It wasn’t until my 20s that I really began to care about my credit score and it’s also the first time I wondered, “What is the highest credit score possible?” I also couldn’t help but wonder about the lowest credit score possible. This is also around the time a lot of free credit score tracking apps began to rise in popularity, making it super easy for anyone to access their score. Prior to the emergence of these apps, you generally had to pay to see your credit score.

Thankfully, that’s not the case anymore and Americans’ credit scores — and the scoring process — is much more transparent than it was in the past. Still, my 20-year-old self still didn’t understand the credit scoring parameters, so, though I could see my score, I didn’t really know where my credit stood. It’s kind of like an SAT score — if you don’t know what the highest and lowest possible scores are, do you really know how well you did on the test?

In the following article, we’ll dive into the ins and outs of the most commonly used credit rating scale and you can learn how your own credit score fits into the scale — and hopefully gain some knowledge about how to give it a boost and maintain a high score.

850 Is the Best Credit Score Possible

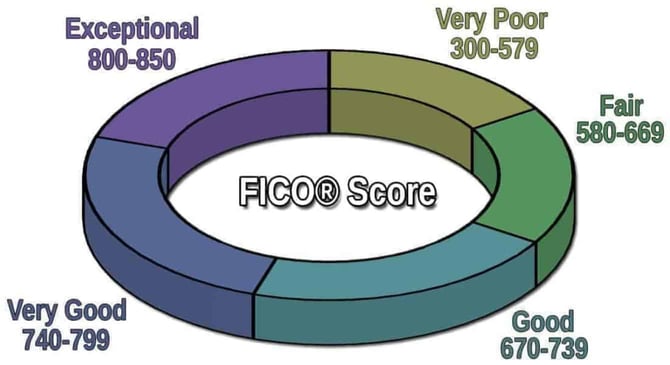

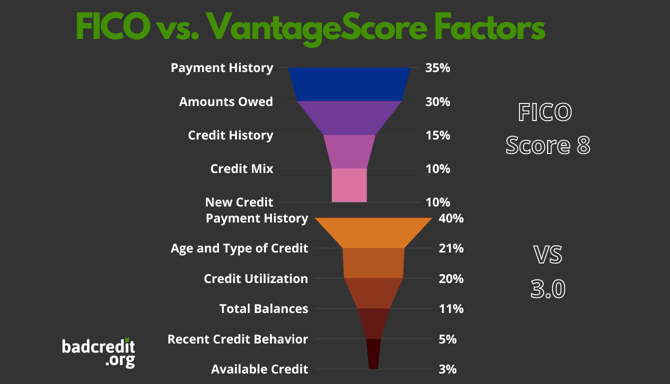

The highest possible FICO credit score one can have is 850, and a credit score above 800 is generally regarded as exceptional credit. The FICO credit score is the most widely used credit score by lenders to determine creditworthiness. The second most common credit score seen by lenders is the VantageScore, which also maxes out at 850.

This is the tier we should all strive to reach. Not only do consumers with excellent credit have the highest odds of approval when applying for loans and credit, they also have access to the best terms and rates.

Conversely, 300 is the Lowest Credit Score Possible

On the other end of the credit spectrum sits the number 300 — the lowest FICO credit score possible, representing the worst credit rating you can have in most instances. However, anything below 580 is generally regarded as bad, or poor, credit.

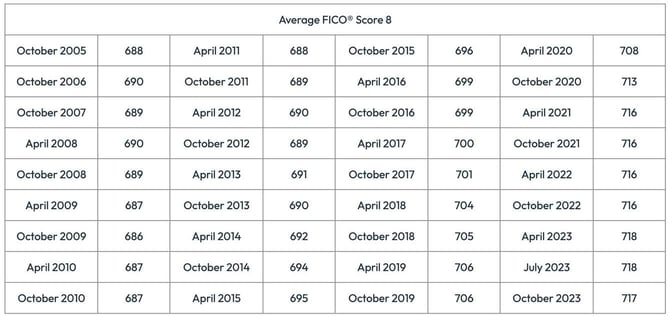

Fair credit is the next tier (580-669) and the Good credit category encompasses scores from 670 to 739. From there, Very Good (740-799) and Exceptional (800-850) represent the top two tiers in the FICO scoring model. Consumers in these categories are considered less risky because of their track records of positive financial management. The average American FICO score sits at 717 after steadily rising 30 points over 14 years (and dipping only once in that span).

