Knowing how to improve your credit score can go a long way toward solidifying a solid, healthy financial future. With so many companies and ads putting up a near-continuous racket about the importance of checking your credit, it’s hard to avoid the lectures about checking your credit. And it’s working — to a degree. More people than ever are keeping track of their credit scores, but, at the same time, over 40% of Americans are still in the dark where their credit is concerned.

Well, almost in the dark. These days, when even your landlord could be checking your credit before approving your application, the chances are pretty good that if you have bad credit, you know it — and you probably learned about it the hard way through a friendly rejection letter.

Regardless of how you discovered your less-than-stellar credit, you can hardly leave it to its own devices. Rough credit can turn downright rocky if the problems are not addressed. On the positive side, it’s never too late to work on improving your credit, and we’ve provided 13 tips to help you determine how to get started. Let’s dive into this informative list that includes how to understand the components of your credit score, how to check your credit score, and how to remove mistakes from your report.

1. Understand the Parts of Your Score

The first — and, arguably, most important — step in increasing your credit score is to develop a foundational knowledge of how your score actually works. That is, you need to know what factors go into your credit score calculation, so that you can understand how to influence them.

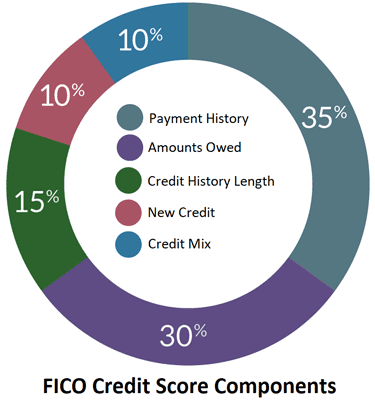

While several models are used to determine your credit score, the most popular, by far, is the FICO Credit Score. That said, regardless of the actual model, they will all be based on the same factors, though each may carry a different weight.

Under the FICO model, the most important factor is your payment history (35%), which looks at whether you pay your debts on time and as agreed. Your payment history includes information from a variety of credit accounts, including installment loans and credit cards.

Almost as important as your payment history is your total amounts owed (30%). This factor takes into account how much debt you currently owe, how that debt compares to your total available credit — also known as your credit utilization rate — and how much of your outstanding debt you’ve already repaid to date.

Another significant factor that influences your credit score is the length of your credit history (15%), which considers the age of your oldest credit account as well as the average age of all of your accounts. Similarly, the amount of recent credit inquiries you have, which falls under new credit (10%), will also impact your score.

Lastly, your credit mix (10%), or the variety of credit accounts you have, will play a small role in determining your credit score. This is because lenders like to see that borrowers can responsibly handle multiple types of credit.

2. Check Your Credit Report (Regularly)

Similar to the chassis of a vehicle, your credit report is the foundational structure of your credit score. In general, consumers will have three credit reports, one each from Equifax, Experian, and TransUnion. The information about your current and past credit accounts, including whether you paid them as agreed, lives on your credit reports.

Since your credit score is based on the information found in your credit reports, it’s extremely important to check all three of your credit reports on a regular basis. Why all three? The credit information on your reports are reported to the credit bureaus by your creditors, and may only have been reported to one or two of the bureaus.

Because a potential lender could check any — or all — of your credit reports, you should, too. This can be done for free once a year through AnnualCreditReport.com.

With a solid understanding of the things that actually impact your credit score, it can be much easier to determine which of your current accounts are dragging down your score. For instance, if you’ve been delinquent on a payment (more than 30 days late) or missed it entirely, it will likely have been reported to the credit bureaus, and will thusly appear on your report.

3. Remove Mistakes From Your Report

Although some of us may be loath to admit it, we all make mistakes — and that includes the major credit bureaus. In particular, the bureaus aren’t legally required to verify every piece of information that comes from the millions of creditors reporting to them, so errors are bound to crop up. When those mistakes are impacting your credit score, however, little typos can mean big money, and should be addressed right away.

Thankfully, the Fair Credit Reporting Act (FCRA) stipulates that both the credit reporting agency and the information provider are responsible for correcting inaccurate or incomplete information when disputed. And, depending on the nature of your problem, the easiest way to get them to fix disputable accounts is to hire an experienced credit repair company to do the heavy lifting.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

In addition to the obvious errors, such as misspelled names or incorrectly reported account balances, credit repair can also help remove other types of disputable accounts. This might include old debts that haven’t correctly aged off your report or various types of unsubstantiated debts for which the collection agency doesn’t have the appropriate documentation and must cease trying to collect.

4. Use Autopay to Always Make Payments On Time

Armed with an error-free credit report and the knowledge of what goes into your score, you can start making strides toward a better credit future. Since your payment history is more than a third of the calculation, working on improving your payment history can have huge impacts on your overall credit score.

