond the locations where Lending Bear maintains a brick-and-mortar presence. His tasks also include developing the company’s marketing efforts.

Diverse Products Meet Consumer Needs

Companies that treat their staff fairly and respectfully often find themselves rewarded with long-tenured employees. Buckley said Lending Bear has employees who have been working with the company since its founding. The business also has numerous employees who’ve enjoyed stints of more than 10 years with the company.

“It’s really interesting to go to our annual conference,” Buckley said. “I see the same people there every single year. They love the company and its ownership, and they love what they do. It’s just been a good experience here at Lending Bear. I’m really glad to be here.”

Lending Bear’s payday loans provide consumers with loans of up to $500 that they pay back to the company at their next payday. Buckley said Lending Bear’s loans differ slightly based on the state the borrower resides in, so loans the company offers in Alabama may have different terms than loans it provides in Florida.

Lending Bear offers pawn loans to provide borrowers with short-term loans they must repay within 30 days. The company ties the size of the pawn loans it offers borrowers to the value of an item they pledge as collateral.

“If you come back in and repay your loan at your 30-day mark, then you get your item back,” Buckley explained. “If you can’t repay the entire amount of your loan at that time, but you’re able to repay a portion of it, then we’ll give you another 30 days to pay us back. Pawn loans can also differ by state, but they all operate about the same.”

Empowering Borrowers to Manage Their Repayments

Lending Bear offers title loans that can provide borrowers up to $10,000 on titles for various types of vehicles, including cars, motorcycles, and recreational vehicles. Lending Bear offers title loans in Alabama and Georgia. Buckley said regulations prevent the company from providing title loans in Florida, but it does offer installment loans to borrowers who reside in the Sunshine State.

Lending Bear’s installment loans provide borrowers with up to $1,500 they repay in smaller payments than those required for payday loans. Buckley said installment loans are Lending Bear’s fastest-growing product in Florida.

“Whether we’re offering a collateralized type of loan or an unsecured type of loan, you’ve got to trust that the person is going to pay you back,” Buckley said. “Obviously, if you’re operating in a subprime space, the payback rate is a little lower than what you’d have if you were dealing with an individual with a stronger credit profile.”

Lending Bear customers can access their account details and create their repayment process on the company’s website. Customers repay the original amount they borrowed plus interest, but the company doesn’t charge additional fees for its products, Buckley said.

Reframing Opinions About Payday Lenders

Most consumers requiring a payday loan need the money to help them through a financial emergency, such as fixing the air conditioner in their residence or repairing their car. Buckley said Lending Bear understands how to underwrite different types of loans and assess a borrower’s ability to repay a loan.

Lending Bear reviews a prospective borrower’s bank statements to determine their loan eligibility. The company’s underwriters can use bank statements to understand a consumer’s income and past experiences with loans, Buckley said. Lending Bear’s reviews of prospective borrowers do not include a hard pull on their credit profile.

Engaging with Lending Bear doesn’t affect a consumer’s credit rating unless the customer doesn’t repay their loan, which will prompt Lending Bear to give the debt to a third-party collection service. The company rarely passes on debt to collection agencies and prefers to manage collection efforts internally.

Buckley said Lending Bear doesn’t employ autodialers or other methods that can make collection processes feel impersonal to borrowers.

“I’ve been in this game long enough to know that continuing to call people to collect on a debt doesn’t work, especially in this day and age,” Buckley said. “People just aren’t going to answer their phones. What we want our customers to know is we will work with you. We can give you a repayment plan that will allow you to pay us back over time with no additional charges to you. We do want our money back, but we also want you to be able to use our products again.”

Lending Bear contacts borrowers who are behind on repaying their loans to direct them to set up a repayment plan on the company’s online portal. Buckley said customers can access the company’s portal and establish a repayment plan without incurring additional fees.

Consumers who aren’t familiar with Lending Bear may have a negative perception of the payday loan industry. But Buckley said consumers who take the time to get to know Lending Bear and its solutions will find the company isn’t out to harm people or push them into debt.

“We’re not loan sharks,” Buckley said. “We’re legitimate businessmen that know how to operate in this industry. And it’s not always an easy industry to operate in. You have to adapt quickly, and you have to have a great website to be able to compete against other lenders.”