Getting a loan when you have bad credit sometimes requires a little thinking outside the box, such as cash-out refinancing your car. Auto equity loans for bad credit make sense when you own a car worth more than what you owe on it.

We review five loan sources and tell you how they work, how to get them, and how to choose the best one. This type of auto loan is a smart alternative if you qualify for one.

The Best Auto Equity Loans For Bad Credit

These five are loan-finding services rather than direct lenders. They can get you multiple quotes for an auto equity loan, cost nothing to use, and won’t harm your credit.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% – 29.99% | 1999 | 3 minutes | 9.5/10 |

If Auto Credit Express prequalifies you for an auto equity loan, it will arrange for a local car dealer to contact you and discuss your loan options. If you like an offer, you can visit the dealer and complete the transaction as quickly as the same day.

The ACE network is effective because many auto dealerships rely on in-house financing and don’t check your credit. They approve bad credit auto loans that banks routinely reject. If you have the required income and equity, you should be able to obtain quick cash through a vehicle refi.

2. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

LendingTree is famous for its mortgage and personal loan lending. But it also operates in the car loan space and may get you up to five offers within minutes of applying

When you select a loan offer, you can quickly complete the paperwork and submit it for final approval. Many applicants refinance their automobiles in less than 24 hours.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

myAutoloan.com helps consumers rapidly receive multiple refinancing offers. The network’s website offers an interest rate estimator, current loan rates, and a loan repayment calculator.

Some lenders on the MyAutoLoan.com network postpone your first monthly payment for up to 90 days. Consider the loan offers carefully before agreeing to one, as each will contain different repayment periods, interest rates, and monthly payment amounts.

- Prequalify in minutes without impacting your credit score

- Refinancing loans save an average of $191 per month

- 125% financing available for cash-out refis

- PenFed Credit Union membership required but can be applied for at the same time as your loan

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 5.19% and up | 1935 | 5 minutes | 8.5/10 |

PenFed Credit Union can preapprove your loan in minutes and tell you whether you qualify to cash out up to 125% of your car’s value. This credit union can finance your loan at a lower rate than traditional banks.

Its website has several resources to help you make an informed decision about your loan, including a loan calculator, rate chart, and educational guides.

5. RefiJet

- RefiJet helps people lower their monthly auto payment

- Pre-qualifying for a refinance auto loan does not impact your credit score

- Nationwide network of lenders

- Presents you with options from lenders that fit your situation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2016 | 5 minutes | 8.0/10 |

The RefiJet national lending network delivers competitive auto refinancing quotes quickly without harming your credit. You can prequalify in minutes online or by speaking to a RefiJet financial expert who will help you review your options.

RefiJet lenders often waive your first monthly payment for the first 60 days. A RefiJet-arranged loan can unlock your car’s equity and provide quick cash for you to use as you see fit.

What Is an Auto Equity Loan?

Your car equity equals the current resale value of your vehicle minus the balance on its associated loan. When you have positive equity, a lender may offer to refinance your vehicle loan for more than your payoff amount. The new loan pays off the old one, and you pocket the remainder.

Extracting cash from your car’s value is just one motive for an auto equity loan. You may also be interested in reducing your overall costs or monthly loan payment amount. Good times to consider an auto equity loan include:

- You’ve improved your credit score

- You can get a lower interest rate

- You’re dissatisfied with your current lender

- You want to reduce your monthly payments by lengthening your repayment period

A car equity loan is not that different from a secured loan you take to finance a vehicle purchase. The equity in your current car resembles the down payment on a new car — it’s your “skin in the game” for the vehicle equity loan.

All financed cars are vulnerable to repossession if borrowers don’t make the payments. This cushions the lender against losses, which is why you can get an auto loan despite having a poor credit score.

If you’ve ever had a home equity loan or a home equity line of credit, you know about the repossession risk in the form of foreclosures. A lender will foreclose on home equity loans just as they would on primary mortgages. Home equity loans are technically second mortgages.

An auto title loan is different from an auto equity loan. A car title loan is an expensive, short-term secured loan that applies to paid-off cars. Car title loans are not traditional loan arrangements.

You can usually borrow only a limited amount of the car’s value with a title loan and the interest rates are high. You turn over the vehicle title to the lender, which allows for easy repossession should the need arise.

Statistics indicate a 20% chance of a repo due to a vehicle title loan. It’s best to avoid taking a title loan unless you have no other alternative.

How Do I Qualify And Apply For an Auto Equity Loan?

You could drive around your neighborhood, stopping by the local dealerships and banks to see which would offer you an auto equity loan. But online lending networks are more efficient, allowing you to qualify and apply for multiple loan offers by submitting a single request form.

1. How to Qualify

It isn’t hard to qualify for an auto equity loan. You must:

- Be at least 18 years old

- Own the car you want to refinance

- Have enough positive equity in the vehicle to meet the lender’s requirements

- Ensure there are no liens on the car other than the current loan

- Earn a set minimum monthly income, enough to afford the car payment

- Disclose your existing debts, housing costs, minimum credit card payments, and any garnishments on your income

If you successfully prequalify for a loan, you’ll be presented with an estimated loan amount and links to one or more direct lenders.