In fact, even if you have a history of missed or late payments, you can still improve your score over time by building a recent history of making on-time payments each month. The credit scoring model will give more weight to recent information, while older information will have less impact the older it gets. Except for bankruptcies, which last 10 years, all of your negative marks should come entirely off your report after seven years.

One way to ensure you are making all of your payments on time is to take advantage of the automatic payments features — often called autopay — offered by many banks, credit card issuers, and other creditors. Typically requiring just a few steps to set up, autopay will pay your bills on a pre-selected date each month, and can usually be set to pay either a set amount or your entire balance.

5. Decrease Your Existing Balances

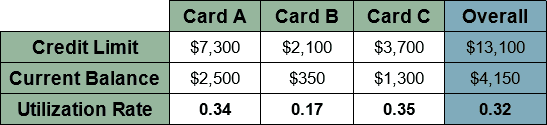

Almost a third of your score is based on your total balances and utilization, so paying down your current debt can have big impacts on a low score. In particular, if you have a high utilization rate (a ratio above 0.3, or 30%) on your revolving debt, such as your credit cards, paying those balances can improve your utilization and potentially improve your score by dozens of points.

Additionally, improving your total amounts owed by paying down your current balances is often the fastest way to increase your credit score. This is because it can result in improvements as soon as your issuers report the updated balances to the bureaus, which most do once a billing cycle.

One thing to keep in mind is that you need to actually decrease your total debt. You will be less likely to see much of an increase in your score from any sort of balance transfer or debt consolidation, as your actual debt-to-credit ratio will remain the same.

6. Increase Your Credit Limits

Similar to the way paying down your balances can positively affect your total amounts owed through your utilization rate, increasing the amount of available credit you have can also have a positive impact on your score. Since your utilization rate is the ratio of your total debts to your total available credit, obtaining more credit can nudge the equation in your favor.

The easiest way to increase your available credit is often to request an increase in your credit card limits. The majority of issuers, even issuers specializing in credit cards for bad credit, will offer credit limit increases to qualified cardholders upon request. Some issuers will also give unsolicited credit limit increases to cardholders who maintain their accounts in good standing.

One thing to remember about requesting a credit limit increase is that many issuers will check your credit via a hard credit inquiry to determine whether to grant the increase. Hard credit inquiries typically have a minor credit score impact, but requesting multiple credit limit increases across your cards may result in many inquiries — and a bigger (negative) score impact.

7. Become an Authorized User

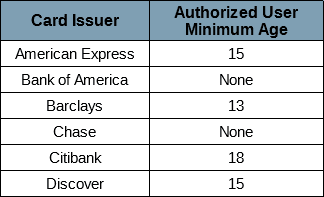

For consumer credit card accounts, authorized users are those who have been allowed access to the account. These users are typically given a secondary credit card with the same account number but in their own name, so it can be used for purchases.

While they can access the line of credit and may see negative credit impacts from things like missed payments, authorized users are not actually held responsible for repayment of the outstanding balance.

Becoming an authorized user may be a good option for improving your credit if you have a close friend or relative with excellent credit, for two reasons. First, the amount of credit available on the card for which you are an authorized user is often added into calculations of your own utilization rates, so you can improve your utilization rate if the account has a low balance.

Secondly, some scoring models will include the age of the authorized user account when determining the length of your credit history and your average account age. This can be especially helpful for those with limited or no established credit history.

8. Diversify Your Accounts

A common misconception about consumer credit is that you’re better off the fewer accounts you have open. While it’s true that lenders aren’t always thrilled to see dozens of existing credit lines, they do want to see a little diversity in your credit report, which is reflected by the credit mix factor of your score.

That’s not to say that you need to collect the complete set of credit types to have a good credit score — but you’re likely going to want more than one to show future lenders that you can handle any type of credit. Lenders particularly appreciate the ability to responsibly use and maintain revolving credit, so a credit card can be a good addition. Those with bad credit should look into top-rated subprime issuers, like our top picks.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 5 minutes | N/A | Yes | 9.5 |

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $400.00 (Subject to available credit)

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 10 minutes | 35.90% Fixed | Yes | 7.5/10 |

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

No matter what your credit mix looks like, of course, you shouldn’t start opening unnecessary credit accounts simply to get a little variety. You should also make sure that you’re aware of any application or processing fees, annual fees, or other associated costs. A minor credit score boost is rarely worth paying a fortune in fees.

