Stressed about money? You’re not alone. A recent survey found that 60% of people said they feel anxious about their financial situation.

Taking control of your spending and setting a budget is one easy way to overcome the tension you feel toward your finances. However, many people shiver at the idea of setting one because creating a budget often seems overwhelming, and the idea of sacrificing certain everyday pleasures may sound too restrictive.

But, what many consumers don’t realize is that this basic money management skill can actually help you feel less constrained in your spending and more in control of where your money goes, allowing you to experience more freedom in your finances and your lifestyle. And, ultimately stress less.

Although the actual task of analyzing, tracking, and drawing up a budget can be tedious, there are plenty of tools and apps that can make it easy while keeping you on track. Let’s look at five of the best budgeting apps to help you set and stick to a budget.

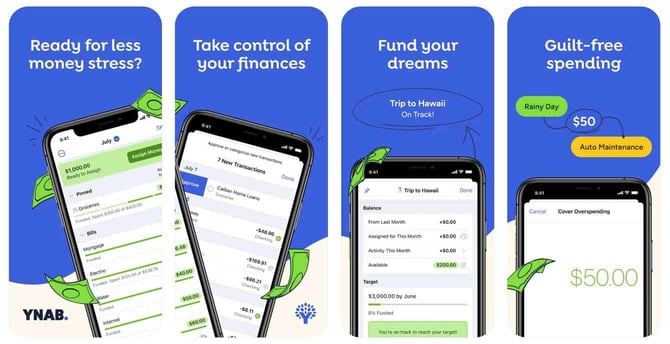

1. You Need a Budget (YNAB)

YNAB allows you to give every dollar you earn a job so you can approach your finances with a plan. These may include addressing categories such as paying off debt or savings goals, including travel, entertainment, or retirement.

By assigning a specific task for every dollar you earn, YNAB ensures you avoid wasteful spending. You receive get detailed reports so you can analyze your money habits and make adjustments to daily and monthly spending.

Plus, you can share expenses with someone else through the app to help you strike financial harmony with your partner. The app even offers tips on how to improve your spending and get out of debt.

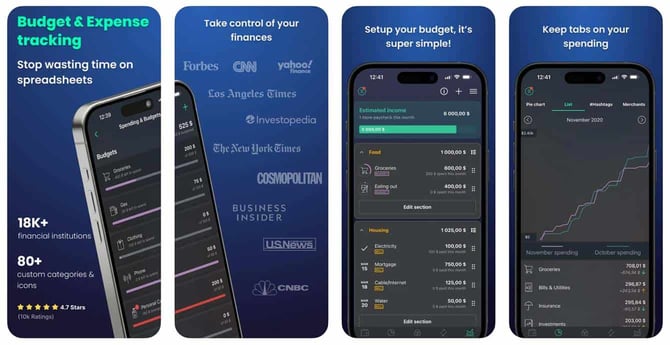

2. PocketGuard

PocketGuard is an innovative budgeting app that brings all of your accounts into one interface for easy tracking. The app allows you to schedule and track all of your expenses and connect your financial accounts to see all of your assets and debts.

You can track your spending and set limits in each category. If you overspend, you’ll receive a notification so you can identify the issue and learn how to manage your money better moving forward. The app even gives you the opportunity to negotiate lower payments on some of your recurring bills, including your cable and cell phone services.

Although you can’t track cash spending with the free version, you can upgrade to Plus for the ability to track one-time and recurring cash spending for a little over $6 per month.

With PocketGuard Plus, you can also track cash you spend and receive, plan for cash bills, including your share of the rent, and access many other helpful features.

3. Goodbudget

The Goodbudget app helps you plan, save money, sync budgets, and even pay off debt. It is a modern take on the classic envelope method, which divides your monthly income into dedicated “envelopes” of money. Once you spend all of the money in an envelope each month, that’s it. You don’t replenish it, which makes sticking to a budget more straightforward.

Goodbudget also syncs with other members of your household so everyone who needs to know can see how much money remains in each envelope. This can foster a sense of teamwork and help you stay motivated.

The app also has planning tools for saving and debt payoff which simplify the process and can help you reach your goals more quickly.

4. EveryDollar

The EveryDollar budgeting app is backed by Dave Ramsey, a well-known financial expert who has provided money guidance through his radio show for more than 30 years. And EveryDollar aims to instill lessons from Ramsey and his team.

The free version allows users to create budgets, track expenses, set due dates and access information about proven budgeting and spending strategies. It can be an excellent choice if you are new to budgeting and need to learn the basics before getting into more advanced concepts.

The Premium version of EveryDollar gives you more power as it connects to you bank account to provide more insights into your financial habits. It uses paycheck planning to help you avoid overdrafts, provides more goal and tracking tools, and even gives you access to financial coaching calls.

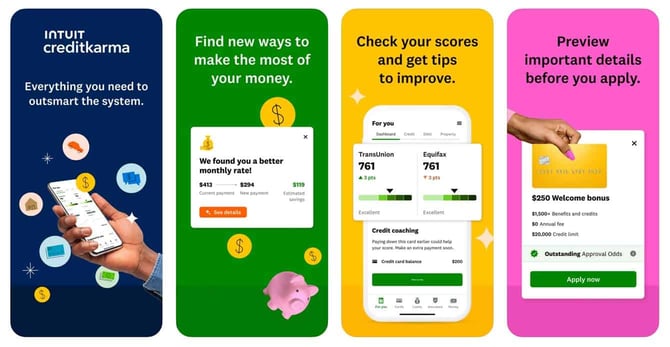

5. Credit Karma

The Credit Karma is a financial management platform that provides tools and insights at your fingertips. It allows you to link your financial accounts to monitor your assets and track your financial progress from a single place.

Through its Net Worth feature, you can monitor your cash flow, receive tips on making significant decisions, and even find ways to save money in your budget. Credit Karma is also a great resource for credit-related information and advice, and it packs its app full of features to help you in that area.

The app allows you to monitor your credit score for free and can tell you why your score went up, down, or stayed the same in any given month. And if you need to build your score, Credit Karma offers a Credit Builder feature that can help you boost a particularly low score quickly.

Get Your Finances on the Right Track with a Budgeting App

A budget helps you track your money better, ensuring you know where each and every dollar goes so you can pinpoint areas where you’re overspending — perhaps without even realizing it — and make better decisions with how to use those funds.

This means you can spend your hard-earned dollars in more meaningful ways, such as on things and experiences you value most. Maybe this means cutting back on dining out expenses so you can save up for that dream vacation. Whatever your passion, you can make it a reality by changing your spending habits.

Whether you have debt you want to pay off or savings goals you want to achieve, a budgeting app is a great way to help you visualize your spending, recurring bills, and savings in one place. Most of the budgeting apps featured are free, while others cost no more than a few bucks a month, and are a wise investment in your financial future.