In today’s world, scams are becoming increasingly sophisticated, preying on people’s vulnerabilities and financial hardships. According to the Federal Trade Commission (FTC), debt collectors generate more fraud reports than any other industry.

Debt collection scams involve fake debt collectors who pressure you, threaten you, or demand payment before you can confirm you owe the debt. To better understand where this fraud is happening and identify the debt collection scam hotspots across the country, we analyzed government data and asked millennials and Gen Zers about their experiences with scams.

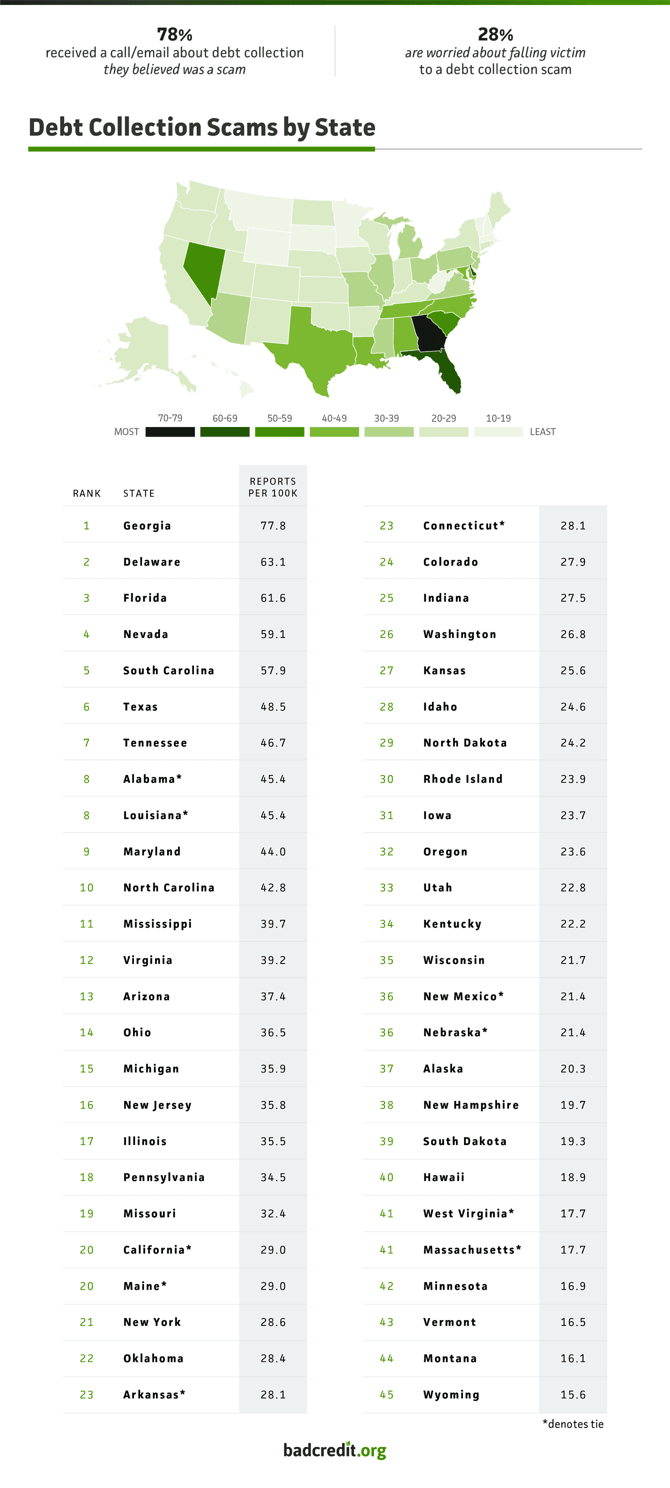

Debt Collection Scam Hotspots by State

In 2023, the FTC received more than 124,400 debt collection scam reports. In our survey of millennials and Gen Zers, 78% of those surveyed say they’ve received a call or email about debt collection they believed was a scam. And more than 1 in 4 (28%) said they are worried about falling victim to a debt collection scam.

When it comes to the states dealing with the most debt collection scams, Georgia, Delaware, and Florida top the list. In 2023, Georgia recorded 77.8 debt collection scam reports per 100,000 people. Delaware came in at 63.1 reports, and Florida at 61.6.

Other states topping the list include Nevada, South Carolina, Texas, Tennessee, Alabama, Louisiana, Maryland, and North Carolina.