9. Avoid Closing Old Accounts in Good Standing

Many of those who have gone through a rough patch in their credit journeys are often guilty of the same mistake: they close up every old account they can find in an effort to simplify their credit. Unfortunately, that effort is often in vain, as closing old accounts can, in many cases, turn into a quick way to decrease your credit score.

The reason closing old accounts can be a bad idea is the 30% of your score that is influenced by your utilization rate. Scoring models look at both your utilization rates on individual cards as well as your overall debt-to-credit ratio. This means closing an account with a high credit limit can increase your overall utilization rate, which can decrease your credit score.

The caveat here, of course, is the balance between maintaining a good utilization rate without paying high fees for the pleasure. Old accounts with particularly high interest rates or annual fees may not be worth the boost to total credit line, and may be better off closed. If you are going to close old accounts, be sure to do so at a time when you don’t intend to apply for new credit and can recover from any drop in score.

10. Open New Accounts Sparingly

For all the reasons you should maintain older accounts, you’ll also want to avoid opening too many new accounts. That is to say, new accounts will lower your average account age, impacting your credit history length factor and decreasing your score.

In addition, opening new accounts, or simply applying for them, can also influence your score through the minor, but still impactful, new accounts factor. Each new account you open represents more debt you can possibly accrue, which makes new lenders nervous that you could get in over your head.

This is also the factor where hard credit inquiries are considered. While generally only having a minor credit impact, too many hard credit inquiries can have a more significant impact, as it is considered a sign to potential lenders that you could be on the verge of opening a slew of new accounts.

11. Compare Rates All at Once

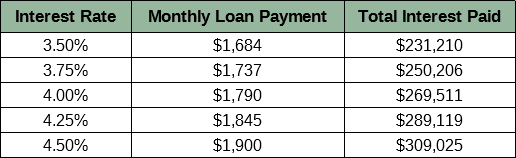

With the average sale price over $375,000 for a single-family home, even a percentage of a percentage point can make a big difference in how much interest you pay over the life of your 30-year loan (as the table shows). That means, when it comes time to take on a mortgage loan, you’re definitely going to want to shop around for the best rate.

While normally you’d have to worry about hard inquiries when obtaining multiple quotes, there is a workaround. Credit agencies know you’re going to request more than one quote when looking for a big loan, so they’ve actually planned for it. All you need to do to avoid dinging your credit with a flood of credit inquiries while you comparison shop your rates is to take advantage of the built-in rate-shopping window.

What’s that mean? In most cases, scoring agencies will actually lump together multiple similar credit inquiries made within the same two-week period, counting them as a single inquiry in your score calculations. This allows you to shop around for the best deal without worrying about your new credit factor tanking your score.

12. Make Multiple Credit Card Payments

As already mentioned, lowering your various debt balances can have a big impact on your credit score by lowering your total debt and utilization rate — but few of us have a lump sum lying around to pay off our debts. If you’re reliant on your biweekly paycheck to slowly wear down your balances, you may be able to boost the effect by making multiple payments each month.

In general, each of your creditors will report your credit balance to the credit bureaus at least once a month, though some may do it more or less frequently. By making payments on multiple dates, such as when each paycheck comes in, you can ensure that the balance reported to the agencies is always at its lowest point.

As an added benefit, making multiple payments on your interest-charging accounts can also save you some cash. Why? Well, despite only being charged monthly, interest is actually compounded daily, using your average daily balance. So, each day at a lower balance equates a savings in interest fees.

13. Contact Your Lenders If You’re Struggling

Another common mistake made by those struggling with debt and poor credit is working under the idea that they have no other option, when, in many cases, there may be ways to improve the situation. And, at the top of the make-it-better to-do list when you may fall behind on your debts is to contact your lenders.

Despite what people may believe, it’s never in the lender’s best interest to have a borrower default on a loan or other credit line. Your creditors would much rather you work with them on a way to repay your debt than to be stuck trying to chase down payments, dealing with court fees, or, worst of all, having to charge-off the debt.

Most lenders are perfectly willing to work out some sort of payment plan, or other arrangement, to help you stay on track with your payments — especially if you contact them before you start missing payments. Proactively managing your debts is always preferable to asking for leniency after the fact.

Improving Your Credit Won’t Happen Overnight

At its heart, your credit score is a quick and easy way for a prospective lender to determine how much credit risk you represent, or the likelihood that you’ll be able (and willing) to repay your debts. Each factor that goes into your credit score adds information about your potential risk and will be considered by potential lenders.

While some factors can be influenced more quickly than others, such as your total amounts owed, there are no instant credit score fixes. Improving your credit score will take time, particularly if you are recovering from negative events that can’t be fixed, only out-waited, like missed payments or bankruptcy. In the end, it may be a long process — and it does require patience — but bringing your credit score up is well worth effort.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.