BadCredit.org survey reveals that 39% of people surveyed are relieved the Fed is expected to lower rates, which may encourage credit card spending (22%) and the purchases of vehicles (11%) and homes (8%).

Due to inflation concerns, the Federal Reserve raised interest rates 11 times between March 2022 and July 2023. We conducted a consumer survey focused on how Americans feel about the news that federal interest rates will likely be lowered this year. The survey also explored how lower rates could affect Americans’ finances in terms of saving versus spending.

10% Said They Are “Concerned” About Lower Rates

The survey found that nearly 4 in 10 Americans (39%) surveyed said they feel relieved the Fed is expected to lower interest rates this year. Ten percent of respondents said they are concerned about a lower rate, 29% are not concerned, and another 22% are still uncertain.

If the Fed does lower interest rates, Gen Z and millennials may be the biggest spenders, as the survey reports that overall:

- 22% said they will be more confident to use credit (28% of Gen Z, 29% of millennials)

- 11% said they will purchase a car/truck (21% of Gen Z, 13% of millennials)

- 8% said they will buy a home (16% of Gen Z, 10% of millennials)

- 7% said they will refinance their home (12% of Gen Z, 10% of millennials)

Emergency Funds & Credit Card Debt Are the Biggest Priorities

But not all Americans will be on a spending spree this year. Spurred by lingering inflation concerns, the survey revealed that many Americans would like to save more this year, with 37% of survey respondents saying they are managing inflation-induced price increases by buying generic products.

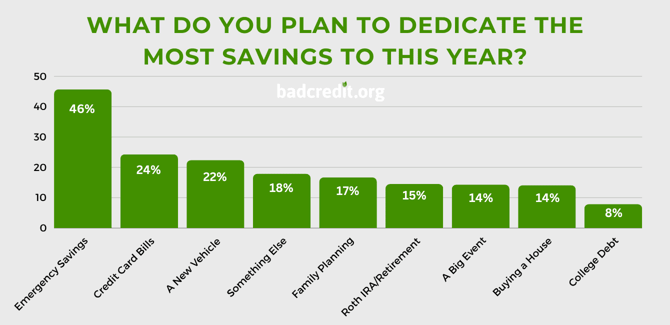

Additionally, almost half of the survey’s respondents (46%) plan to dedicate most of their savings to an emergency fund this year. Other things respondents said they plan to contribute savings toward this year include:

- Paying off credit card bills – 24%

- Buying a new vehicle – 22%

- Family planning – 17%

- Roth IRA/Retirement – 15%

- A big event, such as a wedding – 14%

- Buying a house – 14%

- Paying off student loan debt – 8%

“Our survey found that saving and paying off debts are the general financial priorities of Americans this year. But it’s interesting to see that most aren’t prioritizing paying down student loan debt, which may align with many still holding out hope for forgiveness,” said Ashley Fricker, Senior Editor with BadCredit.org. “While spending money on homes and cars may be long overdue for many, consumers will want to ensure they can manage the payments to avoid damaging their credit, or worse, losing their homes and vehicles.”

Methodology

A national online survey of 1,015 U.S. consumers, ages 18 and older, was conducted by Propeller Insights on behalf of BadCredit.org in February of 2024. Survey responses were nationally representative of the U.S. population for age, gender, region, and ethnicity. The maximum margin of sampling error was +/- 3 percentage points with a 95% level of confidence.