2. How to Apply

Prequalifying for an auto equity loan doesn’t guarantee final approval, but it’s certainly a good start. You still must apply to one or more of the direct lenders recommended by the loan-finding service.

Applying for a loan may have a small impact on your credit score. Each potential lender may do a credit check, but if you are rate shopping, the credit bureaus will count multiple, closely-timed credit inquiries (i.e., clustered within a 30-day period) as a single inquiry. Rate shopping is common in the mortgage industry but also applies to auto loans.

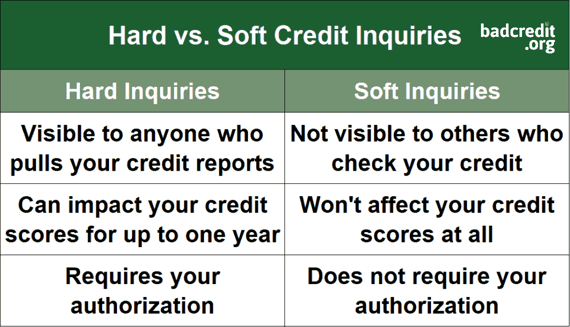

If you’re unfamiliar with hard and soft pulls, they are inquiries about your credit from interested parties (e.g., lenders, credit card companies, employers, landlords, etc.). The FICO credit scoring system bases 10% of your score on applications for new credit.

The scoring system considers frequent hard pulls as indicators of financial distress and can reduce your already bad credit score by a few points each. But receiving new credit can also increase your score, so the final impact is unique to everyone and should be minimal, even if you don’t have good credit.

Only hard pulls will impact your score. You authorize hard inquiries when you apply for a loan or credit card. Hard inquiries appear in your credit history for two years but can only influence your score for one.

Assuming the lender approves your application, you’ll receive all the required forms (including the Loan and Security Agreement) for you to read and sign. The lender will typically want to inspect the vehicle before finalizing the loan.

When you successfully complete all the required steps, the lender will close the refinancing loan in one to 10 business days. If your refinancing involves a cash-out, the lender will send you a check or deposit the money directly into your bank account.

What Interest Rate Will I Get With a Poor Credit Score?

As of December 2022, the average interest rate on a 36-month car refinance loan for someone with a poor FICO score (i.e., 639 or less) is 7.32%.

Interest rates for 48, 60, and 72-month loan terms are 9.51%, 9.27%, and 9.39%, respectively.

Notice that these rates are pretty low, especially when you compare them to an expensive short-term loan (i.e., a title or payday loan). In fact, you may have to pay an APR exceeding 1,000% on a payday loan.

A car loan is also cheaper than an unsecured loan. The lack of collateral makes an unsecured loan riskier to lenders, who must therefore charge higher interest rates.

Remember that interest rates are volatile. The Federal Reserve periodically raises and lowers short-term interest rates, impacting the entire lending marketplace. Any of the reviewed loan networks can provide you with the current refi rates.

Ideally, you want your new APR to be less than the one on your current car loan. But that’s unlikely in the current inflationary environment unless you significantly improve your credit score.

The change in your monthly payments depends on several factors, including:

- A different interest rate

- A new loan repayment period

- The new amount due (i.e., the payoff amount plus cash out)

Ultimately, cash-out refinancing is more expensive than the original loan because you reborrow money on which you’ve already paid interest. Also, expect to pay more interest if you extend the repayment period.

How Do I Choose the Best Car Refinance Loan?

It isn’t always clear which is the best refi loan because of the multiple (and sometimes offsetting) factors involved. These include:

- How much you can borrow: Each lender sets its own policy for the percentage of the car’s value it will refinance. For example, a dealer may limit the amount to 90% of your vehicle’s total Kelley Blue Book value.

- The new loan’s APR: Comparison shopping is easier when you use a lending network. You should be able to determine which lender is offering the best interest rate and the lowest fees.

- The monthly payments: You must be able to afford the loan payments each month, which partially depends on the loan term. You may need to choose a lender that charges a higher APR but gives you a longer repayment period.

- Dealer reputation and loyalty: All other things being equal, you probably want to get your loan from a dealer you trust and with whom you’ve had previous business. If you refinance with the original lender, you may be able to escape the origination fee.

The bottom line is that you should consider and evaluate multiple offers before accepting an auto equity loan. The extra time you spend upfront may save you hundreds of dollars over the life of the loan.

Use Your Car For a Cash-Out Auto Equity Loan

Your car is like a piggy bank on wheels, and you can get money from it through a cash-out refi loan. The five reviewed providers of auto equity loans for bad credit are excellent options when you need to unlock the value you’ve accumulated in your current car.

Whatever you need cash for, your car’s equity is a resource you can tap into when things are tight. And it will provide you with lower interest rates and more favorable terms than many other bad credit loan options. Just be sure to continue making your payments as agreed to avoid the risk of losing your vehicle.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.