While 300 is the lowest end of the base FICO score, the credit-scoring company also offers some industry-specific scoring models that range from 250 to 900. Two of the most used in this category are FICO Auto Scores and FICO Bankcard Scores. Although, the difference between having a credit score of 250 and 300 is probably negligible, since a score so low probably won’t make you attractive to any lender.

22% of Americans Have a Credit Score of 800 or Higher

A credit score of 800 or higher is considered exceptional, and nearly a quarter of Americans have reached that milestone, according to a review by Experian. Lenders consider consumers in this range to be the lowest risk, and with that comes better terms and interest rates on loans and credit cards.

The review also indicated that Baby Boomers (ages 59 to 77) made up nearly half of those with scores of 800 or above at 45%. Generation X (43 to 58) was the next highest at 23.7%, with Millennials (27 to 42) at 15.6%, and the Silent Generation (78+) making up 14.3%. Gen Z (18 to 26) only has 1.3% of the country’s 800-plus scores, but this faction also has some of the least established credit consumers of any generation.

A credit score of 800 or above puts you in rarified air and should grant you access to lower interest rates and better terms. But it still won’t guarantee you the best rates — or even approval. While it significantly increases your odds, lenders also take plenty of other factors into account.

These include income and length of credit history. Lenders may not extend their best terms to an applicant with a high credit score but low income and a shorter credit history.

Only 0.5% of Americans Will Achieve a Perfect 850

Don’t be too hard on yourself if when you do check your credit score, it’s nowhere near the 850 mark — only 0.5% of Americans will ever achieve “perfect” credit. Even the bureaus refer to those who have a credit score above 785 as “high credit score achievers.”

A perfect SAT score may be required to get into a prestigious university, but you don’t need a perfect credit score to get the best loans. Banks aren’t holding out the best-of-the-best offers for those with perfect credit — these can usually be attained by anyone with a credit score above 760, according to FICO spokesman Anthony Sprauve.

Whether you’re 20, 30, or 80 years old, understanding your credit is the universal first step. Only then can you begin the process toward perfect credit — or nearly perfect — because we’ve learned it’s basically the same when it comes to the rates and terms you’ll receive.

Credit Repair May Help Improve Your Score

For those with subprime credit, there are actions you can take to help improve your score, such as always paying your loan and credit statements on time and keeping the balance on your credit cards below 30% of its available limit. But when negative items like late payments and charge-offs — or, especially, inaccuracies and misinformation — on your credit report are keeping your score down, it might be time to refer to a credit specialist.

But when negative items like late payments and charge-offs — or, especially, inaccuracies and misinformation — on your credit report are keeping your score down, it might be time to refer to a credit specialist.

These types of negative items generally take seven years from the original delinquency date to be removed from your credit report, as specified by the Fair Credit Reporting Act. However, when disputed by a credit repair company, these items can be removed sooner, helping you to see positive results more quickly than by choosing to wait it out.

Financial Discipline Can Help Anyone Achieve a High Credit Score

The highest credit score you can earn is an 850, but that score isn’t a realistic goal for the vast majority of financial consumers. But no matter where your score falls on the spectrum, you can improve it with a little commitment.

Paying on time, reducing the amounts you owe, and keeping your credit utilization under 30% can have a dramatic impact on your score long-term. That could give you a shot to achieve the highest score possible — or at least very good one.