The top four states with the fewest debt collection scam reports per 100,000 include:

- Wyoming

- Montana

- Vermont

- Minnesota

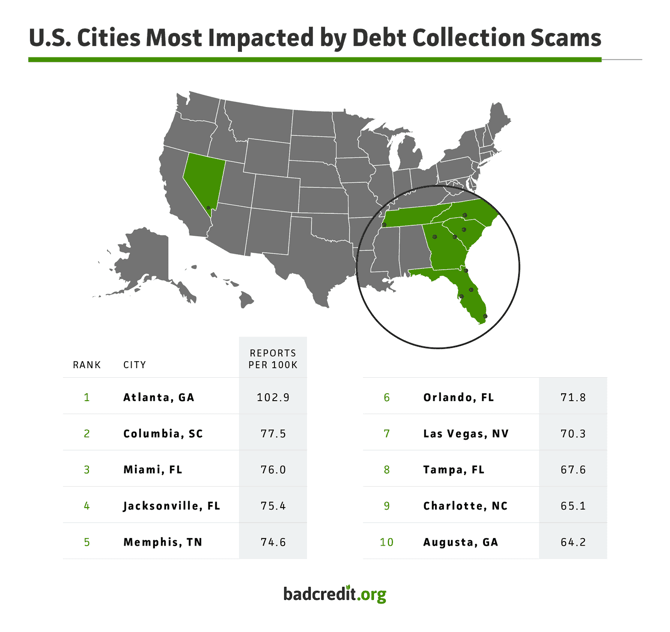

U.S. Cities Reporting the Most Debt Collection Scams

Atlanta, Georgia ranks first among the U.S. cities most impacted by debt collection scams. In Atlanta, 102.9 reports per 100,000 residents were recorded in 2023. Following behind Atlanta is Columbia, South Carolina; Miami; Jacksonville, Florida; and Memphis, Tennessee.

How to Identify a Debt Collection Scam

While debt collection is legal, there are important rights Americans have under the law and tips to help you identify a legitimate debt collector from a scam. According to the FTC, debt collectors can call you, message you on social media, or send letters, emails, or text messages. However, a collector has to give you validation information about the debt within five days of their first contact. They must tell you their name and mailing address, the name of the creditor you owe, how much money you owe, what to do if you don’t think it’s your debt, and your debt collection rights.

Debt collectors are not allowed to harass, threaten, use profane language, lie, or call you more than seven times within a one-week period.

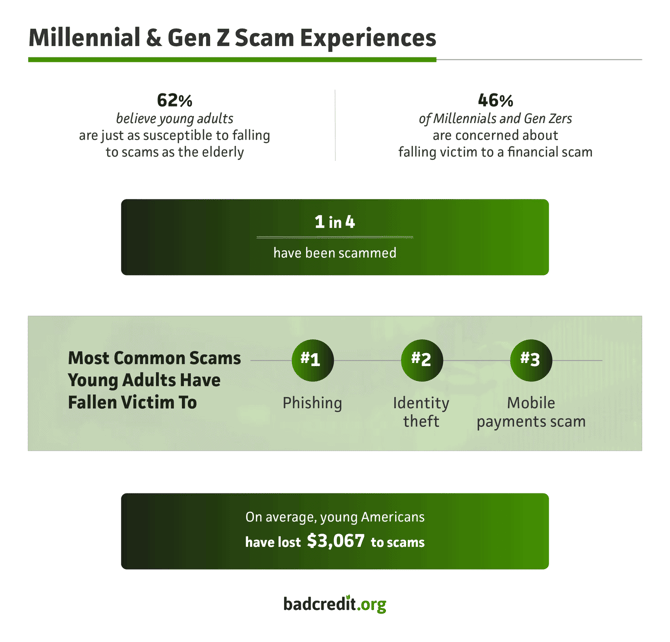

Millennial and Gen Z’s Experiences With Scams

While many people may think scams mostly impact older adults, 62% of millennials and Gen Zers believe young adults are just as susceptible to scams as the elderly. In fact, nearly half (46%) of millennials and Gen Zers are concerned about falling victim to a financial scam.

Among young adults, 1 in 4 say they’ve been scammed. The most common types of scams young adults report falling victim to? Phishing, identity theft, and mobile payment scams. On average, they’ve lost $3,067 to scams so far in their lifetime.

Debt collectors can be a source of stress, but don’t let scammers take advantage of you. To protect yourself and your finances, educate yourself on legitimate debt collection practices. This knowledge will empower you to spot red flags and avoid falling victim to a scam.

Methodology

To determine the states impacted the most by debt collection scams, we analyzed 2023 data from the Federal Trade Commission. To rank the cities most impacted by debt collection scams, we analyzed data per 100,000 of cities with a population greater than 500,000.

In April 2024, we surveyed 809 millennials (aged 28 to 43) and Gen Zers (aged 21 to 27) from across the U.S. about scams and fraud. Forty-eight percent of respondents identified as women, 49% as men, and 3% nonbinary.

For media inquiries, contact media@digitalthirdcoast.net

Fair Use: When using this data and research, please attribute by linking to this study and citing BadCredit.org