Debit and credit cards can look the same, but they’re very different in how they work. Knowing how to use a debit card wisely can save you many headaches if you’re used to using that other common piece of plastic in your wallet or purse: a credit card. So, are debit cards connected to funds in your bank account?

Here’s a breakdown of how debit cards work:

Yes, Debit Cards Are Connected to Funds in Your Account

A debit card is connected to a bank account and works like an electronic check. Once a debit card is run by a cashier through a scanner, for example, the payment is deducted directly (or debited) from your checking or savings account.

The bank electronically verifies that the money is available so the merchant can approve the transaction.

Debit Card Pros: Fast & Easy to Use, No Interest, Safer Than Cash

A debit card can be easier and faster to use than writing a paper check and safer than carrying around cash, even though you can use a debit card to get cash from your bank account when it’s used to make a store purchase. Also, interest isn’t charged for using a debit card.

Debit Card Cons: Can Lead to Overdraft Fees

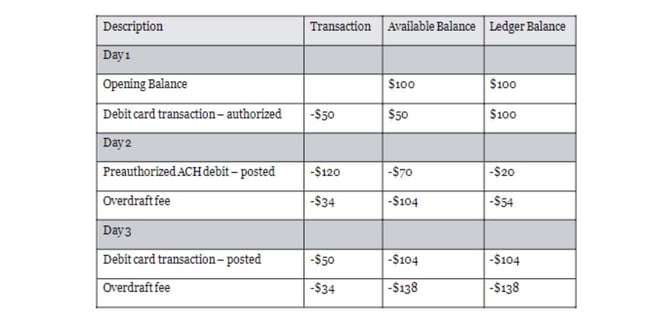

You must remember that an approved transaction could still lead to the account being overdrawn if there isn’t enough money, just as a bounced check can lead to a fee. The average overdraft fee is around $35.

A debit card purchase typically posts within 24 hours, but the bank may not know what other withdrawals a debit card holder made that day until it settles all transactions later in the same day.

Even if you only have $100 in your bank account and you use a debit card for a $200 purchase, the bank may still approve the $200 worth of purchase and assess an overdraft fee for that transaction and subsequent ones until a deposit is made to cover the withdrawals.

Consumers do have some measure of protection against overdraft fees, as regulations generally require them to opt-in (for debit card and ATM transactions) to allow financial institutions to cover their overdraft and collect a fee. If a consumer doesn’t opt in, their purchases can be rejected at the point of sale because their bank won’t cover the overage.

Using a debit card can be a smart decision for consumers who want to stay out of debt by only buying what they can immediately afford, but there are some instances when the benefits of a credit card are worthwhile.

Debit Cards vs. Credit Cards

The other most commonly used form of plastic is credit cards, which allow users to borrow money at the point of sale and pay the balance up to a month later without interest.

Credit Card Pros: Can Improve Credit Score

Credit cards are accepted by almost all businesses around the world, and using them wisely (i.e., paying them off in full each month before interest charges take effect) can help make purchases easier and improve your credit score.

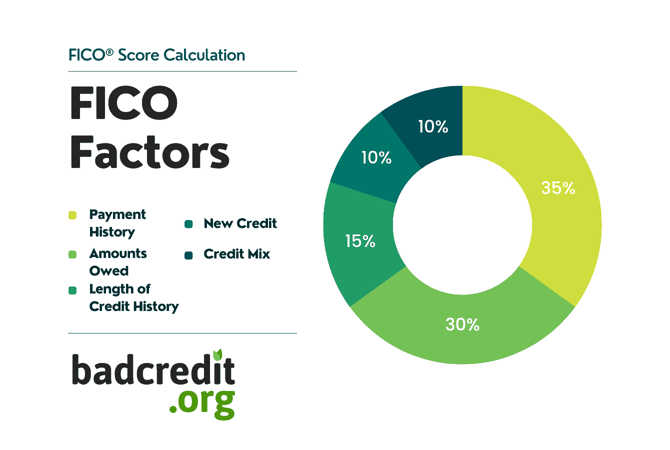

More than one-third of your FICO credit score is determined by payment history, so making payments on time can have a huge impact. Another significant factor is the total amount you owe. This makes up 30% of your FICO score and includes your credit utilization ratio (CUR) which is the percentage of your debt compared to your overall credit limit. Issuers typically want to see this number under 30%.

The longer you use the card responsibly, the more positive credit history you can build up, which is another factor in your score.

Pros for Poor Credit: You Can Still Apply & Work to Rebuild Credit

A credit card can be especially handy to cover certain expenses when funds are tight, and you don’t necessarily need good credit to get approved for one.

Best of all, when used responsibly, they can help you rebuild your credit, as issuers will report your timely payments to all three major credit bureaus. You also may find that credit card issuers (even those that work with consumers who have poor credit) offer rewards programs that provide value and increase your spending power.

Credit Card Cons: Can Lead to Debt

But if you can’t control your spending, a credit card may not be your safest option.

It’s not a secret that credit cards lead some people into debt. If you spend excessively and are unable to pay your balance in full each month, that remaining balance will continue to accrue interest until it is paid. That’s how credit card companies make money — your interest payments. And with today’s technology making it easier than ever to use credit cards, via online shopping, it’s also easier to rack up debt.

If you’re worried about overspending with a credit card or not having enough money in your bank account to pay a debit card transaction, then another option is a prepaid card.

Debit Cards vs. Prepaid Cards

A prepaid card works similarly to a debit card, though money isn’t withdrawn from a connected bank account. Instead, prepaid cardholders load money onto a card through direct deposit or with cash, among other methods, and can spend up to the loaded amount on the prepaid card.

Prepaid Card Pros: No Interest and No Bank Account Required

Prepaid cards are safer than carrying cash and don’t require a credit check or bank account to apply. They’re typically accepted any place that takes credit or debit cards. Prepaid cards don’t have a credit line or interest rate, as credit cards do, and they aren’t tied to bank accounts, as debit cards are.

Prepaid cards are also safer than carrying cash because if your card is lost or stolen, you can typically contact the issuer and have them freeze the card. Then, you can request a replacement card and the company should automatically transfer the remaining balance from your other card onto the new one.

Prepaid Card Cons: Will Not Help Credit

For people who don’t have access to or don’t want to use credit cards or banks, prepaid cards can be a good solution. They don’t, however, help build credit. This is because you can’t spend more money than you load onto the prepaid card, so the company doesn’t need to report your monthly payments (or how creditworthy you are) to any of the credit bureaus.

Without good credit, consumers could end up with higher interest rates on loans they take out in the future.

Final Thoughts

Debit cards provide an effective way to manage and conveniently spend money from an attached bank account. They can help you build positive financial habits, but they don’t provide any benefit to your credit score or profile.

A prepaid card could be an ideal option if you are looking for a card that doesn’t require an underlying bank account.

The best solution for people who want to build their credit profile is to get a credit card and use it responsibly. You can develop good credit behavior by paying your bills on time and in full each month, not spending more money than you have in the bank, and following a monthly budget.