Regardless of the party requesting access, each time someone checks your credit report, the action results in a credit inquiry being recorded on your report. That said, the nature of the request does have an effect.

In particular, inquiries initiated by an application for credit, including credit cards and loans, will generally result in a hard credit inquiry. Inquiries that result from checking your own credit report or performed as part of an employment application or insurance quote will be recorded as soft inquiries.

Only hard credit inquiries are visible to other parties that check your credit report and, thus, only hard credit inquiries will impact your credit score. Here, we’ll take a look at how to remove inquiries from your credit report. While you typically need to simply out-wait legitimate hard inquiries, those made without your permission and/or due to fraud can often be disputed and removed, either with the help of a credit repair company or through a bit of old-fashioned DIY. In the following article, we’ll focus on hard inquiries and how you can address mistakes or fraudulent inquiries on your credit report. We’ll also present some of our top picks for credit repair companies, should you need professional assistance.

1. Hire a Credit Repair Company to Act on Your Behalf

While you can certainly file your credit report disputes yourself, not everyone has the time (or energy) to file disputes with each credit bureau for each individual inquiry — let alone follow up over the next 30 days or more to ensure progress is being made. And when you are trying to remove multiple inquiries from all three reports, well, you could be looking at dozens of dispute forms that need to be filled out and followed up.

Hiring an experienced, reputable credit repair company to go to battle with the bureaus on your behalf can be a good way to get the results you want, without wasting your own valuable time. Many of our top-rated picks for credit repair companies each have decades of experience helping consumers remove errors and unsubstantiated accounts from their reports, and our list includes a variety of services and price ranges.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

+See More Credit Repair Companies

The key to a successful credit repair experience is to know what to expect from the process before you get started. Even the most experienced professionals can’t do the impossible, which, in this case, means removing legitimate, substantiated inquiries. If you really did apply for that credit card, whether you were approved or not, and the issuer can show the supporting documentation, the bureaus have every right to leave that inquiry on your reports.

Additionally, understand that credit repair isn’t an overnight process at the best of times, and can take even longer if you have a large number of disputes. While credit bureaus and information furnishers alike have to respond to a dispute within 30 days, that’s not a guarantee that the problem will be solved in that time. Furthermore, some credit repair companies may have set limits on the number of disputes they can file per client per month.

2. File a Dispute with the Credit Bureaus Yourself

If your credit report beef centers on only a few fraudulent inquiries, it may be just as easy (and more affordable) to dispute the items yourself. You’ll need file a separate dispute for each credit bureau for each individual inquiry, as the three bureaus are distinct entities and aren’t obligated to share information on disputes being investigated.

Being as this is the technological era, you can file your dispute both by mail or online through the credit bureau’s website, though some anecdotal evidence suggests you may have better success with the more traditional snail-mail methods. You may also unknowingly limit your ability to take legal action down the road when filing online.

As if you don’t have enough letters to write, it’s also recommended that you contact more than just the credit bureaus. Your ability to dispute credit report errors is granted by the Fair Credit Reporting Act (FCRA), which requires that both credit reporting agencies and the people, companies, or organizations reporting to those agencies, investigate and address consumer disputes. For the best results, you should contact both the bureau and the furnishing party to dispute the erroneous inquiry.

You can file online disputes with all three credit bureaus through their individual websites.

When you compose your dispute letter, don’t wax poetic about how you’ve been wronged and it’s ruining your life. Instead, put together a concise explanation of why you are disputing the particular inquiry using clear language.

At the same time, don’t forget to include appropriate supporting information to validate your claim that the inquiry is fraudulent or otherwise doesn’t belong. If you have documentation that supports your dispute, be sure to attach a copy to each of your letters, as well. It’s generally better to err on the side of too much evidence than not enough (within reason, of course — you don’t need to attach every financial document you own).

Since the credit bureaus and information furnishers have up to 30 days to complete an investigation, it may be several weeks before you receive a response, but no more than five business days after the investigation is finished. If your dispute is approved, the information should be removed from your credit report fairly soon thereafter, so regularly check your credit to ensure it has been taken off.

If your dispute is rejected but you still feel you have a legitimate case, you can choose to refile your dispute. This is likely to be most successful if you have new evidence to include in your second dispute. The credit bureaus will have the same 30 days to investigate the refiled dispute as they did the original.

In the End, Hard Inquiries Have Short-Term Credit Impacts

Other than when rate-shopping for certain types of loans, every new credit application can mean a new hard inquiry on your credit report — and a few points shaved off your credit score. Because of the potential credit impacts, removing hard inquiries that were made without consent or were the result of fraud can be beneficial to many consumers.

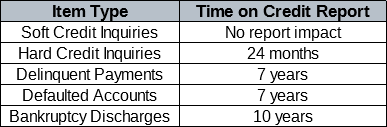

Unfortunately, there may not be much you can do about legitimate credit inquiries on your report, other than being cognizant of the potential impacts when you apply for credit. On the plus side, those inquiries won’t be on your credit report forever; as with other negative marks on your report, hard credit inquiries have a shelf-life of sorts.

In fact, hard credit inquiries are completely removed from your credit report after two years, and may be removed sooner depending on the bureau. Furthermore, hard credit inquiries often stop impacting your credit score well before they even fall off your report. Negative marks of all kinds, including hard inquiries, have less influence on your credit score calculations as they age, so those inquiries may not have much impact after the first 12 months.

The most important thing you can do to keep your score healthy is to simply make on-time payments.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.